Petikan

Berita

Analisis

Pengguna

24/7

Kalendar Ekonomi

Pendidikan

Data

- Nama

- Terkini

- Sblm

Akaun Signal untuk Ahli

Semua Akaun Signal

Semua Peraduan

Kementerian Pertahanan Rusia Mengatakan Pasukannya Menangkap X Prydorozhnie Di Wilayah Zaporizhzhia Ukraine

Indeks Pengurus Pembelian Absa Afrika Selatan Meningkat Kepada 48.7 Mata Pada Januari Daripada 40.5 Mata Pada Bulan Sebelumnya

Tinjauan Selamat Bank Pusat Eropah: Firma Melaporkan Peningkatan Perolehan Sepanjang 3 Bulan Terakhir, Bersih 18% Optimis Mengenai Perkembangan Pada Suku Akan Datang

Tinjauan Selamat Bank Pusat Eropah: Firma Terus Menyaksikan Kemerosotan Keuntungan Mereka, Dengan 10% Bersih Firma Melaporkan Keuntungan Lebih Rendah

Menteri Kewangan Sweden: Rancangan Tahun Ini Dan Pada Tahun-tahun Akan Datang Adalah Untuk Melindungi Dan Memperkukuhkan Kewangan

Hsi Turun 611 Mata, Hsti Turun 191 Mata, Baba Turun Lebih 3%, Bj Ent Water Cecah Paras Tertinggi Baharu, Perolehan Pasaran Meningkat

Indeks Sumber Asas Eropah Turun 3.3%, Dijangka Akan Menurun Harian Terbesar Dalam Hampir 10 Bulan

PMI Pelarasan Bermusim Hungary Jatuh Kepada 49.3 Pada Januari Daripada 54 Disemak Semula Pada Disember - Penerbit

Sekretariat OPEC Menerima Pelan Pampasan Dikemas Kini Daripada Iraq, Emiriah Arab Bersatu, Kazakhstan dan Oman

Amerika Syarikat Kadar Tahunan PPI Teras (Dis)

Amerika Syarikat Kadar Tahunan PPI Teras (Dis)S:--

R: --

Amerika Syarikat Kadar Bulanan Teras PPI (Selepas Pelarasan Bermusim) (Dis)

Amerika Syarikat Kadar Bulanan Teras PPI (Selepas Pelarasan Bermusim) (Dis)S:--

R: --

S: --

Amerika Syarikat Kadar Bulanan PPI (Selepas Pelarasan Bermusim) (Dis)

Amerika Syarikat Kadar Bulanan PPI (Selepas Pelarasan Bermusim) (Dis)S:--

R: --

S: --

Amerika Syarikat Nilai Akhir Kadar Bulanan PPI (Tidak Termasuk Makanan, Tenaga Dan Perdagangan) (Selepas Pelarasan Bermusim) (Dis)

Amerika Syarikat Nilai Akhir Kadar Bulanan PPI (Tidak Termasuk Makanan, Tenaga Dan Perdagangan) (Selepas Pelarasan Bermusim) (Dis)S:--

R: --

S: --

Amerika Syarikat Kadar Tahunan PPI (Tidak Termasuk Makanan, Tenaga Dan Perdagangan) (Dis)

Amerika Syarikat Kadar Tahunan PPI (Tidak Termasuk Makanan, Tenaga Dan Perdagangan) (Dis)S:--

R: --

S: --

Amerika Syarikat PMI Chicago (Jan)

Amerika Syarikat PMI Chicago (Jan)S:--

R: --

Kanada Baki Belanjawan Kerajaan Persekutuan (Nov)

Kanada Baki Belanjawan Kerajaan Persekutuan (Nov)S:--

R: --

S: --

Amerika Syarikat Jumlah Pelantar Minyak Untuk Minggu Ini

Amerika Syarikat Jumlah Pelantar Minyak Untuk Minggu IniS:--

R: --

S: --

Amerika Syarikat Jumlah Bilangan Pelantar Penerokaan Mingguan

Amerika Syarikat Jumlah Bilangan Pelantar Penerokaan MingguanS:--

R: --

S: --

China, Tanah Besar PMI Pembuatan Rasmi (Jan)

China, Tanah Besar PMI Pembuatan Rasmi (Jan)S:--

R: --

S: --

China, Tanah Besar PMI Bukan Pengilangan Rasmi (Jan)

China, Tanah Besar PMI Bukan Pengilangan Rasmi (Jan)S:--

R: --

S: --

China, Tanah Besar PMI Komposit (Jan)

China, Tanah Besar PMI Komposit (Jan)S:--

R: --

S: --

Korea Selatan Baki Dagangan Pendahuluan (Jan)

