Kutipan

Berita

Analisis

Pengguna

24/7

Kalender Ekonomi

Pendidikan

Data

- Nama

- Nilai Terbaru

- Sblm.

Akun Sinyal untuk Anggota

Semua Akun Sinyal

Semua Kontes

U.K. Neraca Perdagangan Non-Uni Eropa (Penyesuaian Per Kuartal) (Okt)

U.K. Neraca Perdagangan Non-Uni Eropa (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Akun Perdagangan (Okt)

U.K. Akun Perdagangan (Okt)S:--

P: --

S: --

U.K. Indeks Sektor Jasa MoM

U.K. Indeks Sektor Jasa MoMS:--

P: --

S: --

U.K. Output Sektor Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)

U.K. Output Sektor Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Output Industri YoY (Okt)

U.K. Output Industri YoY (Okt)S:--

P: --

S: --

U.K. Akun Perdagangan (Penyesuaian Per Kuartal) (Okt)

U.K. Akun Perdagangan (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Neraca Perdagangan Uni Eropa (Penyesuaian Per Kuartal) (Okt)

U.K. Neraca Perdagangan Uni Eropa (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Output Manufaktur YoY (Okt)

U.K. Output Manufaktur YoY (Okt)S:--

P: --

S: --

U.K. PDB MoM (Okt)

U.K. PDB MoM (Okt)S:--

P: --

S: --

U.K. PDB YoY (Penyesuaian Per Kuartal) (Okt)

U.K. PDB YoY (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Output Industri MoM (Okt)

U.K. Output Industri MoM (Okt)S:--

P: --

S: --

U.K. Output Sektor Konstruksi YoY (Okt)

U.K. Output Sektor Konstruksi YoY (Okt)S:--

P: --

S: --

Perancis Indeks Harga Konsumen Final MoM (Nov)

Perancis Indeks Harga Konsumen Final MoM (Nov)S:--

P: --

S: --

China, Daratan Pertumbuhan Kredit Tidak Dibayarkan YoY (Nov)

China, Daratan Pertumbuhan Kredit Tidak Dibayarkan YoY (Nov)S:--

P: --

S: --

China, Daratan Uang Beredar M2 YoY (Nov)

China, Daratan Uang Beredar M2 YoY (Nov)S:--

P: --

S: --

China, Daratan Uang Beredar M0 YoY (Nov)

China, Daratan Uang Beredar M0 YoY (Nov)S:--

P: --

S: --

China, Daratan Uang Beredar M1 YoY (Nov)

China, Daratan Uang Beredar M1 YoY (Nov)S:--

P: --

S: --

India IHK YoY (Nov)

India IHK YoY (Nov)S:--

P: --

S: --

India Pertumbuhan Deposito YoY

India Pertumbuhan Deposito YoYS:--

P: --

S: --

Brazil Pertumbuhan Sektor Jasa YoY (Okt)

Brazil Pertumbuhan Sektor Jasa YoY (Okt)S:--

P: --

S: --

Meksiko Nilai Produksi Industri YoY (Okt)

Meksiko Nilai Produksi Industri YoY (Okt)S:--

P: --

S: --

Rusia Akun Perdagangan (Okt)

Rusia Akun Perdagangan (Okt)S:--

P: --

S: --

Presiden Fed Philadelphia Henry Paulson menyampaikan pidato

Presiden Fed Philadelphia Henry Paulson menyampaikan pidato Kanada Izin Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)

Kanada Izin Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

Kanada Penjualan Grosir YoY (Okt)

Kanada Penjualan Grosir YoY (Okt)S:--

P: --

S: --

Kanada Stok Grosir MoM (Okt)

Kanada Stok Grosir MoM (Okt)S:--

P: --

S: --

Kanada Stok Grosir YoY (Okt)

Kanada Stok Grosir YoY (Okt)S:--

P: --

S: --

Kanada Penjualan Grosir MoM (Penyesuaian Per Kuartal) (Okt)

Kanada Penjualan Grosir MoM (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

Jerman Rekening Koran (Sebelum Penyesuaian Per Kuartal) (Okt)

Jerman Rekening Koran (Sebelum Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

