Prop Trader Complains SGB's "Ghost Slippage" as Firm Refuses to Release Logs

While slippage is generally considered a byproduct of market volatility, its occurrence in calm, unprovoked conditions often suggests issues within the platform's execution mechanism. BrokersView recently noted a detailed account by a trader concerning their experience with the proprietary trading firm Sarmaye Gozare Bartar Ltd. (SGB). The trader reported severe abnormal slippage on their Gold (XAUUSD) orders during a low-volatility period with no market news, and the firm subsequently refused to provide liquidity data to verify the execution.

A Bizarre "Tuesday Nightmare": Dozens of Pips Vanish

For most traders, December 3, 2025, was just an ordinary Tuesday; the Gold market was stable, and there were no macroeconomic news events that would typically cause extreme volatility. However, for the SGB user, this day became an account nightmare.

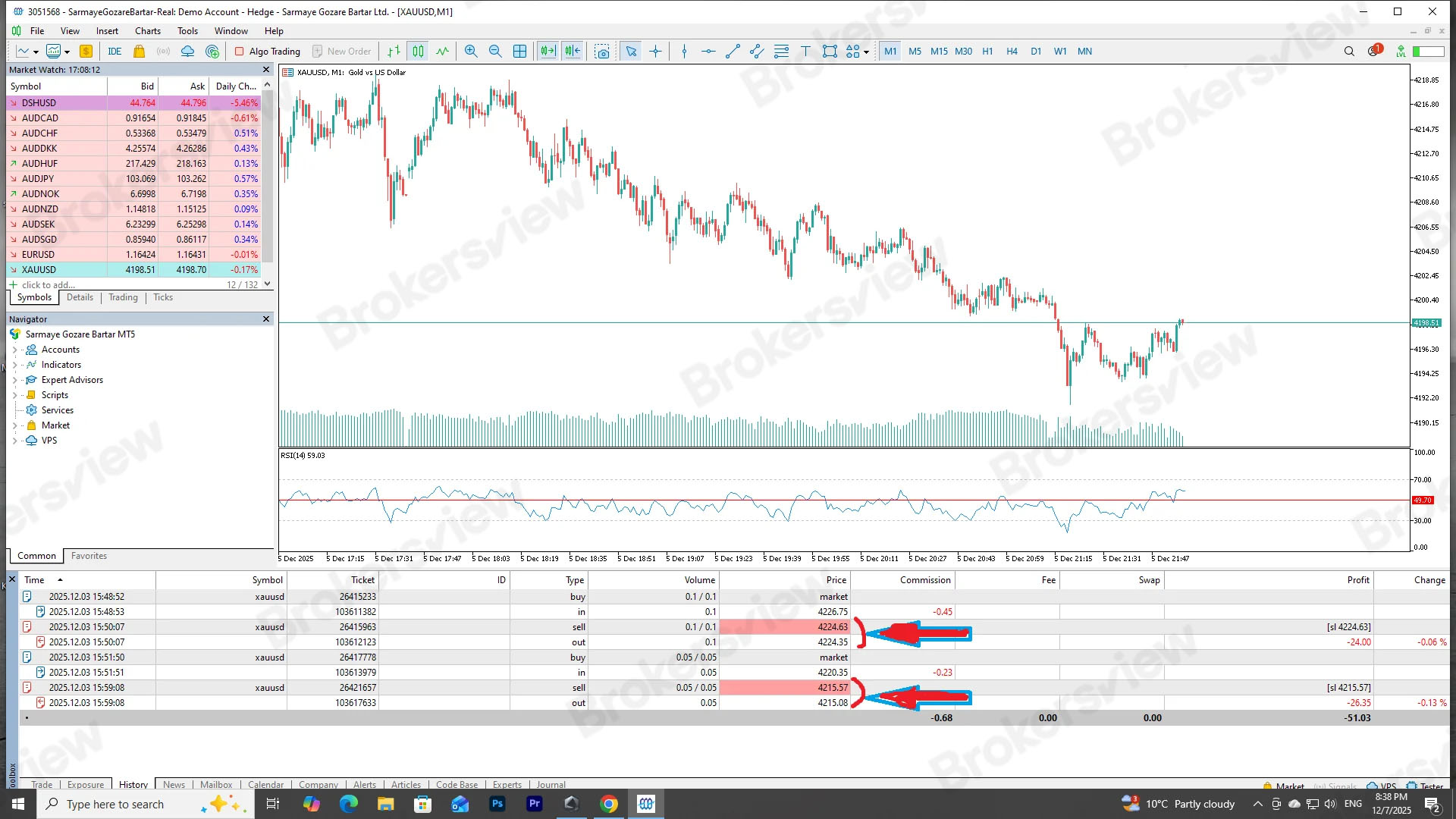

According to the trader's account, they executed multiple operations on XAUUSD (Gold) during that day's session. In the first trade, the expected execution price was approximately 4226.75, but the system's final executed price was 4224.63. This resulted in a slippage of about 21 pips (or $2.1 per ounce) without any visible price gapping.

While the first instance might be tentatively attributed to a momentary liquidity drain, the subsequent second trade completely shattered that assumption. The trader reported that their second order was expected to fill near 4220.35 but was executed at 4215.57. This time, the slippage reached an astonishing 47 pips (about $4.7 per ounce). Both transactions occurred within seconds, yet the candlestick charts showed a calm market where spreads should have been standard.

The Firm's Response: Refusal to Acknowledge, Refusal to be Transparent

Faced with abnormal capital loss, the trader immediately gathered MT5 execution logs, price charts from the same timeframe, and order history screenshots to file a complaint with SGB. The user not only pointed out the irrationality of the slippage but also compared quotes from other brokers at the same time, proving there was no market-wide price jump.

However, SGB's reply was disappointing. The company refused to admit to any execution issues. Suspiciously, when the trader demanded that the firm provide server-side execution logs or Liquidity Provider (LP) data to explain the source of the discrepancy, SGB refused. This lack of transparent handling suggests that the alleged "technical fault" looks more like deliberate "profit harvesting."

The "Shadow" Registered in Saint Lucia

BrokersView found that the proprietary firm, Sarmaye Gozare Bartar Ltd., is registered as an International Business Company (IBC) in Saint Lucia (Registration No. 2025-00343), with its registered address at the Rodney Court Building, Gros-Islet.

It is important to note that IBC registration in Saint Lucia does not grant a regulated financial services license. For a prop firm managing trader funds and evaluations, the lack of endorsement from an authoritative regulator and the refusal to provide underlying data during a dispute represent a significant risk signal.

BrokersView Reminds You

While slippage is inherent to trading, "abnormal slippage" is often a signal of manipulation by the firm. BrokersView advises traders, when choosing a prop trading platform, to test the execution environment thoroughly. Should you discover similar "ghost slippage," immediately cease trading and preserve all evidence. If you have experienced a similar incident, you are welcome to submit a complaint to BrokersView.