SparkFX: A Fraudulent Platform Disguised with False Licensing

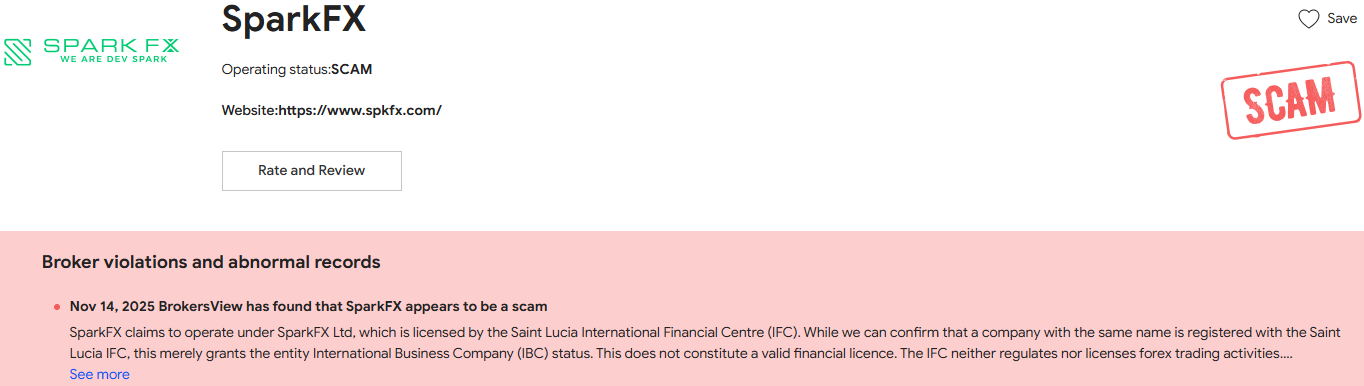

SparkFX promotes itself as a licensed global trading platform, but its claims collapse under scrutiny.

SparkFX’s Regulatory Deception

SparkFX claims to be operated by SparkFX Ltd and to hold a license from “Saint Lucia the Financial Conduct Authority” with registration number 2024-00127. However, there is no regulator called “Financial Conduct Authority” in Saint Lucia. Saint Lucia’s regulator is the Financial Services Regulatory Authority (FSRA), which does not regulate forex.

Although we find that SparkFX Ltd appears on the list of the Saint Lucia International Financial Centre (IFC), the IFC does not regulate or license financial services such as forex trading. Registration with the IFC only grants a company International Business Company (IBC) status, which typically means it is merely a registered shell without any financial regulatory license.