Amerika Serikat Total Pengeboran Mingguan

Amerika Serikat Total Pengeboran MingguanS:--

P: --

S: --

Amerika Serikat Total Nilai Pengeboran Bahan Bakar Fosil Mingguan

Amerika Serikat Total Nilai Pengeboran Bahan Bakar Fosil MingguanS:--

P: --

S: --

Jepang Indeks Difusi Non-Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Difusi Non-Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Prospek Manufaktur Kecil Tankan (kuartal 4)

Jepang Indeks Prospek Manufaktur Kecil Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Prospek Non-Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Prospek Non-Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Prospek Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Prospek Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Difusi Manufaktur Kecil Tankan (kuartal 4)

Jepang Indeks Difusi Manufaktur Kecil Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Difusi Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Difusi Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Nilai Belanja Modal Perusahaan-Besar Tankan YoY (kuartal 4)

Jepang Nilai Belanja Modal Perusahaan-Besar Tankan YoY (kuartal 4)--

P: --

S: --

U.K. Indeks Harga Properti Residential - Rightmove YoY (Des)

U.K. Indeks Harga Properti Residential - Rightmove YoY (Des)--

P: --

S: --

China, Daratan Output Industri YoY (Awal Sampai Akhir Tahun) (Nov)

China, Daratan Output Industri YoY (Awal Sampai Akhir Tahun) (Nov)--

P: --

S: --

China, Daratan Tingkat Pengangguran Perkotaan (Nov)

China, Daratan Tingkat Pengangguran Perkotaan (Nov)--

P: --

S: --

Arab Saudi IHK YoY (Nov)

Arab Saudi IHK YoY (Nov)--

P: --

S: --

Zona Euro Output Industri YoY (Okt)

Zona Euro Output Industri YoY (Okt)--

P: --

S: --

Zona Euro Output Industri MoM (Okt)

Zona Euro Output Industri MoM (Okt)--

P: --

S: --

Kanada Tingkat Penjualan Rumah Siap Huni MoM (Nov)

Kanada Tingkat Penjualan Rumah Siap Huni MoM (Nov)--

P: --

S: --

Zona Euro Total Aset Cadangan (Nov)

Zona Euro Total Aset Cadangan (Nov)--

P: --

S: --

U.K. Ekspektasi Inflasi

U.K. Ekspektasi Inflasi--

P: --

S: --

Kanada Indeks Keyakinan Ekonomi Nasional

Kanada Indeks Keyakinan Ekonomi Nasional--

P: --

S: --

Kanada Konstruksi Rumah Baru (Nov)

Kanada Konstruksi Rumah Baru (Nov)--

P: --

S: --

Amerika Serikat Indeks Tenaga Kerja Manufaktur Fed New York (Des)

Amerika Serikat Indeks Tenaga Kerja Manufaktur Fed New York (Des)--

P: --

S: --

Amerika Serikat Indeks Manufaktur Fed New York (Des)

Amerika Serikat Indeks Manufaktur Fed New York (Des)--

P: --

S: --

Kanada IHK Inti YoY (Nov)

Kanada IHK Inti YoY (Nov)--

P: --

S: --

Kanada Pesanan Belum Selesai Manufaktur MoM (Okt)

Kanada Pesanan Belum Selesai Manufaktur MoM (Okt)--

P: --

S: --

Kanada Pesanan Baru Manufaktur MoM (Okt)

Kanada Pesanan Baru Manufaktur MoM (Okt)--

P: --

S: --

Kanada IHK Inti MoM (Nov)

Kanada IHK Inti MoM (Nov)--

P: --

S: --

Kanada Stok Manufaktur MoM (Okt)

Kanada Stok Manufaktur MoM (Okt)--

P: --

S: --

Kanada IHK YoY (Nov)

Kanada IHK YoY (Nov)--

P: --

S: --

Kanada IHK MoM (Nov)

Kanada IHK MoM (Nov)--

P: --

S: --

Kanada IHK YoY (Penyesuaian Per Kuartal) (Nov)

Kanada IHK YoY (Penyesuaian Per Kuartal) (Nov)--

P: --

S: --

Kanada IHK Inti MoM (Penyesuaian Per Kuartal) (Nov)

Kanada IHK Inti MoM (Penyesuaian Per Kuartal) (Nov)--

P: --

S: --

Tidak Ada Data Yang Cocok

Opini Terbaru

Opini Terbaru

Topik Populer

Kolumnis Teratas

Terbaru

Label putih

Data API

Web Plug-ins

Program Afiliasi

Lihat Semua

Tidak ada data

A coalition of Web3 companies has introduced a new Ethereum token standard designed to streamline compliance and reduce fragmentation in the growing real-world asset (RWA) sector.

