Petikan

Berita

Analisis

Pengguna

24/7

Kalendar Ekonomi

Pendidikan

Data

- Nama

- Terkini

- Sblm

Akaun Signal untuk Ahli

Semua Akaun Signal

Semua Peraduan

U.K. Baki Dagangan Dengan Bukan EU (Selepas Pelarasan Bermusim) (Okt)

U.K. Baki Dagangan Dengan Bukan EU (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

Perancis Nilai Akhir Kadar Bulanan HICP (Nov)

Perancis Nilai Akhir Kadar Bulanan HICP (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Pertumbuhan Tahunan Pinjaman Terkumpul (Nov)

China, Tanah Besar Kadar Pertumbuhan Tahunan Pinjaman Terkumpul (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Tahunan Bekalan Wang M2 (Nov)

China, Tanah Besar Kadar Tahunan Bekalan Wang M2 (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Tahunan Bekalan Wang M0 (Nov)

China, Tanah Besar Kadar Tahunan Bekalan Wang M0 (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Tahunan Bekalan Wang M1 (Nov)

China, Tanah Besar Kadar Tahunan Bekalan Wang M1 (Nov)S:--

R: --

S: --

India CPI YoY (Nov)

India CPI YoY (Nov)S:--

R: --

S: --

India Kadar Pertumbuhan Deposit Tahunan

India Kadar Pertumbuhan Deposit TahunanS:--

R: --

S: --

Brazil Kadar Pertumbuhan Industri Perkhidmatan (Okt)

Brazil Kadar Pertumbuhan Industri Perkhidmatan (Okt)S:--

R: --

S: --

Mexico Kadar Tahunan Keluaran Industri (Okt)

Mexico Kadar Tahunan Keluaran Industri (Okt)S:--

R: --

S: --

Rusia Baki Dagangan (Okt)

Rusia Baki Dagangan (Okt)S:--

R: --

S: --

Presiden Fed Philadelphia Henry Paulson menyampaikan ucapan

Presiden Fed Philadelphia Henry Paulson menyampaikan ucapan Kanada Kadar Bulanan Permit Pembinaan (Selepas Pelarasan Bermusim) (Okt)

Kanada Kadar Bulanan Permit Pembinaan (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

Kanada Kadar Tahunan Jualan Borong (Okt)

Kanada Kadar Tahunan Jualan Borong (Okt)S:--

R: --

S: --

Kanada Kadar Bulanan Inventori Borong (Okt)

Kanada Kadar Bulanan Inventori Borong (Okt)S:--

R: --

S: --

Kanada Kadar Tahunan Inventori Borong (Okt)

Kanada Kadar Tahunan Inventori Borong (Okt)S:--

R: --

S: --

Kanada Kadar Bulanan Jualan Borong (Selepas Pelarasan Bermusim) (Okt)

Kanada Kadar Bulanan Jualan Borong (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

Jerman Akaun Semasa (Tidak Dilaraskan Mengikut Musim) (Okt)

Jerman Akaun Semasa (Tidak Dilaraskan Mengikut Musim) (Okt)S:--

R: --

S: --

Amerika Syarikat Jumlah Bilangan Pelantar Penerokaan Mingguan

Amerika Syarikat Jumlah Bilangan Pelantar Penerokaan MingguanS:--

R: --

S: --

Amerika Syarikat Jumlah Pelantar Minyak Untuk Minggu Ini

Amerika Syarikat Jumlah Pelantar Minyak Untuk Minggu IniS:--

R: --

S: --

Jepun Indeks Tinjauan Pembuatan Kecil Tankan (Suku 4)

Jepun Indeks Tinjauan Pembuatan Kecil Tankan (Suku 4)S:--

R: --

S: --

Jepun Tankan Indeks Pertimbangan Iklim Perniagaan Bukan Perkilangan Berskala Besar (Suku 4)

Jepun Tankan Indeks Pertimbangan Iklim Perniagaan Bukan Perkilangan Berskala Besar (Suku 4)S:--

R: --

S: --

Jepun Tankan Indeks Tinjauan Bukan Pembuatan Besar (Suku 4)

Jepun Tankan Indeks Tinjauan Bukan Pembuatan Besar (Suku 4)S:--

R: --

S: --

Jepun Indeks Tinjauan Pembuatan Besar Tankan (Suku 4)

Jepun Indeks Tinjauan Pembuatan Besar Tankan (Suku 4)S:--

R: --

S: --

Jepun Indeks Penghakiman Kemakmuran Industri Pembuatan Kecil Tankan (Suku 4)

Jepun Indeks Penghakiman Kemakmuran Industri Pembuatan Kecil Tankan (Suku 4)S:--

R: --

S: --

Jepun Indeks Penghakiman Kemakmuran Pembuatan Berskala Besar Tankan (Suku 4)

Jepun Indeks Penghakiman Kemakmuran Pembuatan Berskala Besar Tankan (Suku 4)S:--

R: --

S: --

Jepun Tankan Kadar Tahunan Perbelanjaan Modal Perusahaan Besar (Suku 4)

