BrokersView Swap Rates Cost Comparison: Which Brokers Are the Cheapest & Most Expensive in May 2025?

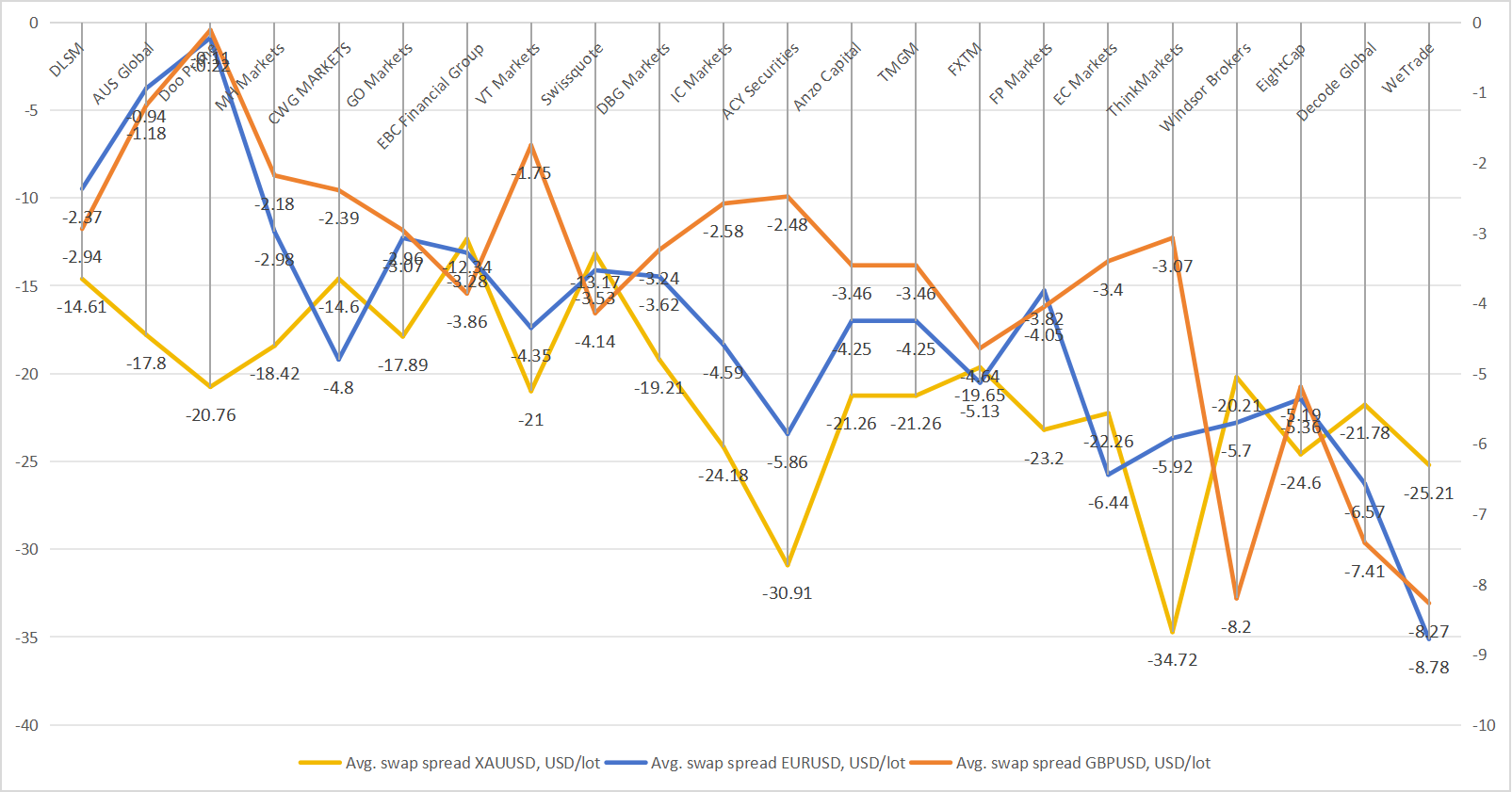

Swap spreads are influenced by a variety of factors, including interest rate differentials, market liquidity, and broker policies. In this comparison, we examine the average swap spreads for EURUSD, GBPUSD, and XAUUSD across several well-known forex brokers. This will help traders make informed decisions based on cost-effectiveness and the specific swap rates offered by each broker.

Top Performers for Swap Efficiency

1. DLSM

EURUSD: -2.37

GBPUSD: -2.94

XAUUSD: -14.61

DLSM offers relatively moderate swap rates across these pairs. The rates for EURUSD and GBPUSD are fairly competitive compared to some brokers, but the swap for XAUUSD is higher, which could be a consideration for traders dealing in XAUUSD.