Korea Selatan Baki Dagangan Pendahuluan (Jan)S:--

R: --

Jepun Nilai Akhir PMI Pembuatan (Jan)

Jepun Nilai Akhir PMI Pembuatan (Jan)S:--

R: --

S: --

Korea Selatan PMI Pembuatan Markit IHS (Dilaraskan Secara Bermusim) (Jan)

Korea Selatan PMI Pembuatan Markit IHS (Dilaraskan Secara Bermusim) (Jan)S:--

R: --

S: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)S:--

R: --

S: --

China, Tanah Besar PMI Pembuatan Caixin (Selepas Pelarasan Bermusim) (Jan)

China, Tanah Besar PMI Pembuatan Caixin (Selepas Pelarasan Bermusim) (Jan)S:--

R: --

S: --

Indonesia Baki Dagangan (Dis)

Indonesia Baki Dagangan (Dis)S:--

R: --

S: --

Indonesia Kadar Inflasi Tahunan (Jan)

Indonesia Kadar Inflasi Tahunan (Jan)S:--

R: --

S: --

Indonesia Inflasi Teras Tahunan (Jan)

Indonesia Inflasi Teras Tahunan (Jan)S:--

R: --

S: --

India PMI Pengilangan Akhir HSBC (Jan)

India PMI Pengilangan Akhir HSBC (Jan)S:--

R: --

S: --

Australia Kadar Tahunan Harga Komoditi (Jan)

Australia Kadar Tahunan Harga Komoditi (Jan)S:--

R: --

S: --

Rusia IHS Markit Manufacturing PMI (Jan)

Rusia IHS Markit Manufacturing PMI (Jan)S:--

R: --

S: --

Turki PMI Pembuatan (Jan)

Turki PMI Pembuatan (Jan)S:--

R: --

S: --

U.K. Indeks Harga Rumah Seluruh Negara MoM (Jan)

U.K. Indeks Harga Rumah Seluruh Negara MoM (Jan)S:--

R: --

S: --

U.K. Indeks Harga Rumah Seluruh Negara YoY (Jan)

U.K. Indeks Harga Rumah Seluruh Negara YoY (Jan)S:--

R: --

S: --

Jerman Kadar Bulanan Jualan Runcit Sebenar (Dis)

Jerman Kadar Bulanan Jualan Runcit Sebenar (Dis)S:--

R: --

Itali PMI Pembuatan (Dilaraskan Mengikut Musim) (Jan)

Itali PMI Pembuatan (Dilaraskan Mengikut Musim) (Jan)S:--

R: --

S: --

Afrika Selatan PMI Pembuatan (Jan)

Afrika Selatan PMI Pembuatan (Jan)S:--

R: --

S: --

Zon Euro Nilai Akhir PMI Pembuatan (Jan)

Zon Euro Nilai Akhir PMI Pembuatan (Jan)S:--

R: --

S: --

U.K. Nilai Akhir PMI Pembuatan (Jan)

U.K. Nilai Akhir PMI Pembuatan (Jan)--

R: --

S: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

R: --

S: --

Kanada Indeks Keyakinan Ekonomi Negara

Kanada Indeks Keyakinan Ekonomi Negara--

R: --

S: --

Kanada PMI Pembuatan (Dilaraskan Mengikut Musim) (Jan)

Kanada PMI Pembuatan (Dilaraskan Mengikut Musim) (Jan)--

R: --

S: --

Amerika Syarikat Nilai Akhir PMI Pembuatan Markit IHS (Jan)

Amerika Syarikat Nilai Akhir PMI Pembuatan Markit IHS (Jan)--

R: --

S: --

Amerika Syarikat Indeks Keluaran ISM (Jan)

Amerika Syarikat Indeks Keluaran ISM (Jan)--

R: --

S: --

Amerika Syarikat Indeks Inventori ISM (Jan)

Amerika Syarikat Indeks Inventori ISM (Jan)--

R: --

S: --

Amerika Syarikat Indeks Pekerjaan Pembuatan ISM (Jan)

Amerika Syarikat Indeks Pekerjaan Pembuatan ISM (Jan)--

R: --

S: --

Amerika Syarikat ISM Mengeluarkan Indeks Pesanan Baharu (Jan)

Amerika Syarikat ISM Mengeluarkan Indeks Pesanan Baharu (Jan)--

R: --

S: --

Amerika Syarikat PMI Pembuatan ISM (Jan)

Amerika Syarikat PMI Pembuatan ISM (Jan)--

R: --

S: --

Korea Selatan CPI YoY (Jan)

