Singapore December 2025 Brokersview Swap Rates Review:Which Brokers Offer the Best Carry Conditions?

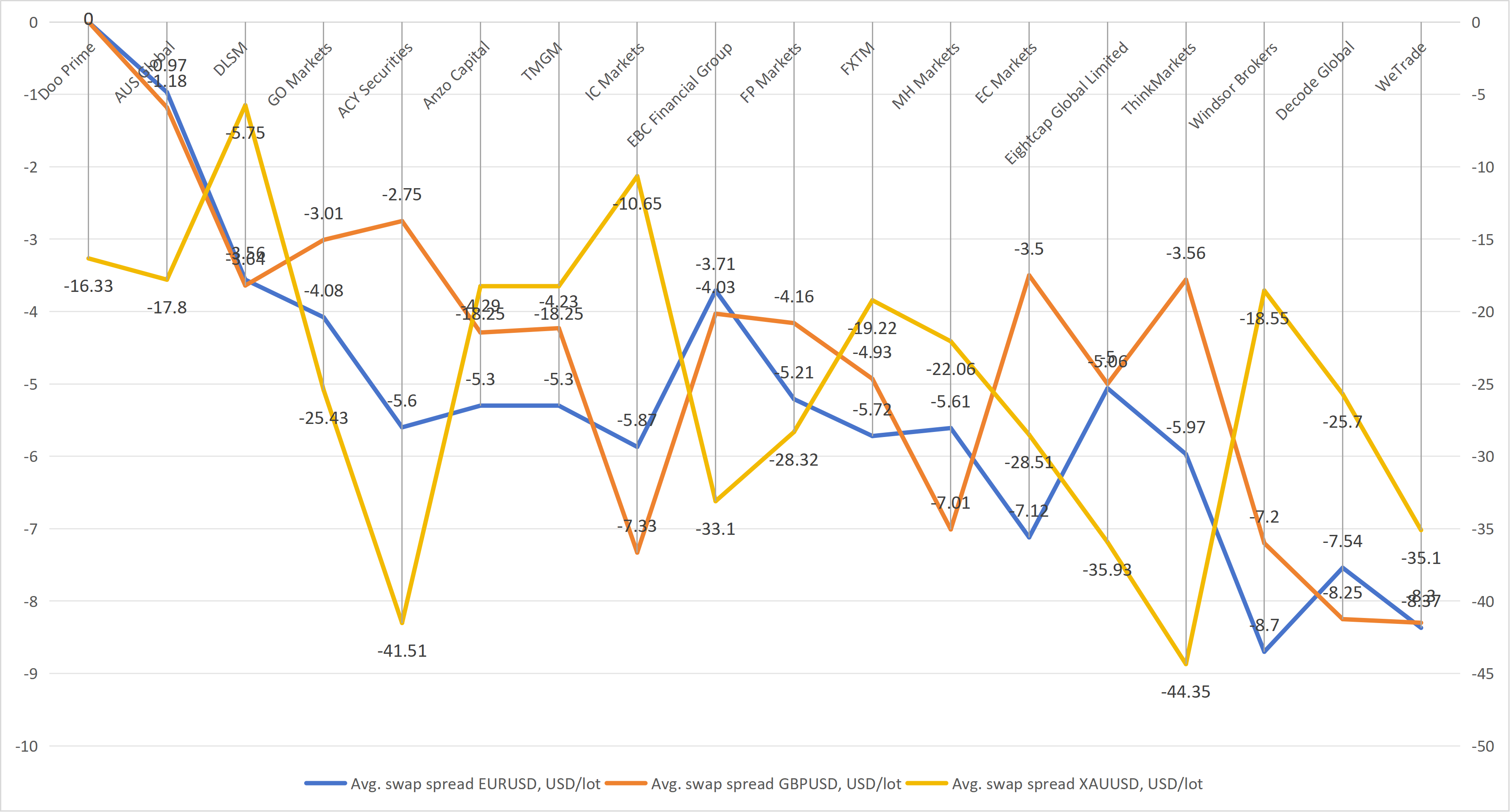

Swap Rates remains a critical cost factor for traders holding positions beyond one trading day. Traders holding positions overnight should look beyond spreads and execution alone—swap costs can quietly erode profitability over time.In December 2025, we reviewed average swap spreads in Singapore across three of the most actively traded instruments—EURUSD, GBPUSD, and XAUUSD—to assess which brokers offer the most competitive overnight conditions.

