September 2025 Broker Spread Review: Who Offers the Best Trading Conditions?

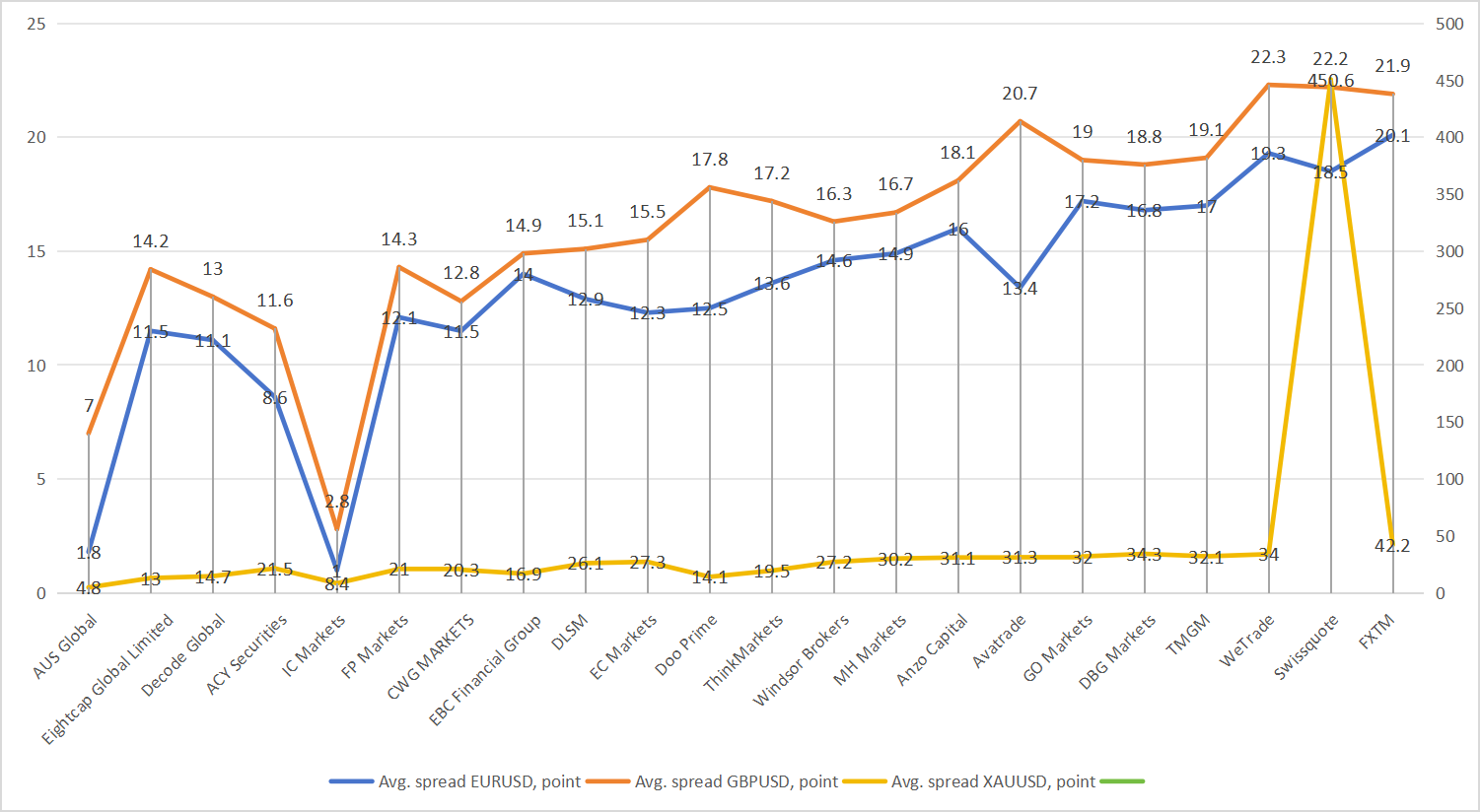

As the third quarter draws to a close, traders are increasingly focused on the cost of execution, with spreads being a primary factor. This September, we've compiled and analyzed the average spreads for three of the most traded instruments—EURUSD, GBPUSD, and XAUUSD —across 22 major brokers to identify the most cost-effective options in the market.

