KCEX Faces New Accusations: Funds Vanish, Account Permanently Banned After "Risk Control Review"

Crypto exchange KCEX is once again under fire for alleged fraudulent practices. A trader has come forward with a detailed complaint accusing the platform of freezing his account and stealing his funds.

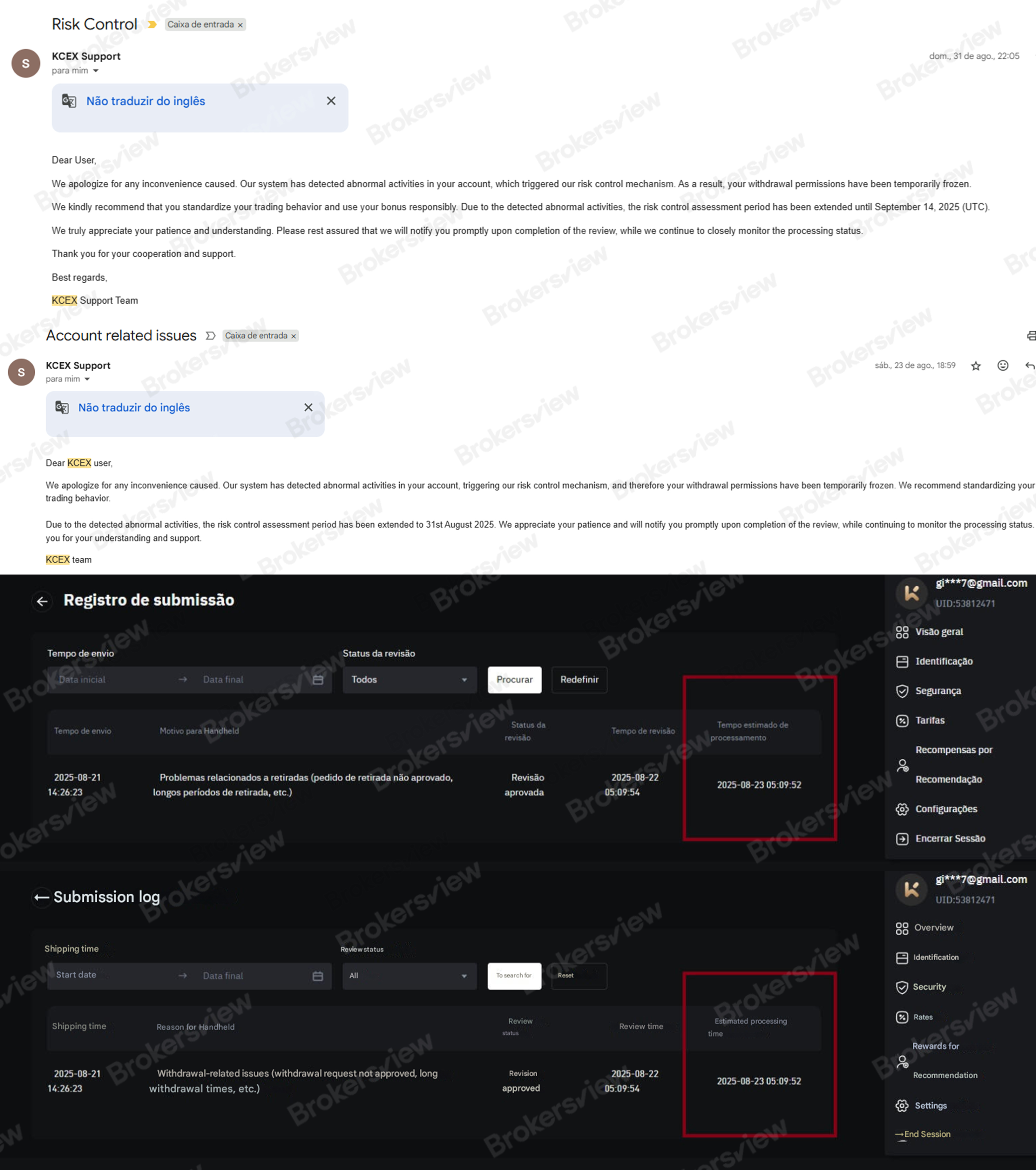

According to the trader, KCEX suddenly froze his account after he earned profits through futures trading, citing a “risk control review.” The exchange demanded ID verification and a handwritten statement, both of which were promptly submitted. However, instead of resolving the review, KCEX repeatedly extended the deadline: first from August 23 to August 31, then again to September 14.

