CPT Markets Blocks Withdrawal Over Alleged 'Illegal Transaction,' Prompting Client Dissatisfaction

This week, a CPT Markets client voiced dissatisfaction over blocked withdrawals. The client's withdrawal request was denied, with the platform alleging illegal transactions in his account.

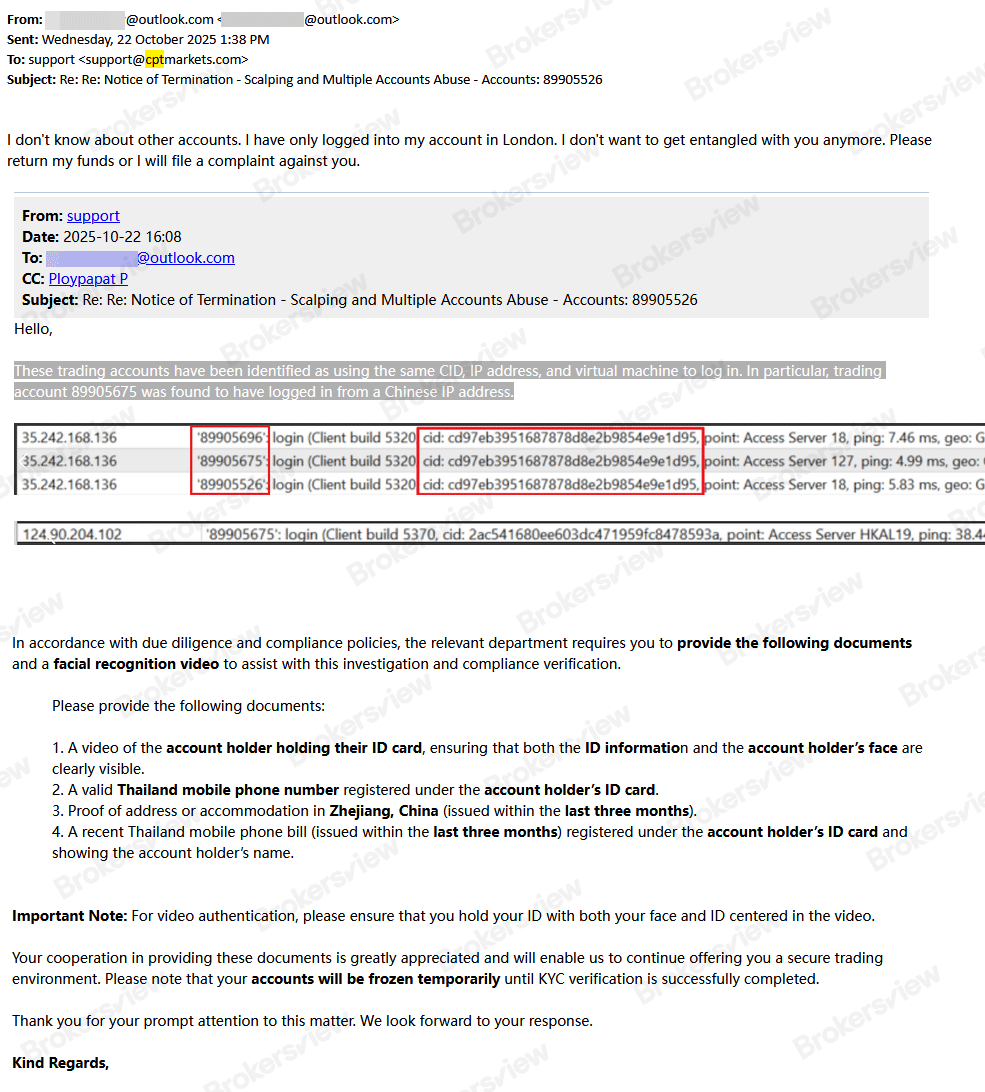

Following the withdrawal denial, CPT Markets' customer service emailed the client a screenshot indicating that trading accounts 89905696, 89905675, and 89905526 had used the same CID, IP addresses, and virtual machine during login. Additionally, the platform noted that the account used by the complainant—89905526—had logged in via a Chinese IP address.

CPT Markets stated that, in order to comply with due diligence and compliance policies, the client must complete the “Know Your Customer” (KYC) verification process. This includes submitting a facial recognition video and providing documents such as:

- Proof of address in Zhejiang Province, China, issued within the past three months

- A valid Thai mobile number registered under the account holder's name

- Recent phone bills for that number, issued within the last three months

The broker further reminded that funds in the client's account would be “frozen temporarily” until KYC verification is completed.

In response to CPT Markets' allegations and requirements, the client firmly stated that he has no idea about the other two accounts and claimed he has never traveled to China, asserting that he has only accessed his account from London, UK. He questions the broker's evidence, stating, “They didn't provide specific evidence, only showed a screenshot that I don't know what it was, and accused my account of illegal transactions.”

He said, “I don't want to get entangled with you anymore. Please return my funds immediately, or I will file a complaint against you.”

The BrokersView team has forwarded the client's complaint to CPT Markets. However, as of the publication of this article, the broker has not responded.

BrokersView reminds you

CPT Markets is regulated by financial watchdogs, including the UK Financial Conduct Authority (FCA) and the Belize Financial Services Commission (FSC).

Investors are advised to verify a broker's regulatory status through BrokersView before trading to avoid unnecessary risks.