OctaFX Faces Client Outrage Over Widespread Withdrawal Failures After Ponzi Allegations by India's ED

Since early this year, when India’s Enforcement Directorate (ED) accused OctaFX of running a Ponzi scheme and defrauding Indian investors of ₹8 billion, complaints against OctaFX have continued to surface for over half a year.

Recently, several more investors have reported serious problems when trying to withdraw funds from the OctaFX platform. Withdrawals are delayed, and customer service keeps making excuses, leading investors to suspect intentional delays or even risks to fund safety.

Investors Face Endless Waiting for Withdrawals

One investor shared that on August 14, he submitted a $600 withdrawal request on OctaFX. The request remained “pending” for a long time, and the platform later asked him to submit a bank statement to verify deposit details. Although the investor provided the required documents, OctaFX customer service never explained how long the review would take and eventually stopped responding, leaving the withdrawal unresolved.

Another investor reported that since August 15, his $320 withdrawal has also remained “pending.” Each time contacting customer service, he was told, “The finance team is checking.” On August 18, the platform claimed that there was an issue with withdrawing via Visa, but failed to provide a clear solution.

This investor said, “Almost every withdrawal runs into problems. The experience is terrible.”

Withdrawal delays, unreachable customer service, and various excuses have led investors to question whether OctaFX is deliberately delaying the withdrawal process, possibly posing risks to fund security.

Behind Octa’s Licenses: Under Which Entity Are Client Accounts Held?