Korea Selatan CPI YoY (Jan)--

R: --

S: --

Jepun Kadar Tahunan Mata Wang Asas (SA) (Jan)

Jepun Kadar Tahunan Mata Wang Asas (SA) (Jan)--

R: --

S: --

Australia Kadar Tahunan Permit Permulaan Perumahan (Dis)

Australia Kadar Tahunan Permit Permulaan Perumahan (Dis)--

R: --

S: --

Australia Kadar Bulanan Permit Pembinaan (Selepas Pelarasan Bermusim) (Dis)

Australia Kadar Bulanan Permit Pembinaan (Selepas Pelarasan Bermusim) (Dis)--

R: --

S: --

Australia Kadar Tahunan Permit Pembinaan (Selepas Pelarasan Bermusim) (Dis)

Australia Kadar Tahunan Permit Pembinaan (Selepas Pelarasan Bermusim) (Dis)--

R: --

S: --

Australia Kadar Bulanan Permit Pembinaan Swasta (Selepas Pelarasan Bermusim) (Dis)

Australia Kadar Bulanan Permit Pembinaan Swasta (Selepas Pelarasan Bermusim) (Dis)--

R: --

S: --

Australia Kadar Pinjaman Semalaman

Australia Kadar Pinjaman Semalaman--

R: --

S: --

Penyata Kadar RBA

Penyata Kadar RBA Jepun Sasaran Hasil Perbendaharaan 10 Tahun

Jepun Sasaran Hasil Perbendaharaan 10 Tahun--

R: --

S: --

Arab Saudi PMI Komposit Markit IHS (Jan)

Arab Saudi PMI Komposit Markit IHS (Jan)--

R: --

S: --

Sidang Media RBA

Sidang Media RBA Turki Kadar Tahunan PPI (Jan)

Turki Kadar Tahunan PPI (Jan)--

R: --

S: --

Turki CPI YoY (Jan)

Turki CPI YoY (Jan)--

R: --

S: --

Turki CPI YoY (Tidak Termasuk Tenaga, Makanan, Minuman, Tembakau Dan Emas) (Jan)

Turki CPI YoY (Tidak Termasuk Tenaga, Makanan, Minuman, Tembakau Dan Emas) (Jan)--

R: --

S: --

Turki Baki Dagangan (Jan)

Turki Baki Dagangan (Jan)--

R: --

S: --

Amerika Syarikat Jualan Runcit Perniagaan Mingguan Redbook

Amerika Syarikat Jualan Runcit Perniagaan Mingguan Redbook--

R: --

S: --

Amerika Syarikat Pembukaan Kerja JOLTS (Dilaraskan Mengikut Musim) (Dis)

Amerika Syarikat Pembukaan Kerja JOLTS (Dilaraskan Mengikut Musim) (Dis)--

R: --

S: --

Mexico PMI Pembuatan (Jan)

Mexico PMI Pembuatan (Jan)--

R: --

S: --

Amerika Syarikat Inventori Minyak Ditapis API Mingguan

Amerika Syarikat Inventori Minyak Ditapis API Mingguan--

R: --

S: --

Tiada data yang sepadan

Aliran Pasaran

Indikator Teratas

Pandangan Terkini

Pandangan Terkini

Topik Trending

Kolumnis Top

Maklumat terkini

White Label

Data API

Web Plug-in

Program Afiliate

Lihat Semua

Tiada data

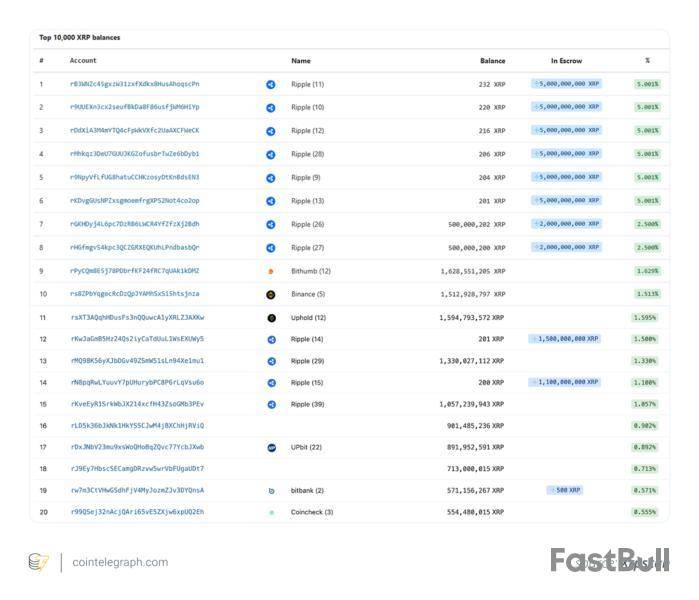

The undisputed XRP rich list

Ripple Labs is by far the largest XRP owner, controlling around 42% of the total 100 billion supply. This is unsurprising, as it is the company that developed the XRP Ledger and created the XRP digital currency.