Jepun Tankan Kadar Tahunan Perbelanjaan Modal Perusahaan Besar (Suku 4)S:--

R: --

S: --

U.K. Kadar Tahunan Indeks Harga Kediaman Rightmove (Dis)

U.K. Kadar Tahunan Indeks Harga Kediaman Rightmove (Dis)S:--

R: --

S: --

China, Tanah Besar Kadar Tahunan Keluaran Industri (Sehingga Tahun) (Nov)

China, Tanah Besar Kadar Tahunan Keluaran Industri (Sehingga Tahun) (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Pengangguran Bandar (Nov)

China, Tanah Besar Kadar Pengangguran Bandar (Nov)S:--

R: --

S: --

Arab Saudi CPI YoY (Nov)

Arab Saudi CPI YoY (Nov)S:--

R: --

S: --

Zon Euro Kadar Tahunan Keluaran Industri (Okt)

Zon Euro Kadar Tahunan Keluaran Industri (Okt)--

R: --

S: --

Zon Euro Kadar Bulanan Keluaran Industri (Okt)

Zon Euro Kadar Bulanan Keluaran Industri (Okt)--

R: --

S: --

Kanada Kadar Bulanan Jualan Rumah Sedia Ada (Nov)

Kanada Kadar Bulanan Jualan Rumah Sedia Ada (Nov)--

R: --

S: --

Zon Euro Jumlah Aset Rizab (Nov)

Zon Euro Jumlah Aset Rizab (Nov)--

R: --

S: --

U.K. Jangkaan Inflasi

U.K. Jangkaan Inflasi--

R: --

S: --

Kanada Indeks Keyakinan Ekonomi Negara

Kanada Indeks Keyakinan Ekonomi Negara--

R: --

S: --

Kanada Bilangan Rumah Baru Dalam Pembinaan (Nov)

Kanada Bilangan Rumah Baru Dalam Pembinaan (Nov)--

R: --

S: --

Amerika Syarikat Indeks Pekerjaan Pembuatan Fed New York (Dis)

Amerika Syarikat Indeks Pekerjaan Pembuatan Fed New York (Dis)--

R: --

S: --

Amerika Syarikat Indeks Pengilangan Fed New York (Dis)

Amerika Syarikat Indeks Pengilangan Fed New York (Dis)--

R: --

S: --

Kanada Kadar Tahunan CPI Teras (Nov)

Kanada Kadar Tahunan CPI Teras (Nov)--

R: --

S: --

Kanada Kadar Bulanan Pembuatan Pesanan Tidak Diisi (Okt)

Kanada Kadar Bulanan Pembuatan Pesanan Tidak Diisi (Okt)--

R: --

S: --

Amerika Syarikat Indeks Pemerolehan Harga Pembuatan Fed New York (Dis)

Amerika Syarikat Indeks Pemerolehan Harga Pembuatan Fed New York (Dis)--

R: --

S: --

Amerika Syarikat Indeks Pesanan Baharu Pembuatan Fed New York (Dis)

Amerika Syarikat Indeks Pesanan Baharu Pembuatan Fed New York (Dis)--

R: --

S: --

Kanada Menghasilkan Pesanan Baharu Kadar Bulanan (Okt)

Kanada Menghasilkan Pesanan Baharu Kadar Bulanan (Okt)--

R: --

S: --

Kanada Kadar Bulanan CPI Teras (Nov)

Kanada Kadar Bulanan CPI Teras (Nov)--

R: --

S: --

Kanada Kadar Tahunan Purata CPI Yang Ditapis (Selepas Pelarasan Bermusim) (Nov)

Kanada Kadar Tahunan Purata CPI Yang Ditapis (Selepas Pelarasan Bermusim) (Nov)--

R: --

S: --

Kanada Kadar Bulanan Inventori Pembuatan (Okt)

Kanada Kadar Bulanan Inventori Pembuatan (Okt)--

R: --

S: --

Kanada CPI YoY (Nov)

Kanada CPI YoY (Nov)--

R: --

S: --

Kanada Kadar Bulanan CPI (Nov)

Kanada Kadar Bulanan CPI (Nov)--

R: --

S: --

Kanada CPI YoY (Selepas Pelarasan Bermusim) (Nov)

Kanada CPI YoY (Selepas Pelarasan Bermusim) (Nov)--

R: --

S: --

Kanada Kadar Bulanan CPI Teras (Selepas Pelarasan Bermusim) (Nov)

Kanada Kadar Bulanan CPI Teras (Selepas Pelarasan Bermusim) (Nov)--

R: --

S: --

Kanada CPI Bulanan (Dilaraskan Mengikut Musim) (Nov)

Kanada CPI Bulanan (Dilaraskan Mengikut Musim) (Nov)--

R: --

S: --

Gabenor Lembaga Rizab Persekutuan Milan menyampaikan ucapan

Gabenor Lembaga Rizab Persekutuan Milan menyampaikan ucapan Amerika Syarikat Indeks Pasaran Perumahan NAHB (Dis)

Amerika Syarikat Indeks Pasaran Perumahan NAHB (Dis)--

R: --

S: --

Australia Nilai Awal PMI Yang Komprehensif (Dis)

