Kutipan

Berita

Analisis

Pengguna

24/7

Kalender Ekonomi

Pendidikan

Data

- Nama

- Nilai Terbaru

- Sblm.

Akun Sinyal untuk Anggota

Semua Akun Sinyal

Semua Kontes

U.K. Neraca Perdagangan Non-Uni Eropa (Penyesuaian Per Kuartal) (Okt)

U.K. Neraca Perdagangan Non-Uni Eropa (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Akun Perdagangan (Okt)

U.K. Akun Perdagangan (Okt)S:--

P: --

S: --

U.K. Indeks Sektor Jasa MoM

U.K. Indeks Sektor Jasa MoMS:--

P: --

S: --

U.K. Output Sektor Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)

U.K. Output Sektor Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Output Industri YoY (Okt)

U.K. Output Industri YoY (Okt)S:--

P: --

S: --

U.K. Akun Perdagangan (Penyesuaian Per Kuartal) (Okt)

U.K. Akun Perdagangan (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Neraca Perdagangan Uni Eropa (Penyesuaian Per Kuartal) (Okt)

U.K. Neraca Perdagangan Uni Eropa (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Output Manufaktur YoY (Okt)

U.K. Output Manufaktur YoY (Okt)S:--

P: --

S: --

U.K. PDB MoM (Okt)

U.K. PDB MoM (Okt)S:--

P: --

S: --

U.K. PDB YoY (Penyesuaian Per Kuartal) (Okt)

U.K. PDB YoY (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

U.K. Output Industri MoM (Okt)

U.K. Output Industri MoM (Okt)S:--

P: --

S: --

U.K. Output Sektor Konstruksi YoY (Okt)

U.K. Output Sektor Konstruksi YoY (Okt)S:--

P: --

S: --

Perancis Indeks Harga Konsumen Final MoM (Nov)

Perancis Indeks Harga Konsumen Final MoM (Nov)S:--

P: --

S: --

China, Daratan Pertumbuhan Kredit Tidak Dibayarkan YoY (Nov)

China, Daratan Pertumbuhan Kredit Tidak Dibayarkan YoY (Nov)S:--

P: --

S: --

China, Daratan Uang Beredar M2 YoY (Nov)

China, Daratan Uang Beredar M2 YoY (Nov)S:--

P: --

S: --

China, Daratan Uang Beredar M0 YoY (Nov)

China, Daratan Uang Beredar M0 YoY (Nov)S:--

P: --

S: --

China, Daratan Uang Beredar M1 YoY (Nov)

China, Daratan Uang Beredar M1 YoY (Nov)S:--

P: --

S: --

India IHK YoY (Nov)

India IHK YoY (Nov)S:--

P: --

S: --

India Pertumbuhan Deposito YoY

India Pertumbuhan Deposito YoYS:--

P: --

S: --

Brazil Pertumbuhan Sektor Jasa YoY (Okt)

Brazil Pertumbuhan Sektor Jasa YoY (Okt)S:--

P: --

S: --

Meksiko Nilai Produksi Industri YoY (Okt)

Meksiko Nilai Produksi Industri YoY (Okt)S:--

P: --

S: --

Rusia Akun Perdagangan (Okt)

Rusia Akun Perdagangan (Okt)S:--

P: --

S: --

Presiden Fed Philadelphia Henry Paulson menyampaikan pidato

Presiden Fed Philadelphia Henry Paulson menyampaikan pidato Kanada Izin Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)

Kanada Izin Konstruksi MoM (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

Kanada Penjualan Grosir YoY (Okt)

Kanada Penjualan Grosir YoY (Okt)S:--

P: --

S: --

Kanada Stok Grosir MoM (Okt)

Kanada Stok Grosir MoM (Okt)S:--

P: --

S: --

Kanada Stok Grosir YoY (Okt)

Kanada Stok Grosir YoY (Okt)S:--

P: --

S: --

Kanada Penjualan Grosir MoM (Penyesuaian Per Kuartal) (Okt)

Kanada Penjualan Grosir MoM (Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

Jerman Rekening Koran (Sebelum Penyesuaian Per Kuartal) (Okt)

Jerman Rekening Koran (Sebelum Penyesuaian Per Kuartal) (Okt)S:--

P: --

S: --

Amerika Serikat Total Pengeboran Mingguan

Amerika Serikat Total Pengeboran MingguanS:--

P: --

S: --

Amerika Serikat Total Nilai Pengeboran Bahan Bakar Fosil Mingguan

Amerika Serikat Total Nilai Pengeboran Bahan Bakar Fosil MingguanS:--

P: --

S: --

Jepang Indeks Difusi Non-Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Difusi Non-Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Prospek Manufaktur Kecil Tankan (kuartal 4)

Jepang Indeks Prospek Manufaktur Kecil Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Prospek Non-Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Prospek Non-Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Prospek Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Prospek Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Difusi Manufaktur Kecil Tankan (kuartal 4)

Jepang Indeks Difusi Manufaktur Kecil Tankan (kuartal 4)--

P: --

S: --

Jepang Indeks Difusi Manufaktur Besar Tankan (kuartal 4)

Jepang Indeks Difusi Manufaktur Besar Tankan (kuartal 4)--

P: --

S: --

Jepang Nilai Belanja Modal Perusahaan-Besar Tankan YoY (kuartal 4)

Jepang Nilai Belanja Modal Perusahaan-Besar Tankan YoY (kuartal 4)--

P: --

S: --

U.K. Indeks Harga Properti Residential - Rightmove YoY (Des)

U.K. Indeks Harga Properti Residential - Rightmove YoY (Des)--

P: --

S: --

China, Daratan Output Industri YoY (Awal Sampai Akhir Tahun) (Nov)

China, Daratan Output Industri YoY (Awal Sampai Akhir Tahun) (Nov)--

P: --

S: --

China, Daratan Tingkat Pengangguran Perkotaan (Nov)

China, Daratan Tingkat Pengangguran Perkotaan (Nov)--

P: --

S: --

Arab Saudi IHK YoY (Nov)

