Brokersview September 2025 Swap Rates Review: Are You Overpaying on Fees?

For traders who hold positions overnight, understanding swap rates is crucial. These fees can either be a small cost that eats into profits or a minor source of income, depending on your position and the interest rate differentials of the currencies involved.

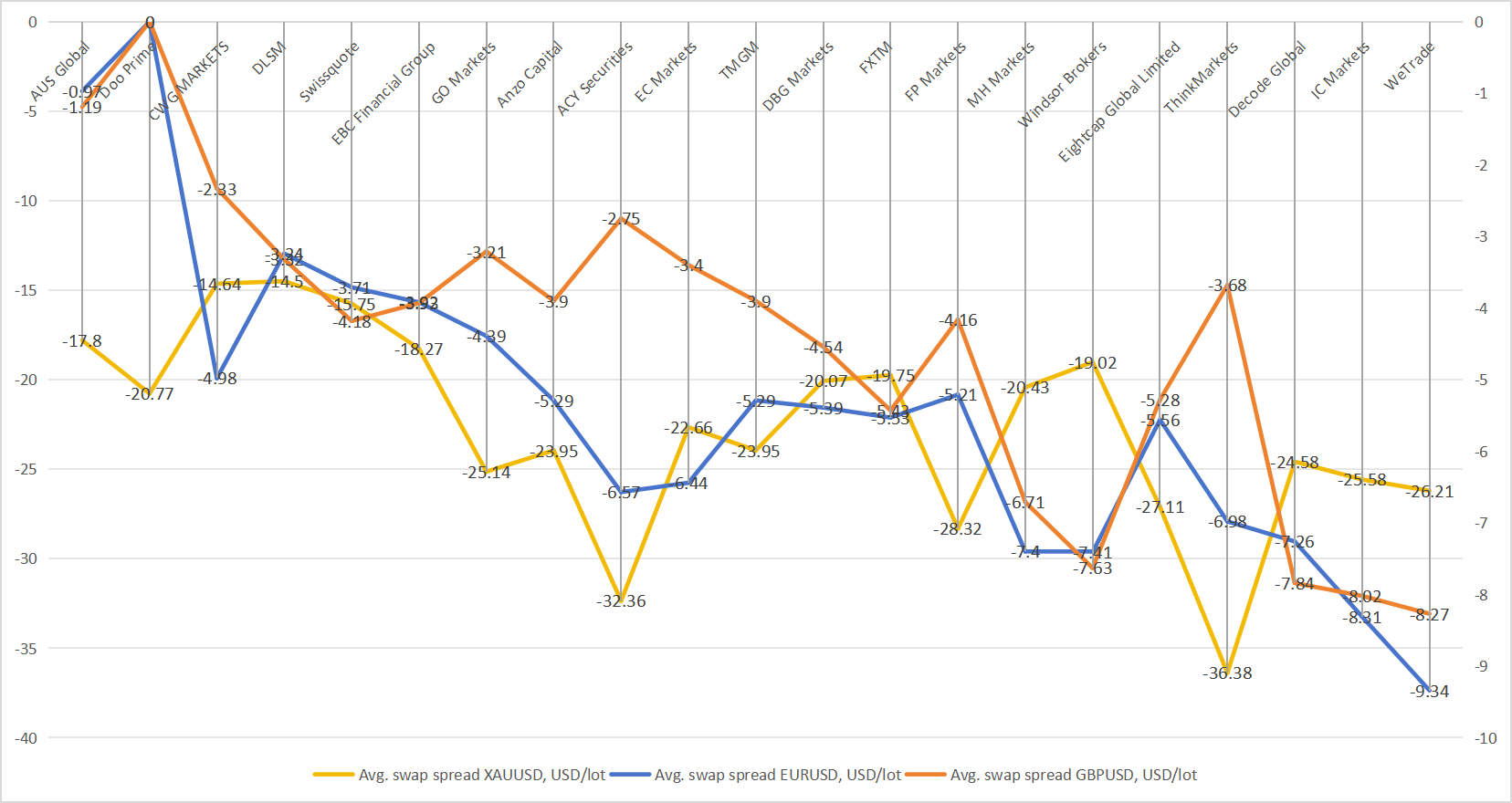

In September, swap rates continued to play a crucial role in determining traders’ overall profitability. After analyzing the average swap spreads across major Forex pairs and gold (EUR/USD, GBP/USD, and XAU/USD), three brokers stood out for offering the most competitive and trader-friendly conditions: AUS Global, Doo Prime, and CWG Markets.

1. AUS Global

EUR/USD: -0.97 USD/lot

GBP/USD: -1.19 USD/lot

XAU/USD: -17.8 USD/lot

AUS Global tops the list for maintaining low and consistent swap charges across all instruments. Its EUR/USD and GBP/USD swaps remain among the lowest in the market, providing cost efficiency for both short-term and swing traders. Even for XAU/USD, AUS Global offers a relatively moderate overnight cost compared to the broader market average.