The data reveals a stark divide between brokers catering to cost-sensitive traders and those with wider, standard spreads.

1.AUS Global

EUR/USD: 1.8 pts

GBP/USD: 7.0 pts

XAU/USD: 4.8 pts

AUS Global takes first place this month, showing remarkable competitiveness on XAU/USD with a spread of only 4.8 points, one of the tightest in the industry. Its balanced performance across forex and XAU/USD pairs suggests strong pricing infrastructure and liquidity depth. AUS Global continues to appeal to traders who diversify between currency and commodity trading.

2.Decode Global

EUR/USD: 11.1 pts

GBP/USD: 13 pts

XAU/USD: 14.7 pts

Decode Global comes in second. While its spreads are considerably wider than AUS Global, it offers access to a broader suite of markets, which may appeal to traders focusing on commodities or seeking diversified trading options. The XAU/USD spread of 14.7 points is notably higher, indicating a premium cost for XAU/USD trading. For currency pairs, the spreads remain moderate but are not optimal for cost-conscious traders.

3.Eightcap Global Limited

EUR/USD: 11.5 pts

GBP/USD: 14.2 pts

XAU/USD: 13 pts

Eightcap Global Limited ranks third in this evaluation. Its spreads are slightly higher than Decode Global for EUR/USD and GBP/USD but marginally lower for XAU/USD. Traders may find Eightcap suitable for casual or long-term trading, though the higher costs make it less competitive for frequent trading or scalping strategies.