Australia Nilai Awal PMI Yang Komprehensif (Dis)--

R: --

S: --

Australia Nilai Awal PMI Industri Perkhidmatan (Dis)

Australia Nilai Awal PMI Industri Perkhidmatan (Dis)--

R: --

S: --

Australia Nilai Awal PMI Pembuatan (Dis)

Australia Nilai Awal PMI Pembuatan (Dis)--

R: --

S: --

Jepun Nilai Awal PMI Pembuatan (Selepas Pelarasan Bermusim) (Dis)

Jepun Nilai Awal PMI Pembuatan (Selepas Pelarasan Bermusim) (Dis)--

R: --

S: --

U.K. Tuntutan Pengangguran (Nov)

U.K. Tuntutan Pengangguran (Nov)--

R: --

S: --

U.K. Kadar Pengangguran (Nov)

U.K. Kadar Pengangguran (Nov)--

R: --

S: --

Tiada data yang sepadan

Aliran Pasaran

Indikator Teratas

Pandangan Terkini

Pandangan Terkini

Topik Trending

Kolumnis Top

Maklumat terkini

White Label

Data API

Web Plug-in

Program Afiliate

Lihat Semua

Tiada data

Japan finance minister Kato:

This article was written by Eamonn Sheridan at investinglive.com.

Blockchain messaging protocol LayerZero has won the bid to acquire crypto protocol Stargate after a shaky first offer and a late four-way bidding war.

Stargate’s community voted on Sunday with a 95% majority to greenlight the LayerZero Foundation’s $110 million acquisition proposal, which it amended after holders of the Stargate (STG) token said the original deal was unfair.

Three of LayerZero’s rivals also put in last-minute bids or intent-to-bids to acquire Stargate, with one bidder, Wormhole, unsuccessfully asking for the vote on LayerZero’s acquisition to be paused.

LayerZero developed and launched Stargate in 2022, and the deal now sees the platform come back under its control. Stargate facilitates transfers across blockchains using liquidity pools that it says allow assets to be transferred natively instead of relying on blockchain bridges, which have a history of being hacked.

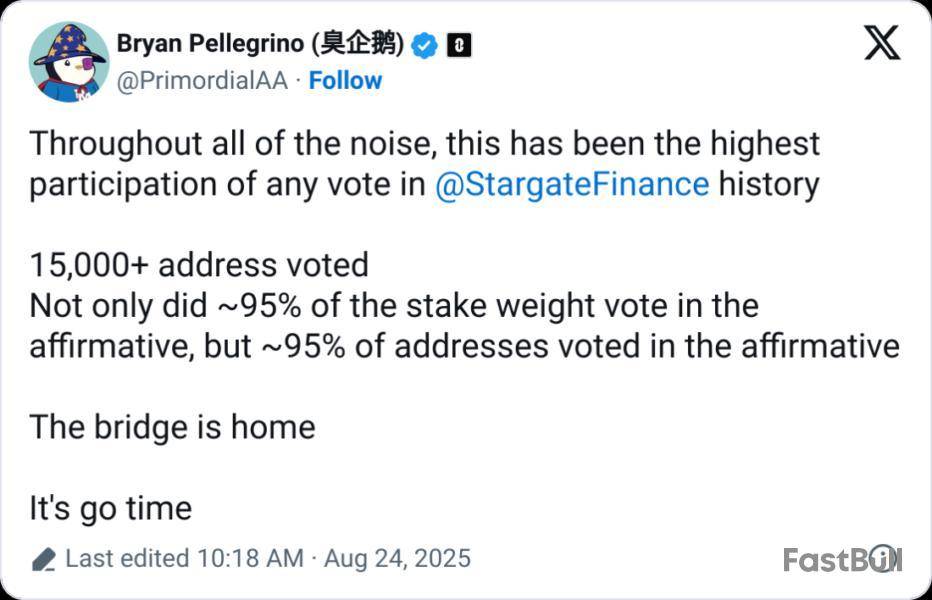

LayerZero claims record participation

LayerZero co-founder and CEO Bryan Pellegrino wrote on X on Sunday that the Stargate community vote had “the highest participation of any vote” in the platform’s history.

The voting website shows over 15,000 addresses took part, with 94.76% representing 7.2 million STG tokens voting in favor, while 5.24%, or 399,400 tokens, voted against.

“Not only did ~95% of the stake weight vote in the affirmative, but ~95% of addresses voted in the affirmative,” Pellegrino added.

Wormhole made offer for Stargate

Wormhole made an offer on Saturday after saying on Wednesday that it would “submit a meaningfully higher bid,” and that LayerZero “doesn’t create a compelling offer, which values Stargate’s ongoing business at an unreasonably low number.”

Wormhole pitched a $120 million all-cash purchase that would see stakers of Stargate’s token “receive 3x the projected revenue for the next 6 months, accelerated and paid immediately, as part of our successful acquisition.”

