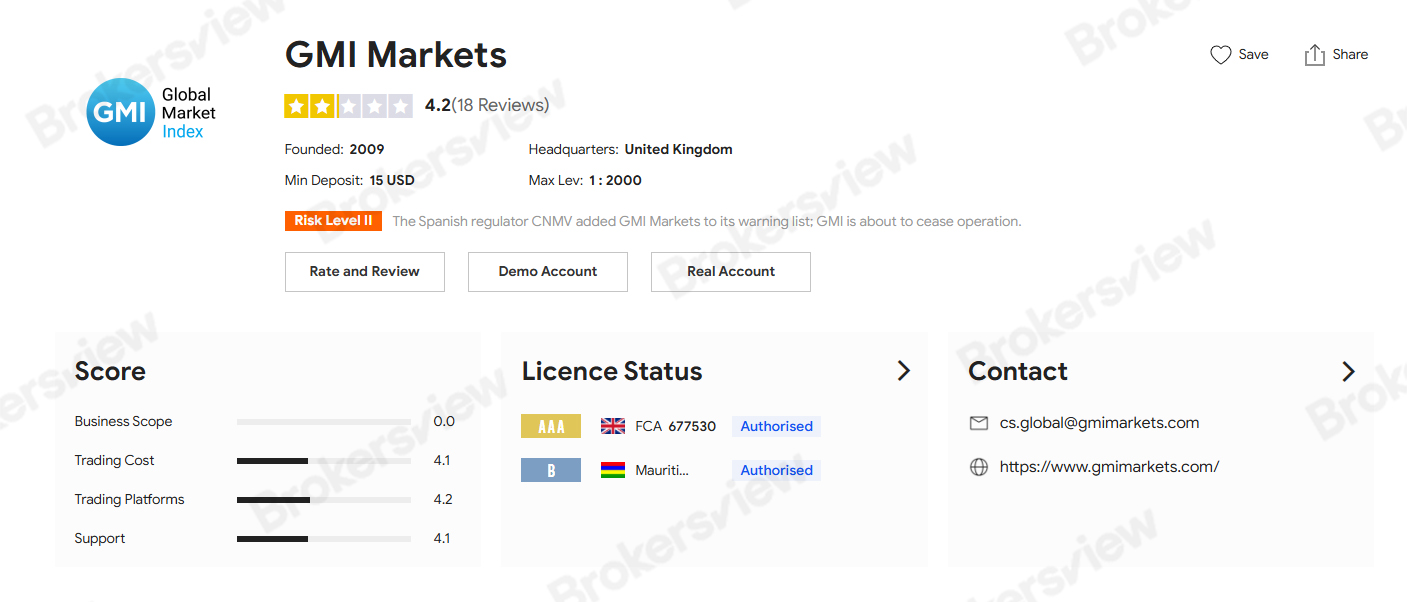

Important Notice: GMI to Cease Global Forex Trading Services, Clients Urged to Manage Funds and Monitor Key Deadlines

Global Market Index (GMI), a well-known foreign exchange broker, has issued an official notice announcing that Global Market Index LLC (SVG) and GMI Global Market Index Limited (St. Lucia) will gradually discontinue forex trading services worldwide. The move marks a full exit from the retail FX market by the long-standing platform, which has been operating for more than a decade and has held authorization from the UK's Financial Conduct Authority (FCA) since 2015.

In its announcement, GMI said the business transition takes effect immediately and outlined several critical deadlines, advising clients to make timely arrangements for their accounts.

Trading Cut-Off Time: 10:00 p.m. GMT on December 24, 2025. After that point, all trading activity must stop. The company strongly recommends that clients close all open positions before the deadline.

Close-Only Mode: From December 26 to 10:00 a.m. GMT on December 31, 2025, client accounts will switch to a restricted mode in which opening new positions will be disabled and only closing transactions will be allowed. All deposit functions will also be suspended starting December 26. Any remaining open positions at 10:00 a.m. on December 31 will be forcibly closed by the system.

Final Withdrawal Deadline: January 31, 2026. The company urges all clients to withdraw all available funds before this date.

Following the announcement, numerous users in investor communities and online forums began discussing the development and sharing updates on their account processing progress.

For affected investors, the immediate priority is to carefully review the official notice, understand the above non-negotiable deadlines, and begin planning the closure of positions and withdrawals to avoid operational obstacles or unnecessary risks arising from missed dates.

All GMI clients are advised to log in to their accounts without delay, review their open positions, and prepare a plan to close trades and withdraw funds before the deadlines. Clients should also retain transaction records, account statements, and communication logs with the platform for future reference.