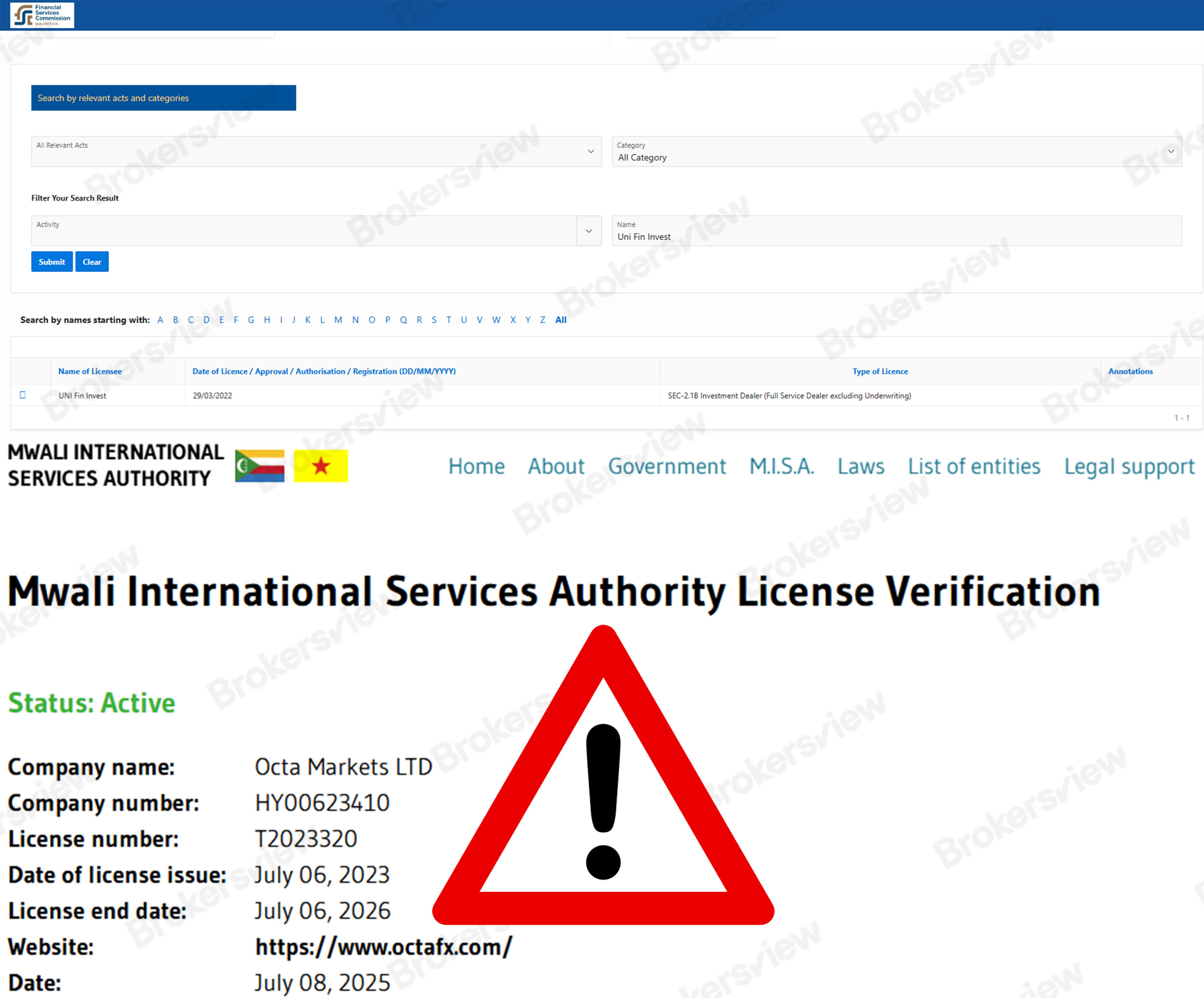

A deeper investigation reveals that Octa’s operating structure is chaotic. According to its official website (https://www.octafx.com/), Octa is jointly operated by Uni Fin Invest (Mauritius) and Octa Markets LTD. Uni Fin Invest holds an offshore license from the Mauritius Financial Services Commission (FSC), which offers limited regulatory oversight, and its domain remains unverified; Octa Markets LTD is registered in Comoros and holds a license (T2023320) issued by the Mwali International Services Authority (MISA), but MISA’s licensing effectiveness is widely questioned internationally. Frustratingly, most accounts for Asian and African investors are opened under these two entities.

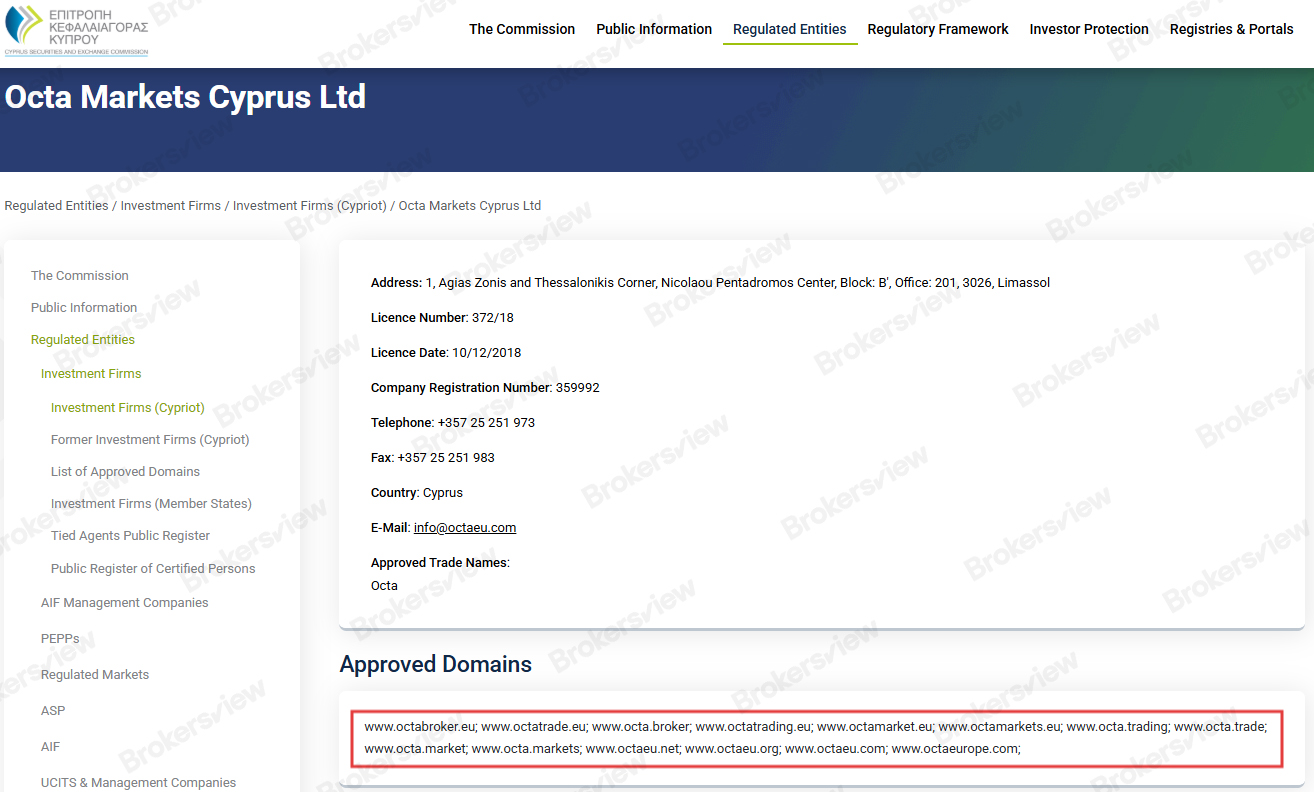

Octa’s Cyprus-based entity, Octa Markets Cyprus Ltd, is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), with license number 372/18, which only allows serving EU clients. The entity’s list of approved domains does not include https://www.octafx.com/.