Arab Saudi IHK YoY (Nov)--

P: --

S: --

Zona Euro Output Industri YoY (Okt)

Zona Euro Output Industri YoY (Okt)--

P: --

S: --

Zona Euro Output Industri MoM (Okt)

Zona Euro Output Industri MoM (Okt)--

P: --

S: --

Kanada Tingkat Penjualan Rumah Siap Huni MoM (Nov)

Kanada Tingkat Penjualan Rumah Siap Huni MoM (Nov)--

P: --

S: --

Zona Euro Total Aset Cadangan (Nov)

Zona Euro Total Aset Cadangan (Nov)--

P: --

S: --

U.K. Ekspektasi Inflasi

U.K. Ekspektasi Inflasi--

P: --

S: --

Kanada Indeks Keyakinan Ekonomi Nasional

Kanada Indeks Keyakinan Ekonomi Nasional--

P: --

S: --

Kanada Konstruksi Rumah Baru (Nov)

Kanada Konstruksi Rumah Baru (Nov)--

P: --

S: --

Amerika Serikat Indeks Tenaga Kerja Manufaktur Fed New York (Des)

Amerika Serikat Indeks Tenaga Kerja Manufaktur Fed New York (Des)--

P: --

S: --

Amerika Serikat Indeks Manufaktur Fed New York (Des)

Amerika Serikat Indeks Manufaktur Fed New York (Des)--

P: --

S: --

Kanada IHK Inti YoY (Nov)

Kanada IHK Inti YoY (Nov)--

P: --

S: --

Kanada Pesanan Belum Selesai Manufaktur MoM (Okt)

Kanada Pesanan Belum Selesai Manufaktur MoM (Okt)--

P: --

S: --

Kanada Pesanan Baru Manufaktur MoM (Okt)

Kanada Pesanan Baru Manufaktur MoM (Okt)--

P: --

S: --

Kanada IHK Inti MoM (Nov)

Kanada IHK Inti MoM (Nov)--

P: --

S: --

Kanada Stok Manufaktur MoM (Okt)

Kanada Stok Manufaktur MoM (Okt)--

P: --

S: --

Kanada IHK YoY (Nov)

Kanada IHK YoY (Nov)--

P: --

S: --

Kanada IHK MoM (Nov)

Kanada IHK MoM (Nov)--

P: --

S: --

Kanada IHK YoY (Penyesuaian Per Kuartal) (Nov)

Kanada IHK YoY (Penyesuaian Per Kuartal) (Nov)--

P: --

S: --

Kanada IHK Inti MoM (Penyesuaian Per Kuartal) (Nov)

Kanada IHK Inti MoM (Penyesuaian Per Kuartal) (Nov)--

P: --

S: --

Tidak Ada Data Yang Cocok

Opini Terbaru

Opini Terbaru

Topik Populer

Kolumnis Teratas

Terbaru

Label putih

Data API

Web Plug-ins

Program Afiliasi

Lihat Semua

Tidak ada data

The AIP 21 Vote for Aergo introduces the new House Party Protocol, aiming to unify its ecosystem. If this vote is successful, it could bring significant changes to AERGO's functionality, potentially increasing user interest and adoption. Such developments often lead to positive price movement as they renew market attention and confidence in the asset. Investors should watch how this vote turns out, as it could serve as a catalyst for a price increase. However, if the vote does not pass, or investors do not see real benefits, there could be little to no price change. source

- Fourth quarter and full-year 2024 total revenue of $2.0 million and $11.0 million, respectively.- Fourth quarter and full-year 2024 CORE EBITDA of $3.3 million and $3.9 million, respectively.- Held 165.8 Bitcoin on February 28, 2025 valued at approximately $14.4 million, as of March 26, 2025

TAMPA, Fla., March 31, 2025 (GLOBE NEWSWIRE) — LM Funding America, Inc. (“LM Funding” or the “Company”), a Bitcoin mining and technology-based specialty finance company, today reported financial results for the three months and full year ended December 31, 2024.

Q4’24 Financial Highlights

All variances are compared with prior year unless stated otherwise:

________________________

1 Core EBITDA is a non-GAAP financial measure, and a reconciliation of Core EBITDA to net income can be found below.

2,3 Based on shares outstanding of 5,133,412 as of December 31, 2024.

Q4’24 Operational Highlights

CEO Commentary

Bruce Rodgers, Chairman and CEO of LM Funding, commented, “Using the halving as our pivot point of opportunity, we transitioned from an infrastructure-light hosted mining strategy to a vertically integrated model—one where we manage the infrastructure ourselves, ensuring better margins and mitigating risks associated with third-party hosting arrangements. With our Oklahoma facility, we secured low-cost power for our miners and now we own and totally control our mining infrastructure and costs. This vertical integration significantly reduces our fleet-wide energy costs and improves our operations for enhanced uptime and mining efficiency. Looking forward, our strong balance sheet and lean operations position us to grow our mining revenue by seeking to acquire new mining sites with similar size, prices, and terms.”

CFO Commentary

Richard Russell, CFO of LM Funding, stated, "Throughout our expansion last year, we remained disciplined in our spending. By actively maintaining a low-cost structure - from power sourcing and infrastructure investments to staffing and equipment - we were able to successfully navigate a challenging year for the industry and our first Bitcoin Halving event, which occurred in April 2024. This strategic cost control enabled us to achieve profitability in 2024 on a Core EBITDA basis, as well as grow our Bitcoin treasury, which is a significant piece of our long-term strategy. By retaining a portion of our Bitcoin mined, we not only capture potential upside for shareholders but also deepen our alignment with the broader Bitcoin industry."

Full Year 2024 Financial Highlights

All variances are compared with prior year unless stated otherwise:

Investor Conference Call

LM Funding will host a conference call today, March 31, 2025, at 8:00 A.M. Eastern Time to discuss the Company’s financial results for the quarter and full year ended December 31, 2024, as well as the Company’s corporate progress and other developments. A copy of this earnings release and investor presentation are available on the Company’s Investor Relations website at https://www.lmfunding.com/investors.

