GTC Management Accused of Using Remote Access and AML Excuses to Trap Funds

Recently, a trader from South Africa filed a complaint with BrokersView, detailing the entire process of falling into a withdrawal trap set by GTC Management. Please note: This fraudulent broker has no affiliation with the regulated broker GTC.

According to the complainant, some staff from GTC Management contacted him via phone and used the remote desktop software AnyDesk to directly control his computer to perform a series of complex operations.

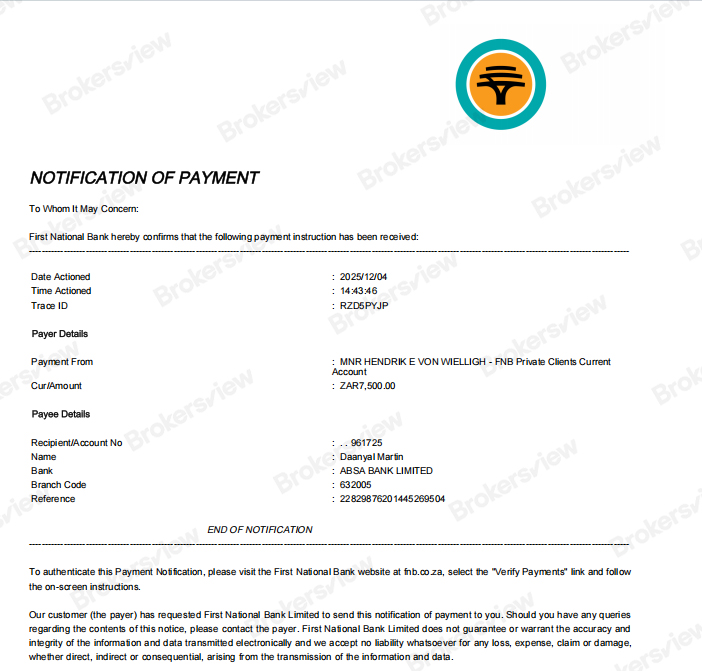

Notifications of Payment provided by the complainant show that the funds initially flowed out in fiat currency. On December 1, 2025, the complainant transferred R1,000via an FNB account to a recipient named "9bb500a18f81479e8098" at Nedbank. Just three days later, on December 4, he transferred another R7,500 to a personal account named "Daanyal Martin" at Absa Bank.