The San Francisco-based operation has its massive stake broken down into two categories:

Ripple runs an escrow release system where a predictable monthly amount of XRP is unlocked. Typically, 1 billion XRP is released per month using a smart contract mechanism on the XRP Ledger.

This is a method for managing supply and maintaining price stability. These released funds are used to fund Ripple’s operational expenses and provide liquidity for its On-Demand Liquidity Service (ODL).

As a part of careful treasury management, Ripple doesn’t flood the markets with fresh XRP every month. Instead, 60% or more of monthly unlocked funds are relocked, with the company not needing the full complement for operational costs.

In an extreme example, if Ripple were to stop relocking tokens, the whole 35-billion escrow stash would be depleted in just three years.

The relocking pattern currently in place means Ripple will likely continue to top the XRP rich list for years to come. For many crypto users, such large control of the supply is uncomfortable. The 42% controlling stake gives it unprecedented influence on the marketing dynamics.

It is basically a double-edged sword that offers flexibility but raises concerns about decentralization and the ethos it backs.

Did you know? There are over 6.6 million active XRP wallets; however, many of these may actually be very small or inactive wallets. Additionally, a notable share of those wallets likely belongs to repeat users who maintain multiple addresses. So, in reality, there might be fewer than 1 million unique XRP holders worldwide.

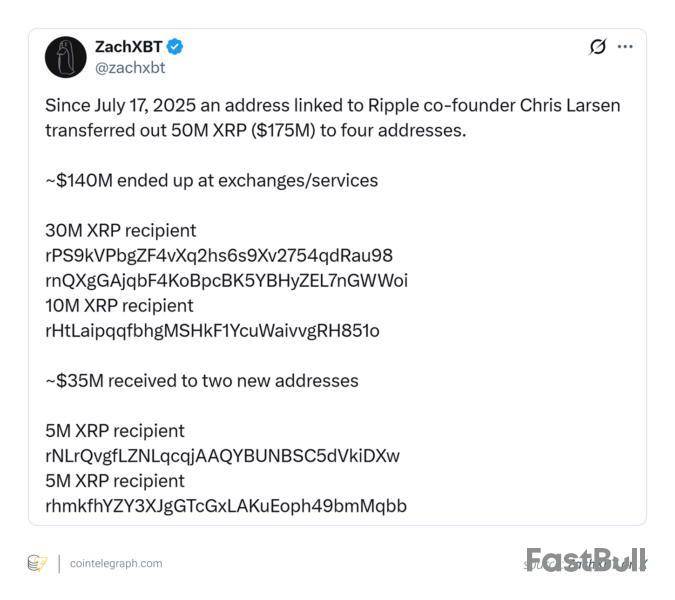

Chris Larsen’s billionaire empire

You might not be surprised to learn that Ripple co-founder and executive chairman Chris Larsen is the largest individual XRP owner with over 2.5 billion XRP worth around $7 billion.

He distributes his holdings across eight distinct crypto wallets, which are tagged by blockchain explorers.

Of his eight wallets, No. 1 through 4 still contain just over 500 million XRP and have never made any outbound transfers. He received these funds as a founder’s gift in 2013. Although wallet No. 5 has been in selling action during 2025, reducing holdings from 500 million XRP to 280 million.

In July 2025, Larsen made significant sell-offs, hitting the headlines when $175 million worth of XRP was transferred onto exchanges after July 17. These sales coincided with XRP reaching seven-year highs above $3.

Still, Larsen’s total holdings represent 4.6% of the entire XRP market cap. This makes him not just one of the wealthiest XRP owners, but one of crypto’s richest individuals.

Even as an individual, he retains enough XRP to significantly influence market dynamics.

“Wallets linked to Chris Larsen only have another 2.81B XRP ($8.4B) left!” noted ZachXBT on X.

Did you know? To enter the top 10% of the XRP rich list, you only require 2,396 XRP, which is about $7,000 as of August 2025.

XRP exchange powerhouses

Billions of dollars in customer funds live on exchange platforms either during daily trading activity or for storage. A selection of the world’s most popular exchanges make the XRP rich list.

Upbit, the Korean giant, is the XRP exchange leader with around 6 billion XRP in custody. It shows that Korean retail demand is incredibly strong, along with the institutional trading volume.