2. AUS Global

EURUSD: -0.94

GBPUSD: -1.18

XAUUSD: -17.8

AUS Global provides favorable swap spreads for forex traders, particularly on EUR/USD and GBP/USD, though its gold swap costs are mid-range.

3. Doo Prime

EURUSD: -0.22

GBPUSD: -0.11

XAUUSD: -20.76

Doo Prime offers the lowest swap rates for major forex pairs, making it an excellent choice for traders who frequently hold EUR/USD and GBP/USD positions overnight. However, its gold swap rates are less competitive.

Avg Swap Rate Analysis for EUR/USD, GBP/USD, and XAU/USD

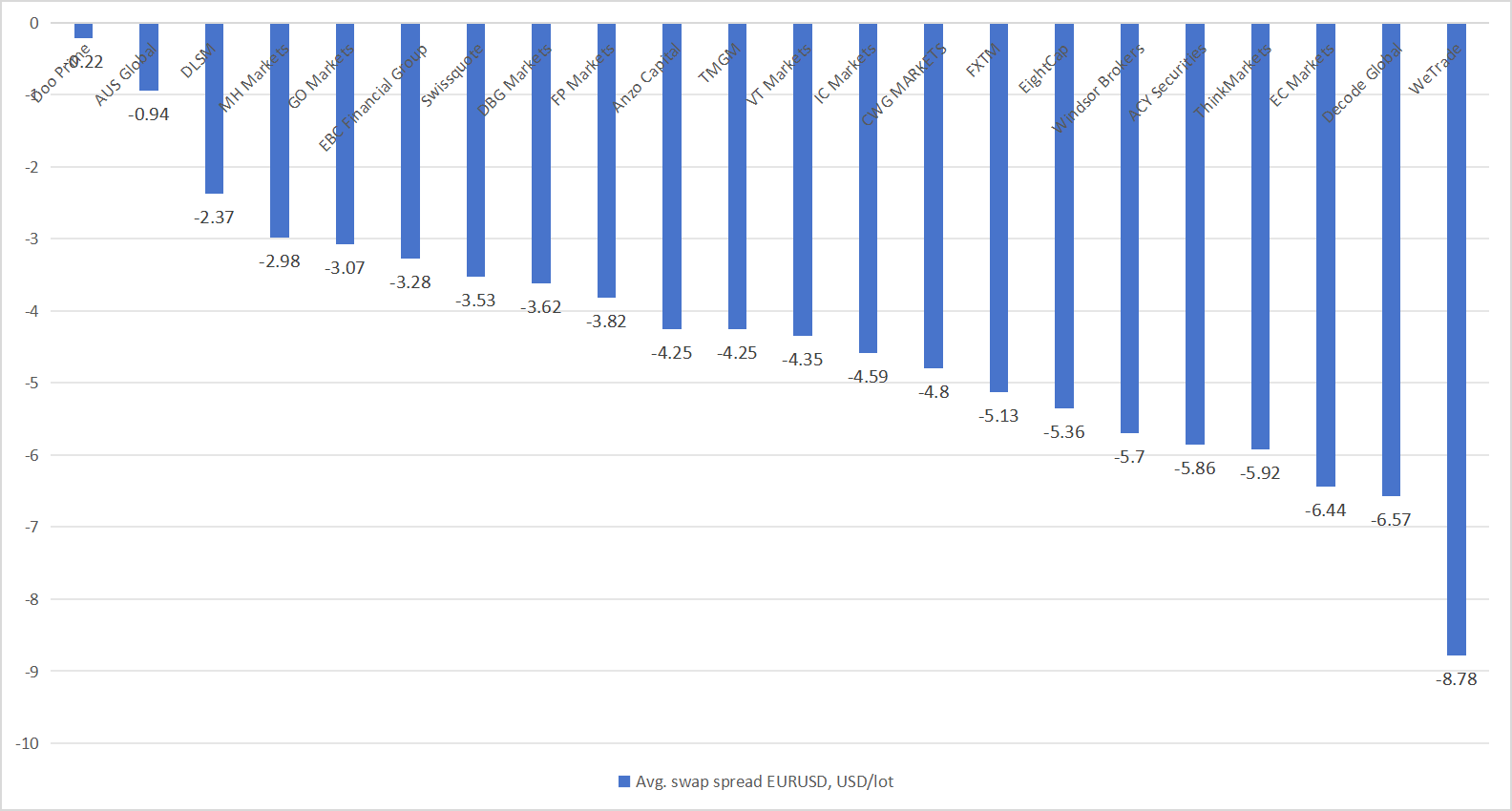

EUR/USD Avg Swap Rate Analysis

- Doo Prime: -0.22 USD/lot

- AUS Global: -0.94 USD/lot

- DLSM: -2.37 USD/lot

- MH Markets: -2.98 USD/lot

- GO Markets: -3.07 USD/lot

Worst performers: EC Markets: -6.44 USD/lot, Decode Global: -6.57 USD/lot, and WeTrade: -8.78 USD/lot.

