Fined $600,000 by NFA! OANDA Charged with Multiple Regulatory Violations

The U.S. National Futures Association (NFA) has imposed a $600,000 fine on OANDA Corporation, a New York-based retail forex broker, citing multiple regulatory breaches. The firm has also been ordered to compensate affected customers.

The penalty follows a formal complaint filed by the NFA’s Business Conduct Committee (BCC), alleging serious misconduct, including poor capital management, system failures impacting customers, incorrect margin calculations, and misleading promotional material.

OANDA faced the following charges:

- Failure to increase net capital by 10% of all liabilities owed to an eligible contract participant counterparty

- Improperly offsetting the foreign currency exposure on transactions executed with an affiliate to determine net capital positions and required capital deductions

- Failure to collect required security deposits from an affiliate on its forex transactions with the firm, which resulted in OANDA failing to maintain minimum net capital.

- Failure to collect the correct security deposits from customers for certain transactions

- Failing to observe just and equitable principles due to a pricing display issue that affected certain customers

- Using deficient promotional material and failing to supervise

OANDA neither admitted nor denied the allegations in the complaint, but the BCC determined that the firm violated multiple regulatory requirements.

Along with the $600,000 monetary fine, the BCC also ordered OANDA to pay restitution to certain customers. OANDA must pay the fine within 30 days and complete customer restitution within 45 days.

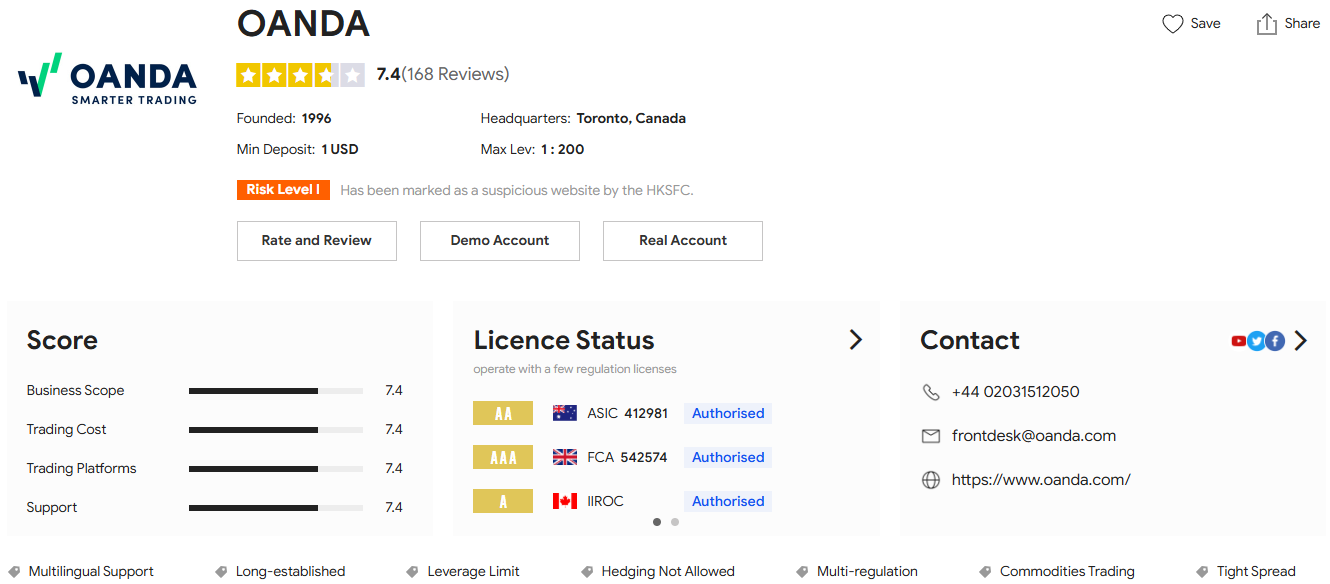

As reported by BrokersView, CVC Capital Partners put OANDA Global Corporation up for sale in July 2024. The firm was later sold to FTMO Group, with the deal announced in February 2025.