Elsewhere, Binance is in second place on the exchange list with over 2.7 billion XRP across its multiple custody wallets. Similarly, Uphold has been growing its position recently with nearly 2 billion XRP, followed by Coinbase at 780 million XRP.

Interestingly, this number for Coinbase has dropped substantially since Q2 2025. It’s likely to be strategic repositioning rather than potential regulatory caution, especially since the US Securities and Exchange Commission’s case against Ripple Labs was dropped earlier in August 2025. This gave XRP unprecedented judicial standing in the United States.

Still, Coinbase slashed holdings by 57% in a single month, while competitors continue to expand their reserves.

It is worth mentioning, though, that the exchange holdings are primarily customer assets rather than institutional trading positions. So, understanding what exchanges hold large XRP amounts can give insight into retail ownership and demand as opposed to institutional control.

Did you know? Only 100 addresses control around 68% of the total circulating supply of XRP in 2025. This gives it one of the highest concentration rates among the top market cap cryptocurrencies.

Whales accumulate record-breaking XRP

2025 has been a watershed year for XRP. It’s gone from a crypto pariah embroiled in a fight with the SEC to an asset with clear legal standing.

Momentum has been building as whales collect XRP. In June 2025, it hit another milestone where wallets holding more than 1 million XRP reached 2,708 addresses. This is the highest level in XRP’s 12-year history.

Each of these whale wallets contains over $2 million worth of XRP at 2025 prices. It reflects institutional confidence in the asset, with the XRP Ledger daily active addresses climbing to 295,000 in June 2025.

This is an activity spike, which indicates interest from both retail and institutions. It’s a jump of nearly seven times the trailing three-month average of 35,000-40,000 active addresses.

XRPScan can give you a peek into the rich list, with the top wallets held by Ripple holding 5 billion XRP in escrow. Outside of these, you can see notable rich list wallets are linked to known global exchanges, with only two anonymous trader wallets making their place in the top 20.

What’s clear from the XRP rich list 2025 is the revelation of highly concentrated ownership.

Ripple Labs dominates at every metric, including Larsen, whose stake totals over $8 billion of XRP holdings.

It raises valid decentralization concerns, especially when combined with record-breaking whale accumulation and growth in institutional wallets. That said, the legal clarity that has emerged following a five-year lawsuit is fueling increased confidence in the asset among institutional investors.

Exchanges, too, are accumulating funds at historic levels, with customer custody deposits swelling these numbers on the rich list. It’s a metric that suggests token ownership is still of interest to retail investors despite concerns.

For nearly two weeks, Ethereum has been confined within the $4,255-$4,500 range, in what appears to be a short-term stagnation marked by uncertainty and cautious trader sentiment.

But zooming out, experts suggest that the crypto asset’s overall upward trend remains clear.Ether’s Multi-Front Surge Against Bitcoin

Since early August, ETH has overtaken Bitcoin in spot market dominance, capturing 32.9% of total share against BTC’s 32.6%. During the week of August 18-25, Ethereum’s share peaked at 41%, which coincided with the total ETH spot volume reaching $480 billion compared to Bitcoin’s $400 billion, according to the latest stats shared by CryptoRank.

Futures markets further validate this momentum, as ETH futures volume surpassed Bitcoin’s since mid-July and reached an all-time high of $3.08 trillion in August. Open interest currently stands at $59 billion, about 15% off its peak, showing some cooling but still reflecting substantial positioning.

A critical driver has been Ethereum ETFs, which attracted roughly $10 billion in net inflows in 2025. Cumulative ETF spot volume is approaching $200 billion, now making up 16% of ETH’s total spot volume, which is a record high. Meanwhile, BlackRock’s ETHA dominates this segment, as it handles 74% of ETF trading volume, while ETH ETF assets under management have reached $25 billion, amidst strong institutional interest.

Still, Ethereum ETFs are on their longest outflow streak since April, six consecutive days, whichhintsat short-term momentum loss. On-chain, Ethereum continues to set records with total value locked at $258 billion, monthly active addresses at 51.7 million, and decentralized exchange volume at $140 billion.

Furthermore, exchange balances are at a three-year low, which means that demand remains resilient. While a pause is evident, Ethereum’s broader trajectory suggests further upside potential remains intact.Silent Compression

Altcoin Vector also echoed a similar sentiment in its latest observation and explained that the market phase has shifted away from Ethereum and toward low-cap tokens. This trend has previously signaled waning altcoin focus and often leads capital rotation back into Bitcoin. However, the picture isn’t entirely bearish for ETH.

The analysis highlights that Ethereum may be undergoing an accumulation phase, with compression building beneath the surface. This could potentially set the stage for its next upward leg once momentum returns.

