Kutipan

Berita

Analisis

Pengguna

24/7

Kalender Ekonomi

Pendidikan

Data

- Nama

- Nilai Terbaru

- Sblm.

Akun Sinyal untuk Anggota

Semua Akun Sinyal

Semua Kontes

Jepang Indeks Prospek Manufaktur Kecil Tankan (kuartal 4)

Jepang Indeks Prospek Manufaktur Kecil Tankan (kuartal 4)S:--

P: --

S: --

Jepang Indeks Prospek Non-Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Prospek Non-Manufaktur Besar Tankan (kuartal 4)S:--

P: --

S: --

Jepang Indeks Prospek Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Prospek Manufaktur Besar Tankan (kuartal 4)S:--

P: --

S: --

Jepang Indeks Difusi Manufaktur Kecil Tankan (kuartal 4)

Jepang Indeks Difusi Manufaktur Kecil Tankan (kuartal 4)S:--

P: --

S: --

Jepang Indeks Difusi Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Difusi Manufaktur Besar Tankan (kuartal 4)S:--

P: --

S: --

Jepang Nilai Belanja Modal Perusahaan-Besar Tankan YoY (kuartal 4)

Jepang Nilai Belanja Modal Perusahaan-Besar Tankan YoY (kuartal 4)S:--

P: --

S: --

U.K. Indeks Harga Properti Residential - Rightmove YoY (Des)

U.K. Indeks Harga Properti Residential - Rightmove YoY (Des)S:--

P: --

S: --

China, Daratan Output Industri YoY (Awal Sampai Akhir Tahun) (Nov)

China, Daratan Output Industri YoY (Awal Sampai Akhir Tahun) (Nov)S:--

P: --

S: --

China, Daratan Tingkat Pengangguran Perkotaan (Nov)

China, Daratan Tingkat Pengangguran Perkotaan (Nov)S:--

P: --

S: --

Arab Saudi IHK YoY (Nov)

Arab Saudi IHK YoY (Nov)S:--

P: --

S: --

Zona Euro Output Industri YoY (Okt)

Zona Euro Output Industri YoY (Okt)S:--

P: --

S: --

Zona Euro Output Industri MoM (Okt)

Zona Euro Output Industri MoM (Okt)S:--

P: --

S: --

Kanada Tingkat Penjualan Rumah Siap Huni MoM (Nov)

Kanada Tingkat Penjualan Rumah Siap Huni MoM (Nov)S:--

P: --

S: --

Kanada Indeks Keyakinan Ekonomi Nasional

Kanada Indeks Keyakinan Ekonomi NasionalS:--

P: --

S: --

Kanada Konstruksi Rumah Baru (Nov)

Kanada Konstruksi Rumah Baru (Nov)S:--

P: --

Amerika Serikat Indeks Tenaga Kerja Manufaktur Fed New York (Des)

Amerika Serikat Indeks Tenaga Kerja Manufaktur Fed New York (Des)S:--

P: --

S: --

Amerika Serikat Indeks Manufaktur Fed New York (Des)

Amerika Serikat Indeks Manufaktur Fed New York (Des)S:--

P: --

S: --

Kanada IHK Inti YoY (Nov)

Kanada IHK Inti YoY (Nov)S:--

P: --

S: --

Kanada Pesanan Belum Selesai Manufaktur MoM (Okt)

Kanada Pesanan Belum Selesai Manufaktur MoM (Okt)S:--

P: --

S: --

Amerika Serikat Indeks Akuisisi Harga Produsen Fed New York (Des)

Amerika Serikat Indeks Akuisisi Harga Produsen Fed New York (Des)S:--

P: --

S: --

Amerika Serikat Indeks Pesanan Baru Manufaktur Fed NY (Des)

Amerika Serikat Indeks Pesanan Baru Manufaktur Fed NY (Des)S:--

P: --

S: --

Kanada Pesanan Baru Manufaktur MoM (Okt)

Kanada Pesanan Baru Manufaktur MoM (Okt)S:--

P: --

S: --

Kanada IHK Inti MoM (Nov)