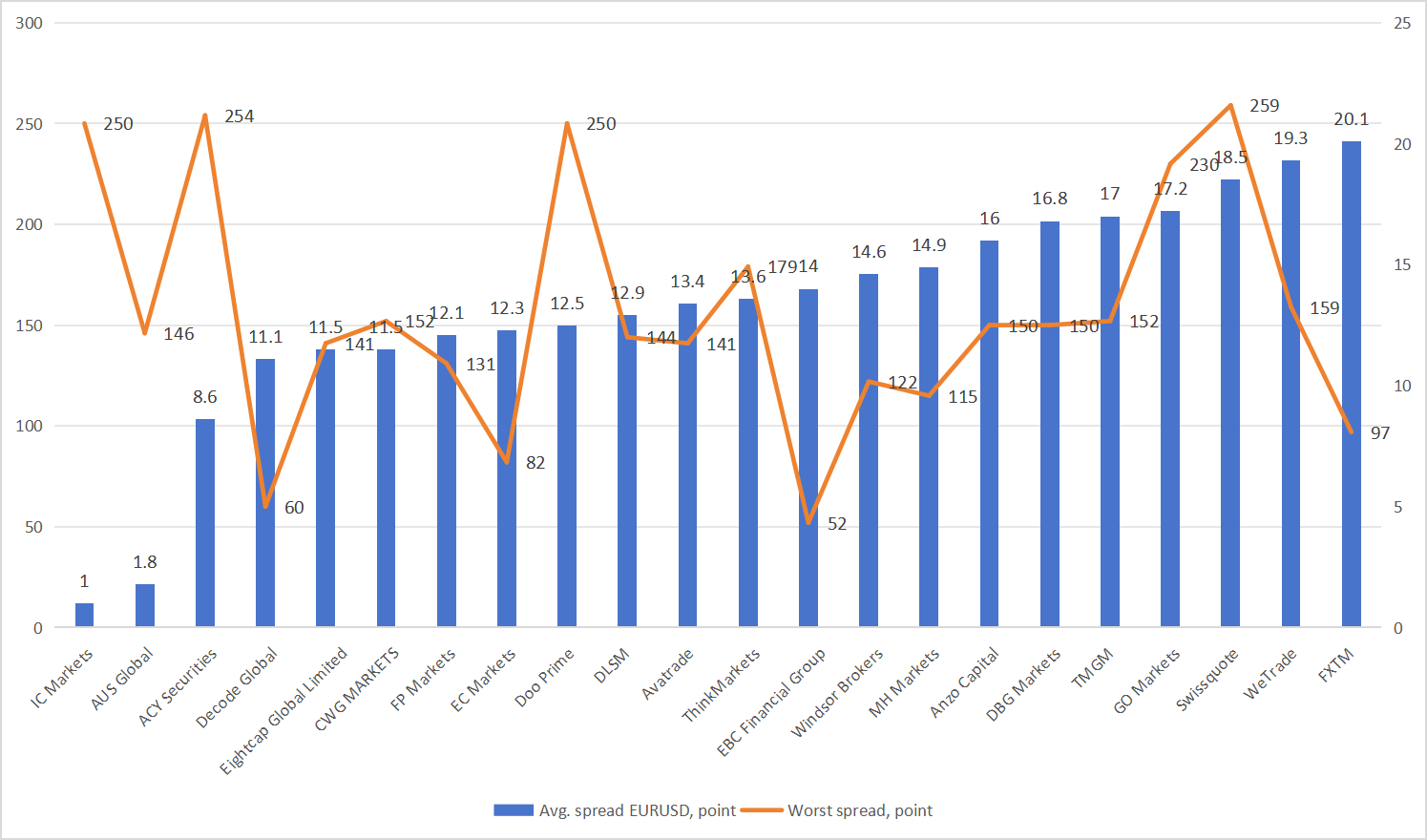

EURUSD Average Spreads

IC Markets – Avg. 1.0 points | Worst 250 points

While the occasional worst-case spike reaches 250 points, its consistent low average makes it highly competitive for scalpers and frequent traders.

AUS Global – Avg. 1.8 points | Worst 146 points

AUS Global provides slightly wider spreads than IC Markets but compensates with a much lower worst-case spread of 146 points. This suggests more stable trading conditions during market volatility, making it appealing for mid-frequency traders seeking predictability.

ACY Securities – Avg. 8.6 points | Worst 254 points

ACY Securities shows the highest average spread among the top three, along with a worst-case spike similar to IC Markets. While it may suit beginners or those using longer-term strategies, frequent traders may find costs prohibitively high compared to the top two brokers.