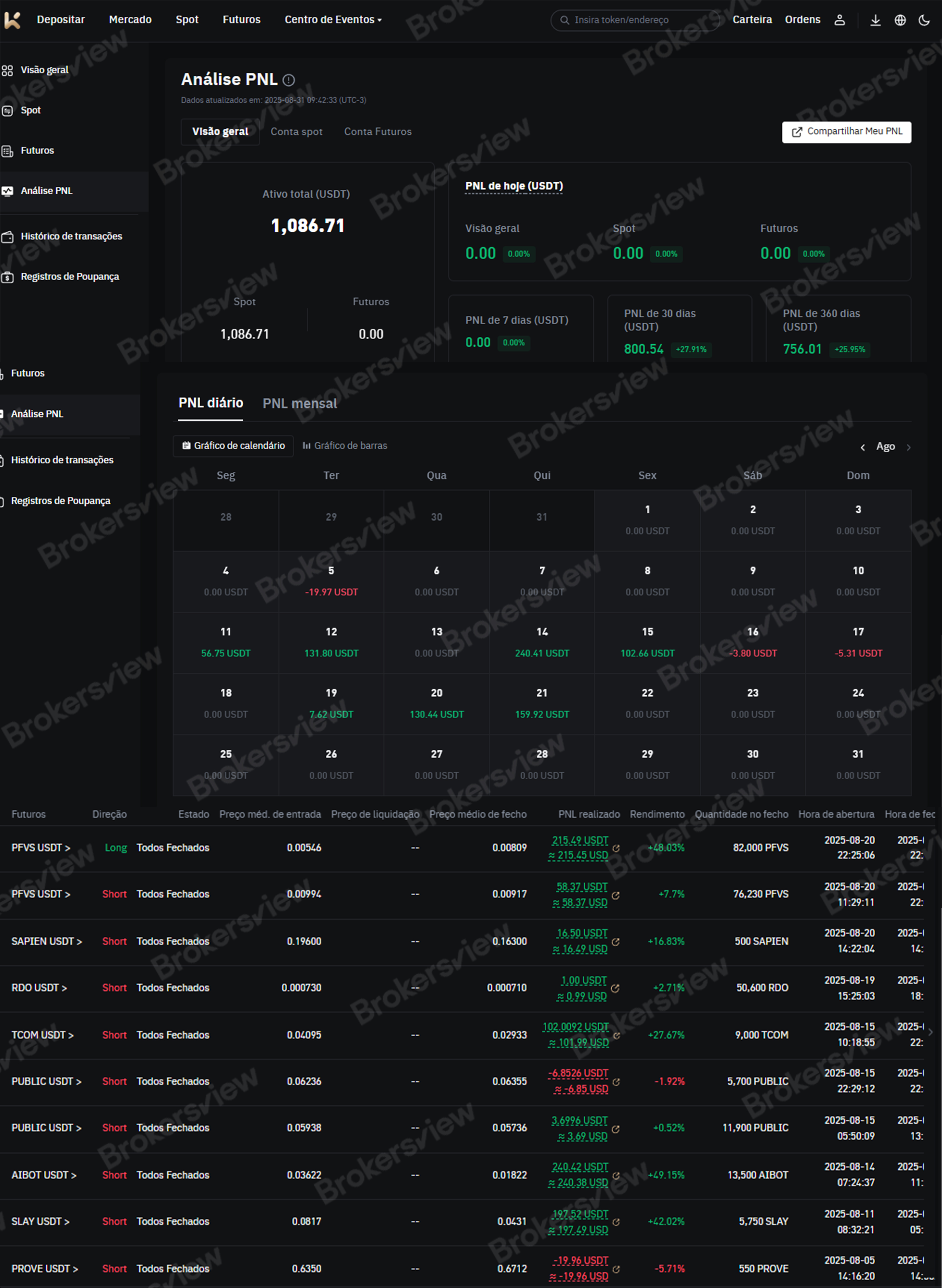

During this delay, the trader’s account held 1,086.71 USDT. But by September 14, the account remained locked, and the balance mysteriously decreased to just 272.83 USDT. The trader alleges that KCEX stole his 813.88 USDT.

