Who Pays the Bill After an Exness Agent Vanishes with 300,000 RMB in Rebates?

When discussing trading risks, we often focus on the volatility of candlesticks while overlooking the "human" risk. Recently, a dispute involving hundreds of thousands of yuan in unpaid rebates has pushed Exness's agent management mechanism into the spotlight. At the same time, a cluster of technical and security incidents - ranging from frequent server outages to unauthorized fund transfers - is eroding the foundation of trust this well-known broker has built over the years. Faced with disappearing agents and a "hands-off" firm, how can investors navigate their way through this regulatory vacuum?

300,000 RMB in Rebates Evaporate with the Agent

For many forex traders, opening an account through an Introducing Broker (IB, or an agent as referred to in this article) is often a move to secure additional commission rebates, a mutually beneficial industry practice. However, a recent ordeal faced by an Exness user reveals the fragile contractual relationship behind this model.

According to the user, he opened an account through an agent and agreed upon periodic commission rebates. Initially, the cooperation was smooth, but as trading volume increased, the agent began frequently withholding portions of the rebates. When the debt snowballed to a staggering 300,000 RMB, the agent chose the most extreme exit: canceling multiple business accounts, severing all contact, and completely "vanishing."

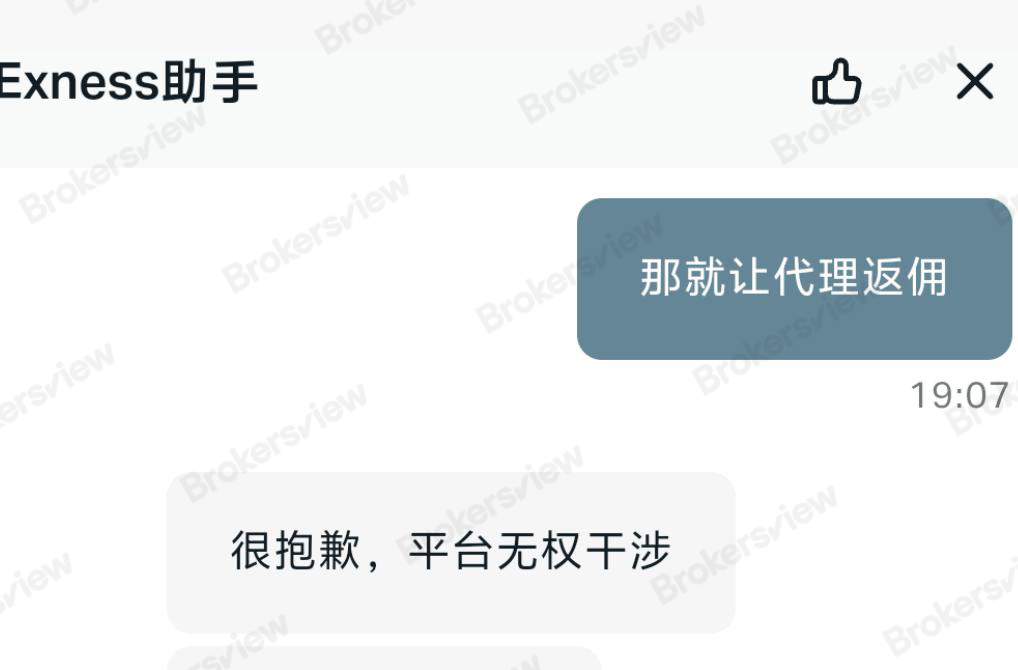

What left the user even more helpless was Exness's stance. When he sought assistance from the broker, hoping to obtain the agent's real identity to pursue legal action, he was met with a refusal. Exness stated that the firm "cannot force agents" to pay rebates and declined to provide the agent's details, citing privacy protection.

This logic - where the firm provides the stage for the agent to perform but claims immunity when trouble arises - places investors in an extremely awkward position. Although the agent conducts business in Exness's name, once a conflict of interest occurs, this relationship becomes a firewall for the broker to evade responsibility.

Technical "Allergies": From System Freezes to Mysterious Transfers

If agent disputes fall into a gray area of business ethics, then recent frequent technical failures are a direct challenge to Exness's core competitiveness.

In October 2025, a sudden server outage swept through the Asian market. A large number of users in China and Japan encountered a "Personal Area Temporarily Interrupted" notice when attempting to log in. Although Exness officially issued a reassuring statement guaranteeing the safety of funds, it could not recoup the potential losses incurred by investors unable to close positions in time. By the end of the same month, multiple traders complained of severe lag during critical market moments, leading to forced liquidations.

Even more alarming are the fund security issues. In late November 2025, BrokersView recorded a highly controversial case of fund theft. A user's $64,500 was transferred to an unauthorized stranger's wallet without the user receiving any OTP (One-Time Password) verification. Exness's explanation was that the system showed a "successful login," and they subsequently refused to accept liability. This approach of shifting the entire risk of account theft onto the user has undoubtedly intensified the community's distrust.

BrokersView Reminds You

From missing agents to technical glitches and fund security disputes, Exness's recent performance exposes dual weaknesses in its risk control system and the protection of client rights.

- The Compliance Black Hole of the Agent Model: Brokers enjoy the traffic dividends brought by agents and should, therefore, bear corresponding supervisory obligations. Tolerating non-compliant agents is essentially an overdraft of brand reputation.

- The Red Line of Technical Stability: For a broker that prides itself on being technology-driven, frequent outages and lags are unacceptable. Behind every "technical failure" lies the real monetary cost to investors.

BrokersView advises investors to ensure they sign legally binding written agreements when cooperating with agents, rather than relying solely on verbal promises. At the same time, for brokers with frequent technical issues, one should carefully assess their capacity to handle extreme market conditions and avoid placing all capital in a single basket. If you have had a similar experience, please submit a complaint to BrokersView.