Conference Call Details

About LM Funding America

LM Funding America, Inc. , operates as a Bitcoin mining and specialty finance company. The company was founded in 2008 and is based in Tampa, Florida. For more information, please visit https://www.lmfunding.com.

Forward-Looking Statements

This press release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the Company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, the risks of operating in the cryptocurrency mining business, our limited operating history in the cryptocurrency mining business and our ability to grow that business, the capacity of our Bitcoin mining machines and our related ability to purchase power at reasonable prices, our ability to identify and acquire additional mining sites, the ability to finance our site acquisitions and cryptocurrency mining operations, our ability to acquire new accounts in our specialty finance business at appropriate prices, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations.

For investor and media inquiries, please contact:

Investor Relations

Orange Group

Yujia Zhai

lmfundingIR@orangegroupadvisors.com

| LM Funding America, Inc. and Subsidiaries Consolidated Balance Sheets (unaudited) | ||||||||

| December 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Assets | ||||||||

| Cash | $ | 3,378,152 | $ | 2,401,831 | ||||

| Digital assets - current (Note 4) | 9,021,927 | 3,416,256 | ||||||

| Finance receivables | 21,051 | 19,221 | ||||||

| Marketable securities (Note 7) | 27,050 | 17,860 | ||||||

| Receivable from sale of Symbiont assets (Note 7) | 200,000 | 200,000 | ||||||

| Prepaid expenses and other assets | 827,237 | 4,067,212 | ||||||

| Income tax receivable | 31,187 | 31,187 | ||||||

| Current assets | 13,506,604 | 10,153,567 | ||||||

| Fixed assets, net (Note 5) | 18,376,948 | 24,519,610 | ||||||

| Intangible assets, net (Note 5) | 5,478,958 | - | ||||||

| Deposits on mining equipment (Note 6) | 467,172 | 20,837 | ||||||

| Notes receivable from Seastar Medical Holding Corporation (Note 7) | - | 1,440,498 | ||||||

| Long-term investments - equity securities (Note 7) | 4,255 | 156,992 | ||||||

| Investment in Seastar Medical Holding Corporation (Note 7) | 200,790 | 1,145,486 | ||||||

| Digital assets - long-term (Note 4) | 5,000,000 | - | ||||||

| Operating lease - right of use assets (Note 9) | 938,641 | 189,009 | ||||||

| Other assets | 73,857 | 86,798 | ||||||

| Long-term assets | 30,540,621 | 27,559,230 | ||||||

| Total assets | $ | 44,047,225 | $ | 37,712,797 | ||||

| Liabilities and stockholders' equity | ||||||||

| Accounts payable and accrued expenses | 989,563 | 2,064,909 | ||||||

| Note payable - short-term (Note 8) | 386,312 | 567,586 | ||||||

| Due to related parties (Note 11) | 15,944 | 22,845 | ||||||

| Current portion of lease liability (Note 9) | 170,967 | 110,384 | ||||||

| Total current liabilities | 1,562,786 | 2,765,724 | ||||||

| Note payable - long-term (Note 8) | 6,365,345 | - | ||||||

| Lease liability - net of current portion (Note 9) | 776,535 | 85,775 | ||||||

| Long-term liabilities | 7,141,880 | 85,775 | ||||||

| Total liabilities | 8,704,666 | 2,851,499 | ||||||

| Stockholders' equity (Note 12) | ||||||||

| Preferred stock, par value $.001; 150,000,000 shares authorized; no shares issued and outstanding as of December 31, 2024 and December 31, 2023 | - | - | ||||||

| Common stock, par value $.001; 350,000,000 shares authorized; 5,133,412 shares issued and outstanding as of December 31, 2024 and 2,492,964 as of December 31, 2023 | 4,602 | 2,493 | ||||||

| Additional paid-in capital | 102,685,470 | 95,145,376 | ||||||

| Accumulated deficit | (65,662,731 | ) | (58,961,461 | ) | ||||

| Total LM Funding America stockholders' equity | 37,027,341 | 36,186,408 | ||||||

| Non-controlling interest | (1,684,782 | ) | (1,325,110 | ) | ||||

| Total stockholders' equity | 35,342,559 | 34,861,298 | ||||||

| Total liabilities and stockholders’ equity | $ | 44,047,225 | $ | 37,712,797 | ||||

| LM Funding America, Inc. and Subsidiaries Consolidated Statements of Operations (unaudited) | ||||||||||||||||

| Three Months Ended December 31, | Years Ended December 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues: | ||||||||||||||||

| Digital mining revenues | $ | 1,814,169 | $ | 3,946,485 | $ | 10,432,605 | $ | 12,289,131 | ||||||||

| Specialty finance revenue | 140,377 | 75,901 | 443,599 | 550,445 | ||||||||||||

| Rental revenue | 30,678 | 33,028 | 123,444 | 144,514 | ||||||||||||

| Total revenues | 1,985,224 | 4,055,414 | 10,999,648 | 12,984,090 | ||||||||||||

| Operating costs and expenses: | ||||||||||||||||

| Digital mining cost of revenues (exclusive of depreciation and amortization shown below) | 1,248,083 | 2,668,770 | 6,990,856 | 9,406,940 | ||||||||||||

| Staff costs and payroll | 907,883 | 1,121,796 | 4,556,781 | 5,858,736 | ||||||||||||

| Depreciation and amortization | 658,757 | 1,495,614 | 7,774,161 | 4,983,480 | ||||||||||||

| Gain on fair value of Bitcoin, net | (4,254,031 | ) | (383,497 | ) | (7,350,805 | ) | - | |||||||||

| Impairment loss on mining equipment | 191,317 | 261,191 | 1,379,375 | - | ||||||||||||

| Impairment loss on mined digital assets | - | 280,278 | - | 965,967 | ||||||||||||