Kanada IHK Inti MoM (Nov)S:--

P: --

S: --

Kanada Nilai Rata-Rata Terpangkas IHK YoY (Penyesuaian Per Kuartal) (Nov)

Kanada Nilai Rata-Rata Terpangkas IHK YoY (Penyesuaian Per Kuartal) (Nov)S:--

P: --

S: --

Kanada Stok Manufaktur MoM (Okt)

Kanada Stok Manufaktur MoM (Okt)S:--

P: --

S: --

Kanada IHK YoY (Nov)

Kanada IHK YoY (Nov)S:--

P: --

S: --

Kanada IHK MoM (Nov)

Kanada IHK MoM (Nov)S:--

P: --

S: --

Kanada IHK YoY (Penyesuaian Per Kuartal) (Nov)

Kanada IHK YoY (Penyesuaian Per Kuartal) (Nov)S:--

P: --

S: --

Kanada IHK Inti MoM (Penyesuaian Per Kuartal) (Nov)

Kanada IHK Inti MoM (Penyesuaian Per Kuartal) (Nov)S:--

P: --

S: --

Kanada IHK MoM (Penyesuaian Per Kuartal) (Nov)

Kanada IHK MoM (Penyesuaian Per Kuartal) (Nov)S:--

P: --

S: --

Gubernur Dewan Federal Reserve Milan menyampaikan pidato

Gubernur Dewan Federal Reserve Milan menyampaikan pidato Amerika Serikat Indeks Pasar Properti NAHB (Des)

Amerika Serikat Indeks Pasar Properti NAHB (Des)--

P: --

S: --

Australia Nilai Awal PMI Komposit (Des)

Australia Nilai Awal PMI Komposit (Des)--

P: --

S: --

Australia Nilai Awal PMI Sektor Jasa (Des)

Australia Nilai Awal PMI Sektor Jasa (Des)--

P: --

S: --

Australia Nilai Awal PMI Manufaktur (Des)

Australia Nilai Awal PMI Manufaktur (Des)--

P: --

S: --

Jepang Nilai Awal PMI Manufaktur (Penyesuaian Per Kuartal) (Des)

Jepang Nilai Awal PMI Manufaktur (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

U.K. Perubahan Jumlah Tenaga Kerja ILO 3-Bulan (Okt)

U.K. Perubahan Jumlah Tenaga Kerja ILO 3-Bulan (Okt)--

P: --

S: --

U.K. Jumlah Klaim Pengangguran (Nov)

U.K. Jumlah Klaim Pengangguran (Nov)--

P: --

S: --

U.K. Tingkat Pengangguran (Nov)

U.K. Tingkat Pengangguran (Nov)--

P: --

S: --

U.K. Suku Bunga Pengangguran ILO 3 Bulan (Okt)

U.K. Suku Bunga Pengangguran ILO 3 Bulan (Okt)--

P: --

S: --

U.K. Upah Rata-Rata Tiap-Minggu, Termasuk Bonus Jangka 3-Bulan, YoY (Okt)

U.K. Upah Rata-Rata Tiap-Minggu, Termasuk Bonus Jangka 3-Bulan, YoY (Okt)--

P: --

S: --

U.K. Upah Rata-Rata Tiap-Minggu, Tidak Termasuk Bonus Jangka 3-Bulan YoY (Okt)

U.K. Upah Rata-Rata Tiap-Minggu, Tidak Termasuk Bonus Jangka 3-Bulan YoY (Okt)--

P: --

S: --

Perancis Nilai Awal PMI Sektor Jasa (Des)

Perancis Nilai Awal PMI Sektor Jasa (Des)--

P: --

S: --

Perancis Nilai Awal PMI Komposit (Penyesuaian Per Kuartal) (Des)

Perancis Nilai Awal PMI Komposit (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

Perancis Nilai Awal PMI Manufaktur (Des)

