OpoFinance Forces Liquidation to Protect Infrastructure in 900,000-Trade Dispute

Currently, many traders utilize automated programs to some extent, as "passive income" remains the ultimate dream of quantitative trading. Recently, an Iranian trader deployed an Expert Advisor (EA) on the OpoFinance platform, only to find himself embroiled in a fierce dispute over "infrastructure protection" versus "legitimate trading," rather than reaping the expected profits.

According to the complaint submitted to BrokersView, the incident occurred on December 12, 2025. To capture market fluctuations while offline, the trader deployed a high-frequency trading robot. Based on his understanding, OpoFinance did not prohibit the use of EA tools. However, when he checked his accounts again, he discovered that two of his accounts had been forcibly liquidated.

Account opening notification sent to the user by OpoFinance

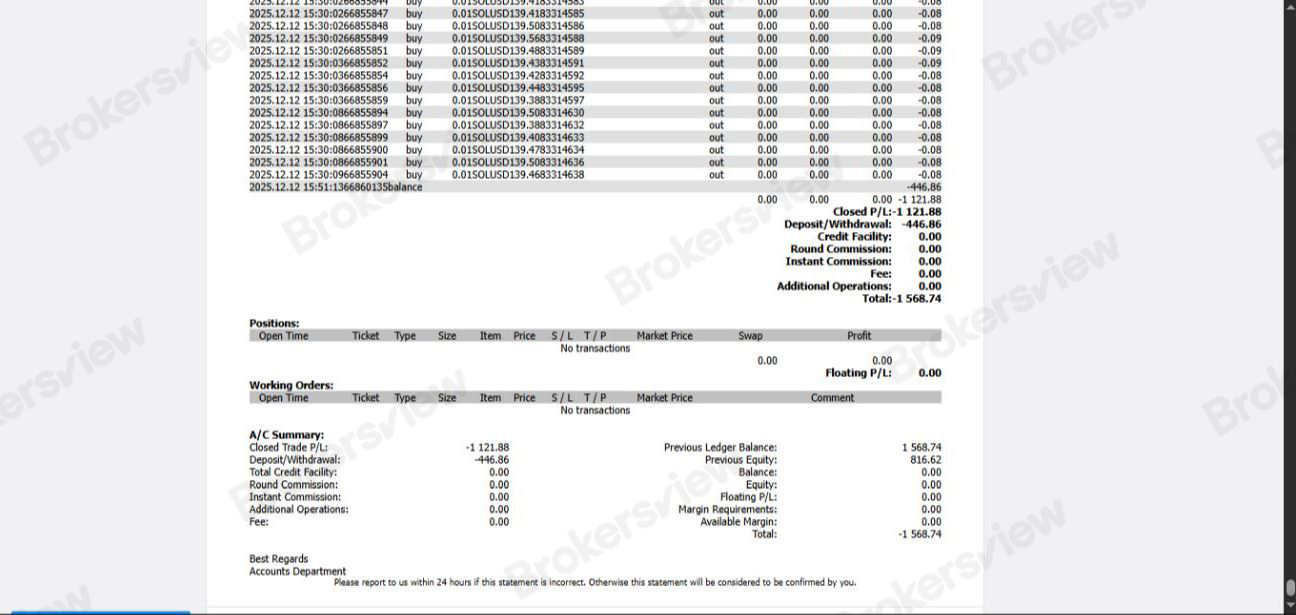

The trader claims that this unannounced action resulted in a direct loss of approximately $2,300, excluding potential profits that could have been realized had the positions remained open. He noted that while the broker claimed to have sent notification emails to two other accounts, the two core accounts that suffered the losses received no prior warning. From his perspective, these liquidations were illogical and directly deprived him of the chance to wait for a market reversal.

Due to local conditions in Iran, the country experienced large-scale internet outages over the past two to three weeks. It was only after his connection was restored that he was able to submit this complaint, at which point he discovered his accounts appeared to have been completely deleted by the platform.