| Realized gain on sale of mined digital assets | - | (999,717 | ) | - | (2,070,508 | ) | ||||||||||

| Professional fees | 434,251 | 634,535 | 2,057,165 | 1,863,038 | ||||||||||||

| Selling, general and administrative | 234,366 | 168,632 | 817,041 | 851,806 | ||||||||||||

| Real estate management and disposal | 70,483 | 19,105 | 159,913 | 146,716 | ||||||||||||

| Collection costs | 4,647 | 12,342 | 41,043 | 29,875 | ||||||||||||

| Settlement costs with associations | - | - | - | 10,000 | ||||||||||||

| Loss on disposal of assets | 81,594 | 9,389 | 136,100 | 9,389 | ||||||||||||

| Other operating costs | 232,168 | 542,105 | 899,569 | 999,959 | ||||||||||||

| Total operating costs and expenses | (190,482 | ) | 5,830,543 | 17,461,199 | 23,055,398 | |||||||||||

| Operating income (loss) | 2,175,706 | (1,775,129 | ) | (6,461,551 | ) | (10,071,308 | ) | |||||||||

| Unrealized gain on marketable securities | 8,206 | 7,134 | 9,190 | 13,570 | ||||||||||||

| Impairment loss on prepaid machine deposits | - | - | (12,941 | ) | (36,691 | ) | ||||||||||

| Impairment loss on prepaid hosting deposits | - | (184,236 | ) | - | (184,236 | ) | ||||||||||

| Unrealized loss on investment and equity securities | (244,809 | ) | 546,563 | (1,097,433 | ) | (9,771,050 | ) | |||||||||

| Impairment loss on Symbiont assets | - | - | - | (750,678 | ) | |||||||||||

| Gain on fair value of purchased Bitcoin, net | (18,729 | ) | - | 39,197 | - | |||||||||||

| Credit loss on Seastar note receivable | - | 22,344 | - | - | ||||||||||||

| Realized gain on securities | - | 2,632 | - | 4,420 | ||||||||||||

| Realized gain on sale of purchased digital assets | - | - | - | 1,917 | ||||||||||||

| Gain on adjustment of note receivable allowance | - | - | - | 1,052,542 | ||||||||||||

| Other income - coupon sales | - | - | 4,490 | 639,472 | ||||||||||||

| Other income - financing revenue | - | - | - | 37,660 | ||||||||||||

| Interest expense | (211,946 | ) | - | (443,700 | ) | - | ||||||||||

| Interest income | 182,620 | 38,705 | 307,316 | 249,586 | ||||||||||||

| Income (loss) before income taxes | 1,891,048 | (1,341,987 | ) | (7,655,432 | ) | (18,814,796 | ) | |||||||||

| Income tax expense | - | (60,571 | ) | - | (60,571 | ) | ||||||||||

| Net income (loss) | $ | 1,891,048 | $ | (1,402,558 | ) | $ | (7,655,432 | ) | $ | (18,875,367 | ) | |||||

| Less: loss attributable to non-controlling interest | 74,760 | (189,208 | ) | 340,056 | 2,931,113 | |||||||||||

| Net income (loss) attributable to LM Funding America Inc. | $ | 1,965,808 | $ | (1,591,766 | ) | $ | (7,315,376 | ) | $ | (15,944,254 | ) | |||||

| Less: deemed dividends (Note 12) | (5,090,619 | ) | - | (6,794,924 | ) | - | ||||||||||

| Net loss attributable to common shareholders | $ | (3,124,811 | ) | $ | (1,591,766 | ) | $ | (14,110,300 | ) | $ | (15,944,254 | ) | ||||

| Basic loss per common share (Note 1) | $ | (0.86 | ) | $ | (0.67 | ) | $ | (5.02 | ) | $ | (6.98 | ) | ||||

| Diluted loss per common share (Note 1) | $ | (0.86 | ) | $ | (0.67 | ) | $ | (5.02 | ) | $ | (6.98 | ) | ||||

| Weighted average number of common shares outstanding | ||||||||||||||||

| Basic | 3,650,624 | 2,362,964 | 2,808,064 | 2,283,836 | ||||||||||||

| Diluted | 3,650,624 | 2,362,964 | 2,808,064 | 2,283,836 | ||||||||||||

| LM Funding America, Inc. and Subsidiaries Consolidated Statements of Cash Flows (unaudited) | ||||||||

| Years Ended December 31, | ||||||||

| 2024 | 2023 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (7,655,432 | ) | $ | (18,875,367 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Depreciation and amortization | 7,774,161 | 4,983,480 | ||||||

| Noncash lease expense | 109,842 | 98,536 | ||||||

| Amortization of debt issue costs | 35,435 | - | ||||||

| Stock compensation | 76,322 | 1,095,705 | ||||||

| Stock option expense | 443,220 | 1,843,731 | ||||||

| Professional fees paid in common shares | 100,001 | - | ||||||

| Accrued investment income | (197,104 | ) | (159,692 | ) | ||||

| Digital assets other income | (4,490 | ) | - | |||||

| Gain on fair value of Bitcoin, net | (7,390,002 | ) | - | |||||

| Impairment loss on mining machines | 1,379,375 | - | ||||||

| Impairment loss on digital assets | - | 965,967 | ||||||

| Impairment loss on mining machine deposits | 12,941 | 36,691 | ||||||

| Impairment loss on hosting deposits | - | 184,236 | ||||||

| Impairment loss on Symbiont assets | - | 750,678 | ||||||

| Unrealized gain on marketable securities | (9,190 | ) | (13,570 | ) | ||||

| Realized gain on securities | - | (4,420 | ) | |||||

| Unrealized loss on investment and equity securities | 1,097,433 | 9,771,050 | ||||||

