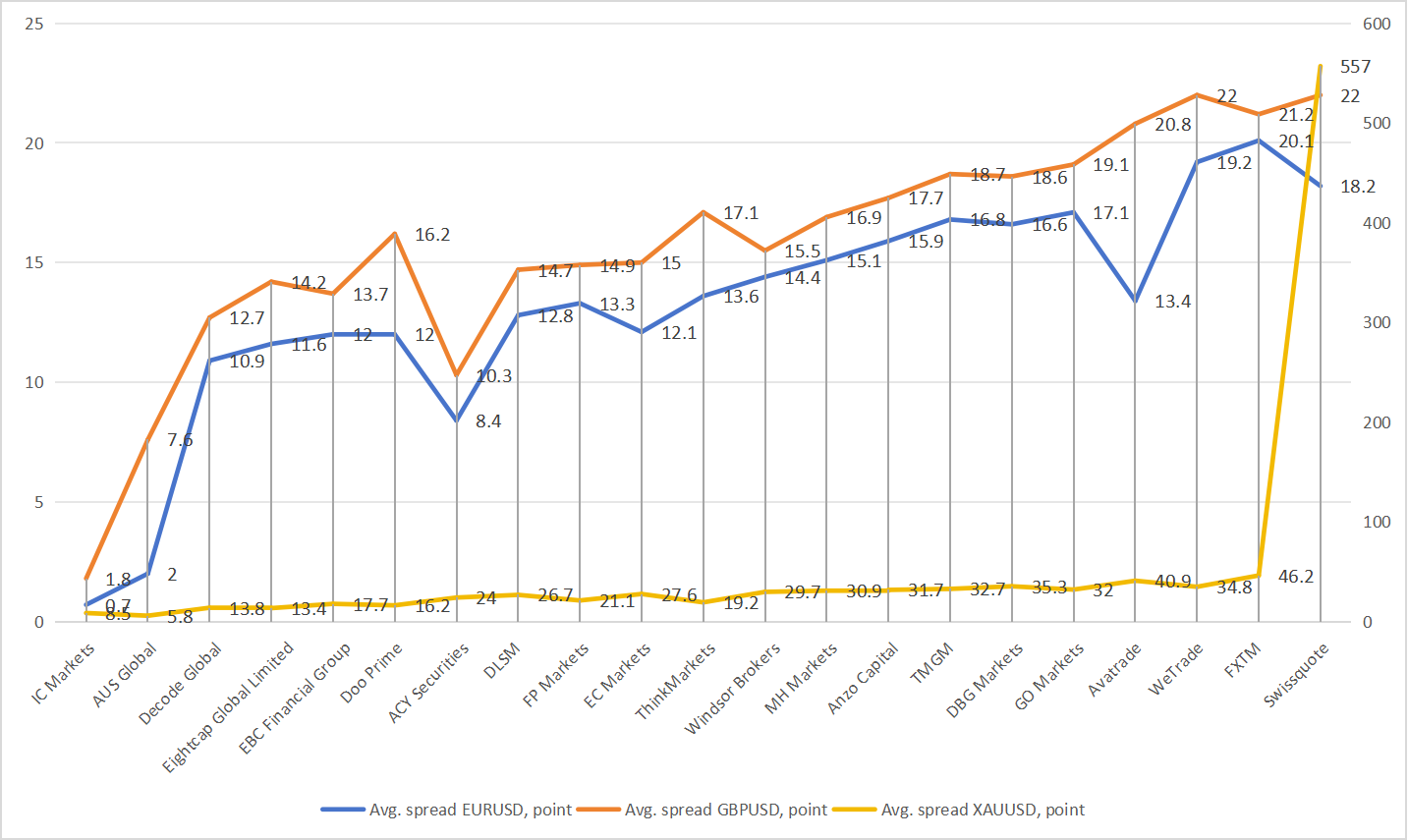

Brokersview October Broker Spread Review: Rankings from Tightest to Widest on Major Pairs & XAUUSD

As the trading landscape evolves, spreads remain a critical factor for traders seeking cost-efficient execution. This October, we conducted a comprehensive review of spreads across several major forex and commodity pairs—EUR/USD, GBP/USD, and XAU/USD—to highlight brokers offering the most competitive pricing.