Top 3 Brokers for Swap Rates (December 2025)

- Doo Prime – Overall Best Performer

EURUSD: 0 USD/lot

GBPUSD: 0 USD/lot

XAUUSD: -16.33 USD/lot

Doo Prime clearly leads the ranking with zero swap spreads on major FX pairs, making it extremely attractive for carry and medium-term strategies. Gold swaps are also relatively moderate compared to peers. For traders sensitive to overnight costs, Doo Prime stands out as the most cost-efficient option.

- AUS Global – Strong FX, Competitive Gold

EURUSD: -0.97 USD/lot

GBPUSD: -1.18 USD/lot

XAUUSD: -17.8 USD/lot

AUS Global ranks second, offering very low swap costs on major currency pairs. While slightly more expensive than Doo Prime, its FX overnight rates remain among the best in the market, with gold swaps still within a reasonable range.

- DLSM – Balanced Choice with Low Gold Swap

EURUSD: -3.56 USD/lot

GBPUSD: -3.64 USD/lot

XAUUSD: -5.75 USD/lot

DLSM earns third place largely due to its exceptionally low gold (XAUUSD) swap cost, one of the best in this category. Although FX swaps are higher than the top two, traders focusing on XAUUSD swing positions may find DLSM particularly appealing.

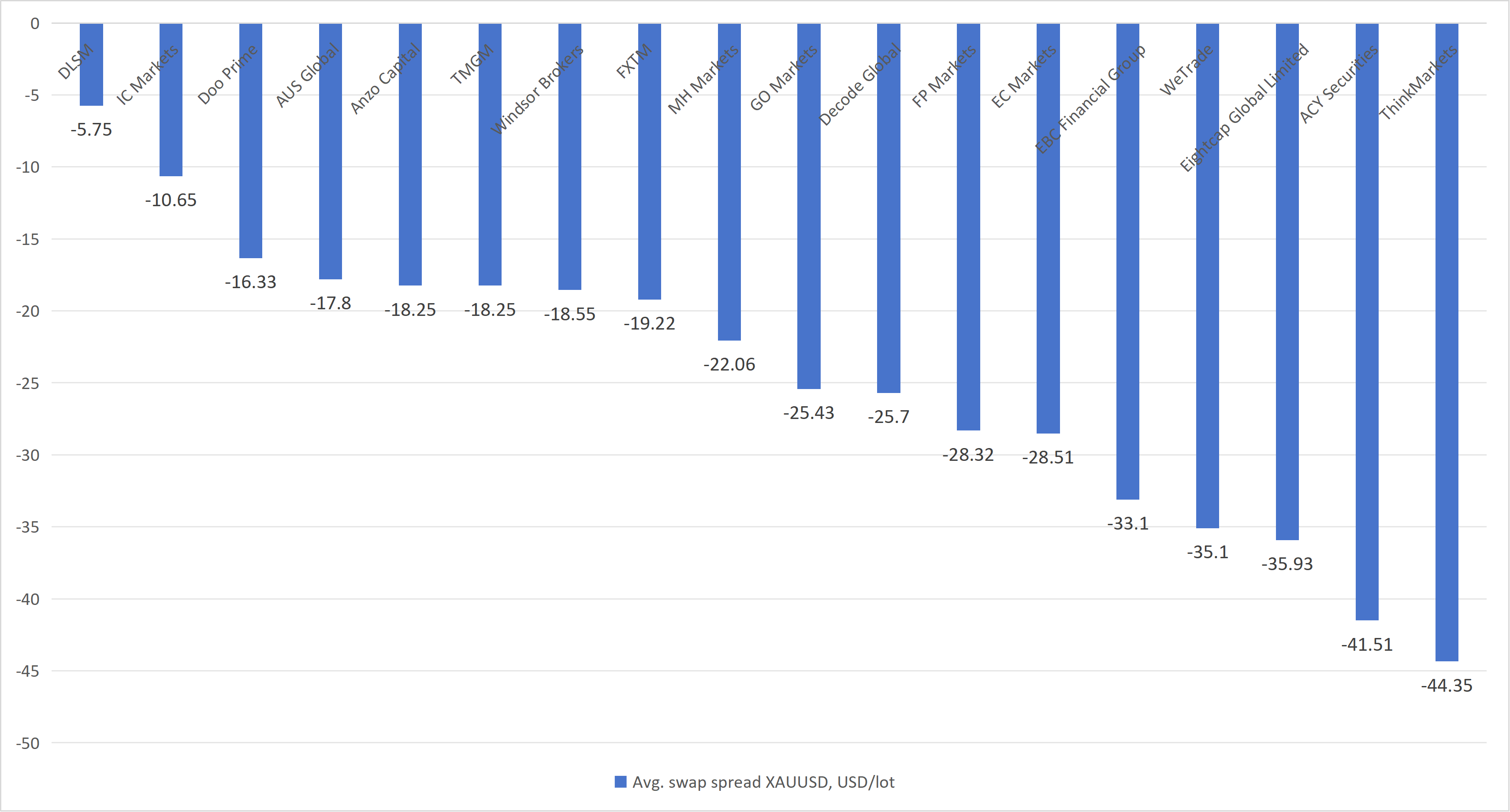

XAUUSD swaps vary significantly across brokers, from around -5.75 to over -44 USD/lot, making broker selection crucial for XAUUSD traders.