Perancis Nilai Awal PMI Manufaktur (Des)--

P: --

S: --

Jerman Nilai Awal PMI Sektor Jasa (Penyesuaian Per Kuartal) (Des)

Jerman Nilai Awal PMI Sektor Jasa (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

Jerman Nilai Awal PMI Manufaktur (Penyesuaian Per Kuartal) (Des)

Jerman Nilai Awal PMI Manufaktur (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

Jerman Nilai Awal PMI Komposit (Penyesuaian Per Kuartal) (Des)

Jerman Nilai Awal PMI Komposit (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

Zona Euro Nilai Awal PMI Komposit (Penyesuaian Per Kuartal) (Des)

Zona Euro Nilai Awal PMI Komposit (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

Zona Euro Nilai Awal PMI Sektor Jasa (Penyesuaian Per Kuartal) (Des)

Zona Euro Nilai Awal PMI Sektor Jasa (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

Zona Euro Nilai Awal PMI Manufaktur (Penyesuaian Per Kuartal) (Des)

Zona Euro Nilai Awal PMI Manufaktur (Penyesuaian Per Kuartal) (Des)--

P: --

S: --

U.K. Nilai Awal PMI Sektor Jasa (Des)

U.K. Nilai Awal PMI Sektor Jasa (Des)--

P: --

S: --

U.K. Nilai Awal PMI Manufaktur (Des)

U.K. Nilai Awal PMI Manufaktur (Des)--

P: --

S: --

U.K. Nilai Awal PMI Komposit (Des)

U.K. Nilai Awal PMI Komposit (Des)--

P: --

S: --

Zona Euro Indeks Sentimen Ekonomi ZEW (Des)

Zona Euro Indeks Sentimen Ekonomi ZEW (Des)--

P: --

S: --

Jerman Indeks Status Ekonomi ZEW (Des)

Jerman Indeks Status Ekonomi ZEW (Des)--

P: --

S: --

Jerman Indeks Sentimen Ekonomi ZEW (Des)

Jerman Indeks Sentimen Ekonomi ZEW (Des)--

P: --

S: --

Zona Euro Akun Perdagangan (Sebelum Penyesuaian Per Kuartal) (Okt)

Zona Euro Akun Perdagangan (Sebelum Penyesuaian Per Kuartal) (Okt)--

P: --

S: --

Zona Euro Indeks Status Ekonomi ZEW (Des)

Zona Euro Indeks Status Ekonomi ZEW (Des)--

P: --

S: --

Zona Euro Akun Perdagangan (Penyesuaian Per Kuartal) (Okt)

Zona Euro Akun Perdagangan (Penyesuaian Per Kuartal) (Okt)--

P: --

S: --

Amerika Serikat Penjualan Retail MoM (Tidak Termasuk Mobil) (Penyesuaian Per Kuartal) (Okt)

Amerika Serikat Penjualan Retail MoM (Tidak Termasuk Mobil) (Penyesuaian Per Kuartal) (Okt)--

P: --

S: --

Tidak Ada Data Yang Cocok

Opini Terbaru

Opini Terbaru

Topik Populer

Kolumnis Teratas

Terbaru

Label putih

Data API

Web Plug-ins

Program Afiliasi

Lihat Semua

Tidak ada data

LayerZero’s acquisition of Stargate Finance brings big changes for both tokens. STG holders are allowed to convert their tokens to ZRO, so this can cause strong price activity. The merge may attract new investors and bring more attention to ZRO. This deal also comes with a promise of future revenue sharing for STG stakers, which can add value. Large moves between assets sometimes bring price swings, so traders should watch closely for supply and demand changes as users swap tokens and news spreads. For more details, read the official announcement on Twitter.

LayerZero@LayerZero_CoreAug 24, 2025STG holders will be able to convert their tokens to ZRO on https://t.co/q4o6Gnt63w on Monday.

STG stakers stay tuned for more information on the revenue share program.