Dan Ives, renowned technology and AI expert and Wall Street analyst, to serve as Chairman of the Board

In an increasingly agentic world, World is delivering critical "Proof of Human" (PoH)

"If we succeed on our mission, World might become the largest network of real people online, fundamentally changing how we interact and transact throughout the Internet" says Sam Altman

The transaction was led by MOZAYYX with a strategic investment from BitMine Immersion (BMNR) and participation from World Foundation, Discovery Capital Management, GAMA, FalconX, Kraken, Pantera, GSR, Coinfund, Occam Crest, Diametric, Brevan Howard, Wedbush and more

EASTON, Pa., Sept. 10, 2025 /PRNewswire/ — ("Eightco Holdings Inc." or the "Company") today announced the closing of its recently announced $270 Million private placement to implement the first-of-its-kind Worldcoin treasury strategy.

The transaction was led by MOZAYYX with participation from a premier list of institutional investors including World Foundation, Discovery Capital Management, GAMA, FalconX, Kraken, Pantera, GSR, Coinfund, Occam Crest, Diametric, Brevan Howard, Wedbush and more. A $20 million investment was made by BitMine Immersion (NYSE AMERICAN: BMNR).

"Since announcing the private placement, we've seen tremendous interest in OCTO and Worldcoin," said Dan Ives, newly appointed Chairman of the Board. "Proof of Human is the next critical step in the AI revolution, and World is uniquely positioned to deliver the trust, verification and authentication that the world needs as AI becomes more deeply embedded in every aspect of our lives."

Proceeds from the private placement will be used for the Company to acquire and hold Worldcoin (WLD) as its treasury reserve asset, while continuing its focus on the core business operations. While the treasury may also hold cash and Ethereum (ETH) as secondary reserve assets, the emphasis will be on Worldcoin.

The Company also announced that the Nasdaq trading symbol for the Company's common stock will be changing to "ORBS." Beginning Thursday, September 11, 2025, shares of the Company's common stock will trade on Nasdaq under the new ticker symbol "ORBS." The Company is not undertaking any other corporate action that affects the rights of outstanding common stock, and no action is required by shareholders in connection with the ticker symbol change.

World creates a zero knowledge (ZK) Proof of Human so a person's human information is not stored on the blockchain. World's proprietary iris-scanning Orb technology is designed to meet the security and identity challenges of the future, offering a path to a universally trusted digital identity and the foundation for the next generation of online trust, verification and economic exchange.

The Orbs are the hardware backbone of Worldcoin, verifying unique humans, distributing tokens fairly, and creating a trusted digital identity system. World will be the leading verification platform for consumers around the world.

RF Lafferty & Co., Inc. acted as the Exclusive Placement Agent in connection with the private placement.

Cantor Fitzgerald & Co. acted as financial advisor to the lead investor, MOZAYYX.

Moelis & Company LLC acted as financial advisor to BitMine Immersion Technologies (BMNR).

Winston & Strawn LLP acted as counsel to the lead investor, MOZAYYX.

Graubard Miller acted as counsel to the Company.

Lucosky Brookman LLP acted as counsel to the placement agent.

The offer and sale of the foregoing securities were made in a private placement in reliance on an exemption from the registration requirement of the Securities Act of 1933, as amended (the "Securities Act"), pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder, and applicable state securities laws. Accordingly, the securities offered in the private placement may not be offered or sold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirement of the Securities Act and such applicable state securities laws. Concurrently with the execution of the securities purchase agreements, the Company and the investors entered into a registration rights agreement pursuant to which the Company has agreed to file a registration statement with the Securities and Exchange Commission (the "SEC") registering the resale of the shares of common stock to be issued or issuable in connection with the offering.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

ABOUT EIGHTCO HOLDINGS INC.

Eightco Holdings Inc. is committed to growth of its subsidiaries, made up of Forever 8, an inventory capital and management platform for e-commerce sellers, and Ferguson Containers, Inc., a provider of complete manufacturing and logistical solutions for product and packaging needs, through strategic management and investment. In addition, the Company is actively seeking new opportunities to add to its portfolio of technology solutions focused on the e-commerce ecosystem through strategic acquisitions. Through a combination of innovative strategies and focused execution, Eightco aims to create significant value and growth for its portfolio companies and stockholders.

