Indian Traders Accuse FX CTRUM of Using Various Excuses to Block Withdrawals

Recently, BrokersView has received accusations from several Indian traders on the review page for the broker FX CTRUM. Feedback from these investors reveals systemic obstacles regarding fund withdrawals on the platform. Combined with BrokersView's regulatory investigation data, this broker—which claims to hold multiple global regulatory qualifications—actually lacks legitimate financial service authorization.

A Seven-Month Withdrawal Tug-of-War

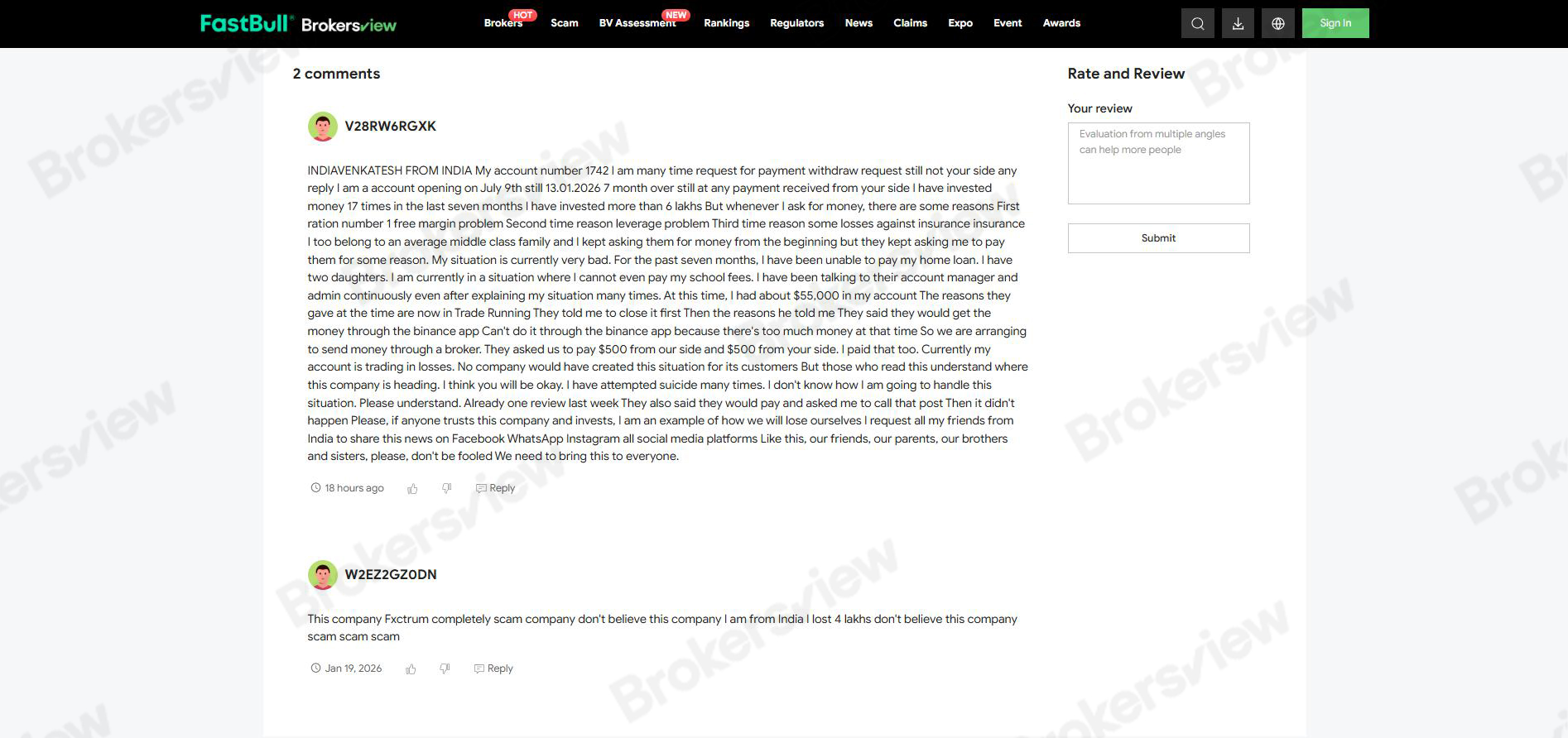

An Indian investor with User ID V28RW6RGXK detailed his experience over the past seven months. From opening his account on July 9, 2025, to January 13, 2026, this user made 17 separate investments, totaling over 600,000 INR. Although his account balance once showed as high as $55,000, he never successfully received a single withdrawal payment during this period.

According to the trader, whenever he initiated a withdrawal request, the broker would cite various reasons to reject it. Initial excuses involved "free margin problems," which then shifted to "leverage problems," and even included losses attributed to "insurance." When the trader attempted to resolve these issues, the broker claimed that due to the large amount in the account, transfers could not be made via the Binance app and had to be arranged through a broker transfer. For this service, the broker demanded a $500 fee from the trader.

Regrettably, even after the trader paid this additional fee as requested, the funds remained uncredited. Currently, his account shows trading losses. The inability to access his funds for such an extended period has led the trader into severe financial difficulties, leaving him unable to pay his home loan and children's tuition fees.

Another user (ID: W2EZ2GZ0DN) left similar feedback, claiming to have lost 400,000 INR on the platform and directly accusing FX CTRUM of being a scam company.

Fabricated Regulatory Status and Identity Theft

In its marketing, FX CTRUM claims to have obtained licenses from multiple authoritative bodies, including the Australian Securities & Investments Commission (ASIC), the Financial Conduct Authority (FCA), the National Futures Association (NFA), and the Securities and Futures Commission (SFC) of Hong Kong. Additionally, the platform claims to be a subsidiary of Fourier Fund LP (Nephila Capital Ltd).

However, BrokersView's investigation reveals that these claims are completely false.

First, no records regarding FX CTRUM or its claimed entities were found in the official registers of ASIC or NFA. This indicates that the platform possesses absolutely no authorization from Australian or U.S. regulators.

Second, regarding the cited FCA and SFC licenses, the investigation found that these license numbers actually belong to "Four Oaks Finance Limited" and "Fourth Dimension Capital Limited," respectively. The names of these two compliant companies bear no resemblance to FX CTRUM, and their website domains are entirely unrelated.

BrokersView Reminds You

FX CTRUM carries extremely high risk and lacks supervision from any genuine regulatory body.

Be Wary of Withdrawal Excuses: Legitimate brokers will never ask investors to pay extra "transfer fees" or "insurance fees" to process withdrawals, nor will they refuse payment through regular channels on the grounds of "large withdrawal amounts."

Verify Regulatory Information: Do not blindly trust the claims made on a broker's website. Always verify on the official websites of regulators (such as the FCA or ASIC) whether the company name and website URL corresponding to the license number match the broker in question.

If you have had a similar experience, please retain all evidence and submit a complaint to BrokersView.