KCEX justified the missing funds by claiming “abnormal activity.” The trader refutes this, asserting that all trades were clean and normal, backed by verifiable P&L records and futures operation logs.

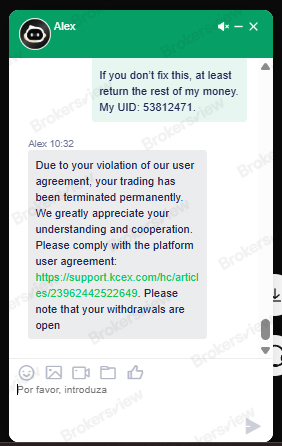

After the balance was drained, KCEX support informed him that his account was permanently banned. Although withdrawals were technically “open,” the trader notes this was meaningless—his funds were already gone.

The complaint accuses KCEX of orchestrating a scam involving deliberate account freezing, deceptive review delays, seizure of client profits, and unjustified banning. The trader concludes by labeling KCEX’s conduct as criminal.

KCEX’s invocation of “risk control” is not the first time. In a case exposed by BrokersView last December, the exchange froze a trader’s 1,050 USDT under the pretext of “abnormal behavior,” which allegedly triggered so-called “risk control restrictions.”

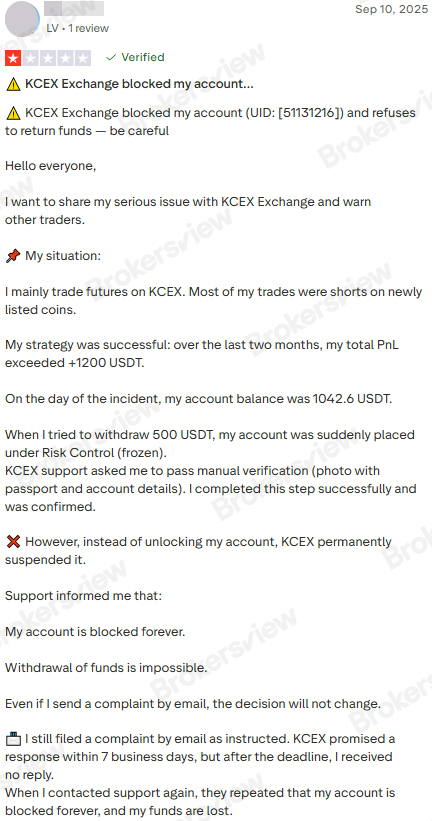

Another trader reported a similar ordeal. His account was abruptly placed under “risk control” following a withdrawal attempt, resulting in an immediate freeze. Despite complying with KCEX’s manual verification demands—including a photo with his passport and account details—his account was permanently suspended without a valid explanation.

Is KCEX operating legitimately?