For additional details, follow on X:

https://x.com/eightcoholdings

https://x.com/iamhuman_orbs

For images of the Orb with the new Chairman, please visit here.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this press release other than statements of historical fact could be deemed forward looking. Words such as "plans," "expects," "will," "anticipates," "continue," "expand," "advance," "develop" "believes," "guidance," "target," "may," "remain," "project," "outlook," "intend," "estimate," "could," "should," and other words and terms of similar meaning and expression are intended to identify forward-looking statements, although not all forward-looking statements contain such terms. Forward-looking statements are based on management's current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: Eightco's ability to maintain compliance with the Nasdaq's continued listing requirements; unexpected costs, charges or expenses that reduce Eightco's capital resources; Eightco's inability to raise adequate capital to fund its business; Eightco's inability to innovate and attract users for Eightco's products; future legislation and rulemaking negatively impacting digital assets; and shifting public and governmental positions on digital asset mining activity. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Eightco's actual results to differ from those contained in forward-looking statements, see Eightco's filings with the Securities and Exchange Commission (the "SEC"), including in its Annual Report on Form 10-K filed with the SEC on April 15, 2025. All information in this press release is as of the date of the release, and Eightco undertakes no duty to update this information or to publicly announce the results of any revisions to any of such statements to reflect future events or developments, except as required by law.

View original content to download multimedia:https://www.prnewswire.com/news-releases/eightco-holdings-inc-closes-270-million-private-placement-as-first-worldcoin-wld-treasury-strategy-302551920.html

SOURCE Eightco Holding Inc. (OCTO)

Gemini, the crypto exchange founded by billionaires Cameron and Tyler Winklevoss of Facebook fame, has raised its proposed price range for its initial public offering in the U.S., now targeting a valuation of more than $3 billion.

In an updated S-1 filing with the Securities and Exchange Commission late Tuesday, Gemini said it now anticipates that the IPO price per share of its Class A common stock will be between $24 and $26, up from $17 to $19 previously.

The crypto exchange, whose legal name is Gemini Space Station, Inc., therefore aims to raise up to $433.3 million by selling 16,666,667 shares in the offering at the top end of the price range. This could be extended to 17,119,474 shares if the underwriters exercise their option to purchase additional Class A common stock from Gemini in full. With approximately 118.8 million total Class A and Class B shares outstanding immediately after the offering, that would put the firm's valuation at $3.09 billion.

In an earlier filing on Tuesday, Gemini confirmed that Nasdaq had entered into an agreement to buy $50 million of its Class A common stock in a private placement at a per share price equal to the IPO at close, less underwriting discounts and commissions.

"Based on the initial public offering price of $25 per share (which is the midpoint of the estimated price range set forth on the cover page of this prospectus), Nasdaq, will purchase 2,116,402 shares of our Class A common stock," the firm said in the subsequent filing.

Gemini also confirmed it had signed a term sheet with Nasdaq to give Nasdaq's clients, including listed companies and member firms, access to crypto custody and staking through Gemini. Gemini will share related fees with Nasdaq and also resell Nasdaq's Calypso collateral management solution to its institutional customers. The deal still requires final agreements, expected after the IPO, and Gemini will update investors once the details are finalized.

Gemini aims to debut on Nasdaq this Friday, trading under the ticker "GEMI." It will become the third publicly traded crypto exchange in the U.S., following Coinbase and Bullish.

Figure also lifts price range amid crypto IPO boom

Gemini joins a growing list of crypto companies seeking to go public, including BitGo, Grayscale, Kraken, and Figure. Crypto platform Bullish recently saw its shares jump over 150% on their NYSE debut day last month. Circle, issuer of the USDC stablecoin, also had a blockbuster IPO launch earlier this year.

In its amended S-1 filing on Tuesday, Mike Cagney-founded blockchain-based lending firm Figure Technology Solutions also raised its estimated IPO price range to between $20 and $22 per share from $18 to $20. The company plans to offer approximately 26.6 million shares of its Class A common stock in the IPO, with stockholders providing an additional 4.85 million, bringing the total offering to 31.5 million shares — upsized from around 26.3 million previously.

At the top end of the price range, Figure's IPO would raise roughly $693 million, and value the company at roughly $4.7 billion with approximately 211.7 million total Class A and Class B shares outstanding immediately after the offering, excluding the underwriters' overallotment option.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ethereum layer-2 network Linea has restored its mainnet sequencer after a temporary performance degradation, the team said Wednesday.

According to Linea’s status page, the issue was detected at around 5:52 am UTC. Engineers identified the root cause and deployed a fix less than an hour later, by 6:15 am UTC.

The disruption affected Linea’s mainnet sequencer, which is responsible for ordering and batching transactions on the network. While the nature of the performance issues was not detailed, Linea confirmed on their status page that the problem was identified by 6:15 am UTC and was given a fix almost immediately.

