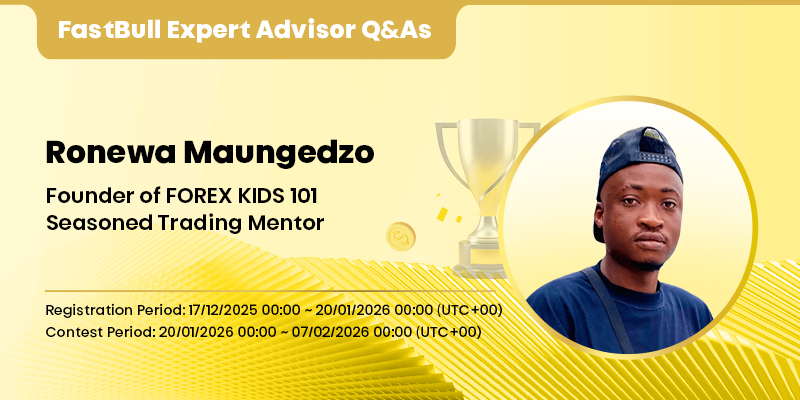

FastBull Expert Advisor Q&As | Ronewa Maungedzo: The Art of Structure, Patience, and Sustainable Profitability

The 2026 FastBull GOLD Global S1 Gold Short-Term Trading Competition is about to officially launch, and the eyes of traders worldwide are focused on the upcoming showdown in the gold market. To help participants stand out in this fierce competition, FastBull has invited members of our Expert Advisor panel for exclusive in-depth interviews.

Today, we are joined by Ronewa Maungedzo, the founder of FOREX KIDS 101 and a seasoned trading mentor. Renowned for his signature RSS & SRR X-Setup strategy, Ronewa joins us to share how to achieve consistent profitability by utilizing price action analysis and disciplined market structure thinking within a high-pressure, short-term competitive environment.

Q1: Welcome, Ronewa! As an Expert Advisor for this contest, what do you believe is the primary value that trading competitions offer to traders?

Ronewa: Trading competitions provide a unique environment where discipline, execution quality, and emotional control are tested under real pressure. Unlike casual trading, a competition forces traders to operate with accountability, consistency, and time constraints. The true value lies in exposing weaknesses—whether psychological, technical, or risk-related—while also sharpening decision-making. For serious traders, competitions accelerate growth by simulating professional conditions where performance must be repeatable, not accidental.

Q2: This contest uses standardized account parameters and is limited to XAUUSD. What is the significance of such a highly consistent environment for testing trading abilities?

Ronewa: A standardized environment removes external variables and excuses. When every participant trades the same instrument under identical account conditions, performance is driven purely by skill, structure, and discipline. Gold is an ideal benchmark instrument because it is highly liquid, technically expressive, and sensitive to macro sentiment. This setup reveals who truly understands market behavior versus who relies on over-optimization or favorable conditions.

Q3: In a competition setting, how should traders balance entry frequency, position sizing, and drawdown management?

Ronewa: Balance starts with accepting that not every moment is a trading opportunity. Entry frequency must be dictated by clarity, not boredom. Position sizing should always be a function of invalidation (stop-loss levels), not confidence. In my view, drawdown management is the cornerstone—once drawdown exceeds control, decision quality deteriorates rapidly. In competition trading, survival and consistency outperform aggression. Traders who protect capital create more opportunities than those who chase performance.

Q4: Your system emphasizes structure and consistency. What advantages does a market-structure-based system offer in a competition?

Ronewa: Market structure provides context. It tells you where you are in the auction process—whether price is expanding, correcting, or rebalancing. In a competitive setting, this clarity is invaluable because it filters noise and prevents impulsive trades. A structure-based system allows traders to operate with precision, align entries with higher-probability zones, and maintain consistency regardless of short-term volatility.

Q5: Is patience still crucial in a short-term trading contest? How would you define "patience"?

Ronewa: Absolutely. Patience in this context does not mean inactivity—it means restraint. It is the ability to wait for price to reach areas of interest, to allow setups to fully form, and to avoid forcing trades due to time pressure. Short-term trading rewards those who act decisively only when conditions align. Patience is what separates calculated execution from emotional reaction.

Q6: How can young and aspiring traders develop an intuition for "sustainable profitability" during an 18-day short-term contest?

Ronewa: Sustainable profitability begins with understanding process over outcome. Young traders must learn to judge success based on rule adherence, not short-term gains. Keeping detailed trade journals, reviewing losses objectively, and limiting exposure during uncertainty all help build intuition. Over time, intuition becomes refined pattern recognition grounded in experience—not guesswork or impulse.

Q7: If you were to evaluate a trader's sustainability, what behavioral traits would you focus on most?

Ronewa: The most important traits are emotional neutrality, consistency, and accountability. Sustainable traders do not overreact to wins or losses. They follow predefined rules, respect risk, and accept uncertainty without forcing outcomes. They also review their own behavior honestly. A trader who can pause, reassess, and adapt without abandoning structure has a high probability of long-term success.

Q8: For trades held longer than 60 seconds on Gold, what win-rate optimization advice do you have using your X-Setup strategy?

Ronewa: The X-Setup performs best when aligned with higher-timeframe structure and executed with precise timing. Traders should focus on entering at areas of liquidity convergence—such as key support or resistance shifts—rather than chasing momentum. Confirmation through displacement, rejection, or volume imbalance significantly improves win rates. Most importantly, invalidation must be clearly defined before entry. When risk is tightly controlled and entries are structure-based, holding trades beyond 60 seconds becomes a strategic decision rather than a psychological burden.

Ready to test your trading workflow? Registration for 2026 FastBull GOLD Global S1 is closing soon! Contest starts Jan 20!