Account statement provided by the user

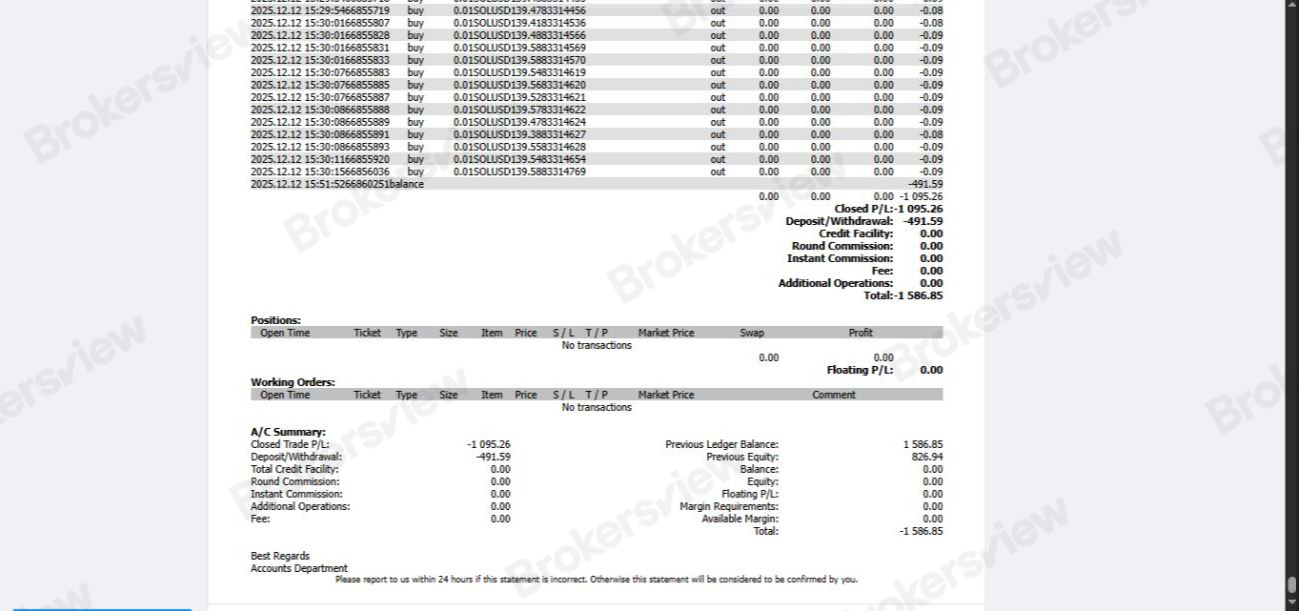

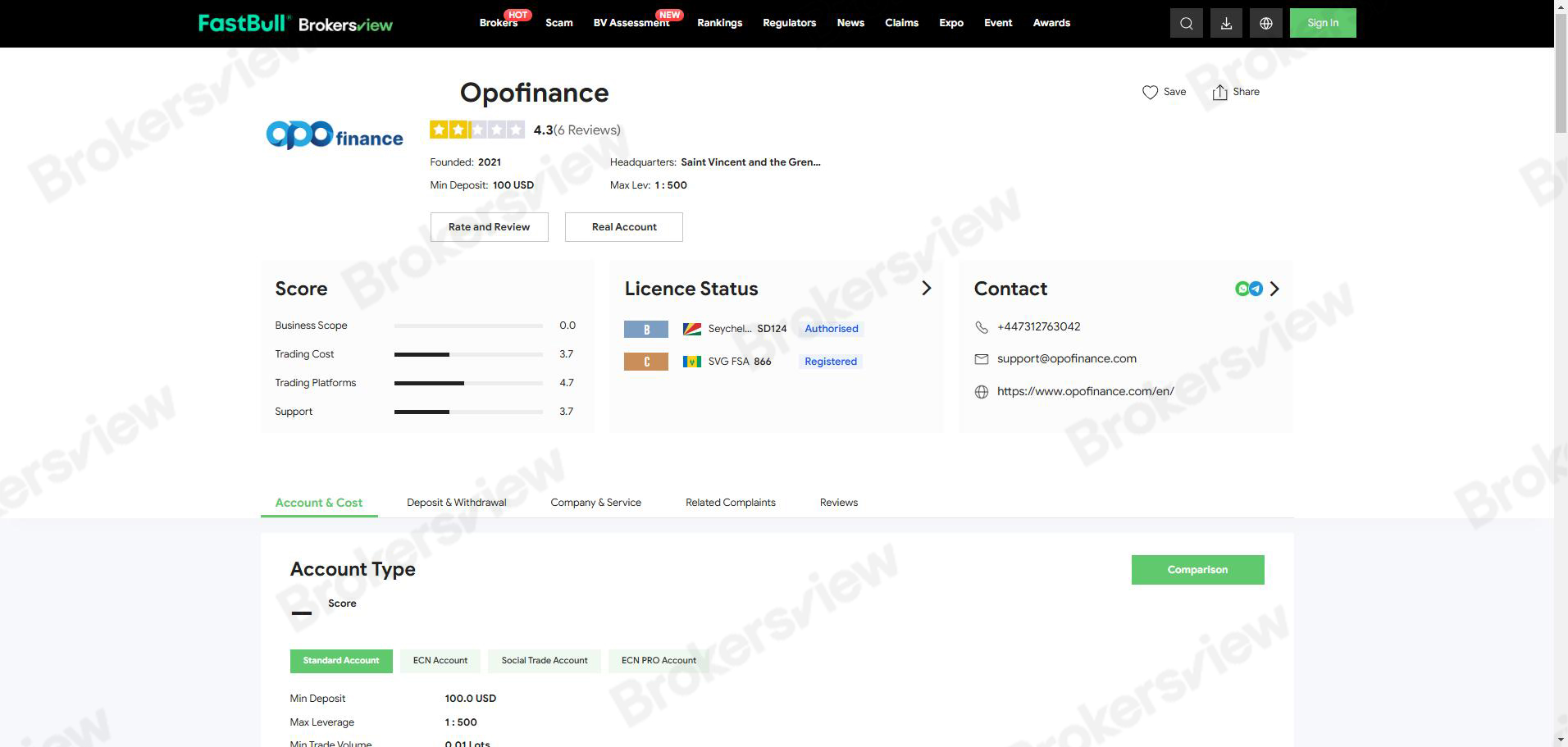

The core of this dispute lies in the definition of "High-Frequency Trading" (HFT). The trader also provided screenshots of a ruling email from the Financial Commission (FinCom), a third-party dispute resolution organization.

FinCom's investigation documents show that OpoFinance alleged the client's trading behavior posed a threat to the platform. Data revealed that the user's EA executed over 900,000 trades in a short period, primarily concentrated on the SOL/USD pair with minimal lot sizes (0.01 lots). The broker argued that such extreme high-frequency activity was not normal investment behavior but rather an "intentional circumvention" designed to exploit system characteristics, avoid commissions, or abuse pricing mechanisms.

Consequently, OpoFinance intervened under the guise of "protecting infrastructure." FinCom accepted the broker's evidence and, citing Rule 16.1, dismissed the client's claim, stating the complaint lacked substance or was pursued for an improper purpose. Nevertheless, the documents indicate that the client eventually received a remaining balance of approximately $1,015.50.

Email from the Financial Commission, dismissing the complaint due to alleged abuse of high-frequency strategies