MBG will soon list on BingX, a popular exchange, which could give the token much more exposure. Listing on a known platform often boosts price, as more people can buy and sell. MBG is also running a buyback and burn program just after the listing, which means fewer tokens in supply. Growing demand and shrinking supply can push prices even higher. Because BingX has millions of users, high trading volume is possible right after launch. These reasons together can make the listing a big catalyst. Read the announcement at Twitter.

MultiBank.io@multibank_ioAug 24, 2025Only 1 Day to Go! $MBG is officially listing on BingX this August 25 at 8 AM GMT

Over 20 million traders will soon have access to the token backed by $29B in real-world assets.

And it’s just in time! $MBG’s Buyback & Burn program kicks off on August 27.

Supply will… pic.twitter.com/cEl1BoQZgd

Solidus Ai Tech is launching its AI Model Marketplace, letting users access several advanced AI models. Offering real AI products can grow token use and awareness. If many builders and businesses join the marketplace, this could drive real need for the AITECH token, which may boost the price. However, if the marketplace does not get enough users or interest, the real impact may be small. Watching adoption after launch will be important. Still, this step can bring attention to AITECH and set it apart from other AI tokens. See more at Twitter.

AITECH@AITECHioAug 24, 2025Foundational Models on the Solidus Ai Tech Ai Marketplace!

From Web3-native LLMs to advanced reasoning and multilingual instruction models, the Solidus Ai Tech AI Marketplace provides access to a diverse range of foundational AI models.

ASI1-mini: Agentic AI for autonomous… pic.twitter.com/yMzcLCrz8P

Pavel Durov, founder of the messaging application Telegram, provided an update regarding his ongoing case in France, and said the criminal investigation against him is “struggling” to find any evidence of wrongdoing.

Durov said his arrest by French authorities in August 2024 was “unprecedented” and added that holding a tech executive accountable for the actions of independent users was “legally and logically absurd,” in a Telegram post on Sunday. Durov added:

“One year after this strange arrest, I still have to return to France every 14 days, with no appeal date in sight,” he continued, while also warning that the French government has done irreparable damage to France’s image as a free country.

The arrest of Durov sparked widespread condemnation from the crypto community, human rights groups, and free speech activists, who accused the French government of arresting the Telegram founder to pressure him into censoring the platform.

Pavel Durov’s arrest creates massive backlash against the French government

Durov was charged and initially barred from leaving France in connection with a probe into the Telegram platform’s content moderation policies, with French law enforcement officials accusing the platform of hosting harmful content.

French President Emmanuel Macron denied the arrest was politically motivated, triggering a torrent of censorship accusations and criticism from the crypto community.

“In a state governed by the rule of law, freedoms are upheld within a legal framework, both on social media and in real life, to protect citizens and respect their fundamental rights,” Macron wrote in a translated August 26 X post.

Mert Mumtaz, CEO of node provider Helius, responded to Macron by asking: “Why aren't you personally in jail for not controlling 100% of all crime in France?”

Durov has repeatedly said that Telegram complies with all legal law enforcement requests and maintains that the company will exit a jurisdiction before succumbing to censorship pressures.

The Telegram platform will not compromise user privacy by handing over encryption keys or building backdoors into the messaging application, Durov said.

Two months after Elon Musk criticized the Trump administration’s handling of the national debt, reports indicate that the US has added another $1 trillion in federal debt in just 48 days.

Deficit spending has become the largest macro driver with the least mainstream attention. Bitcoin, Ethereum, and decentralized finance (DeFi) are no longer just speculative plays. Rather, they are structural hedges against a broken fiscal system.

Is the US Debt Spiral About Spending or Interest Rates?

The surge translates to around $21 billion per day. It highlights what analysts and investors like Elon Musk have warned before, that the fiat system is locked into an unsustainable path, and digital assets may be the hedge.

In hindsight, Elon Musk particularly called out the recently signed One Big Beautiful Bill Act as crucial in further amplifying an already alarming deficit.

However, since August 11, US debt has ballooned by $200 billion, pushing the national total within striking distance of $38 trillion.