| Loss on disposal of fixed assets | 136,100 | 9,389 | ||||||

| Allowance for loss on debt security | - | - | ||||||

| Proceeds from securities | - | 744,036 | ||||||

| Realized gain on sale of digital assets | - | (2,072,425 | ) | |||||

| Reversal of allowance loss on debt security | - | (1,052,542 | ) | |||||

| Investments in marketable securities | - | (739,616 | ) | |||||

| Change in operating assets and liabilities: | ||||||||

| Prepaid expenses and other assets | 3,781,133 | 189,407 | ||||||

| Hosting deposits | (12,941 | ) | (36,691 | ) | ||||

| Repayments to related party | (6,901 | ) | (52,643 | ) | ||||

| Accounts payable and accrued expenses | (1,075,346 | ) | 177,478 | |||||

| Mining of digital assets | (10,432,605 | ) | (12,289,131 | ) | ||||

| Proceeds from sale of digital assets | — | 10,874,701 | ||||||

| Lease liability payments | (108,131 | ) | (95,948 | ) | ||||

| Income tax receivable | — | 262,279 | ||||||

| Net cash used in operating activities | (11,946,179 | ) | (3,404,681 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Net collections of finance receivables - original product | 1,059 | (6,428 | ) | |||||

| Net collections of finance receivables - special product | (2,889 | ) | 14,009 | |||||

| Capital expenditures | (1,732,472 | ) | (1,625,284 | ) | ||||

| Proceeds from sale of fixed assets | 78,806 | - | ||||||

| Acquisition of Tech Infrastructure JV I LLC assets | (3,642,870 | ) | - | |||||

| Investment in note receivable | (3,587,195 | ) | (125,000 | ) | ||||

| Collection of note receivable | - | 2,651,943 | ||||||

| Collection of note receivable - related party | 1,449,066 | - | ||||||

| Investment in digital assets | (485,500 | ) | (35,157 | ) | ||||

| Proceeds from sale of digital assets | 8,309,104 | 27,815 | ||||||

| Proceeds from the sale of tether | 11,928 | - | ||||||

| Symbiont asset acquisition | - | 1,800,000 | ||||||

| Financing activities for Symbiont asset acquisition | - | (402,361 | ) | |||||

| Distribution to members | (19,616 | ) | - | |||||

| Net cash provided by investing activities | 379,421 | 2,299,537 | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from borrowings | 6,329,910 | - | ||||||

| Insurance financing repayments | (709,491 | ) | (624,481 | ) | ||||

| Exercise of warrants | 4,748,971 | |||||||

| Exercise of options | 25,000 | - | ||||||

| Proceeds from equity offering | 2,148,689 | - | ||||||

| Issue costs for the issuance of common stock | — | (106,550 | ) | |||||

| Net cash provided by (used in) financing activities | 12,543,079 | (731,031 | ) | |||||

| NET INCREASE (DECREASE) IN CASH | $ | 976,321 | $ | (1,836,175 | ) | |||

| CASH - BEGINNING OF PERIOD | 2,401,831 | 4,238,006 | ||||||

| CASH - END OF PERIOD | $ | 3,378,152 | $ | 2,401,831 | ||||

NON-GAAP CORE EBITDA RECONCILIATION

Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Tax, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized loss on investment and equity securities, impairment loss on mined digital assets, impairment of long-lived assets, impairment of prepaid hosting deposits, contract termination costs and stock compensation expense and option expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of Bitcoin miners.

The following tables reconcile net loss, which we believe is the most comparable GAAP measure, to EBITDA and Core EBITDA:

| Three Months Ended December 31, | Years Ended December 31, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net loss | $ | 1,891,048 | $ | (1,402,558 | ) | $ | (7,655,432 | ) | $ | (18,875,367 | ) | ||||

| Income tax expense | - | 60,571 | - | 60,571 | |||||||||||

| Interest expense | 211,946 | - | 443,700 | - | |||||||||||

| Depreciation and amortization | 658,757 | 1,495,614 | 7,774,161 | 4,983,480 | |||||||||||

| Income (loss) before interest, taxes & depreciation | $ | 2,761,751 | $ | 153,627 | $ | 562,429 | $ | (13,831,316 | ) | ||||||

| Unrealized loss on investment and equity securities | 244,809 | (546,563 | ) | 1,097,433 | 9,771,050 | ||||||||||

| Gain on adjustment of note receivable allowance | - | - | - | (1,052,542 | ) | ||||||||||

| Impairment loss on mined digital assets | - | 143,317 | - | 965,967 | |||||||||||

| Impairment loss on prepaid machine deposits | 12,941 | - | 12,941 | 36,691 | |||||||||||

| Impairment loss on prepaid hosting deposits | - | 184,236 | - | 184,236 | |||||||||||

| Costs associated with At-the-Market Equity program | - | - | 119,050 | - | |||||||||||

| Contract termination costs | - | - | 250,001 | - | |||||||||||

| Impairment loss on Symbiont assets | - | - | - | 750,678 | |||||||||||

| Impairment loss on mining equipment | 191,317 | - | 1,379,375 | - | |||||||||||

| Stock compensation and option expense | 110,805 | 410,584 | 519,542 | 2,939,436 | |||||||||||

| Core income (loss) before interest, taxes & depreciation | $ | 3,321,623 | $ | 345,201 | $ | 3,940,771 | $ | (235,800 | ) | ||||||

Dubai, UAE, March 31, 2025 (GLOBE NEWSWIRE) — Between traditional banks, digital wallets, crypto exchanges, and specialized financial tools, companies often find themselves bouncing between multiple accounts, apps, and cards just to handle everyday transactions.

This fragmented banking system isn’t just inconvenient – it is costly, inefficient, and poses a higher security risk. As each platform comes with its own set of fees, login credentials, and compliance requirements, individuals and businesses end up paying more in transaction costs and losing valuable time managing it all.

The result? A disjointed, inefficient, and frustrating experience that hinders growth and reduces profitability. At a time when speed, simplicity, and security are non-negotiable, the old way of banking is no longer sustainable.

Individuals and businesses deserve a better, more streamlined solution.