Axelar, Across also considered a bid for Stargate

The cross-blockchain platforms Axelar Network and Across Protocol also signalled their interest in bidding for Stargate on Sunday, with both noting that the vote on LayerZero’s bid would need to be paused.

Across co-founder Hart Lambur posted to Stargate’s forum that it’d been suggested to him that his platform submit an offer for Stargate, but he had “no interest in rushing an 11th-hour proposal, however if this process is slowed down and other bids are properly considered, Across will participate.

The Axelar Foundation posted to the forum a few hours later that it had a “strong interest” in bidding if a “competitive process” was created for the acquisition, it would pitch “a comprehensive proposal and encourage Stargate to collect all options before making a decision.”

However, Stargate Foundation lead Angus Lamps said in response to the bids that the vote on LayerZero’s bid can’t be paused, and Stargate “has been engaging with any parties” that sign a non-disclosure agreement and want to conduct due diligence.

LayerZero’s initial proposal pitched using Stargate’s excess revenue for a ZRO buyback program, which some Stargate community members called “not attractive at all” as it didn’t offer advantages to STG holders.

It revised the offer on Sunday to give Stargate stakers half of all top-line revenue for six months, with the remaining half used to buy back its LayerZero (ZRO) token.

Under the approved deal, all circulating STG will be swapped for ZRO at a ratio of 1 STG to 0.08634 ZRO.

A crucial question has been raised by Bitcoin's recent market performance: Is the bull run already over, or is this just a mid-cycle pause? BTC has had difficulty maintaining upward momentum since hitting a new high earlier this summer, and recent price action indicates the rally may be losing steam. Because Bitcoin has failed to stay above the 50-day EMA, this is the main problem. In the past, this level has served as a solid basis for bullish continuation, however, in the present configuration Bitcoin tried to break through but failed.

The rejection at this moving average indicates a market where buying pressure is insufficient to sustain the subsequent leg up, and indicates a weakness in demand. Volume has been continuously dropping, adding to the bearish weight, and indicating that traders are not very confident. Every correction during prior strong bull phases was greeted by aggressive buybacks and increased volume inflows. Now, the lack of these indicators suggests hesitancy on the part of investors who are hesitant to commit to additional upside. Chart by TradingView">

The next logical area of support for Bitcoin is around the 100 EMA, which is close to $111,000, if it is unable to regain the 50 EMA anytime soon. A test of that area might significantly strain sentiment, and possibly prolong the correction. The story would change from a healthy retracement to a more comprehensive trend reversal if it breaks below it.

The failed 50 EMA breakthrough, however, indicates that the road to higher highs might be postponed for the time being. The main resistance level that investors should keep a close eye on is $116,000. Talk of a sustained bull run seems premature in the absence of a clear move above it.

Shiba Inu is anemic

Shiba Inu's recent trading sessions have seen nearly zero volatility, signaling the start of an extremely stagnant phase. Although symmetrical triangles are frequently used to precede breakouts, the current dynamics indicate that SHIB may be headed for a protracted period of sideways movement rather than an explosive rally.

According to the chart, SHIB has been steadily tightening between levels of support and convergent resistance. Every recovery attempt has been capped by the upper descending trendline, and the July ascending support has prevented the token from dropping further. This gives the appearance of a balanced market that lacks clear-cut momentum.

It is a double-edged sword that volatility has dropped to almost zero. It lessens the possibility of unexpected malfunctions in the near future, on the one hand. On the contrary, it indicates that liquidity is dwindling and that traders are generally disinterested at current levels. The price may move indistinguishably for weeks as a result of this type of compression.

There has been a consistent drop in volume, and the token is still below its major moving averages. A breakout from this triangle might be more noise than signal if there isn’t a significant catalyst or a spike in demand. This means patience is key for investors.

The absence of volatility raises the possibility that stagnation rather than growth will characterize the foreseeable future, even though the symmetrical triangle can ultimately resolve in either direction. It is unlikely that the market will regain momentum in the near future unless SHIB recovers important levels above $0.0000135 and $0.0000141.

XRP's bounce

After a sharp decline, XRP recently made one of the most unexpected recoveries of the summer, rising above the 50-day EMA. The asset appeared destined to decline further toward the 100-day EMA near $2.75, making this recovery nearly impossible. Rather, XRP abruptly reversed course, pushing back above short-term resistance and surprising the market. Because of how swiftly sentiment changed, the move has been called an unthinkable comeback.

A few sessions ago, XRP was on the edge of diving below the 100 EMA as it struggled to stay above $2.80. Volume was declining, and momentum indicators were weak. Nevertheless, the market managed to muster enough strength to push the token back above the 50 EMA, giving investors hope for a possible continuation rally.

There is a catch to this rally though. Although the 50 EMA breakout appears promising, XRP never really broke through its 26 EMA support. It may not be as strong as it looks because the price tested it several times but was unable to close much below it. In summary, technical resilience rather than fresh demand is the foundation of XRP’s recovery. This raises doubts about the rally’s viability.