By 6:32 am UTC, the Linea team said it had transitioned into a monitoring phase to ensure stability and evaluate the results. “A fix has been implemented and we are monitoring the results,” the team said.

Cointelegraph reached out to Linea for more information, but did not receive a response by publication.

This is a developing story, and further information will be added as it becomes available.

According to a recent report by The Economic Time, a whopping 93% of Indian investors want to have some sort of cryptocurrency regulation.

Among these investors, 56% want to make sure that regulation will ensure investor protection and stability.

Twenty-four percent of those from the pro-regulation crowd want minimal regulation in order to be able to foster innovation.

The remaining 13% want regulation only for taxation purposes. Notably, the overwhelming majority of the survey respondents (84%) believe that cryptocurrency taxes are currently unfair.

Major impediments

The current taxation regime and the lack of regulatory clarity are believed to be stifling the industry's growth.

Notably, 90% of the poll respondents claim that they would be more willing to invest in crypto if the rules were clearer and taxation was less draconian.

Growing political force

Just like in other countries, cryptocurrencies are becoming politically relevant, with a staggering 91% of the respondents claiming that they would take into account specific crypto policies when casting their vote.

The lion's share of urban voters under 35 is more likely to support cryptocurrency-friendly candidates.

Current legal status

So far, cryptocurrencies remain in a legal grey area in India, meaning that this novel asset class remains unregulated.

In 2018, the Reserve Bank of India prohibited banks from providing cryptocurrency services, but the ban was then overturned in 2020 by the Supreme Court since it was deemed to be unconstitutional.

Cardano , the 10th-ranked cryptocurrency asset, is facing a crucial test in its consolidation move. In the last 24 hours, its value has dropped by more than 3.6% against declining volume. These developments raise concerns about ADA’s ability to rally.

Cardano price struggles below resistance as volume declines

According to CoinMarketCap data, Cardano has failed to break out above the $0.8955 resistance level. This has triggered a sell-off on the market, resulting in caution from participants amid a possible retest of the $0.80 support. Many traders have pulled back to monitor how events unfold.

The pullback has resulted in declining volume. Notably, trading volume has dropped by 14.54% to $1.42 billion within the last 24 hours.

On-chain data shows that Cardano whales, who were in an accumulation mode in the previous week, also contributed to the current situation. These large holders sold off about 30 million ADA in a profit-taking move that has increased the selling pressure and affected price movement.

Usually, retail investors look to whales for direction, and the recent sell-off has created a severely impacted investor outlook on ADA.

As of press time, Cardano is changing hands at $0.8786, representing a 1.14% decline in value within the last 24 hours. The asset fell from a peak of $0.8936, leaving investors disappointed as they anticipated a breach of the psychological $1 resistance.

Community sentiment remains bullish despite setback

Cardano’s quest to reclaim the $1 level might have to wait longer. The current setup of declining price and volume is not contributing to upward momentum. However, the community remains bullish, with 88.4% of voters betting on a price rise to over $1. This is despite the asset only hitting that target a few times in 2025 so far.

If Cardano surges to $1, it will succeed in dethroning Tron from ninth place in terms of market capitalization ranking. Market observers are closely monitoring developments.

White Label

Data API

Web Plug-in

Pembuat Poster

Program Afiliate

Risiko kerugian dalam perdagangan instrumen kewangan seperti saham, FX, komoditi, niaga hadapan, bon, ETF dan kripto boleh menjadi besar. Anda mungkin mengalami kerugian keseluruhan dana yang anda depositkan dengan broker anda. Oleh itu, anda harus mempertimbangkan dengan teliti sama ada perdagangan sedemikian sesuai untuk anda berdasarkan keadaan dan sumber kewangan anda.

Tiada keputusan untuk melabur harus dibuat tanpa menjalankan usaha wajar secara menyeluruh sendiri atau berunding dengan penasihat kewangan anda. Kandungan web kami mungkin tidak sesuai dengan anda kerana kami tidak mengetahui keadaan kewangan dan keperluan pelaburan anda. Maklumat kewangan kami mungkin mempunyai kependaman atau mengandungi ketidaktepatan, jadi anda harus bertanggungjawab sepenuhnya untuk sebarang keputusan perdagangan dan pelaburan anda. Syarikat tidak akan bertanggungjawab ke atas kehilangan modal anda.

Tanpa mendapat kebenaran daripada tapak web, anda tidak dibenarkan menyalin grafik, teks atau tanda dagangan tapak web. Hak harta intelek dalam kandungan atau data yang dimasukkan ke dalam laman web ini adalah milik pembekal dan pedagang pertukarannya.

Tidak log masuk

Log masuk untuk mengakses lebih banyak ciri

Log masuk

Daftar