- الوسطاء HOT

- الإحتيال

- مراجعة بي في NEW

- القوائم

- الهيئات الرقابية

- الأخبار

- الشكوي

- اكسبو HOT

- الحادث

- الجوائز

Daily Technical Analysis: [20 JAN]

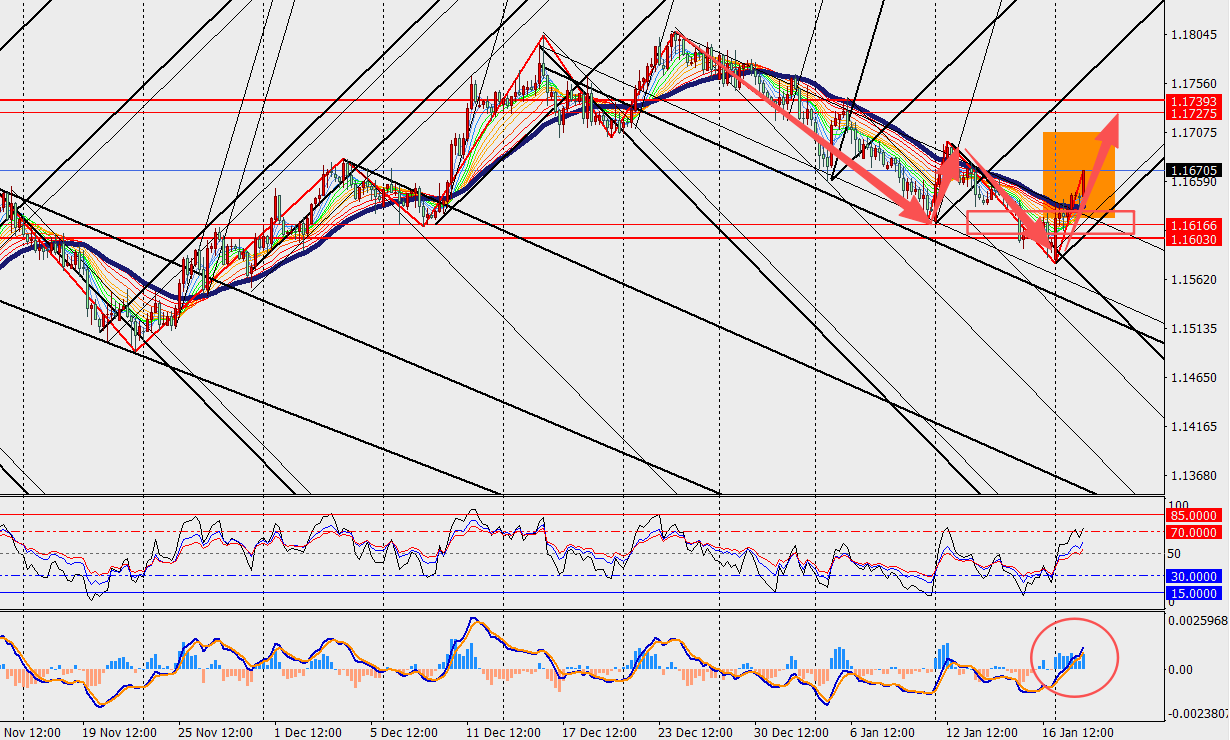

1. EUR/USD Analysis:

News Summary:

As Europe considers how best to respond to U.S. President Donald Trump’s latest threats over Greenland’s sovereignty, an extreme potential countermeasure is sparking debate among investors. European countries hold trillions of dollars’ worth of U.S. Treasuries and equities, some of which are owned by public-sector funds. Given the United States’ reliance on foreign capital, Europe could respond to Trump’s renewed tariff war by selling such assets, a move that could push up U.S. borrowing costs and weigh on U.S. equity markets.

Trend Analysis:

We can see EUR/USD has rebounded again on the H4 chart and is trading near the 48 hours moving average. Meanwhile, the MACD double line and histogram bars are expanding below the zero axis. The buy limit could be placed, stop loss is necessary.

Today's Key Price Levels:

Key Support Levels: [1.1600]

Key Resistance Levels: [1.1750]

Pivot Points [1.1630]

2. USD/JPY Analysis:

News Summary:

Citigroup said that if the yen remains persistently weak, the Bank of Japan could raise interest rates three times this year, effectively doubling the policy rate. If USD/JPY breaks above 160, the BOJ may raise the unsecured overnight call rate by 25 basis points to 1% in April. If the yen stays at low levels, a second hike of the same magnitude could take place in July, and a third increase before year-end cannot be ruled out.

Trend Analysis:

On the H4 chart, we can see USD/JPY has rebounded after a decline and is trading near the 48 hours moving average. In addition, the MACD double line and energy bars continue to converge around the zero axis. The sell limit could be set, stop loss is mandatory.

Today's Key Price Levels:

Key Support Levels: [157.00]

Key Resistance Levels: [158.80]

Pivot Points [158.40]