Should XRP fail to gain traction above $3.05 and retest the $3.20-$3.30 range, the move may not last as long as it seems. The market might retest the 100 EMA if it is unable to hold above the 50 EMA, at which point genuine support would need to be verified. For the time being, holders of XRP can find solace in this improbable recovery, but the warning indicators are still there: This recovery could be brief in the absence of volume and more solid fundamentals.

By Vicky Ge Huang

Eric Trump wasn't always a crypto bro. He says banks made him this way.

In early 2021, not long after the Jan. 6 riot at the U.S. Capitol, several banks that the Trumps did business with cut them off, shutting down hundreds of accounts for the family's businesses without citing an explicit reason, Trump said in an interview with The Wall Street Journal.

The Trump Organization went scrambling, scattering millions across accounts at regional banks before eventually migrating to a new bank that he declined to name.

"At that time, I realized how fragile the financial system was and how easily it could be weaponized against you," Trump said, adding that he believed that the decisions were political.

Banks say they don't close accounts for political reasons, but the issue of "debanking" has become a rallying cry in conservative circles, where criticism of lenders intensified after banks embraced diversity policies in the wake of the George Floyd murder in 2020. Both conservatives and crypto firms have accused banks of denying them services on political or religious grounds, and Elizabeth Warren, the Democratic senator from Massachusetts, has said banks should stop what she described as discriminatory practices.

The experience fueled the Trumps' interest in the cryptocurrency world, long hailed by true believers as a place where banks don't call the shots on who can have accounts and how they move their money.

Eric Trump, executive vice president at the Trump Organization, has been at the forefront of the first family's rapid entry into the business in the president's second term. The Trumps have built substantial interests in bitcoin mining and acquisition and various other crypto tokens. A stake in one firm, World Liberty Financial, was recently valued at $4.5 billion.

Democrats and critics outside the government say the first family's huge foray into crypto poses major conflicts of interest — especially as President Trump lightens regulations on the industry. The Trumps say the efforts are separate from the president's official business. "I literally have nothing to do with Washington, D.C.," Eric said.

Now, President Trump has made the issue of debanking a central point of his administration, galvanizing support from a wide range of conservative groups, lawmakers and crypto companies.

The push culminated in an executive order this month that directs regulators to investigate whether banks discriminate on political or religious grounds, and punish those found to have done so.

Meanwhile, the Trump Organization has sued Capital One, one of the banks that dropped it, alleging the accounts were closed for political reasons. The company denied any political motives. In general, banking executives say they often can't be specific on reasons for closing accounts but have noted that they faced regulatory pressure in the past to avoid customers that could expose them to reputational risks.

Bricks and mortar

A decade ago, there was no world in which Trump imagined himself working in crypto. He is a self-proclaimed "bricks-and-mortar guy," who once shared his father's early skepticism of bitcoin.

Trump, 41 years old, helms the family's real-estate empire and oversees about 25 new hotel, golf course, residential and commercial building projects. The father of two says he got his start in the family business at 11, pouring concrete slabs and doing tile work. These days, he wakes up at 4:30 a.m. and goes to bed at 10 p.m. He never drinks coffee and is typically coiffed and clad in a suit. He said he finds joy in obsessing over every detail of the Trump properties. "Real estate is my baby," he said.

Golf-industry executive Tom Bennison, a personal friend of President Trump for decades, said he has watched the younger Trump gain skill rapidly. "He took the reins of a big, diversified, multibillion-dollar company with 20,000-plus employees" and has made it stronger, Bennison said.

Trump's office on the 25th floor of Trump Tower in Midtown Manhattan is adorned with memorabilia from his real-estate work, such as a plaque for the Saudi-backed LIV Golf League, which has tournaments on Trump courses. There are also many tributes to the family's political rise: A framed electoral map from 2016 has a note in black marker that reads "Great job, Eric! Thanks, Dad" while on a wall in front of his desk is a painting of the famous moment when Trump, bloodied after an assassination attempt, raised his fist in the air.

The decor does little to convey his newfound enthusiasm for crypto, a world much more abstract than real estate or politics.

Trump started warming to the industry during President Trump's second presidential campaign, he said. Everywhere he went, crypto insiders complained that the Biden administration was using regulatory pressure to cut off their companies' access to banking services.

"This whole system was weaponized against them, no different than it had been weaponized against us for different reasons," Trump said.

Crypto community

Some of Trump's smartest friends were into crypto. Digital assets seemed a good hedge against physical investments — portable, easily traded and immune to fire or flood.

The hours spent in the courtroom during his father's 2024 criminal hush-money trial allowed plenty of time to ponder the situation. Many of the family's crypto ventures were in progress around that time, and World Liberty Financial — the family's flagship crypto firm — launched in September and soon introduced a token called WLFI as well as a stablecoin, a type of coin with a 1:1 link to the dollar.

World Liberty said in March that it had sold $550 million of WLFI to investors, including the Chinese-born crypto billionaire Justin Sun, who is the subject of a civil fraud lawsuit from the Securities and Exchange Commission that was paused earlier this year. In June, it received a $100 million investment from a United Arab Emirates-based company called Aqua 1 Foundation, which had virtually no industry presence before its investment in World Liberty.