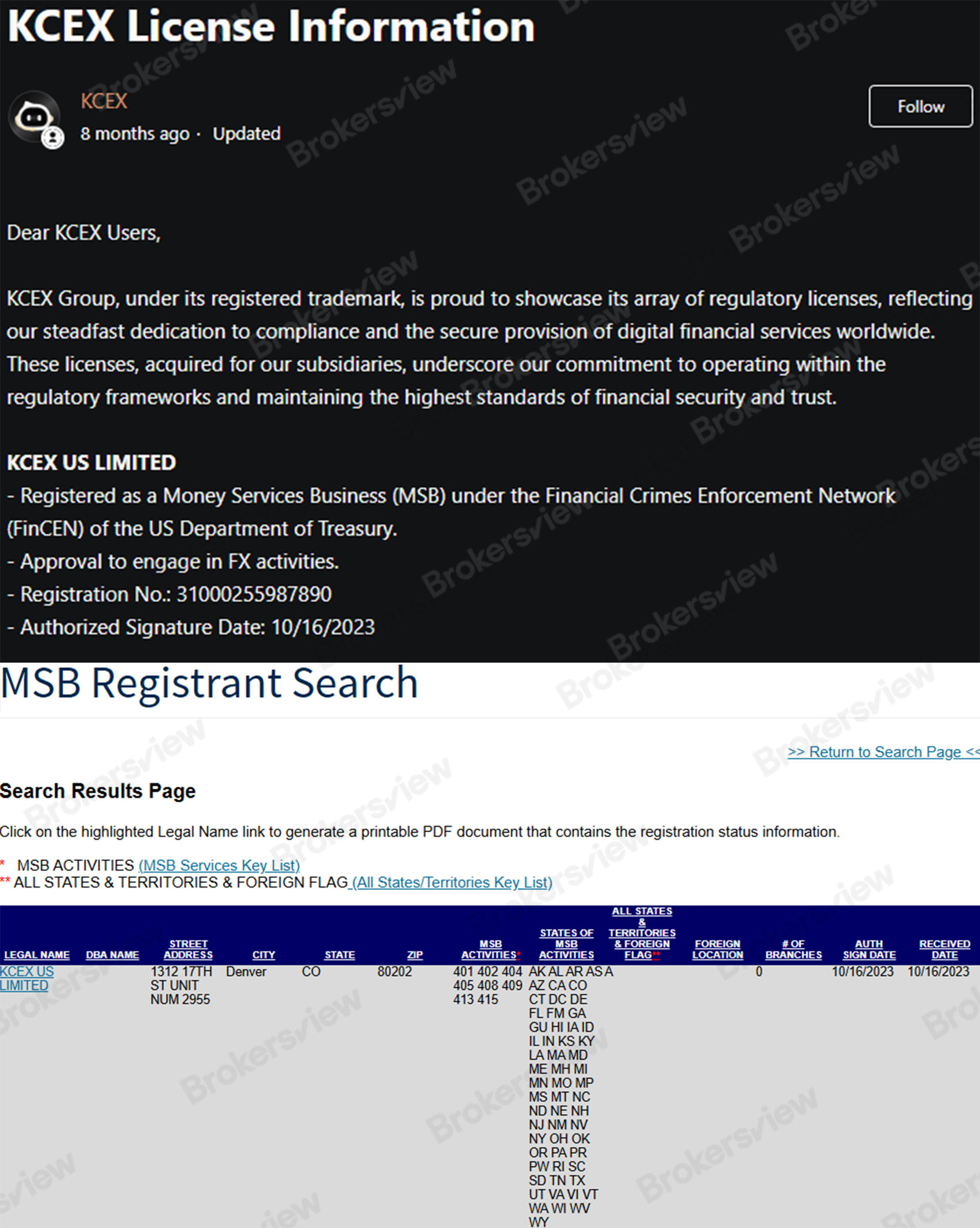

KCEX displays its registration as a Money Services Business (MSB) under FinCEN on its website. Our search confirms the record. However, this registration only means KCEX must follow anti-money laundering (AML), recordkeeping, and reporting rules. It does not grant a crypto exchange license.

Crypto regulation remains fragmented globally. In the U.S., no single federal agency issues comprehensive licenses for crypto exchanges. The Commodity Futures Trading Commission (CFTC) regulates crypto derivatives and futures markets, while the Securities and Exchange Commission (SEC) may assert jurisdiction over certain crypto assets deemed securities. For a Money Transmitter License or others, oversight depends on state-level rules.

KCEX claims to hold an “array of regulatory licenses,” yet no other licenses are shown. FinCEN’s MSB status alone is not enough to validate KCEX’s crypto operations, as the exchange is offering crypto trading services. This gap exposes traders to risks of fraud, misconduct, and regulatory evasion.

To report suspected fraud or misconduct by a trading platform, Submit a Complaint through BrokersView.