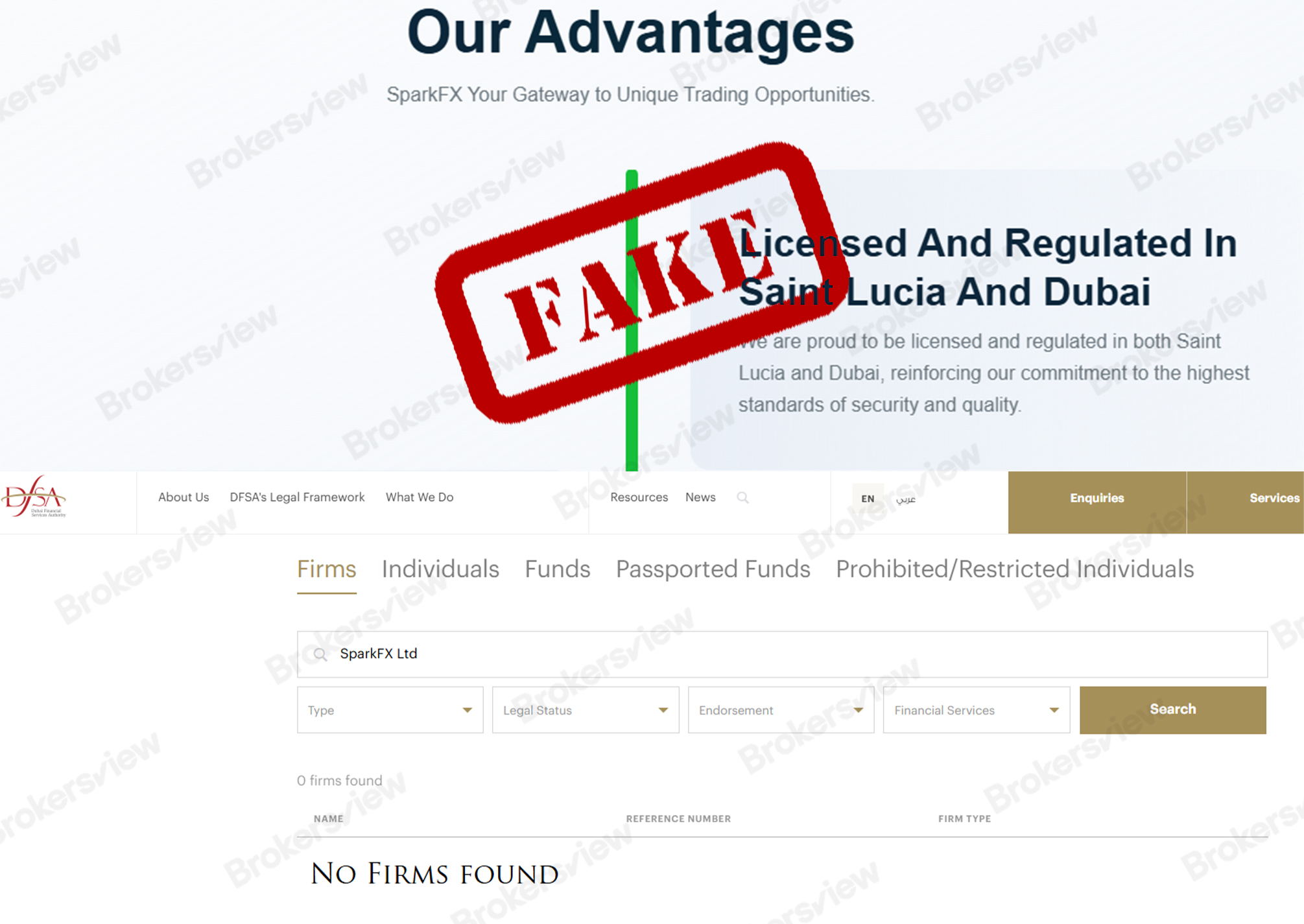

SparkFX also claims to be regulated in Dubai, but the Dubai Financial Services Authority (DFSA) does not list it as a licensed entity.

