Daily Technical Analysis: [03 Dec]

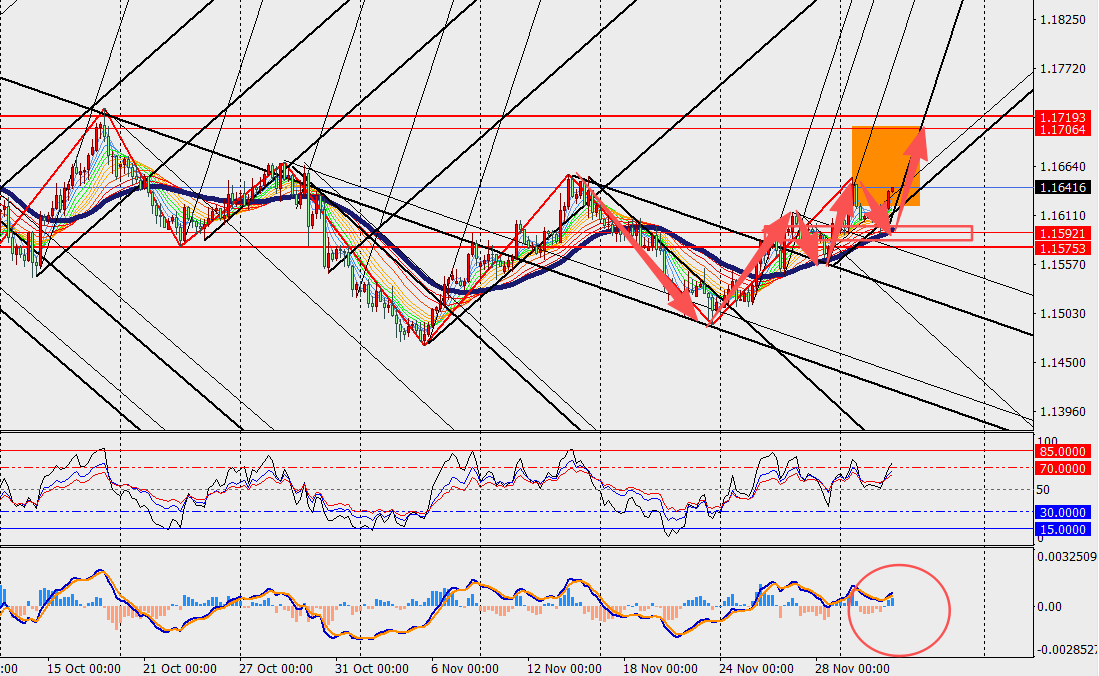

1. EUR/USD Analysis:

News Summary:

Eurozone data released on Tuesday showed that the unemployment rate for October came in slightly weaker than expected, rising 0.1 percentage point above the market forecast of 6.3%, with an actual reading of 6.4%. Although the figure was marginally below expectations, market sentiment has remained stable. Investors generally believe the data is unlikely to alter the European Central Bank’s stance of keeping interest rates steady, as the ECB has clearly stated that it will maintain policy continuity for the foreseeable future.

Trend Analysis:

On the H4 chart, we can see EUR/USD has been rebounding within a consolidation range and is trading above the 48 hours moving average. However, the MACD double line and histogram bars are expanding above the zero axis. The buy limit could be set, stop loss is necessary.

Today's Key Price Levels:

Key Support Levels: [1.1570]

Key Resistance Levels: [1.1720]

Pivot Points [1.1600]

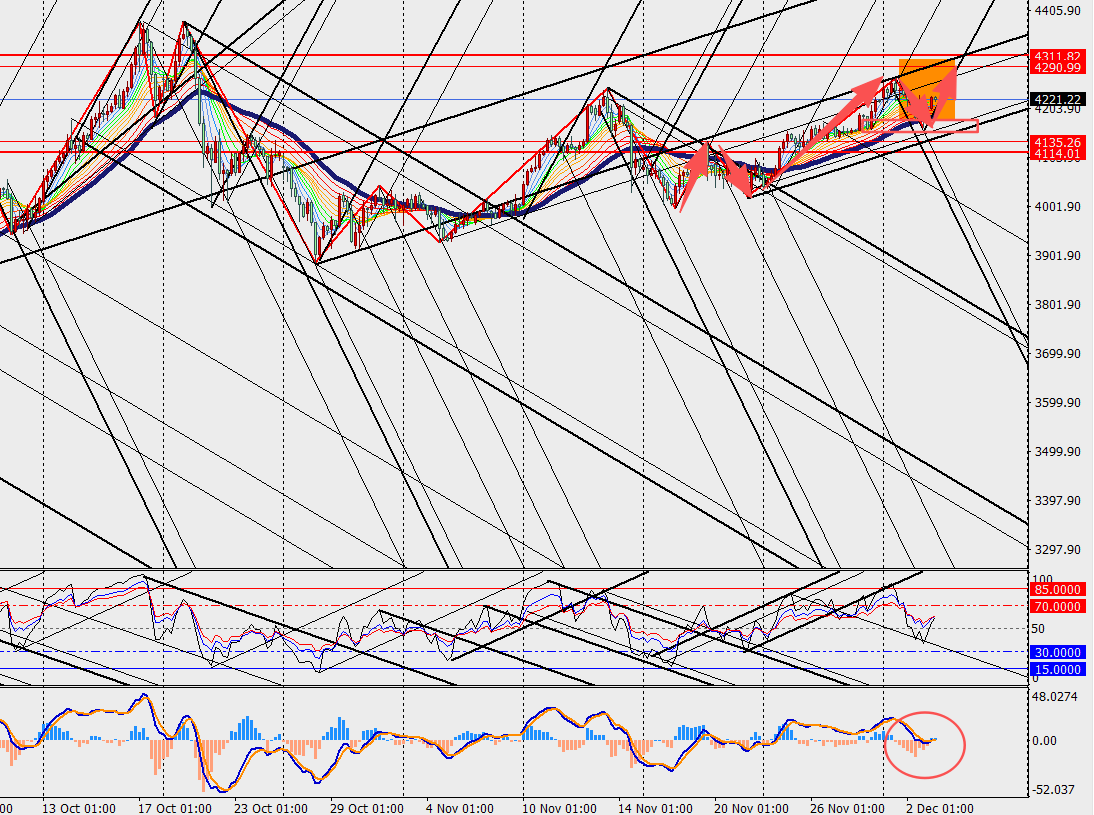

2. Gold Analysis:

News Summary:

Previously, the U.S. dollar index had been rapidly seeking a bottom due to a reversal in Federal Reserve rate-cut expectations and the stance of several central banks signaling policies contrary to the Fed. However, the excessively crowded short-dollar positions, along with the sharp rise in U.S. Treasury yields, forced the dollar index to rebound in a choppy manner. The dollar’s recovery not only made gold—priced in U.S. dollars—relatively more expensive, but also absorbed market liquidity, thereby suppressing gold’s upward momentum.

Trend Analysis:

We can see gold has rebounded and is trading above the 48 hours moving average. In addition, the MACD double line and energy bars are expanding above the zero axis. The buy limit could be placed, stop loss is mandatory.

Today's Key Price Levels:

Key Support Levels: [4180]

Key Resistance Levels: [4270]

Pivot Points [4200]