GMI Misses Its Own Deadline Leaving Client Funds Hostage in PTK Wallets

As we enter February 2026, the January 31st final withdrawal deadline set by the broker GMI has officially passed. For investors who once believed this long-standing broker would make a "graceful exit," reality has instead devolved into a grueling tug-of-war over their money. Despite GMI’s repeated assurances in its exit announcement to "do its utmost to process withdrawals," a significant volume of funds remains trapped in the wallets of a third-party partner known as PTK.

The timeline for this departure began on December 17, 2025, when the broker—which had been in operation since 2009—announced it would gradually discontinue its global Forex trading services due to the founder's retirement and the lack of a reliable successor. According to the schedule released at that time, all positions were to be forcibly liquidated by December 31, with January 31, 2026, established as the "final deadline" for clients to withdraw their funds.

Initially, GMI was regarded as a model of corporate responsibility after it reportedly rejected acquisition offers from entities with questionable risk profiles. However, as the January 31 deadline fades into the rearview mirror, the true quality of that "responsibility" is being called into question.

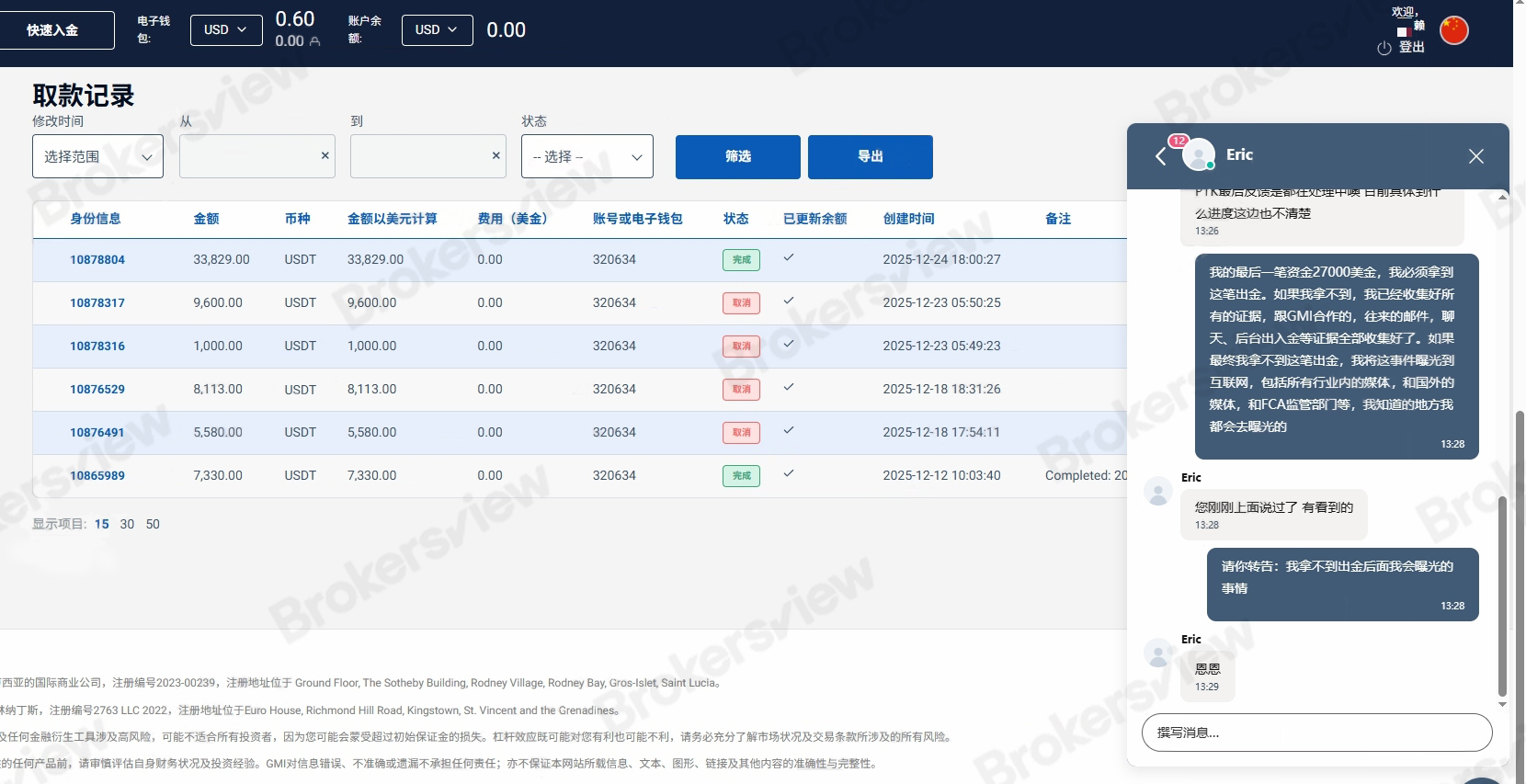

One investor from China reported that as of February 4, his withdrawal application for $27,000 had been pending for nearly 50 days. On January 30—just one day before the final deadline—the last response he received was a hollow, templated statement: "The funds have been transferred to the PTK wallet and require processing by PTK; the PTK wallet is currently under maintenance."

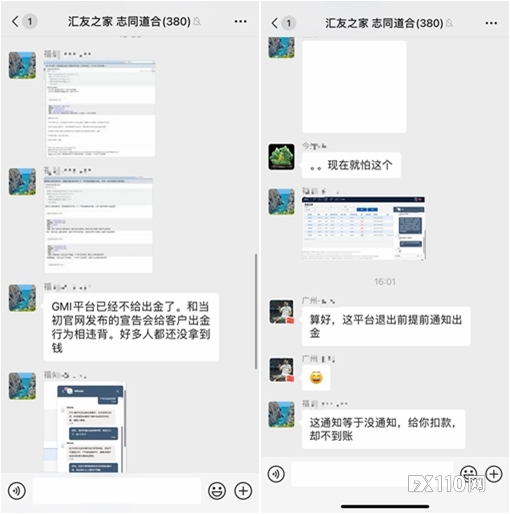

In February, the situation took a turn for the worse. Although GMI’s official website remains accessible, its live chat system has been disabled, and inquiries sent via email have vanished into a void. As for PTK, the entity allegedly "under maintenance," it has failed to respond to a single email desde the beginning of this crisis.

The crux of the current deadlock lies in the blurred lines of responsibility between GMI and its third-party payment processor, PTK. GMI attributes the non-arrival of funds to PTK’s "wallet maintenance," yet for the investors, their contractual agreement is with the broker, not the payment channel.

It is noteworthy that throughout the process of shutting down its global retail operations, GMI has not clarified whether it will simultaneously surrender its licenses from the UK’s FCA and Mauritius, or if it intends to sell them to another entity. Given that GMI involves entities across multiple jurisdictions—including the UK, St. Vincent and the Grenadines, and St. Lucia—this complex structure is now serving as a significant hurdle for investors seeking legal recourse.

To date, GMI has issued no official public statement regarding the unresolved funding issues following the January 31 deadline, nor has it provided a clear solution or a new timeline. For the investors caught in the middle, every minute of waiting is accompanied by the mounting anxiety of watching their assets slip away.

BrokersView Reminds You

The moment a broker announces its exit from the market is often when risks are most concentrated. If you still have funds stagnant on the GMI platform, you may submit a complaint to BrokersView. We will assist you in monitoring the subsequent developments of this case.