More recently, publicly traded crypto-payments firm ALT5 Sigma sold $1.5 billion in shares to acquire WLFI tokens and appointed Trump as a director on the company's board.

Ethics lawyers have lambasted the Trump family's crypto endeavors as an unprecedented blurring of the lines between the president's business interests and his presidential power.

"What Donald Trump is doing with crypto is the essence of corruption, because you have the man who is ultimately in charge of regulating the industry, who has vast financial interests in multiple dimensions of that industry, he can't help but make decisions that impact his own pockets," said Norm Eisen, the White House ethics czar during the Obama administration.

White House press secretary Karoline Leavitt said the "media's continued attempts to fabricate conflicts of interest are irresponsible" and that "neither the president nor his family have ever engaged, or will ever engage, in conflicts of interest."

Bitcoin rhapsody

In December, Eric Trump flew to Abu Dhabi for his first appearance at a major bitcoin conference. There, he rhapsodized about bitcoin and met Mike Ho, chief strategy officer of bitcoin miner Hut 8. The publicly traded company would soon strike a deal with Trump's yet-to-be-launched data center company to form American Bitcoin, which specializes in bitcoin mining, the process of performing complex computational feats to obtain the currency.

Trump, who is described as the co-founder and chief strategy officer of American Bitcoin, owns a 9.3% stake in the company, according to a recent filing.

Anthony Scaramucci, a first-term adviser to President Trump whose investment firm SkyBridge Capital has been investing in crypto since 2020, said Eric Trump isn't a casual crypto fan. "He's read the bitcoin white paper. He's done a tremendous amount of homework," said Scaramucci.

Among the Trump family's crypto ventures, none has generated as much controversy as the $TRUMP memecoin. Launched just three days before President Trump took office, the token reached a peak market cap of nearly $15 billion, though it has now fallen to around $1.7 billion. It is unclear how the family splits its memecoin earnings with its partners.

Even seasoned crypto players view memecoins — tokens based on viral internet memes or celebrities — with skepticism.

Eric Trump said memecoins allow investors to directly support their passions and serve as a powerful gateway drawing newcomers into the crypto world.

"If somebody wants to go in and they want to buy $TRUMP, congratulations, now you have access to Bitcoin, you have access to Ethereum, you have access to USD1, you have access to the United States dollar," he said. "You just took the first step in actually creating some financial freedom that I think so many people around the world want."

Musing about the future, Trump posited that lots of real-world assets could benefit from a marriage with crypto. "Why is it that if I wanted to refinance Trump Tower, I couldn't tokenize this asset and put it on the street for billions of people around the world to otherwise invest in it," he said. "They love New York. They love Fifth Avenue. They love Trump."

Write to Vicky Ge Huang at vicky.huang@wsj.com

Last edition, I wrote about how “DAT (digital asset treasury) summer” was pulling attention and capital away from traditional startup rounds. At the time, some VCs also flagged another issue: limited partners (LPs) had become far more cautious about backing crypto funds. So in this edition, I’m digging into why raising a crypto VC fund has gotten harder — even in a bull market — and what that means for the road ahead.

Fundraising began to get materially tougher after the 2022 collapses of Terra (LUNA) and FTX, which eroded LP trust and left reputational scars across the sector, several VCs told me. “The sentiment on crypto has improved a lot, but that has not outweighed broader concerns about venture performance,” said Regan Bozman, co-founder of Lattice Fund. “The new challenge is crypto venture is now competing with ETFs and DATs for inflows.”

Today, only funds with a clear edge or exceptional track record are still drawing new LP commitments, said Michael Bucella, co-founder at Neoclassic Capital. That dynamic has fueled what Dragonfly’s general partner Rob Hadick described as a “flight to quality.” In 2024, he noted, just 20 firms captured 60% of all LP capital, while the other 488 split the remaining 40%. Even with liquidity improving this year through M&As and IPOs, the fundraising bar remains far higher than before the 2022 collapses.

The broader data backs it up. Crypto VC fundraising has shrunk dramatically since the 2021–2022 boom. In 2022, firms raised more than $86 billion across 329 funds, but that collapsed to $11.2 billion in 2023 and $7.95 billion in 2024, according to The Block Pro data from my colleague Ivan Wu. So far in 2025, just $3.7 billion has been raised across 28 funds — underscoring how much tougher the environment has become. Both the amount raised and the number of funds are on a steep downtrend, reflecting LP caution and a more selective capital base.

Family offices, wealthy individuals, and crypto-native funds remain active in backing crypto VCs. But pensions, endowments, funds-of-funds, and corporate venture arms have largely stepped back since 2022, leaving a smaller, more selective pool of LPs, several VCs told me.

Why it’s harder to raise now than in 2021 or early 2022

The last bull cycle was unusual — in 2021 almost anyone could raise a crypto VC fund, often without much experience, but many of those funds still haven’t returned capital. LPs are now waiting for real DPI (distributions to paid-in capital) before committing fresh money. “LPs are increasingly skeptical about unrealized gains and prioritize funds with proven track records of realized returns,” said Sep Alavi, general partner at White Star Capital.