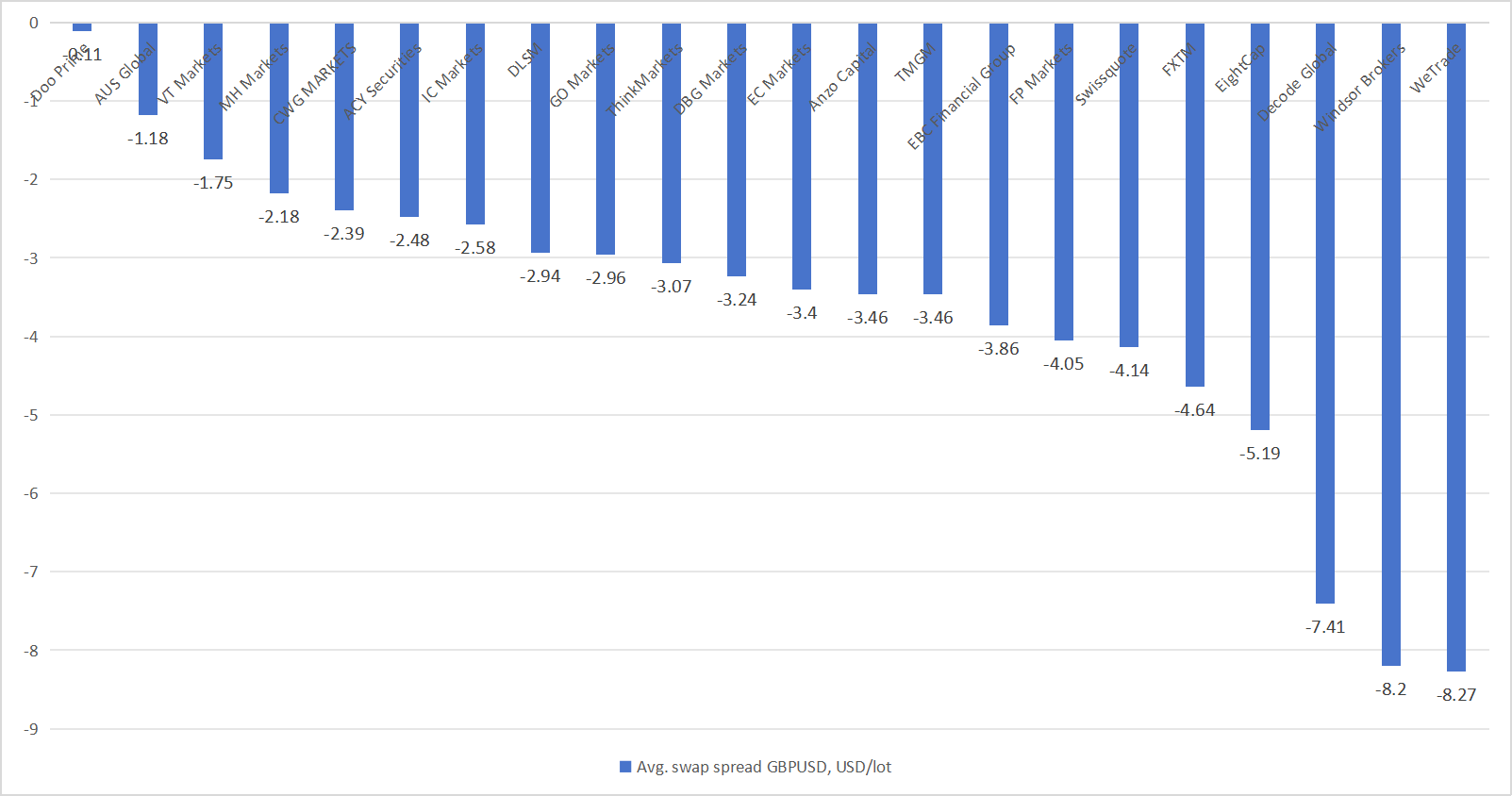

GBP/USD Avg Swap Rate Analysis

- Doo Prime: -0.11 USD/lot

- AUS Global: -1.18 USD/lot

- VT Markets: -1.75 USD/lot

- MH Markets: -2.18 USD/lot

- ACY Securities: -2.48 USD/lot

Worst performers: FXTM: -4.64 USD/lot, Windsor Brokers: -8.2 USD/lot, and WeTrade: -8.27 USD/lot.