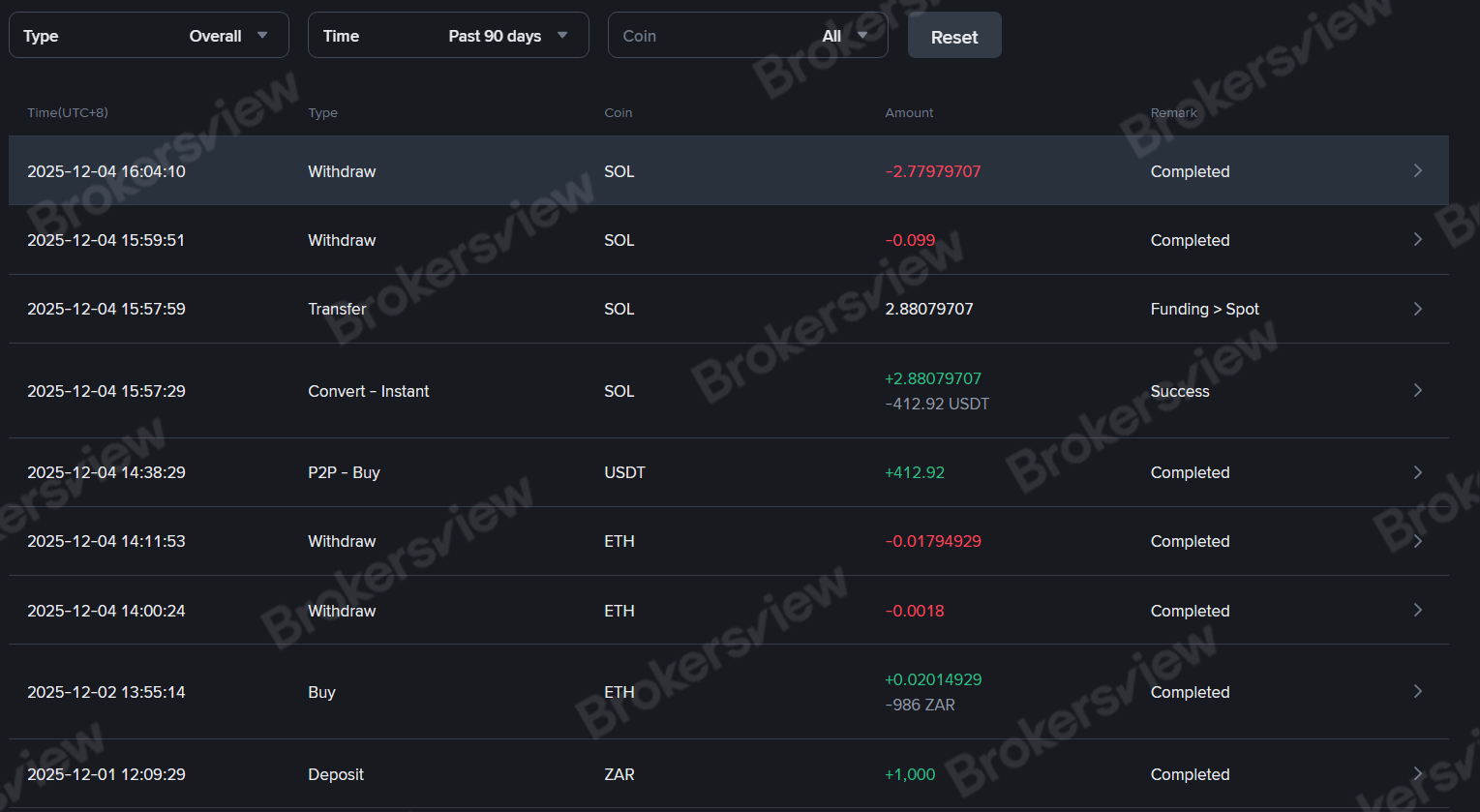

Under their remote control, these funds did not enter the platform directly but first entered the complainant's Binance account. Binance asset history records clearly document this process: on the afternoon of December 4, 2025, the funds were quickly converted into USDT and SOL, and then withdrawn within a few minutes. The complainant believed he was funding an investment account, but the money eventually flowed to GTC Management. This series of operations turned what would have been traceable bank transfers into difficult-to-track on-chain transactions.

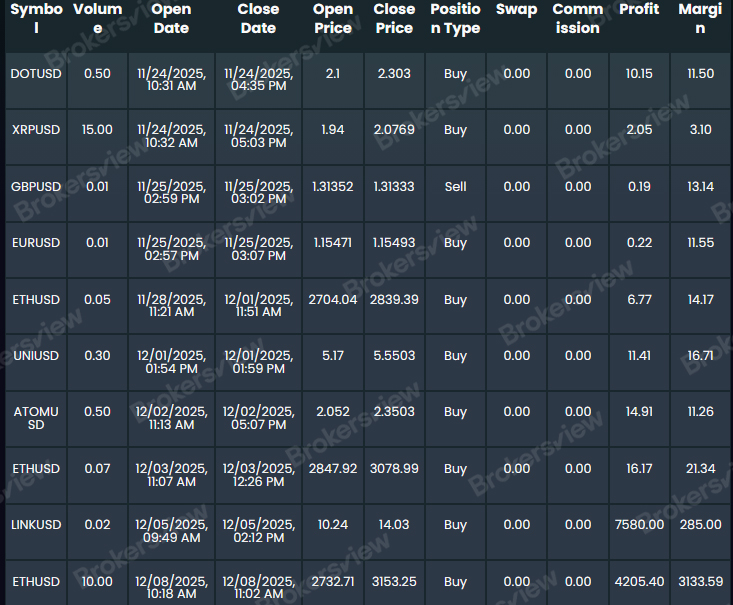

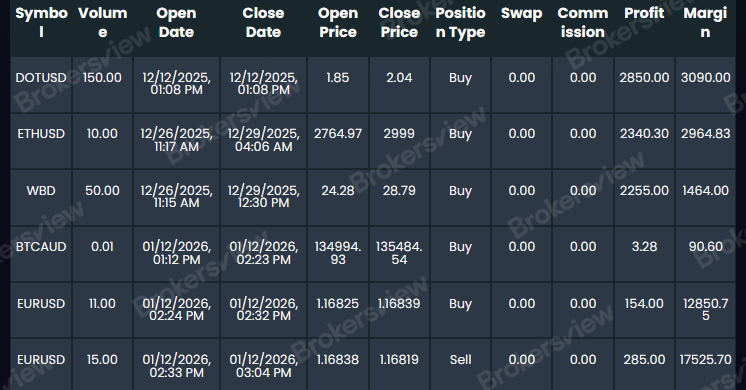

The process seemed smooth at the time, and the subsequent trading performance left the complainant quite satisfied. He admitted that after the funds arrived, both the broker and he performed some trades, and "the results were great." The account balance grew rapidly in a short period, and everything seemed to be progressing toward expected profitability.

However, when the complainant decided to withdraw the funds, the platform's previously proactive attitude suddenly turned to silence. Emails went unanswered, and withdrawal applications were shelved. Even more suspicious was the platform's functional setup—the complainant discovered that although there was an entry point to submit a request on the withdrawal page, there were no options to select an asset network or link a target wallet.

Secondary Deposit Requirements Under the Guise of "AML"

While he was caught in an state of anxiety, the previously unreachable broker suddenly initiated contact and proposed a so-called "solution." They claimed that to prevent the account funds from being flagged by the system as "money laundering" or fraud, the complainant could not withdraw directly but must first create an "EXT Wallet."

The conditions for activating this wallet and completing the transfer were staggering: the complainant had to transfer additional funds from Binance equivalent to 50% to 100% of the withdrawal amount. For a trader who simply wanted to recover his own money, this was undoubtedly a massive red flag. This logic—requiring a user to make a large deposit before withdrawing—completely exposed the fraudulent broker's intent: they are not concerned with compliance, but with how to squeeze the last bit of savings out of their users.

BrokersView Reminds You

The case of the fraudulent broker GTC Management demonstrates to all traders the risks behind "remote assistance." If you encounter a situation where you are asked to pay high fees to withdraw funds, please stop all transfers immediately and submit a complaint to BrokersView. We will assist you in exposing such misconduct.