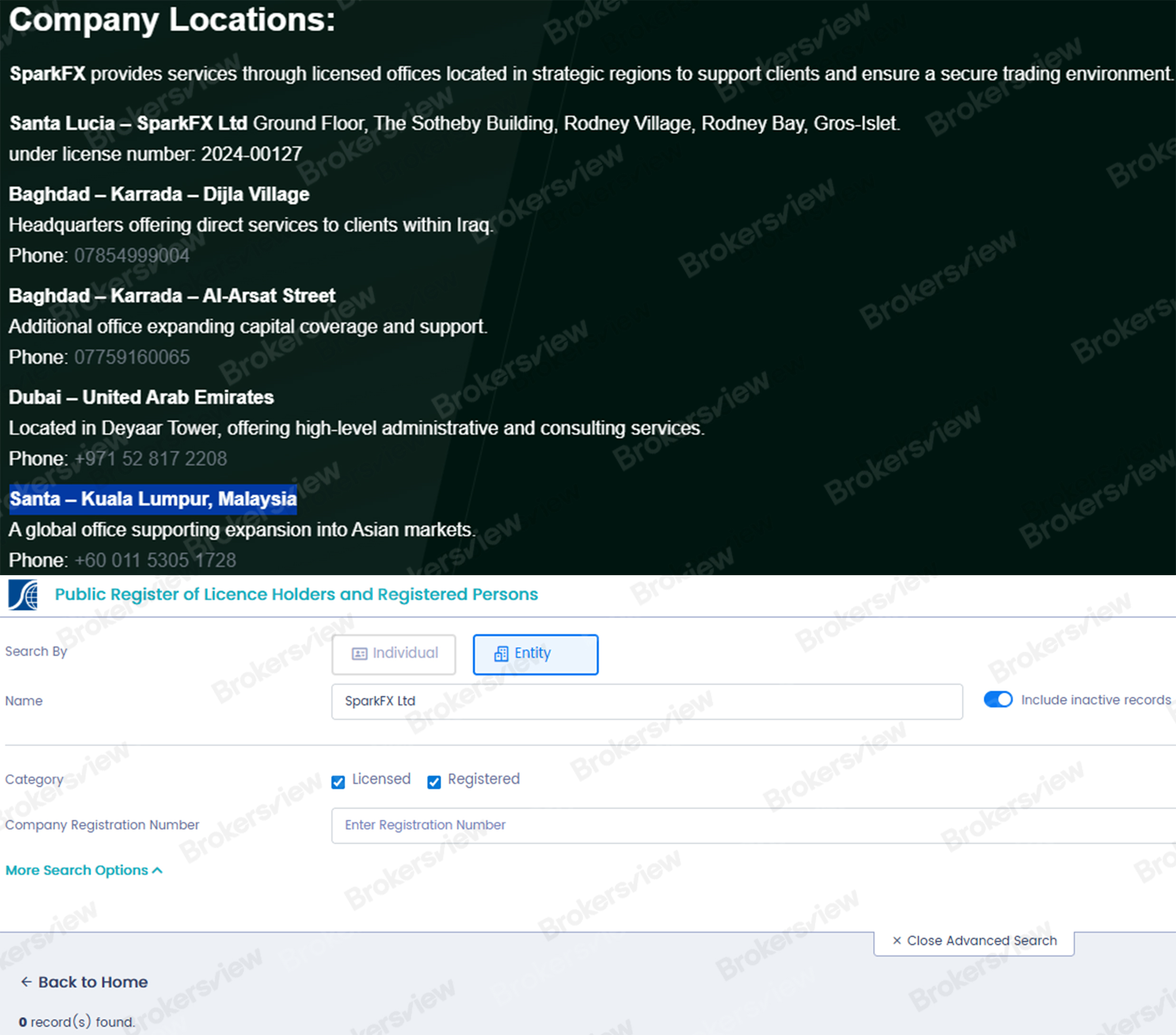

In addition, a physical address in Malaysia is displayed on its website. Similarly, Malaysia’s Securities Commission (SC) has no record of the company.

This pattern, involving the fabrication of a non-existent regulator and claims of international presence without regulatory approval, is a major red flag. It suggests SparkFX is attempting to build a facade of credibility while operating outside the law.

Manufactured Credibility

SparkFX’s simplified language and promise of “higher returns” target inexperienced investors, while poor risk disclosure leaves them underestimating dangers and overestimating gains.

SparkFX repeatedly highlights its global expansion and growing client base, aiming to project an image of rapid success and broad recognition. Yet, no verifiable details are provided to support these claims.

The platform also promotes a range of generic service features, such as advanced trading tools, personalised coaching, and market alerts, to reinforce its “professional image”. While these offerings sound impressive, they lack transparency and regulatory backing.

Investors should be cautious of vague language used to obscure a platform’s actual operations. Many fraudulent websites rely on copied templates filled with exaggerated claims but lacking any substantiation.

BrokersView Reminds You

SparkFX’s promises should be treated as warning signs, not opportunities. Behind the facade lies an unregulated operation where deposits are exposed to the risk of total loss.

Do not rely on a company’s own claims of licensing or regulation. Always verify directly with the relevant financial authority. In the case of SparkFX, such verification quickly exposes the truth: there is no valid license, no recognised oversight, and no protection for investors.

Report forex fraud through BrokersView.