Finam Forex Details Updated Income Tax Thresholds for Russian Traders

Finam Forex, one of Russia's licensed forex dealers, has once again been among the first in the sector to remind clients of their personal income tax obligations on trading profits earned during the 2025 calendar year. This year's guidance highlights changes to income thresholds that affect how the tax rate is applied.

Under Russian tax law, licensed forex dealers act as tax agents and are required to withhold personal income tax on clients' results from derivative financial instruments. The tax is calculated after the final trading session of the year and withheld from funds held across all client trading accounts. If insufficient funds are available, the dealer continues daily monitoring until January22,2026. Failing that, the client must settle the tax independently based on a notice from the tax authority.

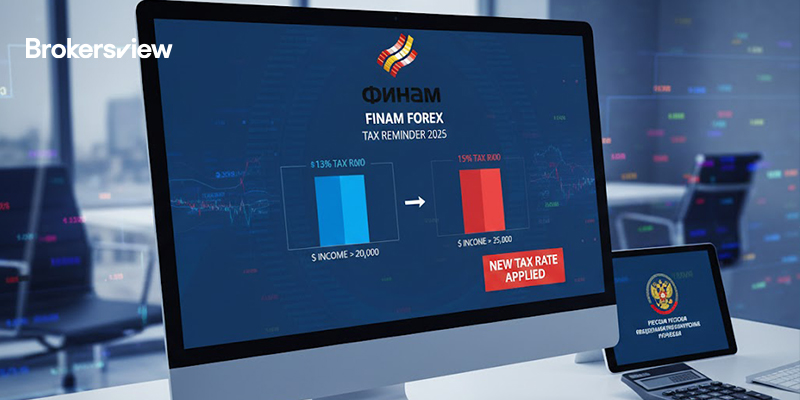

The applicable tax rates themselves remain unchanged: 13% on income up to a certain level, and 15% on income exceeding that threshold. However, for 2025 the higher rate now applies to income above 2.4 million rubles, compared with 5 million rubles previously. As a result, a larger group of traders becomes subject to the higher marginal rate, despite no change to the percentages themselves.

Finam's explanation indicates that taxable income is calculated as profit for the reporting year minus documented expenses, without offsetting losses from previous years. The dealer also noted that earlier withheld amounts are taken into account when finalising the annual calculation.

Based on Finam's previously published aggregated client results for the third quarter of 2025, 913 retail clients generated total profits of 146.7 million rubles, averaging around 161,000 rubles per trader for the quarter. On an annualised basis, this level of income remains below the first tax threshold, suggesting that for the majority of clients the practical impact of the revised thresholds may be limited.