Daily Technical Analysis: [04 Dec]

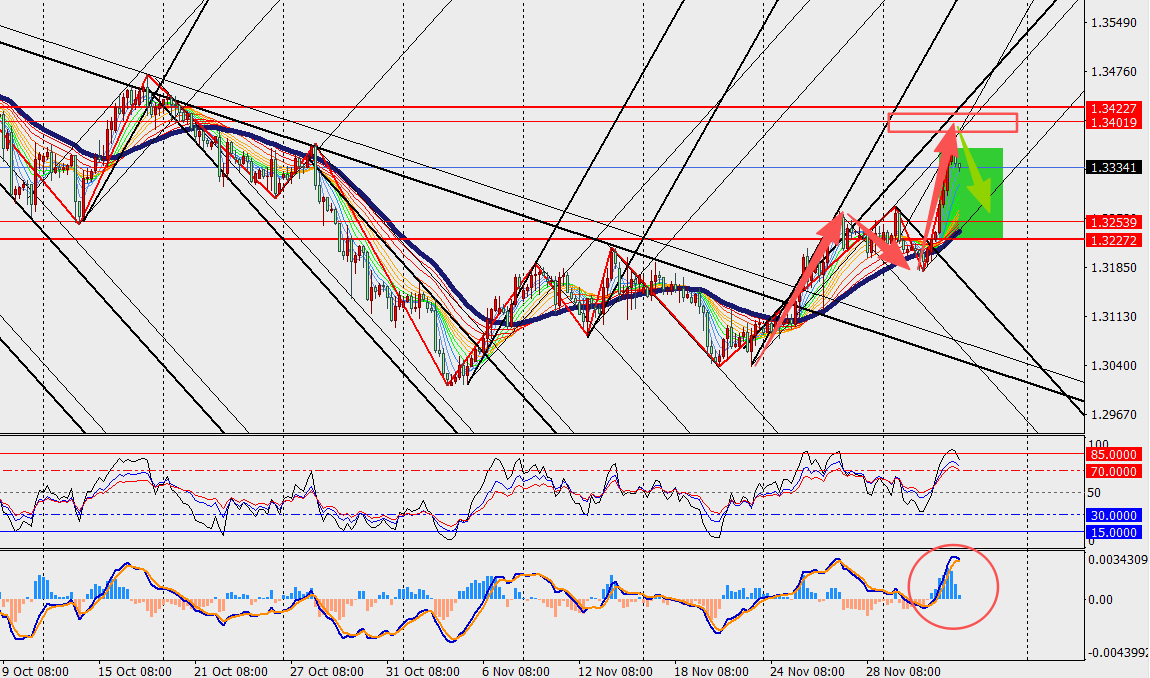

1. GBP/USD Analysis:

News Summary:

According to one of the UK’s largest mortgage lenders, UK house prices rose for a third consecutive month, indicating that the market has withstood the looming threat of higher taxes ahead of the Labour government’s November 26 budget. The Nationwide Building Society reported that average house prices increased by 0.3% in the month to November, reaching £272,998, following a revised 0.2% rise in the previous month.

Trend Analysis:

On the H4 chart, we can see GBP/USD has surged significantly and is trading above the 48 hours moving average. Meanwhile, the MACD double line and histogram bars are showing top divergence above the zero axis. The sell limit could be placed, stop loss is necessary.

Today's Key Price Levels:

Key Support Levels: [1.3250]

Key Resistance Levels: [1.3420]

Pivot Points [1.3370]

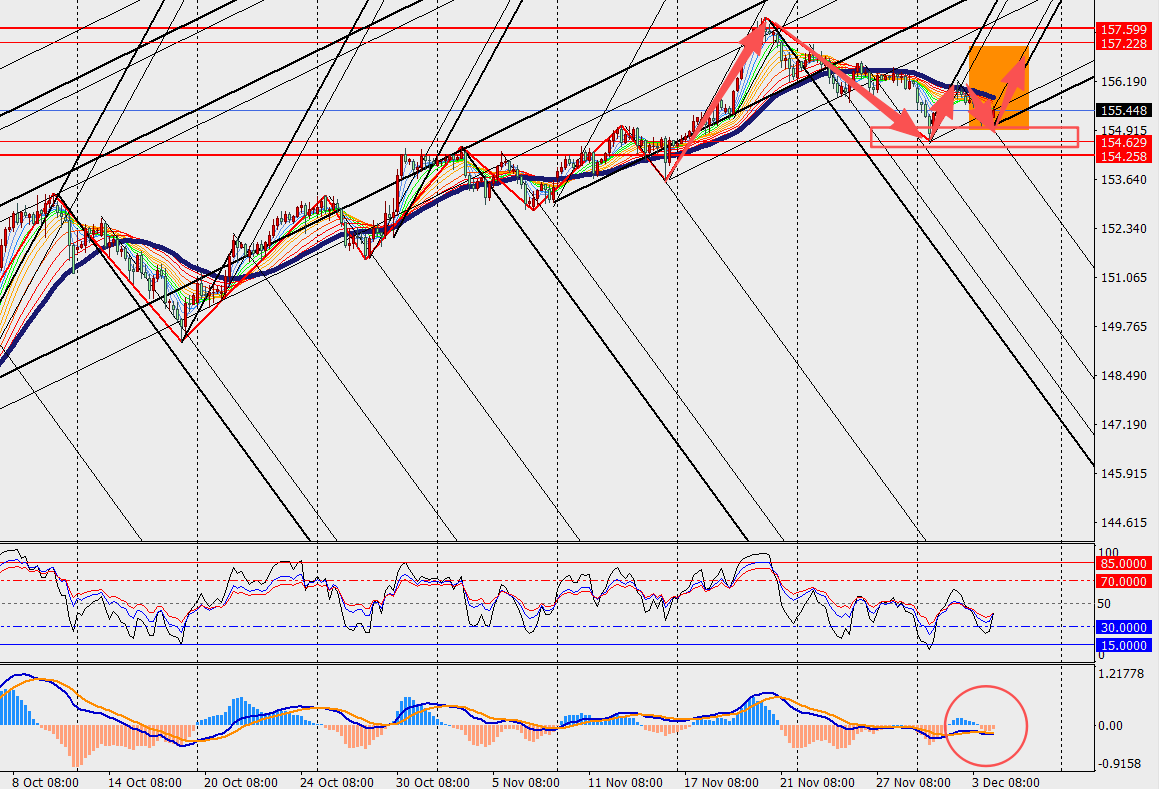

2. USD/JPY Analysis:

News Summary:

Market expectations for rising consumer prices in Japan are suppressing inflation-adjusted bond yields, thereby weakening the support those yields typically provide for the yen. A key gauge of future inflation expectations—the 10-year breakeven inflation rate—surged this week to its highest level on record since data began in 2004. It briefly touched around 1.74% on Monday and has remained above 1.7% even after the Bank of Japan governor moved to tighten monetary policy.

Trend Analysis:

We can see USD/JPY has fallen and then rebounded, returning toward the 48 hours moving average on H4 chart. On the other hand, the MACD double line and energy bars are converging below the zero line. The buy limit could be used, stop loss is mandatory.

Today's Key Price Levels:

Key Support Levels: [154.50]

Key Resistance Levels: [157.00]

Pivot Points [155.00]