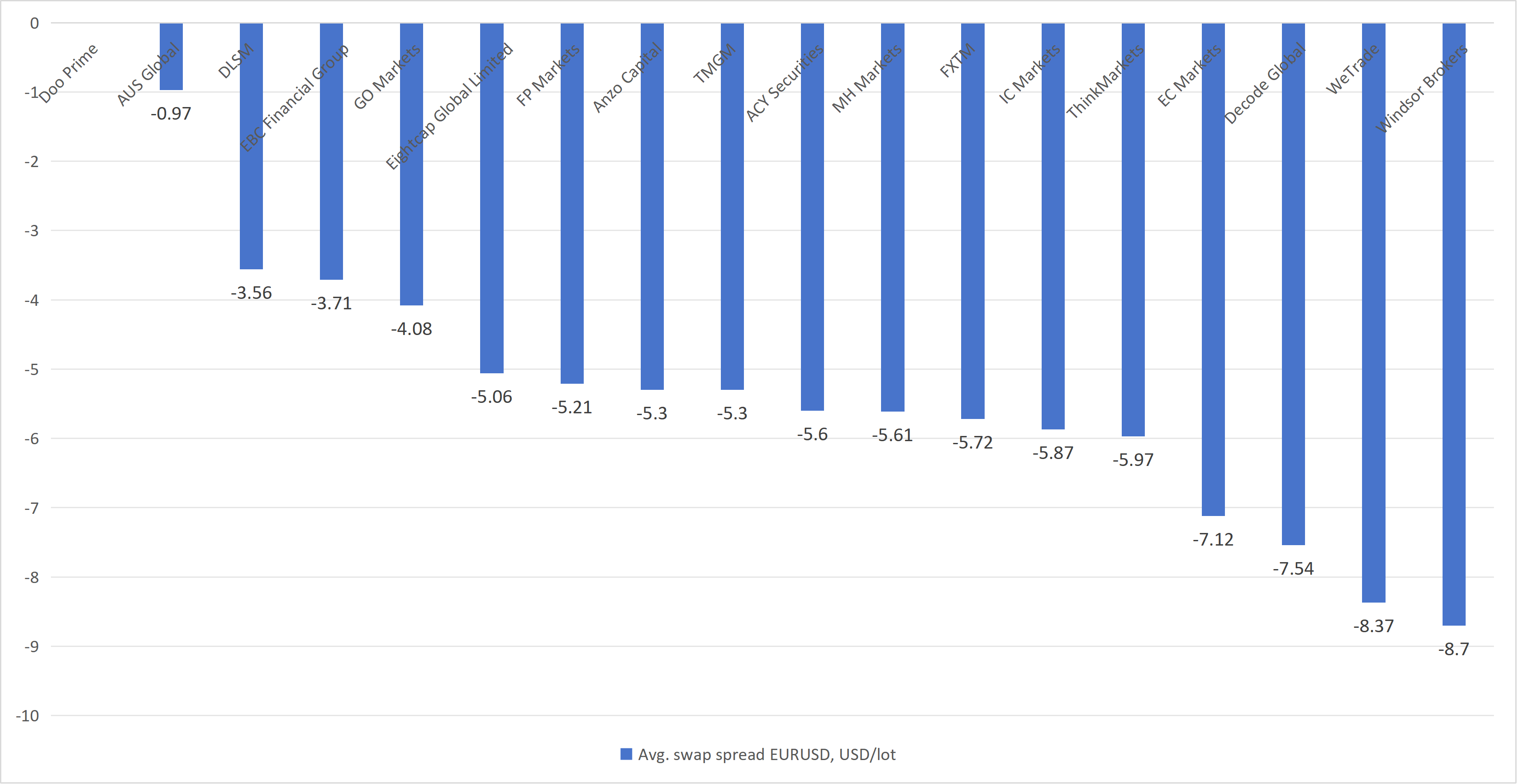

EURUSD Swap Rates

For EURUSD traders, lower (or zero) swap costs can significantly improve long-term performance.

- Doo Prime – 0 USD/lot

Doo Prime ranks first with zero swap cost on EURUSD, a rare advantage in the current market. This makes it particularly attractive for swing and position traders who hold EURUSD overnight for extended periods.

- AUS Global – -0.97 USD/lot

AUS Global takes second place with a minimal negative swap. While not entirely swap-free, its EURUSD holding cost remains among the lowest available in Singapore.

- DLSM – -3.56 USD/lot

DLSM ranks third. Although its EURUSD swap is higher than Doo Prime and AUS Global, it still sits in a relatively competitive range compared with many mainstream brokers.

