How the Multi-Million Dollar Trove Markets Project Collapsed in Minutes

On January 20, 2026, the highly anticipated Perpetual DEX project, Trove Markets, suffered a catastrophic collapse following its Token Generation Event (TGE). Within minutes, its native token, $TROVE, plummeted by 98%. This crash erased the project's Fully Diluted Valuation (FDV), shrinking it from $20 million to approximately $110,000, leaving countless retail investors with massive losses. Rather than a failed launch, the event appears to be a meticulously planned, multi-layered capital scam.

Trove Markets initially positioned itself as a platform tailored for retail traders in the Asia-Pacific region. Leading up to the launch, the team conducted a presale on the Hyperliquid platform. Despite lacking venture capital (VC) backing, a mature product, or meaningful on-chain traction, the project's aggressive marketing successfully pushed fundraising past its $2.5 million target, ultimately securing over $11.5 million. Many retail investors overlooked the absence of fundamentals, lured in instead by the project's grand narrative.

The turning point involved the project's choice of underlying blockchain. During the presale, Trove loudly publicized plans for a permissionless integration with Hyperliquid via the HIP-3 proposal, claiming to have raised funds to purchase 500,000 HYPE tokens to meet integration requirements. However, shortly after the Initial Coin Offering (ICO) concluded, the team abruptly abandoned Hyperliquid, choosing instead to launch the token on Solana. The official explanation blamed a liquidity partner for withdrawing the necessary HYPE tokens, rendering the integration impossible.

On-chain data, however, tells a different story. Wallets linked to the project offloaded approximately 194,273 HYPE tokens within a 24-hour window, valued between $10 million and $12.9 million. There was no credible explanation for this sell-off, and the project's founder went as far as to deny controlling the wallet. It became evident that Hyperliquid was merely used as a marketing engine to raise capital; once the funds were secured, investors were abandoned in a sudden pivot to the Solana ecosystem.

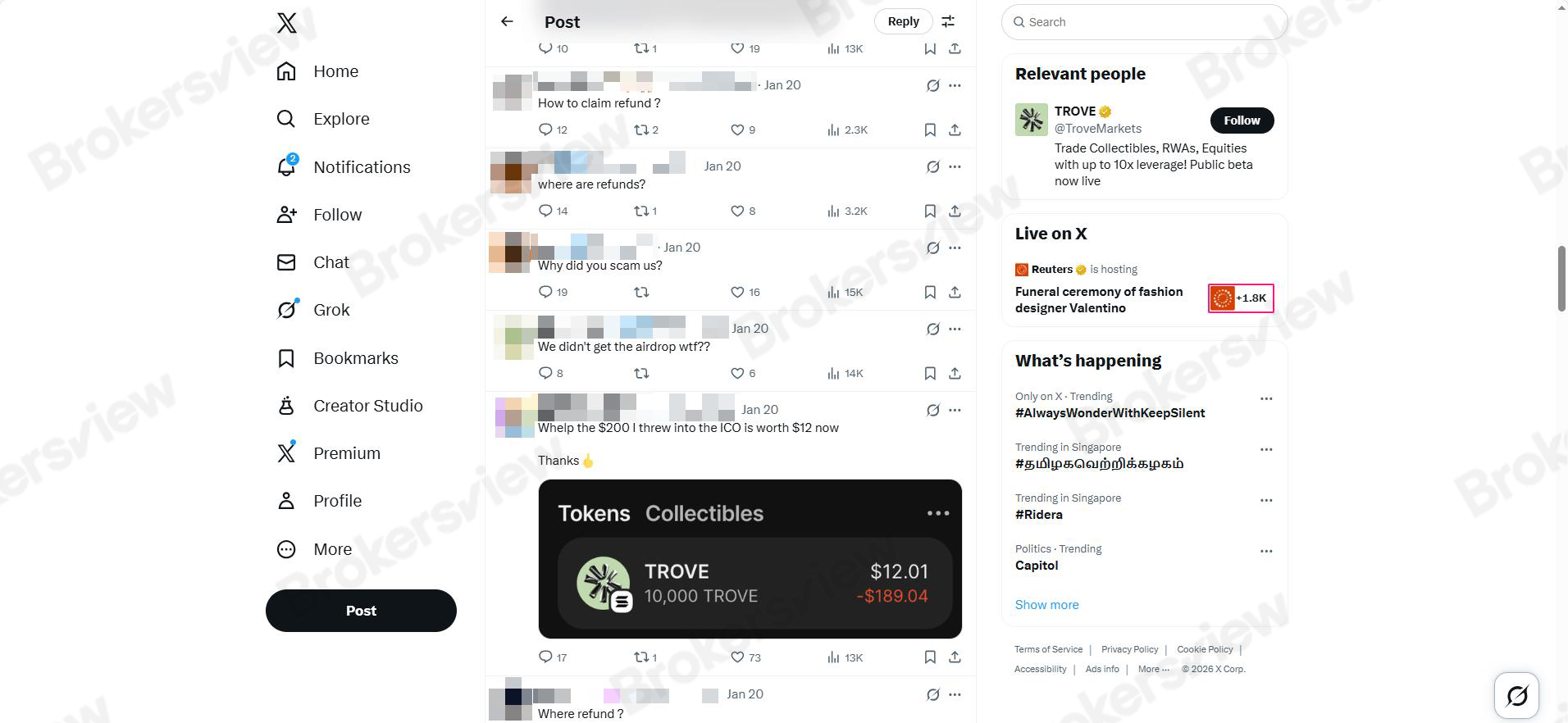

Subsequent developments further incensed the community. Following the ICO, Trove representatives announced they would retain $9.3 million to "build platform infrastructure"—a move widely flagged as a major red alert. Immediately after the token went live, the team withdrew approximately $2.5 million in liquidity, causing an instantaneous price collapse. One victim reported that an initial $20,000 investment, which was supposed to yield $14,000 in USDC and $6,000 in $TROVE, returned a mere $600 after the crash. Despite the community's outcry, the team offered no refunds.

The "extraction" extended beyond presale participants. Allegations surfaced that the team paid prominent KOLs (Key Opinion Leaders) to promote the project during the presale without disclosing these financial interests, creating artificial hype. Furthermore, the team is suspected of using presale fundraising data to manipulate outcomes on the prediction market Polymarket, resulting in losses of up to $73,000 for some traders. From presale investors and prediction market users to early supporters, nearly every participant in the ecosystem became a target for value extraction.

Currently, the official Trove Markets account on X has ceased all updates. On-chain sleuth ZachXBT responded to the project's final post by identifying an individual known as "unwisecap," who had introduced himself as a co-founder at the Token 2049 conference in October 2025. Facing devastating losses, some users have already proposed filing a class-action lawsuit against the project.

BrokersView Reminds You

The collapse of Trove Markets serves as another stark reminder of the high risks within the cryptocurrency market. Investors must remain extremely vigilant when participating in new projects.

Many seemingly objective project recommendations may hide undisclosed paid partnerships. You should exercise extreme caution when a project lacking VC backing and a tangible product is promoted on a massive scale.

If you encounter similar investment scams, please retain all relevant evidence and submit a complaint to BrokersView to protect your legal rights.