According to an announcement sent to Cointelegraph, the standard, ERC-7943, creates a minimal, modular interface designed to work across Ethereum layer-2s and Ethereum Virtual Machine (EVM) chains, while remaining agnostic to implementation and vendor-specific infrastructure. This means it can work in any setup and isn’t locked into any specific company’s tools.

Dario Lo Buglio, the co-founder of Brickken and the author of the Ethereum Improvement Proposal (EIP)-7943, told Cointelegraph that the new standard acts as a “universal layer” that sits on top of any token type. This allows developers and institutions to avoid having to use wrappers and custom bridges while integrating tokenized assets into apps.

ERC-7943 is backed by a coalition of Web3 and fintech firms, including Bit2Me, Brickken, Compellio, Dekalabs, DigiShares, Hacken, Forte Protocol, FullyTokenized, RealEstate.Exchange, Stobox and Zoth.

Responding to a “perfect storm” of institutional interest

According to Lo Buglio, EIP-7943 is a direct response to developer frustration and a “perfect storm of institutional interest.”

Data from the RWA tracker RWA.xyz shows that the total value of tokenized RWAs onchain has reached $28.44 billion, up nearly 6% in the last 30 days. Meanwhile, stablecoins’ total stablecoin value and total asset holders are up nearly 7% and 9%, respectively.

The growth of RWAs shows that institutions are currently adopting RWAs at scale, with issuers competing for market share. Lo Buglio said this highlights the need for a new token standard that addresses the needs of developers and financial institutions alike.

“Financial institutions want programmable controls that match their compliance frameworks. Developers, on the other hand, are stuck rewriting custom logic for every RWA token,” Lo Buglio told Cointelegraph. “We needed a common foundation.”

Lo Buglio told Cointelegraph that the standard entered the review stage of the EIP process and has already received feedback from compliance professionals and other token standard authors.

“The EIP still stands on the review stage, which is where the main feedback will be proposed and incorporated.”

Tackling fragmentation and enabling composability

Earlier efforts to standardize RWA tokenization on Ethereum include ERC-1400 and ERC-3643. ERC-1400 introduced a hybrid model blending features of fungible and non-fungible tokens (NFTs), with built-in compliance tools.

ERC-3643 focused on regulated assets like securities, integrating onchain identity and permission layers to enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Lo Buglio said ERC-1400 aims to focus on separating logic from storage and said that ERC-3643 is strong for securities, but it’s tightly coupled to its own identity and permissioning stack. Unlike these solutions, he said, it differentiates itself by being a minimal, implementation-agnostic interface.

“EIP-7943 defines only what must exist — not how it’s built — so any project or protocol can slot it into their stack without friction,” Lo Buglio told Cointelegraph.

“Its primary goal is to solve the problem of industry fragmentation by providing a single, standardized set of functions for compliance.”

The XRP Ledger has lost one of its biggest signals of strength.

Daily payment volumes, which often held steady above 200-300 million XRP and sometimes touched 2 billion, have now dropped sharply to 114.07 million XRP in the last 24 hours. For a network built around payments rather than DeFi or NFTs, this slide raises tough questions about demand and market confidence.

Payment Volumes Show Cracks in Utility

The XRP Ledger was designed to power fast, low-cost cross-border transactions at scale. For years, Ripple has promoted this as a key advantage over other blockchains. But falling transaction volumes suggest real-world adoption isn’t keeping pace with the company’s vision.

Ripple CEO Brad Garlinghouse insists XRPL remains “a decentralized, battle-tested, open-source blockchain designed to function at scale,” but these numbers are now challenging that narrative.

XRP Price Steady, But Momentum Weak

XRP is trading around $2.97, stuck between resistance at $3.10 and support near $2.92 at the 50-day EMA. The RSI sits at 55, showing neutral momentum. But price stability without growth in network activity is a warning sign for traders.

Any rally without a rebound in on-chain demand may struggle to hold.

Binance Reserves Surge, TVL Drops

Market data points to other signs. Binance now holds a record 3.57 billion XRP, up by 670 million since September began. That kind of accumulation on exchanges is often linked to selling pressure.