2. Doo Prime

EUR/USD: 0 USD/lot

GBP/USD: 0 USD/lot

XAU/USD: -20.77 USD/lot

Doo Prime secures the second spot with its zero-swap policy on EUR/USD and GBP/USD—an excellent advantage for traders holding currency positions over multiple days.

3. CWG Markets

EUR/USD: -4.98 USD/lot

GBP/USD: -2.33 USD/lot

XAU/USD: -14.64 USD/lot

CWG Markets ranks third, standing out with the lowest gold swap rate among all reviewed brokers. For traders focused on precious metals, CWG Markets provides a clear cost advantage. While its currency pair swaps are moderately higher than the top two brokers, the savings on gold positions make it an attractive option for diversified portfolios.

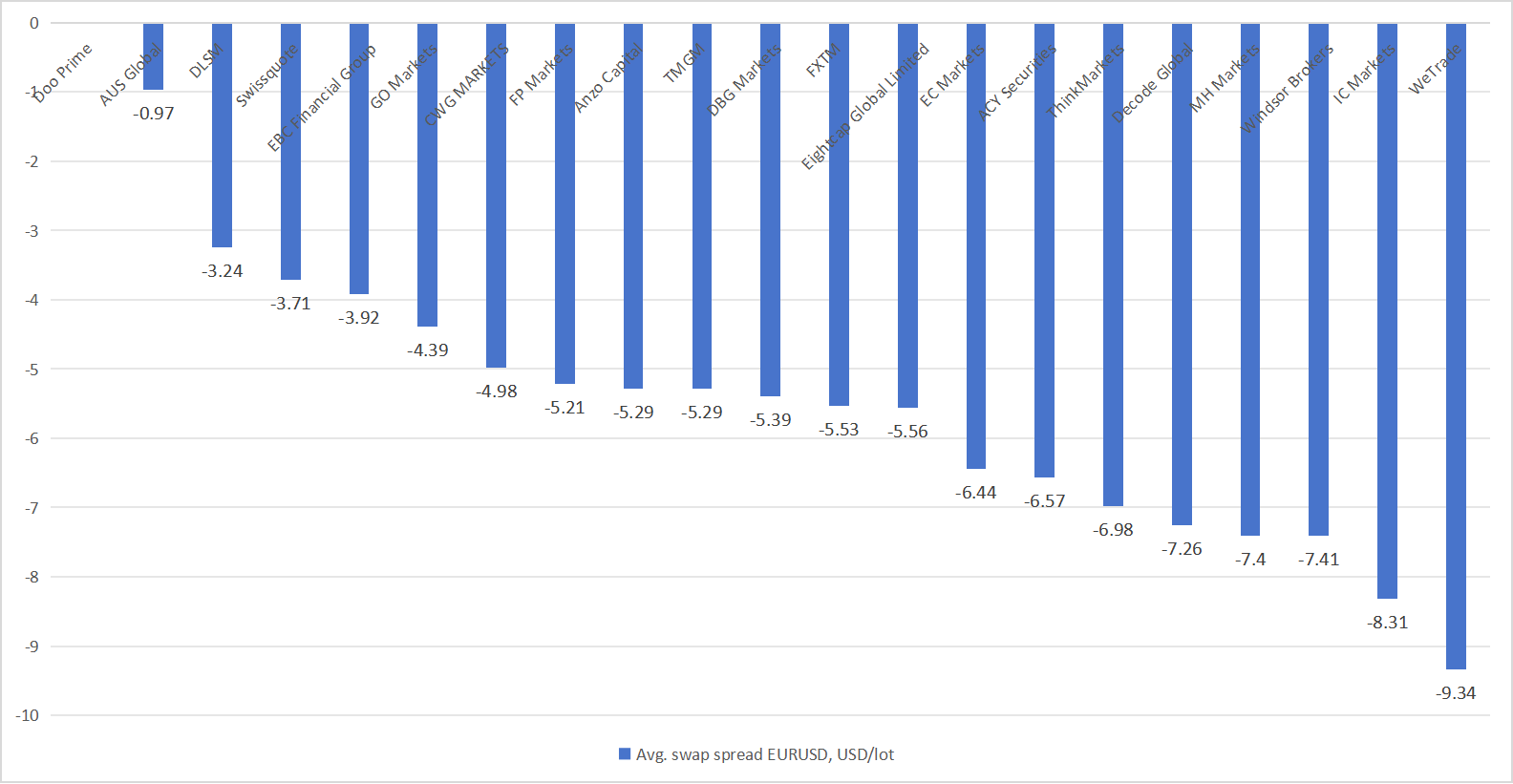

EUR/USD Swap Rates

1. Doo Prime — 0 USD/lot

Doo Prime ranks first with a zero swap policy on EUR/USD.This means traders can hold positions overnight without paying or earning any interest, making it an ideal choice for short-term and algorithmic traders who frequently roll positions over multiple days. Such a neutral swap structure helps minimize trading costs and allows for more flexible position management.

2. AUS Global — -0.97 USD/lot

AUS Global takes second place with an average EUR/USD swap spread of -0.97 USD/lot, one of the lowest negative swaps in the market.The broker’s competitive overnight cost structure provides an advantage for traders holding medium-term positions while keeping expenses under control. This low swap rate demonstrates AUS Global’s consistent focus on cost efficiency and client retention.