Now imagine a single, unified platform that merges traditional banking with modern financial tools, an Omnibank built to give companies everything they need in one place. Biptap is leading the charge to make that vision a reality.

Biptap’s Vision? A Unified Financial Ecosystem

Businesses today operate in a hybrid reality, where fiat and crypto, local and global, digital and physical transactions all intersect. However, managing these financial layers still requires navigating a maze of disconnected banks, apps, and platforms.

This is why Biptap envisions a different future. A future where businesses no longer need to compromise between traditional banks and modern fintech. The goal now is building the first Omnibank – an all-in-one financial platform that eliminates the need for businesses to juggle multiple banking apps, services, and systems; a platform that consolidates the best of both worlds into a single, unified financial ecosystem.

A system where businesses manage everything – business operations, international payments, payroll whether in fiat or crypto, and even give out loyalty rewards through one powerful, secure platform.

What sets Biptap apart isn’t just the breadth of its offerings — it’s the depth of integration. With Biptap as an Omnibank platform, businesses can access:

More than just convenience, it’s empowerment. Biptap as an Omnibank platform is designed to evolve alongside businesses. It was built to ensure businesses stay competitive no matter how fast the financial industry shifts.

So, why do businesses need an Omnibank?

As the demand for seamless financial solutions continues to grow, Biptap is emerging as the go-to platform for individuals seeking an all-in-one solution for their daily finances. But what about businesses?

Say you are running a business with a different supplier for every essential tool. One vendor for raw materials, another for packaging, someone else for logistics, and a separate team for customer service.

Sure, it works. But it’s a nightmare to manage. You waste time coordinating between providers, costs stack up, and when something goes wrong, no one takes full accountability.

That’s exactly what businesses face today with their finances. One bank for accounts, another app for payments, a separate crypto wallet, a platform for international transactions, and maybe even a custom tool to handle rewards or commissions. It’s fragmented, inefficient, and — frankly — outdated.

Now enter Biptap as an Omnibank. An all-in-one financial operating system designed to unify the entire process. One platform that handles traditional banking essentials, modern financial services, and business tools.

Overall, Biptap as an Omnibank is Built to Empower Businesses

You see, the financial world isn’t standing still, and neither should businesses. Biptap as an Omnibank evolves alongside the market. It’s here to ensure that companies aren’t stuck with outdated systems or are forced to rebuild their financial infrastructure every few years.

The vision is not only about simplifying finances, but it is so much more than that. This is about empowering businesses with future-proof solutions. From integrated payment systems to custom-branded services, companies can scale faster, adapt to emerging trends, and stay competitive — all without overhauling their infrastructure.

What makes Biptap’s approach different is the ability to integrate the emerging technologies of blockchain and advanced data encryption with the stability and familiarity of traditional banking. This means businesses get the best of both worlds: reliability where it counts and innovation where it matters.

So the real power of Biptap as an Omnibank is not just about what businesses can do today, but what they’ll be ready for tomorrow.

Because why juggle five different platforms when one can do it all — faster, safer, and more efficiently?

About Biptap

Biptap is a banking infrastructure that combines the reliability of traditional finance with the innovation of blockchain technology. Designed for both Web2 enterprises and Web3 innovators, we provide crypto and fiat transaction management with top-tier security, scalability, and accessibility.

Our solutions include virtual and physical cards, offramp services, offshore banking, payment processing, and Whitelabel business solutions. Trusted by over 200K users since 2021, Biptap processes $120M+ in monthly transactions, ensuring global banking anytime, anywhere.

Website: http://biptap.com/

Twitter: https://x.com/biptapofficial

Instagram: https://www.instagram.com/biptap.official

YouTube: https://www.youtube.com/@biptapofficial

Discord: https://discord.com/invite/biptap

LinkedIn: https://www.linkedin.com/company/biptap/

Media Contact Information

Penny Chou

Head of Marketing at Biptap

penny(at)biptap.com

TORONTO, March 31, 2025 (GLOBE NEWSWIRE) — Matador Technologies Inc. (“Matador” or the “Company”) (TSXV: MATA, OTCQB: MTDTF) announces the addition of two members to its team as the Company advances toward the launch of its digital gold product on the Bitcoin network in early 2025. Antoine De Vuyst has joined Matador as Chief Technology Officer (CTO), and the pseudonymous artist and developer known as dxxmsdxy (pronounced “doomsday”) has joined as Lead Designer.

Antoine De Vuyst – Chief Technology Officer

Antoine De Vuyst is a Bitcoin entrepreneur, developer, and community organizer with long-standing involvement in the crypto ecosystem. He is the founder of Bitcoin Bay, a Toronto-based crypto community launched in 2014, and has been active in the Ordinals space. Antoine is a holder and inscriber of Ordinals across Bitcoin and Litecoin, and he created the Bitbars collection on Bitcoin and Litebars on Litecoin. At Matador, Antoine will oversee product and development efforts, including work on the Company’s digital gold platform.

dxxmsdxy – Lead Designer

dxxmsdxy is a pseudonymous artist and developer known for work in onchain art on Bitcoin since 2014. They are the creator of an early 1/1 token and have contributed to the Ordinals ecosystem. Among their notable projects are BITBARS, one of the early art collections inscribed on Bitcoin, and SEEDS, a recursive project that enables holders to customize their inscriptions using onchain mechanics. With a background in product design and systems thinking, dxxmsdxy will lead the design and user experience of Matador’s digital gold platform.

“We’re excited to have Antoine and dxxmsdxy join the Matador team,” said Deven Soni, CEO of Matador Technologies. “Their combined experience with Bitcoin and Ordinals, along with their design and development expertise, will contribute significantly to the launch of our digital gold product.”

For additional information, please contact:

Media Contact:

Sunny Ray

President

Email: sunny@matador.network

Phone: 647-932-2668

About Matador Technologies Inc.