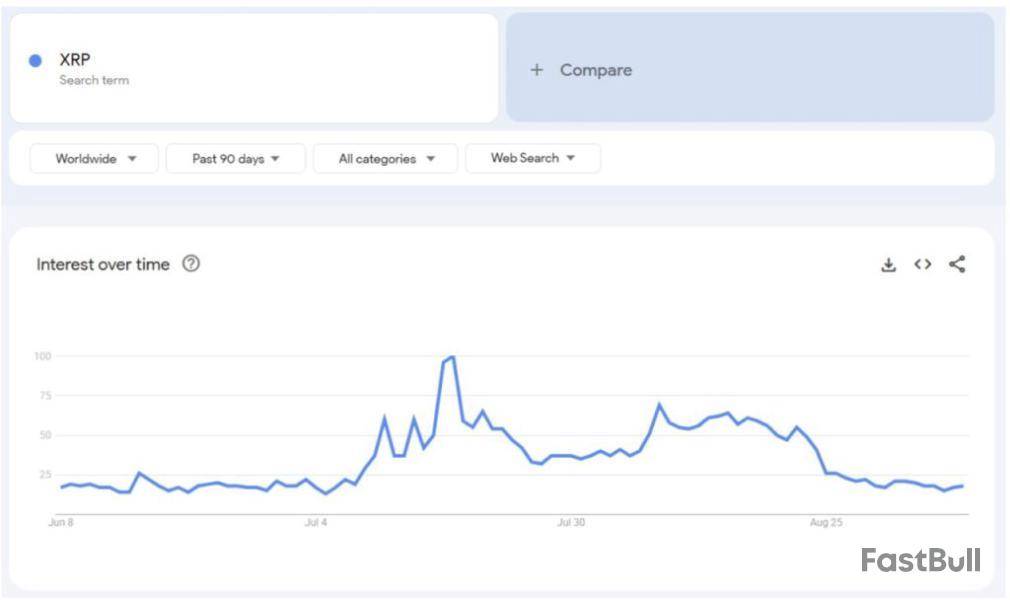

Total value locked on XRPL has also slipped from $120M to $98M, while DEX activity hit its lowest level since April. And Google Trends data shows interest in “Ripple ” has collapsed from a score of 100 to just 19 in two months.

A Critical Moment for XRP

Ripple continues to position itself as a leader in global payments, building solutions for cross-border transfers, stablecoins, and custody services. But the latest on-chain numbers tell a different story.

With regulatory pressure from the SEC still clouding sentiment, and key adoption metrics falling, XRP is at a crossroads. The asset may need more than price rallies to prove its place in the market.

"All the ingredients are there for an epic end-of-year run for Solana," Bitwise Chief Investment Officer Matt Hougan said in his latest memo to clients late Tuesday, arguing that the recipe of exchange-traded product inflows and corporate treasury purchases could usher in "Solana season" with strong returns.

Following that recipe, Bitcoin went from around $40,000 in January 2024 to nearly $125,000, Hougan noted, with Ethereum discovering the same in April 2025, where prices subsequently tripled to almost $5,000 at its August peak.

In those respective time periods, the Bitcoin network has produced (mined) 322,681 BTC, while ETPs and corporations have bought more than 1.1 million BTC; and the Ethereum network has produced 388,568 ETH, while ETPs and corporations have acquired 7.4 million ETH, according to Bitwise.

"It's no surprise that the recipe works. It’s classic supply and demand," Hougan said. "When demand exceeds supply, prices typically go up."

Why Solana?

With the same conditions now setting up for SOL, the Bitwise CIO sees Solana as "next" to follow this path.

Several issuers — including Grayscale, VanEck, Franklin Templeton, Fidelity, Invesco/Galaxy, Canary Capital — and Bitwise itself — have filed for spot Solana ETFs in the U.S., with the Securities and Exchange Commission expected to decide by Oct. 10, potentially setting up multiple launches in Q4, Hougan said.

In July, REX‑Osprey launched the first U.S. ETF offering SOL exposure with native staking rewards under the Investment Company Act of 1940 (the "'40 Act") as a workaround compared to the more common Securities Act of 1933 ('33 Act) route used by spot Bitcoin and Ethereum ETFs. While not a standard spot ETF under the 1933 Act, the SSK fund still holds actual SOL — at least 50% directly staked — with the rest allocated to staking vehicles such as exchange-traded products and liquid staking tokens.