Rising interest rates since March 2022 have also pushed allocators toward safer, more liquid assets. Neoclassic Capital’s other co-founder, Steve Lee, noted that this cycle’s gains have been concentrated in bitcoin, ethereum, and a few blue chips through ETFs and DATs, leaving little spillover into smaller projects where VC value usually emerges. “LPs see short-term gains in large caps, while VC value takes longer to materialize,” Lee said.

An early-stage VC founder, who didn't wish to be identified, added that the lack of an “altcoin bid” — with very few tokens performing since the 2021–22 cycle — has weighed on LP appetite, since many crypto VCs invest in tokens. AI is also a major distraction: “AI is such an overarching shiny object that it has captured a lot of tech-focused LP interest,” said Lattice Fund’s Bozman.

Overall, while raising today may not be harder than the post-Luna/FTX years, it’s still far tougher than the easy-money days of 2021 and early 2022.

What the future of crypto VC could look like

If fundraising remains tight, most VCs expect a wave of consolidation ahead, where smaller, weaker or undifferentiated funds will quietly disappear. Alavi expects smaller or underperforming funds to struggle with follow-on vehicles, while Hadick noted the market is already thinning out as capital concentrates with the strongest players.

The early-stage crypto VC founder argued that the middle tier will hollow out: small, sub-$50 million funds with a sharp edge will survive, as will the mega-funds like Paradigm and a16z, but underperforming mid-sized funds will fade away. Neoclassic’s Bucella added that crypto VC may increasingly resemble traditional markets, with a large liquid base supported by a smaller, but higher-quality venture segment. “Capital markets have a wonderful way of self-corrective behavior. We’re coming out of a period of over-allocation to venture and under-allocation to liquid strategies,” Bucella said.

Others see the model itself evolving. Erick Zhang of Nomad Capital predicted fewer firms will remain purely crypto-focused, with web2 VCs dipping into crypto and crypto funds branching into web2.

The timeline for LPs returning in size varies. Lee at Neoclassic said LPs will return once capital flows shift from bitcoin and ethereum toward mid- and small-cap token ecosystems — a change he expects to be accelerated by stablecoin-driven on-chain capital.

Alavi thinks it could be mid-2026 as interest rates decline and M&A boosts distributions, while Hadick believes most institutional investors are already back, apart from pensions, which he expects to return over the next few years with regulatory clarity and a market that has matured. The early-stage VC founder suggested LPs will only flood in again once the next “super-hot narrative” — like stablecoins or another breakout use case — takes hold.

To subscribe to the free The Funding newsletter, click here.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

New allegations surfaced, claiming Binance is deliberately holding back Solana’s momentum to protect the BNB token, throwing the crypto market into controversy.

It adds to the list of times the largest exchange on trading volume metrics has been accused of using Wintermute market maker to influence prices.

Is Binance Secretly Holding Back Solana in Favor of BNB?

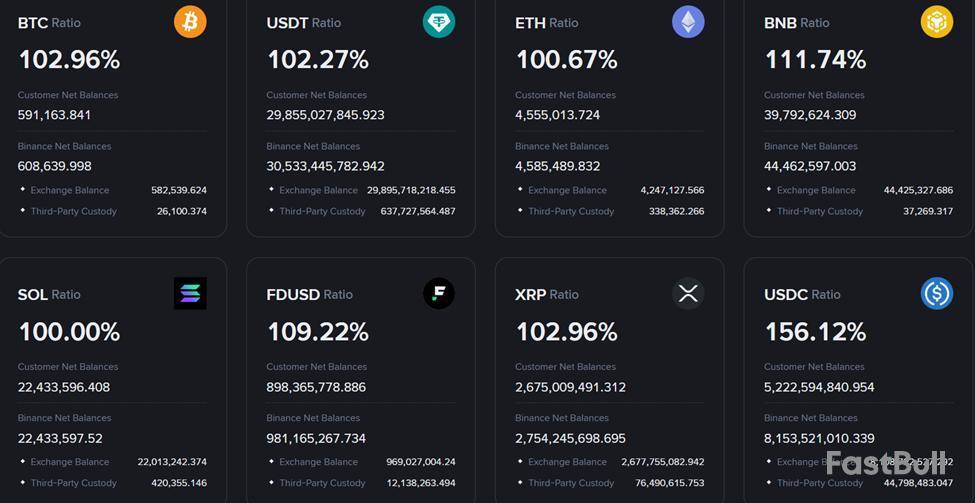

He shared what he called “receipts,” questioning how the Binance exchange could be sourcing SOL for trading activity when its proof of reserves (PoR) shows no Solana holdings beyond customer deposits.

As of the time of this writing, Solana was trading at $203 with a market cap of $109.7 billion, just behind BNB’s $865.97 price and $120.6 billion capitalization.

Indeed, Binance’s proof of reserves shows no Solana holdings beyond customer deposits of 22.433 million SOL tokens. The holdings comprise 22.013 million in exchange balance and 420.35 in third-party custody.

Meanwhile, this is not the first time Binance and Wintermute have been tied together in market controversy.