Regulatory Warnings

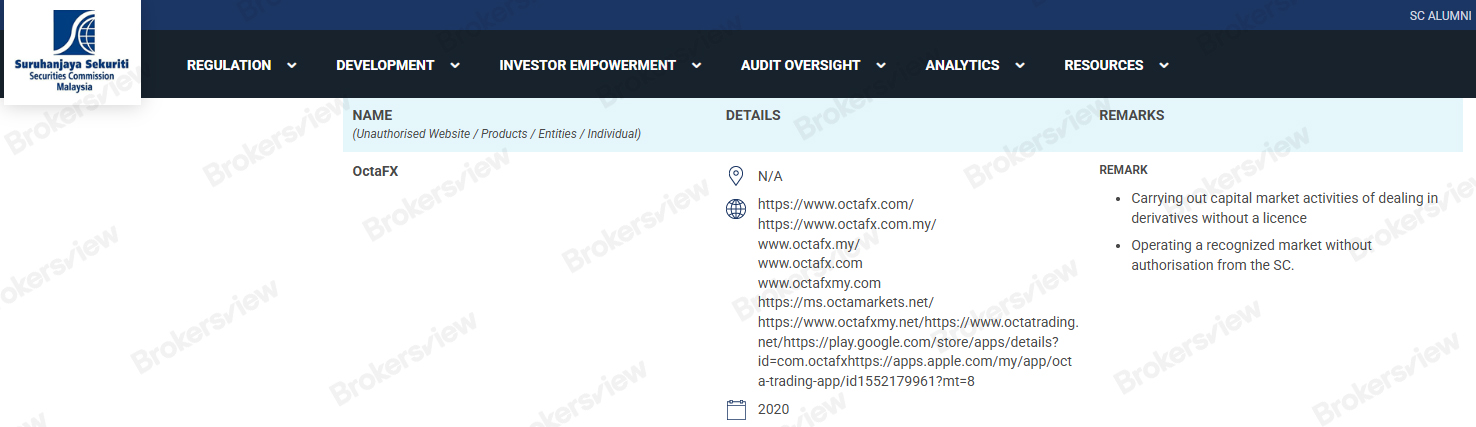

In 2020, the Securities Commission Malaysia (SC) placed OctaFX (www.octafx.com) on its investor alert list for unauthorized operations.

In June this year, the Monetary Authority of Singapore (MAS) directly blocked the unregulated Octa platform, clearly stating that its Comoros and Mauritius entities had not obtained any licenses recognized in Singapore and were operating illegally.

This incident highlights major flaws in OctaFX’s withdrawal processes. Investors are advised to choose platforms carefully and always verify regulatory status before investing.

We’ll keep tracking the development of this case—stay tuned for updates.

Updates:

OctaFX and the second investor have reached a mutual agreement, resolving the withdrawal dispute.

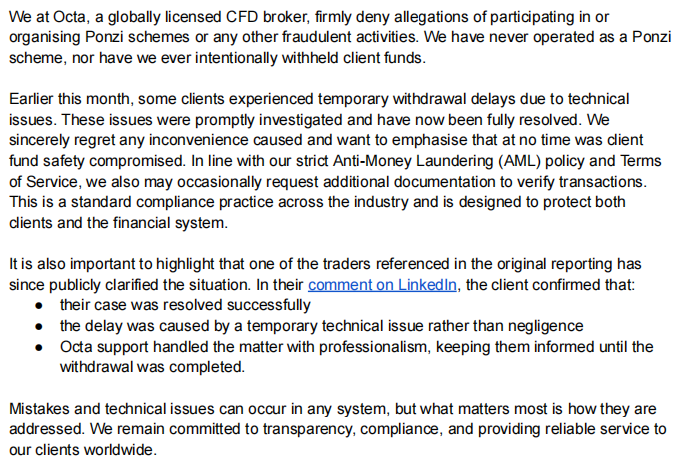

OctaFX's statement reads as follows:

If you've fallen victim to financial scams or faced potential fraudulent practices or misconduct by your brokers, reach out to us through Submit a Complaint. The BrokersView team is dedicated to exposing scams, raising investor awareness, and assisting with dispute resolution between traders and brokers free of charge.