SSK has attracted just $195.1 million in net inflows since launch compared to $5.8 billion and $8.4 billion for the Bitcoin and Ethereum ETFs, respectively, so it remains to be seen if the more traditionally-structured spot SOL ETF products will fare better.

Meanwhile, Galaxy Digital, Jump Crypto, and Multicoin Capital pledged $1.65 billion this week to Forward Industries, a new publicly traded Solana treasury company that will buy and stake SOL, adding to other accumulators of the cryptocurrency like DeFi Development Corp., Sol Strategies, and Upexi. Forward named Multicoin co-founder Kyle Samani as chairman, positioning him to champion Solana publicly as one of its "most articulate and consistent promoters," much like Michael Saylor has done for Bitcoin and Tom Lee for Ethereum, Hougan wrote.

ETFs and treasury company flows alone aren't enough to spark demand, Hougan acknowledged, with investors needing a compelling reason to buy in. Ethereum ETFs, for example, didn't draw major inflows until nearly a year after approval, when stablecoin adoption drove new interest in Ethereum as the leading stablecoin blockchain, he said.

For Solana, the pitch is speed and cost, in Hougan's view, describing it as a programmable blockchain built for stablecoins, tokenized assets, and DeFi, with transactions costing less than a cent and finalizing in milliseconds after a pending upgrade — far faster than Ethereum. Unlike Ethereum, Solana also doesn't rely on Layer 2s, offering a simpler user experience, he argued. While critics point to greater centralization risks, Solana has still carved out a strong position as the third-largest blockchain in stablecoin liquidity, fourth in tokenized assets, and is up 140% in tokenized AUM this year, Hougan said.

Solana's key difference from Bitcoin and Ethereum

However, when it comes to the potential price impact from these catalysts, there's one major difference between Solana, Bitcoin, and Ethereum, Hougan said — Solana is comparatively tiny.

While Bitcoin currently sits at a market cap of $2.2 trillion and Ethereum at $522.6 billion, according to The Block's prices page, Solana's market cap comes in at $119.4 billion. Therefore, Solana is just 5% of the size of Bitcoin and 23% the size of Ethereum, Hougan noted.

"Scaled for the size of the blockchain, a relatively small amount of flows into Solana could significantly impact prices," he wrote. The Bitwise CIO argued that Forward Industries' planned $1.65 billion Solana buy would have an impact similar to a $33 billion Bitcoin purchase, though the effect is tempered by Solana's higher annual inflation rate of about 4.3%, versus just 0.8% for Bitcoin and 0.5% for Ethereum.

"But the setup is still attractive," Hougan said. "My suggestion? Keep your eye on Solana in the coming months."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Demand for regulated XRP products continues to rise, as Canada's 3iQ XRP ETF sets a new record. In a recent tweet, Canadian investment fund manager 3iQ shared that investor demand has seen the 3iQ XRP ETF, called XRPQ, exceed CAD 150 million in AUM, the largest in its category.

XRPQ launched in June this year with a 0% management fee for its first six months, and it quickly established itself among Canadian peers. Ripple also stood out as an early investor in the fund, boosting investor confidence, which helped accelerate adoption across investors, including individuals, wealth advisors, institutions and family offices.

RippleX@RippleXDevSep 09, 2025Demand for regulated XRP products in Canada continues to grow with @3iq_corp's $XRPQ ETF. 📶🇨🇦 https://t.co/aawxRl2FvB

RippleX highlighted this milestone in a recent tweet, noting increased demand for regulated XRP products in Canada.

In a similar milestone, in late August, the CME Group reported that its crypto futures suite had surpassed $30 billion in notional open interest for the first time, with XRP futures becoming the fastest ever contract in its history to cross $1 billion in open interest (OI), doing so in just over three months.

Optimism soars amid increased demand

The recent milestone suggests rising demand for XRP products as the crypto asset gains increased interest on the market.

According to Bloomberg analysts, the next 12 to 18 months might see hundreds of crypto-related ETP launches, with currently over 90 crypto ETF filings with the SEC.

Several asset managers have filed for spot XRP ETFs with the SEC, including 21Shares, Bitwise, Canary Capital and Grayscale.