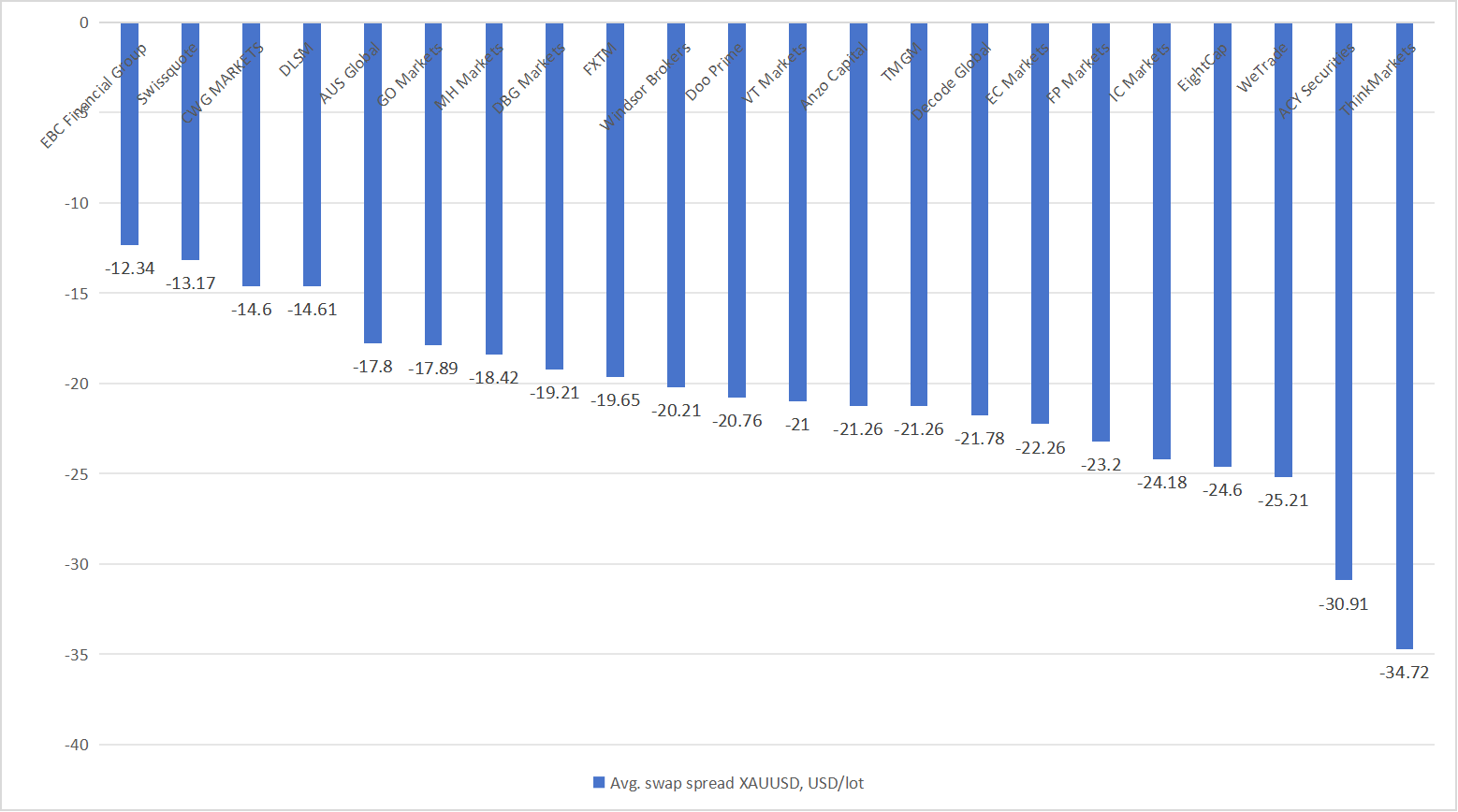

XAU/USD Avg Swap Rate Analysis

- EBC Financial Group: -12.34 USD/lot

- Swissquote: -13.17 USD/lot

- CWG MARKETS: -14.6 USD/lot

- DLSM: -14.61 USD/lot

- AUS Global: -17.8 USD/lot

EBC Financial Group provides the best rates, while ThinkMarkets and ACY Securities charge significantly more.

Conclusion:

When selecting a forex broker, the swap spread should be a key consideration, especially for traders who hold positions overnight or trade in volatile assets like gold. Brokers like Doo Prime and AUS Global offer some of the lowest swap spreads, while others such as ACY Securities impose higher costs that can add up over time. Understanding these charges is crucial to minimizing costs and maximizing profitability in the long run.

For more comprehensive evaluation data, please check the BV evaluation column.