Matador Technologies Inc. leverages blockchain technology to digitize real-world assets like gold. Focused on building innovative financial solutions, Matador is at the forefront of integrating blockchain technology to preserve and grow value. Matador’s digital gold platform aims to democratize the gold buying experience, combining the best of modern technology and time-proven assets, to create a platform that will allow users to buy, sell, and store gold 24/7 in a convenient and engaging way.

Cautionary Statement Regarding Forward-Looking Information

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

Forward Looking Statements – Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties, including risks associated with the implementation of the Company's treasury management strategy and the launch of its mobile application as currently proposed or at all. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including with respect to the potential acquisition of Bitcoin and/or US dollars, the pricing of such acquisitions and the timing of future operations. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements.

By Elsa Ohlen

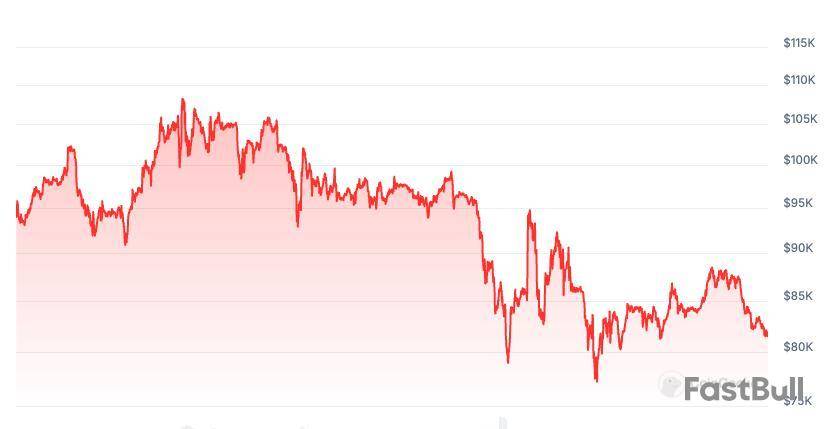

Bitcoin, XRP and other cryptocurrencies struggled Monday as investors prepared for an escalating trade war on the back of new tariffs coming into effect this week from President Donald Trump.

The world's largest digital coin by market value, Bitcoin, is down 2.4% to $81,482 over the last 24 hours, according to CoinDesk data.

XRP, the cryptocurrency used to settle and facilitate transactions on Ripple Labs payment platform, dropped 5.3% to $2.07 over the last 24 hours by early Monday.

Despite cryptos often being referred to as "digital gold" it trades much more like risky assets than safe haven assets such as gold. On Monday, the market remained under pressure and stock futures fell on the last trading day of the quarter, largely on increased uncertainty around Trump's tariff policies.

Other cryptos were down too — Ethereum lost 3%, Solana was down 1.7% and Cardano dropped 7%.

"[Market pressure is] forcing us to consider BTC's return below $80,000 as the main scenario for the near term," FxPro analyst Alex Kuptsikevich notes.

However, Matthew Mena, research analyst at 21Shares, a crypto asset firm suggested crytos could be reignited by regulatory clarity, stablecoin legislation moving forwards, and the U.S. strategic Bitcoin reserve becoming real. He said this could potentially push Bitcoin back to $100,000.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

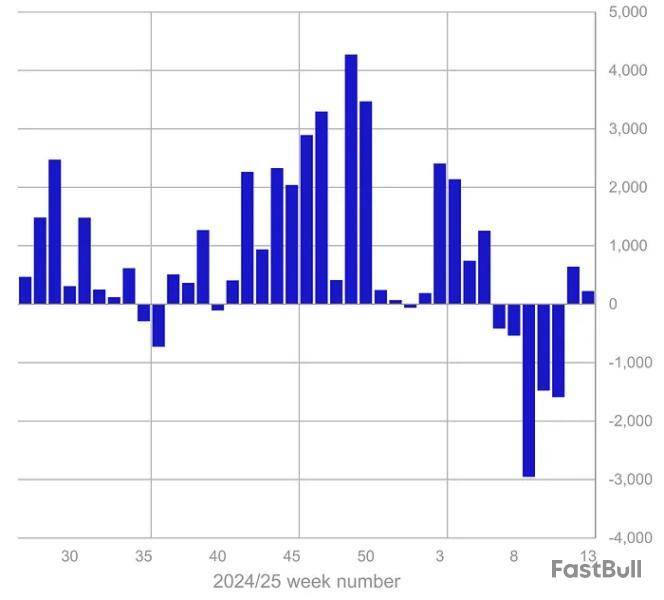

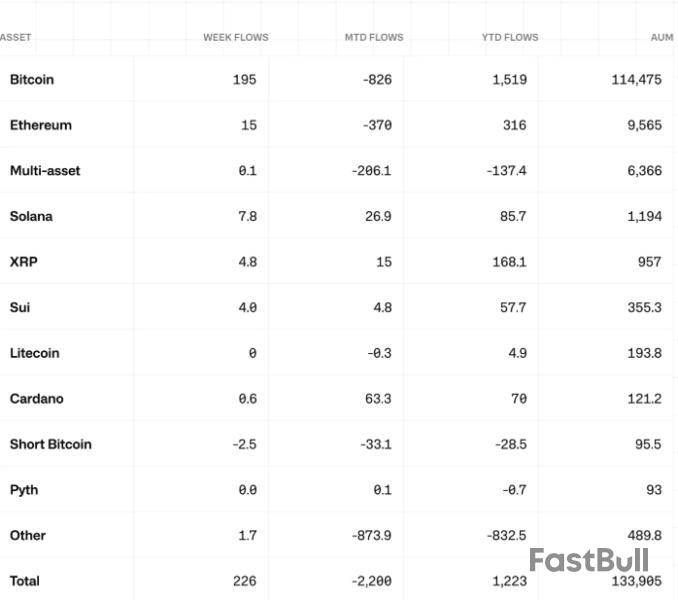

Cryptocurrency exchange-traded products (ETPs) continued to see modest inflows last week, extending a reversal from a record-breaking streak of outflows.

Global crypto ETPs posted another $226 million in inflows in the last trading week, adding to the prior week’s $644 million inflows, CoinShares reported on March 31.