The trader does not accept this ruling. He questioned the impartiality of FinCom, claiming they merely took the broker's word at face value and ceased responding to his emails after he objected to the decision.

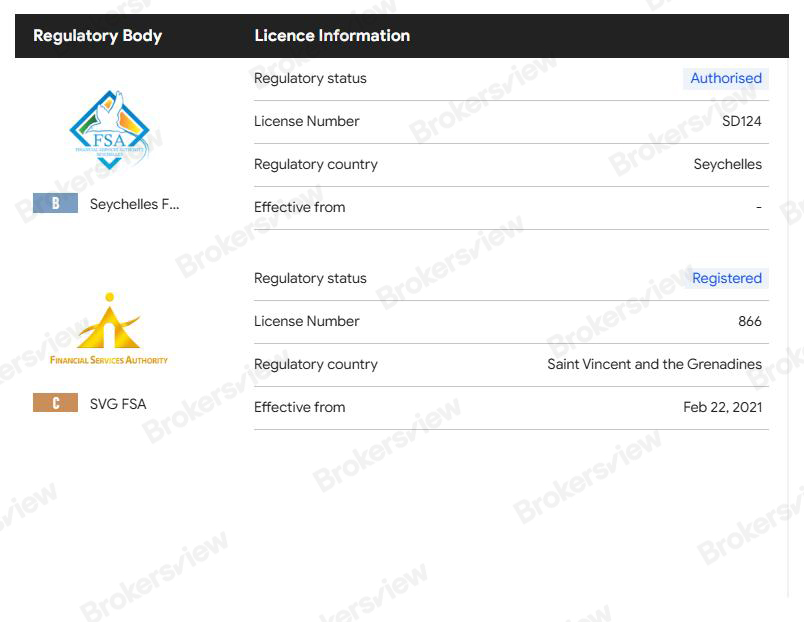

Regarding regulatory compliance, BrokersView's review page shows that OpoFinance holds a Seychelles FSA license and is registered in Saint Vincent and the Grenadines (SVG FSA).

As of now, OpoFinance has not issued a direct response to this specific complaint received by BrokersView. The specific reasons for account deletion and technical details remain to be further verified.

BrokersView Reminds You

High-Frequency Trading (HFT) and scalping strategies often exist in a regulatory gray area within the retail forex market. Even if a platform claims to support EAs, user agreements typically include restrictions on server request frequency (Server Load). Short-term trading involving hundreds of thousands of orders can easily trigger a platform's risk management system.

Before using automated strategies, it is recommended to read the platform's execution policies thoroughly and regularly back up your trading logs to prevent the loss of evidence should an account be frozen.

If you are in a dispute with a broker, you may submit a complaint to BrokersView, and we will assist you in monitoring the progress of the situation.