1.IC Markets

EUR/USD: 0.7 points

GBP/USD: 1.8 points

XAU/USD: 8.5 points

IC Markets continues to lead the market in terms of cost efficiency. With ultra-tight spreads, IC Markets is an ideal choice for forex traders employing high-frequency or scalping strategies.

2.AUS Global

EUR/USD: 2 points

GBP/USD: 7.6 points

XAU/USD: 5.8 points

Notably, AUS Global offers the tightest spread for XAU/USD among the top brokers, making it particularly appealing for traders focusing on commodities without sacrificing forex trading efficiency.

3.Decode Global

EUR/USD: 10.9 points

GBP/USD: 12.7 points

XAU/USD: 13.8 points

Decode Global rounds out the top three, providing consistent spreads across forex and gold markets.

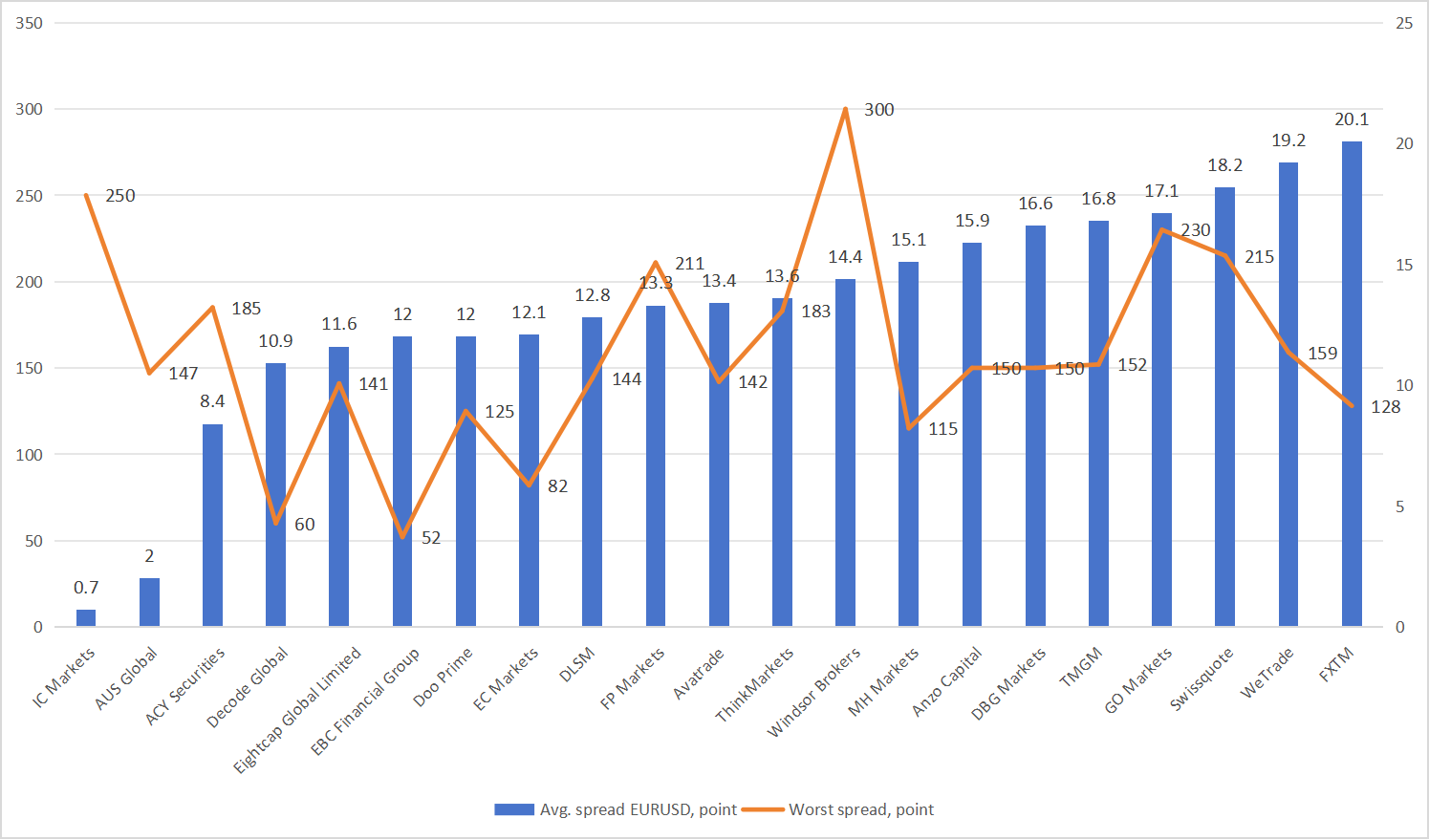

EURUSD Average Spreads

1.IC Markets

Average Spread (EUR/USD): 0.7 points

Worst Spread: 250 points

While volatility spikes can push spreads significantly higher—up to 250 points—the broker’s consistently low average spread keeps trading costs minimal for most market conditions.

2.AUS Global

Average Spread (EUR/USD): 2 points

Worst Spread: 147 points

AUS Global delivers competitive average spreads while keeping worst-case spreads relatively moderate. Traders looking for a balance between reliability and low trading costs may find AUS Global appealing, especially for standard trading conditions.

3.ACY Securities

Average Spread (EUR/USD): 8.4 points

Worst Spread: 185 points

ACY Securities offers higher average spreads than the other two, but its worst-case spreads remain within a reasonable range compared to other brokers with similar pricing tiers. It may suit traders who prioritize accessibility and multi-asset offerings over ultra-tight spreads.