Washington posted a $291 billion deficit in July alone, the second-largest for any July on record. Deficits are running at $1.63 trillion for fiscal year 2025, up 7.4% year-over-year (YoY), and on track to exceed $2 trillion.

Similarly, government spending has exploded to 44% of GDP, a level only seen during World War II and the 2008 financial crisis.

While the Federal Reserve (Fed) still insists on a soft landing, the underlying numbers tell a harsher story. Revenues are barely growing at 2.5% annually, while spending surged nearly 10% last month.

“…It’s a spending issue, NOT an interest rate issue… It’s a spending crisis,” analysts at the Kobeissi Letter articulated.

This remark suggests that annual deficits would remain in the trillions even if the Fed slashed rates.

Implications for Crypto and Financial Markets

Bond markets are already flashing warning signs. Investors demand higher yields for US Treasuries, with recent auctions clearing above 5%, a rarity in modern history.

As debt refinancing accelerates at higher rates, the fiscal hole deepens. This presents a rather technical outlook for equities, commodities, and especially crypto.

In the short term, higher yields can drain liquidity from risk assets. However, in the long term, persistent deficit spending erodes confidence in fiat. This trend has historically benefited Bitcoin and hard-cap digital assets.

While crypto traders often frame Bitcoin as digital gold, the case strengthens when fiat regimes demonstrate fiscal unsustainability.

“On our current fiscal path, there is 100% certainty of US bankruptcy over the long run,” they added.

For many in crypto, America’s debt trajectory validates the thesis that decentralized assets offer protection against sovereign fiscal mismanagement.

With $38 trillion in debt looming and deficits locked in above $1.5 trillion annually, the temptation for future policymakers to inflate away obligations grows. That risk is bullish for Bitcoin’s scarcity narrative.

Altcoins could also benefit indirectly, as institutional allocators explore alternatives to yield-squeezed Treasuries.

Stablecoins and tokenized Treasuries are already absorbing capital, but liquidity spillover may extend over time into broader crypto markets.

What happens next hinges on whether Congress reins in spending (unlikely in an election year) and how aggressively the Fed balances rate policy against debt sustainability. Nevertheless, either path carries risks.

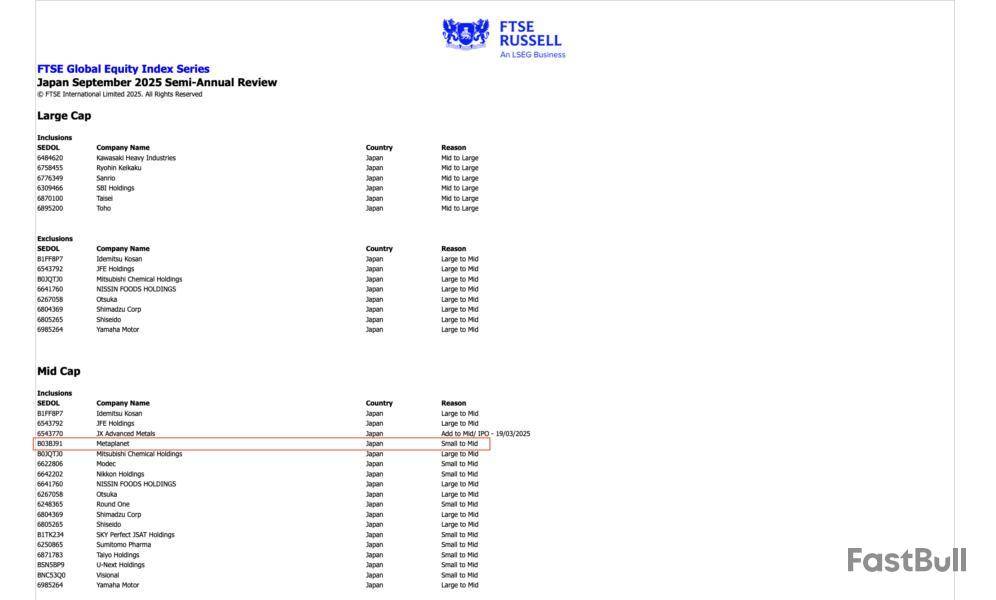

Metaplanet, a Bitcoin treasury company, has been upgraded from a small-cap to a mid-cap stock in index provider FTSE Russell’s September 2025 Semi-Annual Review, bumping it up for inclusion in the flagship FTSE Japan Index.