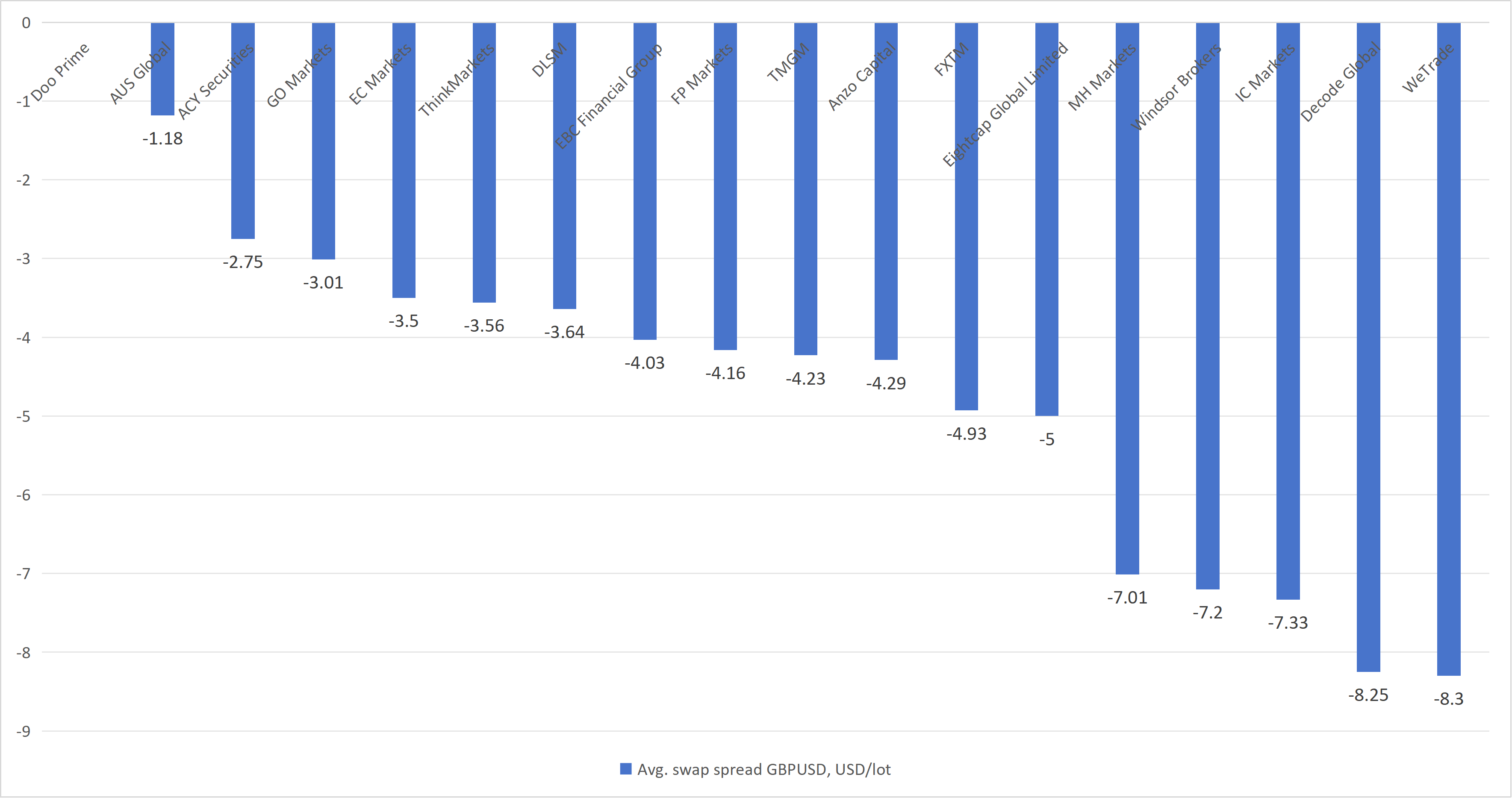

GBPUSD Swap Rates

- Doo Prime: 0 USD/lot

- AUS Global: -1.18 USD/lot

- ACY Securities: -2.75 USD/lot

Doo Prime again leads with zero swap, followed closely by AUS Global. ACY Securities places third with a moderate overnight cost.

XAUUSD Swap Rates

- DLSM: -5.75 USD/lot

- IC Markets: -10.65 USD/lot

- Doo Prime: -16.33 USD/lot

For gold traders, DLSM stands out with the lowest XAUUSD swap cost, while IC Markets and Doo Prime follow.

Conclusion

For December 2025, Doo Prime, AUS Global, and DLSM emerge as the top three brokers in Singapore for overnight interest performance. Traders who frequently hold positions overnight should pay close attention to swap policies, as these costs can have a material impact on overall profitability—especially in long-term or carry-based strategies.

As always, consider swap policies alongside regulation, execution quality, and platform stability before choosing a broker.

For more comprehensive evaluation data, please check the BV evaluation column.