Despite the two-week positive trend after a five-week outflow streak, total assets under management (AUM) continued to decline, dropping below $134 million by March 28.

Last week’s inflows suggest positive but cautious investor behavior amid core Personal Consumption Expenditures in the US coming in above expectations, CoinShares’ head of research James Butterfill said.

Bitcoin leads weekly inflows

Bitcoin investment products attracted the majority of inflows, totaling $195 million for the week, while short-BTC investment products saw outflows for the fourth consecutive week, totaling $2.5 million.

Altcoins, in aggregate, saw their first week of inflows totaling $33 million, following four consecutive weeks of outflows totaling $1.7 billion.

Among individual altcoins, Ether (ETH) saw $14.5 million in inflows. Solana (SOL), XRP (XRP) and Sui (SUI) followed with $7.8 million, $4.8 million and $4 million, respectively.

AUM drops to lowest level in 2025 amid price slump

Despite recent inflows, crypto ETPs have failed to trigger a reversal in terms of total AUM.

Since March 10, the total crypto ETP AUM dropped 5.7% from 142 billion, amounting to 133.9 billion as of March 28, the lowest level in 2025.

According to CoinShares’ Butterfill, the AUM decline could be attributed to a slump in cryptocurrency prices.

“Recent price falls have pushed Bitcoin global ETP’s total assets under management to their lowest level since just after the US election at $114 billion,” Butterfill wrote.

Since Jan. 1, 2025, the BTC price has dropped 13.6%, while the total market capitalization has tumbled nearly 20%, according to data from CoinGecko.

Metaplanet issued ¥2 billion ($13.3 million) worth of zero-interest bonds to fund its bitcoin acquisition plan following a meeting of its board of directors, according to a disclosure filing. The debt security will be allocated via Metaplanet’s EVO FUND, allowing investors to redeem bonds at full face value by Sept. 30, 2025.

Simon Gerovich, CEO of Metaplanet, said the firm was “buying the dip!” in a post on X. Bitcoin was down roughly 2%, trading under $81,800 per The Block’s price page.

Metaplanet is Asia’s largest BTC holder, having spent an estimated $260 million on bitcoin since last year. Its most recent purchase, as of writing, increased the firm’s total reserve to some 3,200 BTC — ranking Metaplanet 10th in a cast of the world’s largest corporate BTC holders led by Michael Saylor's firm, Strategy, per BitcoinTreasuries data. The Tokyo-listed giant also added Eric Trump, son of U.S. President Donald Trump, to its advisory board.

“It’s a positive story for BTC where Metaplanet sees the long-term value in owning bitcoin” said Paul Howard, Senior Director at crypto market maker Wincent, about the news.

While Howard perceived Metaplanet’s expanded BTC buying power as bullish, the company’s stock dropped over 9% after the announcement, according to Google Finance data. Metaplanet stock fell amid a broader decline in Japan’s Nikkei 225, which dipped 4% in anticipation of fresh tariffs from President Trump on April 2. Howard expects other stock markets to follow suit.

“Almost all global markets are seeing the impact of the tariffs from the U.S., so the Nikkei, one of the first large markets to open, will always reflect this position before other markets open. The expectation is other markets will follow suit on opening,” Wincent’s Senior Director told The Block.

Aran Hawker, CoinPanel CEO, shared a similar outlook, adding that macroeconomic factors looked likely to kneecap bitcoin and risk-assets in the short term. “As for the Nikkei dip — whether it's being driven by the post-holiday catch-up (Liberation Day) or concerns about a new wave of Trump-era tariffs — it's clear that global macro signals are jittery right now. That sort of backdrop tends to pull capital toward lower-risk assets, at least in the short term,” Hawker opined.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Label putih

Data API

Web Plug-ins

Pembuat Poster

Program Afiliasi

Berdagang Instrumen Keuangan Seperti Saham, Mata Uang, Komoditas, Kontrak Berjangka, Obligasi, Dana, Atau Mata Uang Kripto Adalah Perilaku Berisiko Tinggi, Termasuk Kehilangan Sebagian Atau Seluruh Jumlah Investasi Anda, Sehingga Perdagangan Tidak Cocok Untuk Semua Investor.

Anda Harus Melakukan Uji Tuntas Anda Sendiri, Menggunakan Penilaian Anda Sendiri, Dan Berkonsultasi Dengan Penasihat Yang Memenuhi Syarat Saat Membuat Keputusan Keuangan Apa Pun. Konten Situs Web Ini Tidak Ditujukan Kepada Anda, Situasi Keuangan Atau Kebutuhan Anda Juga Tidak Diperhitungkan. Informasi Yang Terdapat Di Situs Web Ini Belum Tentu Tersedia Secara Waktu Nyata, Juga Belum Tentu Akurat. Setiap Pesanan Atau Keputusan Keuangan Lainnya Yang Anda Buat Sepenuhnya Menjadi Tanggung Jawab Anda Dan Anda Tidak Boleh Bergantung Pada Informasi Apa Pun Yang Disediakan Melalui Situs Web. Kami Tidak Memberikan Jaminan Apa Pun Untuk Informasi Apa Pun Di Situs Web Dan Tidak Bertanggung Jawab Atas Kerugian Transaksi Apa Pun Yang Mungkin Timbul Dari Penggunaan Informasi Apa Pun Di Situs Web.

Dilarang Menggunakan, Menyimpan, Menggandakan, Menampilkan, Memodifikasi, Menyebarluaskan Atau Mendistribusikan Data Yang Terdapat Dalam Situs Web Ini Tanpa Izin Tertulis Dari Situs Web Ini. Semua Hak Kekayaan Intelektual Dilindungi Oleh Pemasok Dan Bursa Yang Menyediakan Data Yang Terdapat Di Situs Web Ini.

Tidak Masuk

Masuk untuk mengakses lebih banyak fitur

Anggota FastBull

Belum

Pembelian

Masuk

Daftar