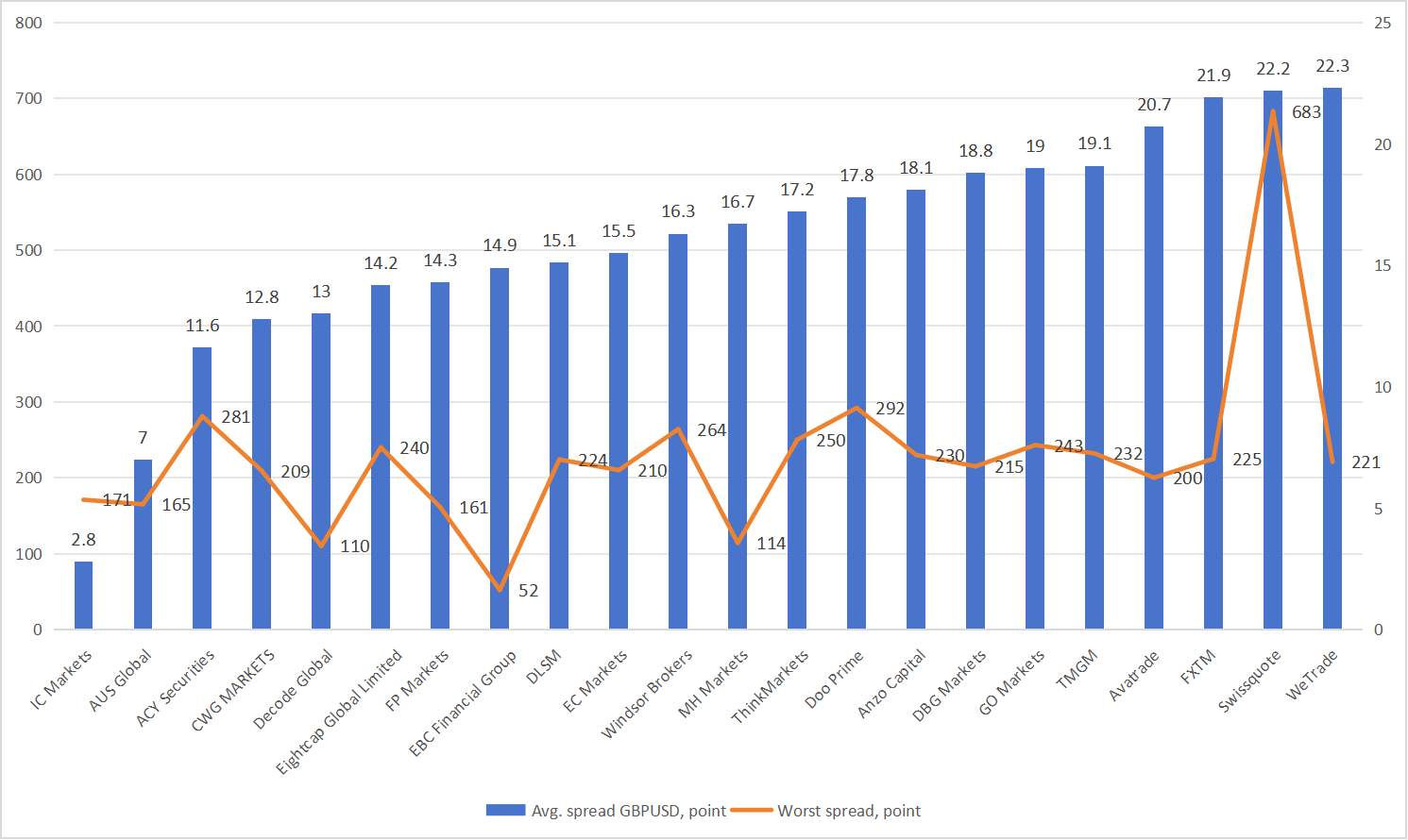

GBPUSD Average Spreads

IC Markets – Avg. 2.8 points | Worst 171 points

IC Markets continues to impress with its consistently tight spreads, maintaining an average of just 2.8 points on GBP/USD. While occasional market volatility caused the worst spread to spike to 171 points, this is generally expected during major news events.

AUS Global – Avg. 7 points | Worst 165 points

AUS Global offers slightly wider spreads compared to IC Markets, with an average of 7 points. Despite the higher average, AUS Global's worst spread of 165 points indicates the broker manages volatility relatively well. This broker is suitable for traders who value a balance between execution reliability and moderate trading costs.

ACY Securities – Avg. 11.6 points | Worst 281 points

ACY Securities rounds out the top three but shows a clear disadvantage in terms of spread consistency. The average spread of 11.6 points, and the worst spread reached a staggering 281 points. While ACY Securities may still serve beginner or long-term position traders, active traders and scalpers should approach with caution.