According to Nova Dius Wealth President Nate Geraci, while the XRP ETF approval odds in 2025 are at 87% on Polymarket, he personally thinks it is closer to 100%.

In an update on the XRP Ledger, version 2.5.1 of rippled, the reference server implementation of the XRP Ledger protocol, is now available. This release was rolled back from version 2.6.0 after issues were discovered, but it retains an important fix for stalled consensus rounds.

Binance founder Changpeng Zhao, CZ, has responded to a tweet, making an adjustment about the size of his net worth.

He also commented on his biography, which was shared in brief by a crypto enthusiast, starting from CZ’s childhood.

CZ’s path from poverty to billionaire status

The @Crypto_Jargon X account published a thread about Changpeng Zhao’s biography, revealing all the humps and bumps CZ was driven through and reminding the community of his current high-tier status and the fortune he has made.

The thread mentions the move of CZ’s family from China to Canada, where his father made a living washing dishes. When CZ was a teenager, he took on multiple jobs, including the one where he made burgers at a McDonald's and then worked night shifts at a gas station.

In 2017, CZ and his team founded what has now become the largest crypto exchange in the world by trading volumes, Binance. This platform now has a daily volume of $20,747,488,726.73 and is worth around $300 billion.

His fortune began to grow fast. In 2023, CZ had to step down from his CEO position, handing it over to Richard Teng, because of regulators’ scrutiny, and Binance was forced to pay the largest fine in history - $3.6 billion. In 2024, CZ went to jail and spent four months there, from May to September. The source claims that while inside, CZ earned $25 million per day.

There, he also started writing a book, and before he began his prison term, CZ founded The Giggle Academy for free online education.

CZ reveals truth about his fortune size

CZ’s net worth is currently around $64 billion, the report stated. However, Changpeng Zhao responded that this figure is “probably off (way too much).” He did not reveal the real size of his fortune, and he has always done that. As for his bio, he said: “Just the beginning.”

CZ 🔶 BNB@cz_binanceSep 10, 2025The wealth estimates are probably off (way too much), but thanks for the story. Just the beginning.

In a recent interview with Anthony Pompliano, CZ also dodged answering this question, just saying that money is not a problem for him now and he can afford either to make investments of any size or to start his own projects. He now values time a lot more than money. He also tweeted earlier that he holds all his personal funds in crypto – Bitcoin and BNB.

Great news – Kraken is bringing tokenized securities to Europe.

The US-based crypto exchange has officially launched xStocks, Backed’s tokenized securities, for eligible European investors. This comes after it first rolled out tokenized securities in June, marking a major step in bringing blockchain technology closer to traditional markets.

xStocks Now in Europe

European users can now trade tokenized certificates representing more than 50 US stocks and ETFs, with extended trading hours available 24/5.

These xStocks are blockchain-based tokens that mirror the value of real shares, giving investors the flexibility to buy, sell, and hold stocks the same way they trade cryptocurrency.

The platform allows investors to skip traditional brokers, move their assets across platforms with ease, and even hold their investments in self-custody. These digital assets can also be integrated into DeFi protocols, opening up new opportunities in on-chain finance.

Kraken@krakenfxSep 10, 2025Europe, your wait is over.

xStocks are now live in the Kraken app for eligible clients in Europe!

Break the broker barrier 👇https://t.co/viHhrZp8Jv pic.twitter.com/sGV7MeI4nJ

Kraken first launched xStocks as SPL tokens on the Solana blockchain and now plans to introduce support for Ethereum-based BEP-20 tokens. The exchange has also signaled plans to expand xStocks to additional blockchains like Ink.

Simplifying US Stock Access

Mark Greenberg, Kraken’s global head of consumer said that the goal is to make it easier for European investors to access US stock markets, which has traditionally been complicated.

Arjun Sethi, co-CEO of Kraken, emphasized that tokenized equities are becoming a foundational element of the next financial system.

He notes that financial markets are shifting rapidly, and stocks, bonds, currencies, and treasuries will eventually move on public blockchains.

Regulators Warn of Risks

Tokenized securities are gaining traction in Europe, with Gemini and Robinhood already offering similar products. Nasdaq also recently filed with the SEC to enter the sector.

However, regulators are expressing caution. The European Securities and Markets Authority (ESMA) has warned that some platforms offering tokenized US equities may mislead investors by providing only digital rights rather than true ownership.