The index provider updates and rebalances the indices quarterly, and following Metaplanet’s strong Q2 performance, added it to the FTSE Japan Index, a stock market index of mid-cap and large-cap companies listed on Japanese exchanges.

Metaplanet’s inclusion in the FTSE Japan Index means it is automatically added to the FTSE All-World Index of the largest publicly-listed companies by market capitalization in each geographic region.

The inclusion of Metaplanet in major, globally recognized stock market indices means the company will redirect capital flows into Bitcoin from traditional financial markets and give passive stock investors indirect exposure to the world’s largest cryptocurrency.

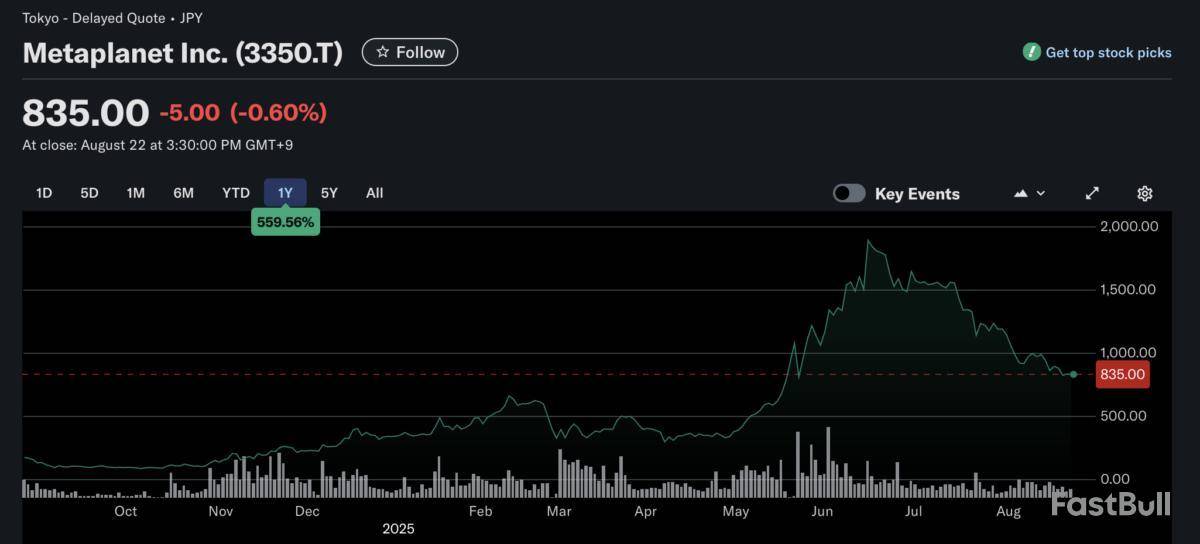

Metaplanet outperforms Japan’s blue chip stocks, as it eyes expansion

Metaplanet outperformed the Tokyo Stock Price Index (TOPIX) Core 30, a stock market benchmark index, featuring Japanese manufacturing and technology giants Toyota, Sony, Nintendo, and others, according to the company’s Q2 financial report.

The Bitcoin treasury company announced year-to-date (YTD) gains of about 187% in August, compared to the TOPIX 30’s 7.2% YTD appreciation.

Metaplanet currently holds 18,888 BTC in its corporate treasury, making it the seventh-largest publicly traded holder of the supply-capped coin, according to BitcoinTreasuries.

Originally a hotel operator, Metaplanet rebranded itself as a Bitcoin treasury company in 2024. The company now holds more BTC than Coinbase, Tesla, the Hut 8 mining firm, and is Japan’s largest BTC treasury company by BTC holdings.