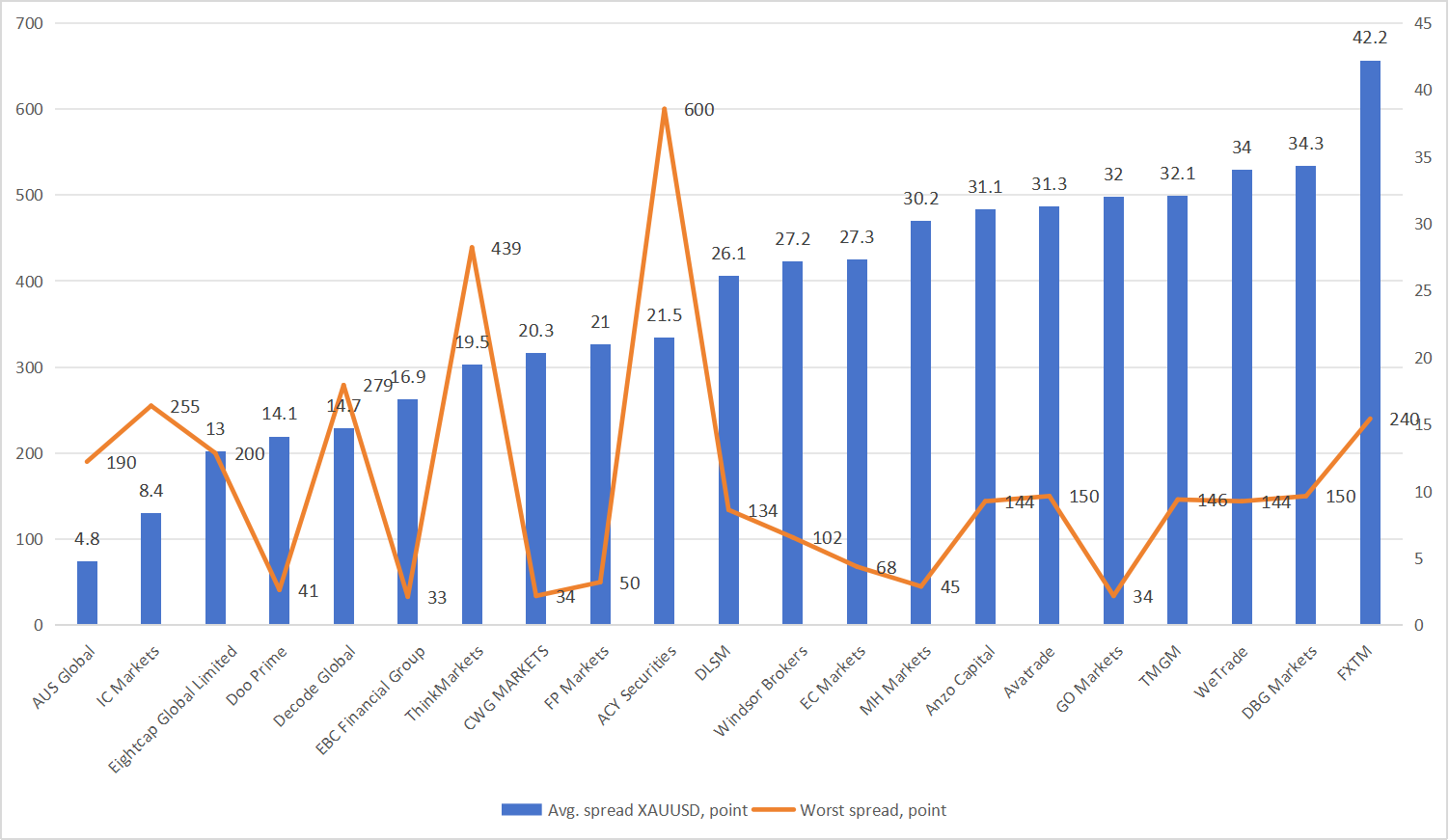

XAUUSD Average Spreads

AUS Global – Avg. 4.8 points | Worst 190 points

AUS Global leads the pack with the tightest average spread on XAUUSD, making it highly attractive for scalpers and short-term traders. While its worst-case spread of 190 points indicates occasional volatility during major news events, its overall cost efficiency remains unmatched in this trio. The platform’s reliability and competitive pricing make it a top choice for those who prioritize low trading costs.

IC Markets – Avg. 8.4 points | Worst 255 points

IC Markets takes second place with a solid average spread of 8.4 points. However, during periods of high volatility, the spread can widen to 255 points, which may impact trading strategies that require tight spreads. Nonetheless, its platform stability and execution speed make it a strong contender.

Eightcap Global Limited – Avg. 13 points | Worst 200 points

Eightcap Global Limited ranks third with an average spread of 13 points. While slightly higher than the first two, it maintains a relatively controlled worst-case spread of 200 points. Still, it remains a viable option for traders prioritizing platform usability and regulatory assurance.

Summary

Overall, for September, AUS Global, Decode Global and Eightcap Global Limited clearly outperforms the others brokers, offering superior pricing for traders across major forex pairs and XAU/USD. Traders looking to minimize costs while maintaining execution quality would benefit most from this broker.

Data Source: Brokersview Spread Ranking