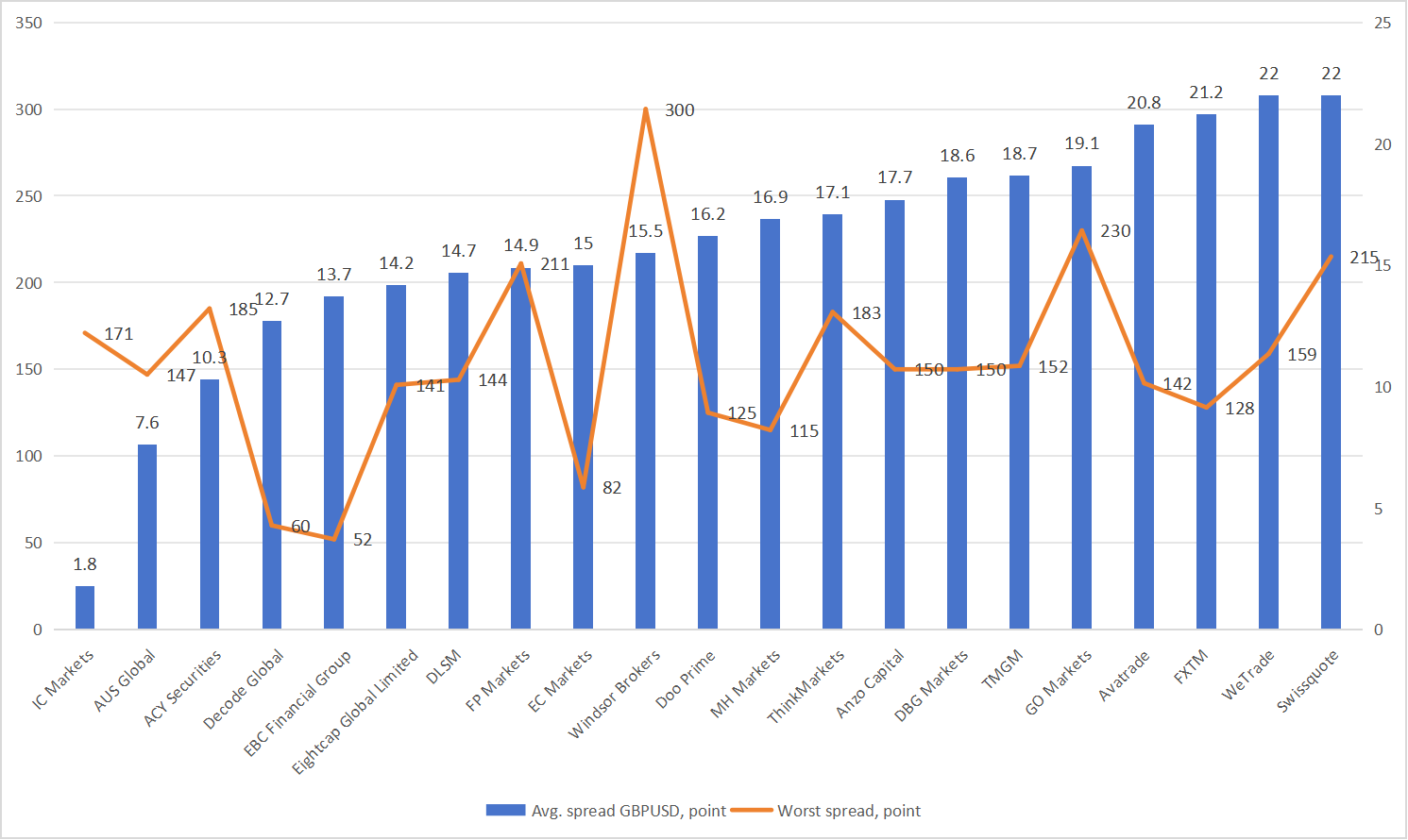

GBPUSD Average Spreads

1.IC Markets

Average Spread: 1.8 points

Worst Spread: 171 points

IC Markets stands out as the leader in tight spreads for GBP/USD. While occasional spikes can reach 171 points, its overall pricing remains among the most competitive in the market.

2.AUS Global

Average Spread: 7.6 points

Worst Spread: 147 points

Though its average spread is wider than IC Markets, AUS Global demonstrates relative stability, with worst-case spreads lower than several competitors, making it attractive for traders seeking a balance between cost and reliability.

3.ACY Securities

Average Spread: 10.3 points

Worst Spread: 185 points

ACY Securities rounds out the top three for GBP/USD spreads. It still provides competitive execution for traders who prefer a well-established broker offering access to multiple currency pairs.

