Unregulated Brokers Weekly Report: Global Regulators Flag Fraudulent Trading Platforms

During the past week, BrokersView exposed 63 fraudulent brokers. Investigations revealed that these brokers lack authorization from any financial regulatory authority, constituting typical unlicensed operators potentially violating financial services laws across multiple countries and regions.

Many fraudulent brokers attempt to conceal their regulatory status, evade disclosing basic information about client fund security, and deceive unsuspecting investors.

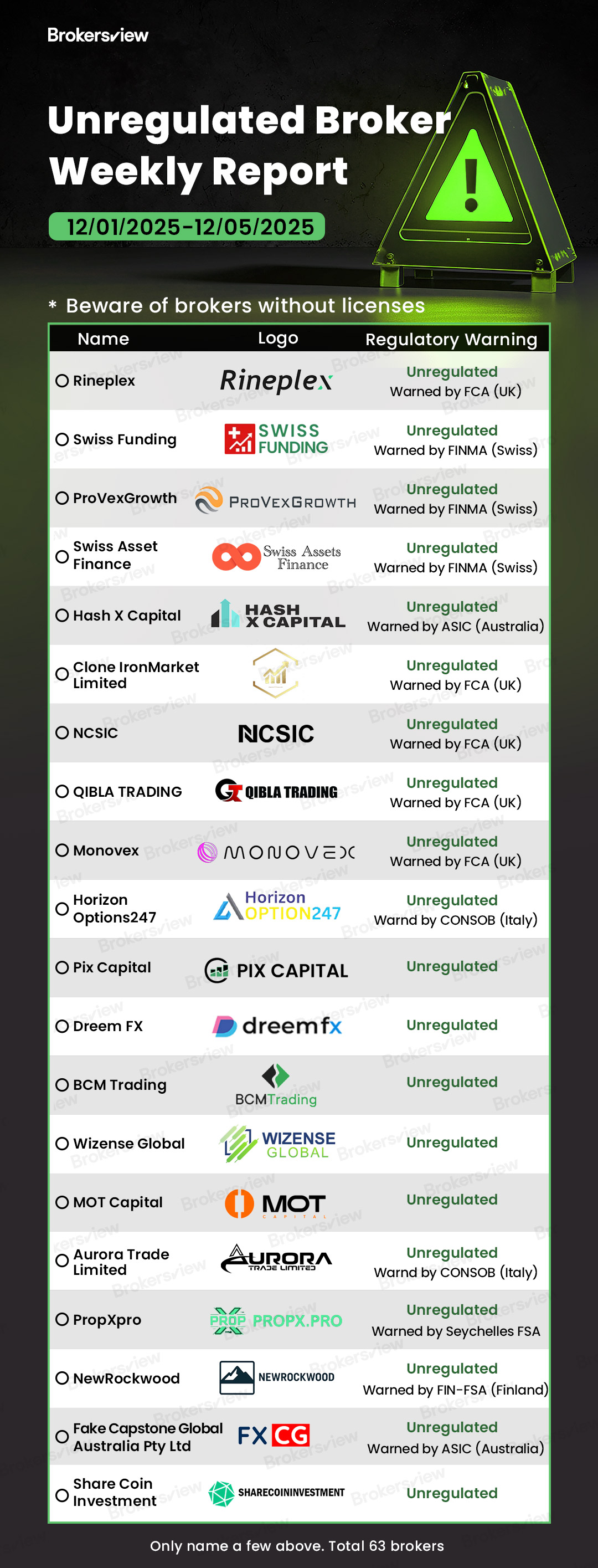

Furthermore, some brokers have received warnings from the Financial Conduct Authority (FCA), the Swiss Financial Market Supervisory Authority (FINMA), the Australian Securities and Investments Commission (ASIC), the Commissione Nazionale per le Società e la Borsa (CONSOB), the Seychelles Financial Services Authority (Seychelles FSA), and the Finnish Financial Supervisory Authority (FIN-FSA). According to regulators, financial service providers listed on investor warning lists or subject to warnings are not under their supervision. Local investors should therefore remain vigilant to avoid falling victim to fraud.

While some brokers exposed by BrokersView have not yet drawn regulatory attention, they still pose significant risks. When dealing with unlicensed brokers, investors' funds receive no protection. Should disputes arise, investors may lose all their capital. Therefore, investors should exercise caution to safeguard their money.

Scam brokers exposed by BrokersView from December 1 to 5, 2025:

BrokersView reminds you

BrokersView is dedicated to helping forex traders gain in-depth insights into forex trading platforms, providing timely updates on brokers' regulatory statuses, and exposing unregulated brokers with potential risks through “Scam” for investor reference.

If you encounter suspicious or fraudulent brokers in financial markets, submit complaints via BrokersView to protect investor rights and prevent more people from falling victim to fraud.

If you have questions about a broker, you may ask BrokersView. Our team will provide detailed answers free of charge.