Cloudflare Outage Aftermath: Brokers' Losses Come into Focus

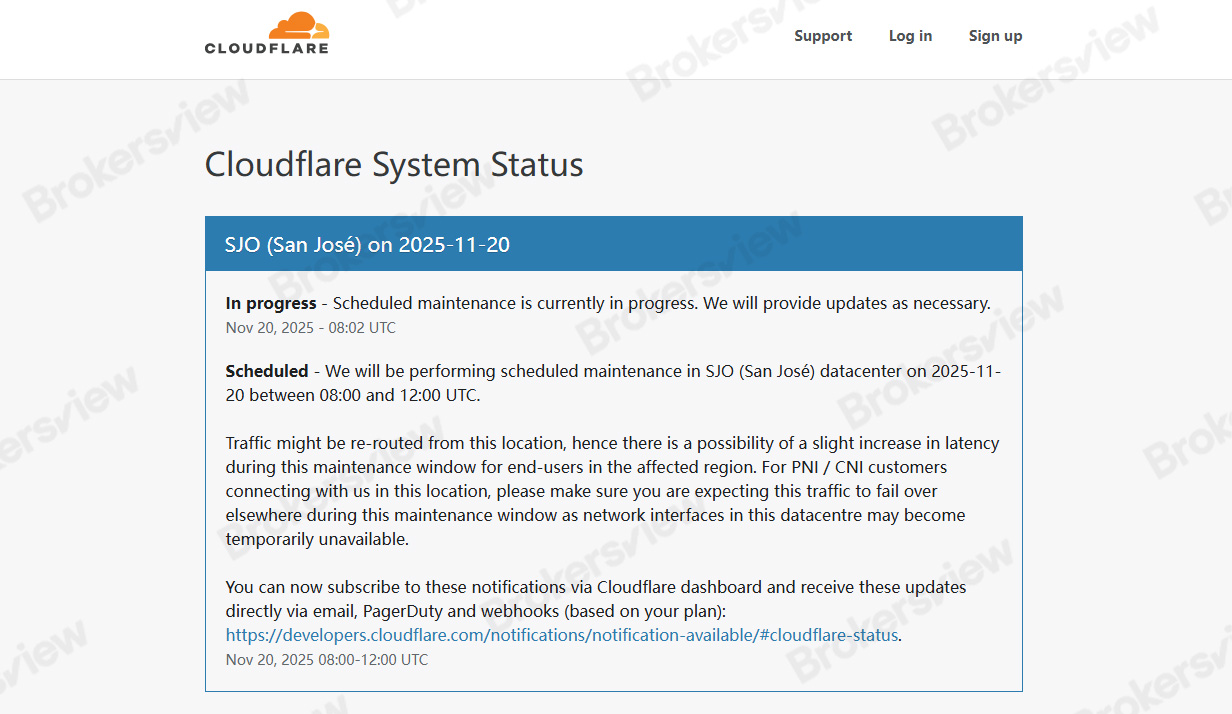

The global Cloudflare outage on November 18 has entered the recovery phase, but its impact on the trading industry is still evident. Most affected platforms—including brokers such as Monaxa, Skilling.com, Xtrade, and FXPro—have gradually restored access, yet the several hours of "slowed operations" have had a tangible effect on trading flow and liquidity.

Although major brokers have not publicly disclosed losses resulting from the outage, market estimates suggest that during the core trading hours affected by the downtime, the industry may have lost around $1.58 billion in trading volume, equivalent to roughly 1% of monthly broker turnover (approximating the impact on spreads and commission revenue for the month). This estimate is based on sample industry trading volumes and the concentration of activity during the outage period.

An equally notable effect is the lag in user behavior. Traders reported pausing their activity when they were unable to log in, deposit funds, or close positions in time. Even after systems were restored, it took time to return to normal trading rhythm. Many brokers regard these intangible effects as a form of "hidden cost."

Additionally, some third-party services—such as payment gateways, identity verification, and analytics websites—also experienced simultaneous slowdowns, causing the entire industry chain to operate at a reduced pace during the outage. Industry discussions are increasingly shifting from "what went wrong with Cloudflare" to "are we over-reliant on a single provider?"

Global Ripple Effects: More Than Just Brokers

Beyond individual brokers, the outage affected several critical areas:

- Financial markets: Cloudflare's stock fell approximately 5% in premarket trading, reflecting market sensitivity to infrastructure disruptions. Some global financial regulators' technical systems were also mildly affected.

- Trading security and infrastructure dependence: Industry experts noted that Cloudflare is not merely a CDN provider but a key part of the security infrastructure for FX and CFD brokers. This incident reinforced that high-level protection is not optional but essential for sectors that rely on real-time trading and high-frequency data.

- Crypto platforms and high-traffic services impacted: Multiple popular crypto services experienced "500 Internal Server Error" messages, including blockchain explorers, data tracking tools, and social media platforms. Users were blocked from accessing dashboards, analytics, and trading tools. A similar outage occurred last month at Amazon Web Services, highlighting the growing dependence of the digital trading ecosystem on a few core web service providers.