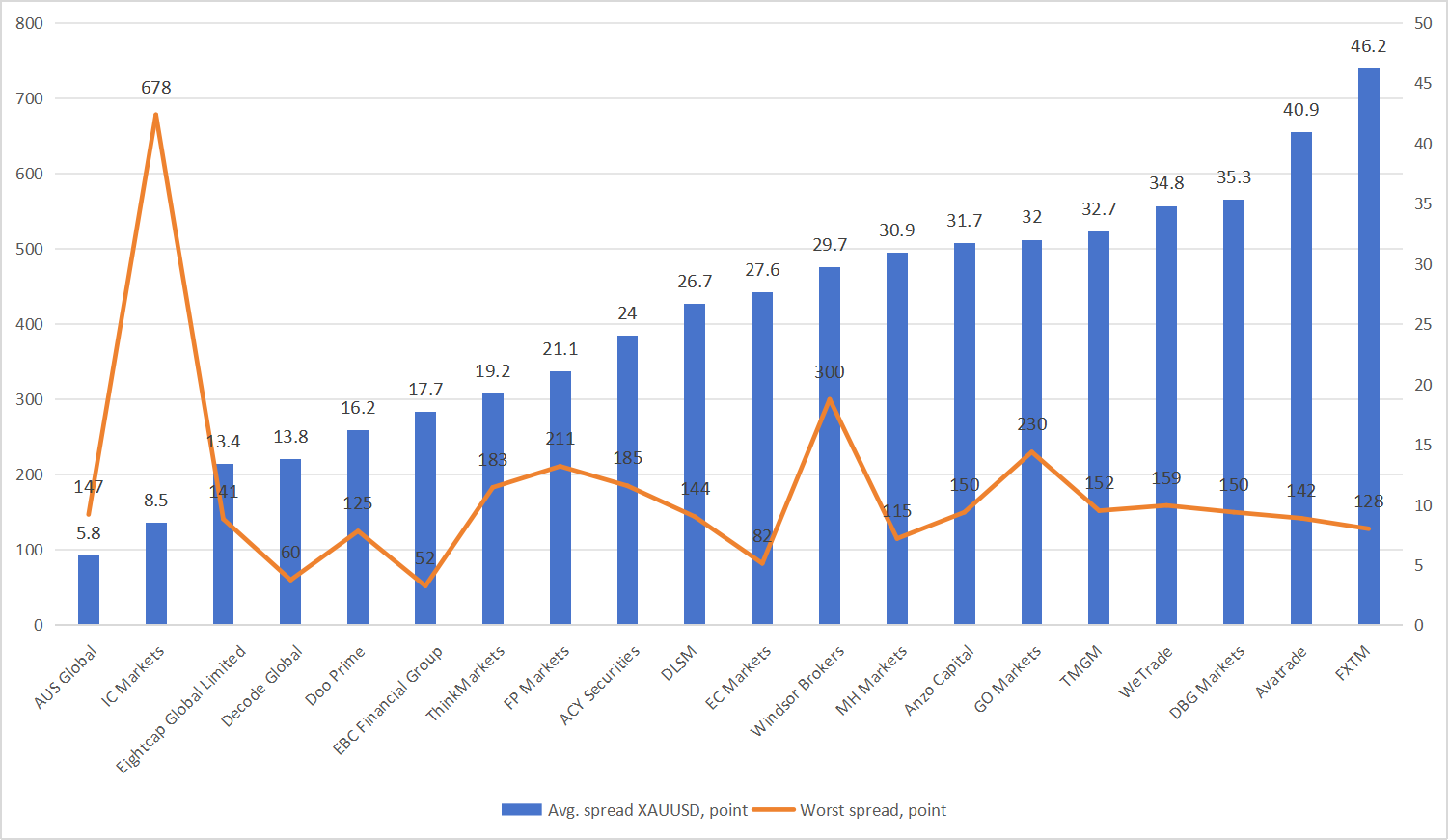

XAUUSD Average Spreads

1.IC Markets

Average Spread: 1.8 points

Worst Spread: 171 points

With an exceptionally low average spread, IC Markets is the top choice for active traders and scalpers. Even though the worst spread occasionally widens during volatile conditions, the broker consistently delivers efficient execution and minimal trading costs.

2.AUS Global

Average Spread: 7.6 points

Worst Spread: 147 points

AUS Global recorded the lowest worst-case spread among the top three, indicating relatively steady performance even under market pressure. This makes it a good option for swing and day traders looking for reliability over ultra-tight spreads.

3.ACY Securities

Average Spread: 10.3 points

Worst Spread: 185 points

Although its spreads are slightly higher, ACY Securities remains competitive for traders who value broad instrument access and institutional-grade trading infrastructure. It’s best suited for those prioritizing flexibility and robust platform support.

Summary

This October spread review highlights the brokers offering the most cost-efficient trading opportunities. For traders prioritizing tight spreads in both forex and gold, IC Markets and AUS Global are clear front-runners, while others may be better suited for less frequent trading or alternative services.

Data Source: Brokersview Spread Ranking