In July, Metaplanet CEO Simon Gerovich signaled that the company would use a portion of its BTC stash to buy additional income-generating businesses, and floated the possibility of acquiring a digital bank or a business adjacent to digital assets and money.

The company’s executives have set a target to accumulate 210,000 BTC by 2027, 1% of the currency’s total 21 million supply.

The entire cryptocurrency market headed straight south on Sunday evening, led by a massive price drop from the largest of the bunch.

Bitcoin’s price had calmed at around $115,000 all day with little to no moves in either direction, but suddenly plunged to its lowest price level since July 10.

Recall that the primary cryptocurrencyskyrocketedon Friday after Fed Chair Jerome Powell’s somewhat optimistic speech about upcoming interest rate cuts. The asset went from under $112,000, which was a local low at the time, to over $117,000 within an hour or so.

However, that relief rally was short-lived, and BTC quicklyretracedto around $115,000, where it spent most of the weekend. Less than an hour ago, though, the bears unexpectedly reemerged by pushing BTC to a six-week low of $110,600 (on most exchanges).

Bitcoin recovered two grand since then, but still trades below $113,000. It took most altcoins south with it, including ETH, which was flying high.

In fact, the second-largest cryptocurrency just painted a new all-time high of almost $5,000. As the community was anticipating a breakthrough above that milestone, though, ETH plummeted to nearly $4,700 before recovering to around $4,800 as of press time.

Most altcoins charted similar volatile price moves over the past hour, which has harmed over-leveraged traders. Data from CoinGlass shows that the hourly liquidations have shot up to well over $300 million, with longs responsible for roughly 90% of the entire amount.

The wrecked positions on a daily scale are almost double that size, with over 130,000 traders liquidated. The single-largest wrecked position took place on OKX and was worth north of $12 million.

Label putih

Data API

Web Plug-ins

Pembuat Poster

Program Afiliasi

Berdagang Instrumen Keuangan Seperti Saham, Mata Uang, Komoditas, Kontrak Berjangka, Obligasi, Dana, Atau Mata Uang Kripto Adalah Perilaku Berisiko Tinggi, Termasuk Kehilangan Sebagian Atau Seluruh Jumlah Investasi Anda, Sehingga Perdagangan Tidak Cocok Untuk Semua Investor.

Anda Harus Melakukan Uji Tuntas Anda Sendiri, Menggunakan Penilaian Anda Sendiri, Dan Berkonsultasi Dengan Penasihat Yang Memenuhi Syarat Saat Membuat Keputusan Keuangan Apa Pun. Konten Situs Web Ini Tidak Ditujukan Kepada Anda, Situasi Keuangan Atau Kebutuhan Anda Juga Tidak Diperhitungkan. Informasi Yang Terdapat Di Situs Web Ini Belum Tentu Tersedia Secara Waktu Nyata, Juga Belum Tentu Akurat. Setiap Pesanan Atau Keputusan Keuangan Lainnya Yang Anda Buat Sepenuhnya Menjadi Tanggung Jawab Anda Dan Anda Tidak Boleh Bergantung Pada Informasi Apa Pun Yang Disediakan Melalui Situs Web. Kami Tidak Memberikan Jaminan Apa Pun Untuk Informasi Apa Pun Di Situs Web Dan Tidak Bertanggung Jawab Atas Kerugian Transaksi Apa Pun Yang Mungkin Timbul Dari Penggunaan Informasi Apa Pun Di Situs Web.

Dilarang Menggunakan, Menyimpan, Menggandakan, Menampilkan, Memodifikasi, Menyebarluaskan Atau Mendistribusikan Data Yang Terdapat Dalam Situs Web Ini Tanpa Izin Tertulis Dari Situs Web Ini. Semua Hak Kekayaan Intelektual Dilindungi Oleh Pemasok Dan Bursa Yang Menyediakan Data Yang Terdapat Di Situs Web Ini.

Tidak Masuk

Masuk untuk mengakses lebih banyak fitur

Anggota FastBull

Belum

Pembelian

Masuk

Daftar