Five months ago, reports suggested Wintermute was involved in coordinated sell-offs that tanked smaller tokens such as ACT. Binance was also allegedly linked to the activity.

Similarly, seven months ago, Binance also faced scrutiny over $20 million worth of crypto transactions tied to Wintermute.

BeInCrypto reported that this sparked heated debates about opaque relationships between exchanges and market makers. BeInCrypto also explored the role of market makers beyond providing essential liquidity and preventing price volatility.

Critics argue that if Binance uses Wintermute to influence liquidity flows and suppress Solana, it would represent a direct conflict of interest.

More closely, it would undermine the credibility of both PoRs frameworks and the fairness of open markets.

Industry Voices Call for Action with Market at a Crossroads

The allegations have reignited questions about Binance’s dominance and the vulnerabilities of centralized exchange-driven markets.

“So the ‘new system’ is even worse than the old system? Why are any of us accepting a system this fragile … corrupt … and manipulatable? When will Binance be involuntarily shuttered? Arrest them. Prosecute them,” wrote Alan Knitowski, founder and former CEO of NASDAQ-listed companies Cisco Systems and Phunware Inc.

These remarks highlight growing frustration among traditional finance (TradFi) veterans entering crypto. Many of them believed blockchain markets would provide a more transparent alternative to legacy systems.

Instead, recurring accusations of manipulation and conflicts of interest may fuel skepticism.

The accusations come at a pivotal time for Solana, which has seen explosive adoption across DeFi, NFTs, and meme coins.

Its rise has positioned it as a potential challenger to Ethereum’s scaling dominance, and now, apparently, to Binance’s BNB token.

Whether the claims prove accurate, the controversy mirrors the fragile trust underpinning crypto markets.

On one hand, Solana’s community sees a network surging toward mainstream adoption. On the other hand, critics say entrenched players may be actively engineering ceilings to preserve their own dominance.

The tension leaves regulators, investors, and developers facing the same unresolved question: How much power should centralized exchanges still wield over market outcomes?

Pavel Durov, founder of the messaging app Telegram, reflected on his arrest one year ago by French authorities with a message on the platform, claiming French authorities have so far failed to find evidence of wrongdoing on his part.

"Arresting a CEO of a major platform over the actions of its users was not only unprecedented — it was legally and logically absurd," Durov wrote of his arrest, which made international headlines and spurred support from the crypto community.

Durov was arrested on August 24, 2024, and was later charged with 12 counts related to complicity in crimes facilitated by the messaging app, from money laundering to child sexual abuse material distribution. Durov was formally placed under investigation related to the charges.

"A year later, the 'criminal investigation' against me is still struggling to find anything that I or Telegram did wrong," Durov continued. "One year after this strange arrest, I still have to return to France every 14 days, with no appeal date in sight."

Telegram is home to a thriving Web3 scene through its integrations with The Open Network, whose native token, Toncoin, is the twenty-first largest cryptocurrency by market cap, according to price data. Toncoin has been adopted into a digital asset treasury (DAT) company called Verb Technology, which currently holds over 8% of the token's circulating supply and plans to rebrand to Ton Strategy Company.

Active addresses on TON spiked in the weeks following Durov's arrest, though activity has somewhat subsided since that peak, according to The Block's data.

Durov was first allowed to leave France in March to travel to Dubai, where Telegram is headquartered and Durov's family is based. Following an appeals court decision, Durov may leave metropolitan France only to Dubai, for up to 14 consecutive days per trip, provided he notifies the investigating judge one week in advance. Other locations require additional authorization from a French judge.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-in

Pembuat Poster

Program Afiliate

Risiko kerugian dalam perdagangan instrumen kewangan seperti saham, FX, komoditi, niaga hadapan, bon, ETF dan kripto boleh menjadi besar. Anda mungkin mengalami kerugian keseluruhan dana yang anda depositkan dengan broker anda. Oleh itu, anda harus mempertimbangkan dengan teliti sama ada perdagangan sedemikian sesuai untuk anda berdasarkan keadaan dan sumber kewangan anda.

Tiada keputusan untuk melabur harus dibuat tanpa menjalankan usaha wajar secara menyeluruh sendiri atau berunding dengan penasihat kewangan anda. Kandungan web kami mungkin tidak sesuai dengan anda kerana kami tidak mengetahui keadaan kewangan dan keperluan pelaburan anda. Maklumat kewangan kami mungkin mempunyai kependaman atau mengandungi ketidaktepatan, jadi anda harus bertanggungjawab sepenuhnya untuk sebarang keputusan perdagangan dan pelaburan anda. Syarikat tidak akan bertanggungjawab ke atas kehilangan modal anda.

Tanpa mendapat kebenaran daripada tapak web, anda tidak dibenarkan menyalin grafik, teks atau tanda dagangan tapak web. Hak harta intelek dalam kandungan atau data yang dimasukkan ke dalam laman web ini adalah milik pembekal dan pedagang pertukarannya.

Tidak log masuk

Log masuk untuk mengakses lebih banyak ciri

Keahlian FastBull

Belum lagi

Belian

Log masuk

Daftar