Without full ownership, investors could lose benefits such as voting rights and dividend claims. ESMA also stressed that most tokenized assets remain relatively illiquid, which adds another layer of risk.

Kraken Expands Offerings, Eyes Public Listing In 2026

The launch of xStocks is just one part of Kraken’s wider growth plan.

In April 2025, the exchange introduced commission-free trading for over 11,000 U.S.-listed stocks and ETFs, to bridge the gap between traditional finance and digital assets.

In July, it launched U.S.-Regulated Derivatives. This followed its $1.5 billion acquisition of CFTC-licensed NinjaTrader, part of a broader push to create a unified marketplace across asset classes.

Kraken is reportedly planning to raise $500 million at a $15 billion valuation and aims to pursue a public listing as early as Q1 2026.

This could set the stage for a new era of global investing. Stay tuned to Coinpedia for more updates!

XRP has been stuck in a sideways drift, hanging around the $3 mark for the past few weeks. At first glance, the price chart looks sluggish enough to give short sellers, also known as "bears," confidence.

But the way the Bollinger Bands are shaping up across time frames suggests something less obvious, and it is exactly this kind of setup that tends to punish those betting against the trend.

The $2.90 midline on the daily candles has become a balancing point, where the market keeps changing direction. Dips below it do not last long but, at the same time, rebounds above stall just before the upper band at $3.09. When prices do this, it is usually not just a slow fade but a real surge. TradingView">

To make this setup for XRP a complete bear trap, we need a clean push through $3.10. Those who saw the flat summer action as weakness might want to think again.

XRP bears, beware

The pressure is the same in the 12-hour view, only more immediate. XRP spent almost all of August below the midline, finally broke through this September and now remains strong even though volumes are on the low side.

Now the bands are starting to widen, which often signals that the next move will be a quick one. The risk here is not that XRP pulls back — it is that the price rises too quickly for traders who have become too pessimistic.

On the surface, it may seem as though the XRP price is stalling, but the Bollinger Bands offer a deeper message: the easy short could be the wrong one, and bears who jump in too early may be walking straight into a trap.

Label putih

Data API

Web Plug-ins

Pembuat Poster

Program Afiliasi

Berdagang Instrumen Keuangan Seperti Saham, Mata Uang, Komoditas, Kontrak Berjangka, Obligasi, Dana, Atau Mata Uang Kripto Adalah Perilaku Berisiko Tinggi, Termasuk Kehilangan Sebagian Atau Seluruh Jumlah Investasi Anda, Sehingga Perdagangan Tidak Cocok Untuk Semua Investor.

Anda Harus Melakukan Uji Tuntas Anda Sendiri, Menggunakan Penilaian Anda Sendiri, Dan Berkonsultasi Dengan Penasihat Yang Memenuhi Syarat Saat Membuat Keputusan Keuangan Apa Pun. Konten Situs Web Ini Tidak Ditujukan Kepada Anda, Situasi Keuangan Atau Kebutuhan Anda Juga Tidak Diperhitungkan. Informasi Yang Terdapat Di Situs Web Ini Belum Tentu Tersedia Secara Waktu Nyata, Juga Belum Tentu Akurat. Setiap Pesanan Atau Keputusan Keuangan Lainnya Yang Anda Buat Sepenuhnya Menjadi Tanggung Jawab Anda Dan Anda Tidak Boleh Bergantung Pada Informasi Apa Pun Yang Disediakan Melalui Situs Web. Kami Tidak Memberikan Jaminan Apa Pun Untuk Informasi Apa Pun Di Situs Web Dan Tidak Bertanggung Jawab Atas Kerugian Transaksi Apa Pun Yang Mungkin Timbul Dari Penggunaan Informasi Apa Pun Di Situs Web.

Dilarang Menggunakan, Menyimpan, Menggandakan, Menampilkan, Memodifikasi, Menyebarluaskan Atau Mendistribusikan Data Yang Terdapat Dalam Situs Web Ini Tanpa Izin Tertulis Dari Situs Web Ini. Semua Hak Kekayaan Intelektual Dilindungi Oleh Pemasok Dan Bursa Yang Menyediakan Data Yang Terdapat Di Situs Web Ini.

Tidak Masuk

Masuk untuk mengakses lebih banyak fitur

Anggota FastBull

Belum

Pembelian

Masuk

Daftar