Singapore Authorities Charge Samtrade FX Executives Over Copy Trading Fraud and Money Laundering

Singapore’s police have formally charged three senior executives of online trading platform Samtrade FX for allegedly defrauding clients and laundering funds. Goh Nai De (CEO), Goh Li Xing (CTO), and Alfred Yue (Head of Dealing and Strategy) are accused of manipulating trades to create false profits for users of the platform’s “copy trading” feature.

Between January and December 2021, Yue allegedly controlled 11 “Ultimate Trader” accounts and adjusted bid-ask spreads so that trades copied by clients appeared profitable. Investors were unaware that these trades had been deliberately tilted to benefit the executives. During the same period, the trio allegedly received S$8.7 million (Goh Nai De), S$4.8 million (Goh Li Xing), and S$650,000 (Yue) from funds deposited by clients copying the rigged trades.

The executives now face multiple charges: Goh Nai De with 11 counts each of fraudulent practices and money laundering, Goh Li Xing with 11 counts of fraud and seven of money laundering, and Alfred Yue with 11 counts of fraud and eight of money laundering. Convictions under the Securities and Futures Act carry up to seven years’ imprisonment or fines up to S$250,000 per charge. Money laundering offences under the Corruption, Drug Trafficking and Other Serious Crimes Act carry penalties of up to 10 years’ imprisonment or fines up to S$500,000 per charge.

Authorities emphasize that copy trading and similar automated investment products carry significant risks. Investors are urged to exercise caution and verify the integrity of platforms and account managers.

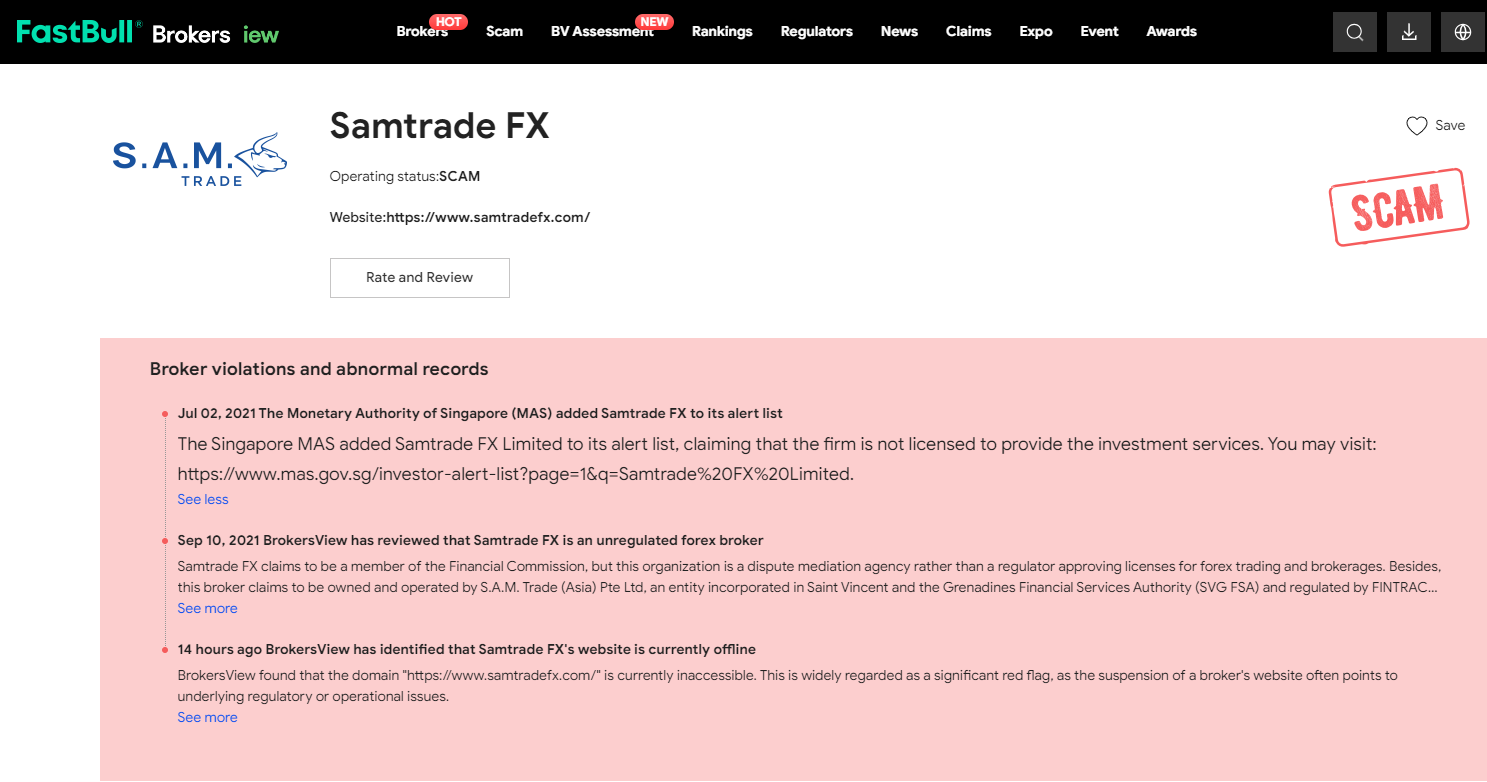

In 2022, BrokersViews expressed concerns about Samtrade FX’s irregular trading activities, while the Monetary Authority of Singapore (MAS) simultaneously began investigating the platform. MAS later added it to its investor alert list and revoked its licenses.

BrokersViews Reminds You

Copy trading and other automated trading services are not risk-free and that investors should exercise caution, conduct due diligence, and be aware that platforms and account managers may not always act in the clients’ best interests.