3. DLSM — -3.24 USD/lot

DLSM secures third place with an average swap spread of -3.24 USD/lot. While slightly higher than the top two brokers, DLSM still remains within a favorable range compared to the broader industry average. It serves as a balanced option for traders seeking reasonable overnight costs along with stable execution and liquidity conditions.

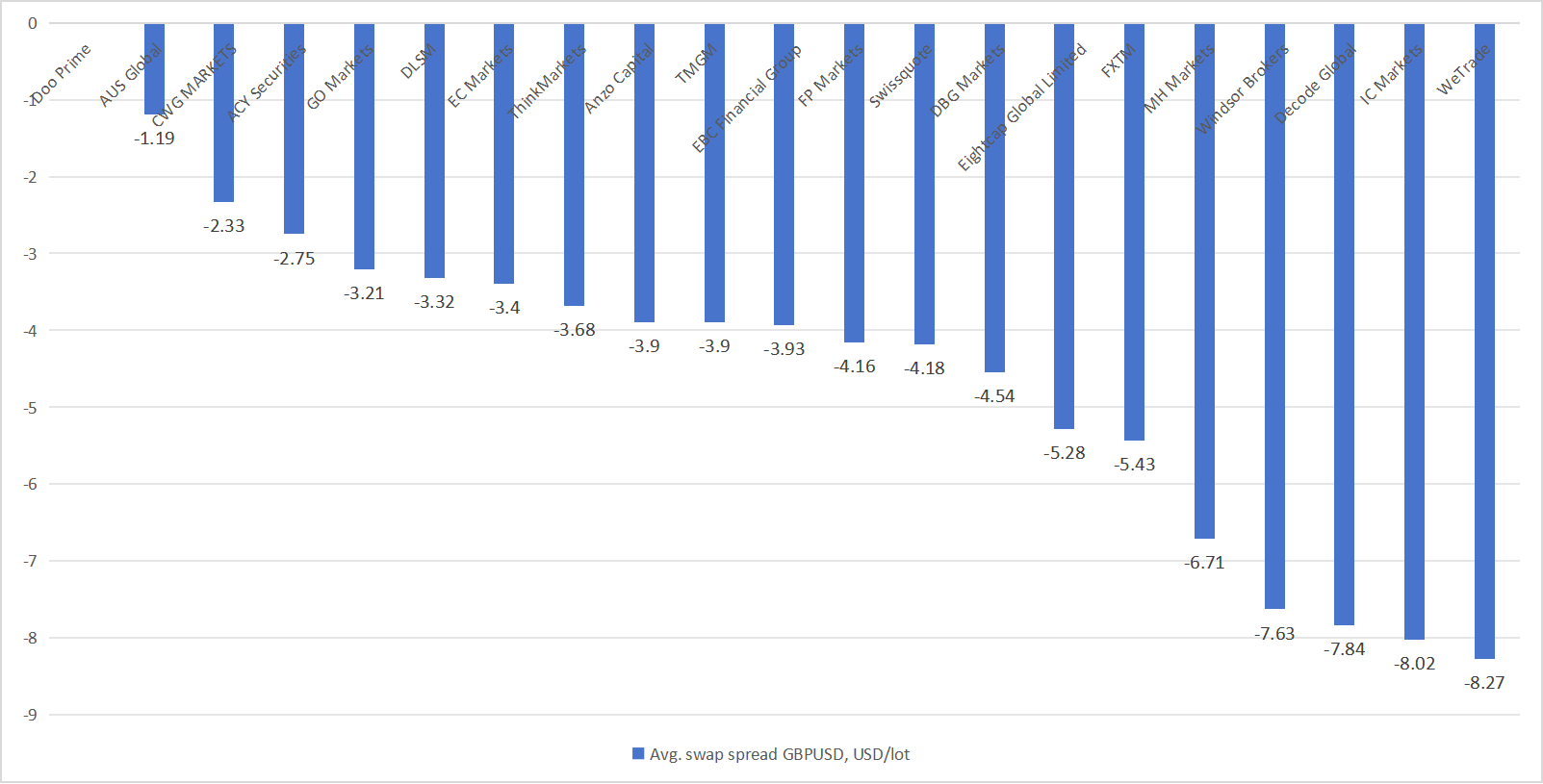

GBP/USD Swap Rates

1. Doo Prime — 0 USD/lot

Doo Prime leads the ranking with a zero overnight swap rate on GBP/USD.For traders who prefer medium- to long-term trading strategies, this means they can hold positions overnight without any additional cost.This zero-swap policy provides a clear advantage for swing traders and those employing hedging strategies.

2. AUS Global — -1.19 USD/lot

AUS Global secures the second position with an average swap spread of -1.19 USD/lot, one of the lowest in the market. This makes AUS Global an excellent choice for traders seeking low-cost overnight exposure without the complexities of hidden fees.

3. CWG Markets — -2.33 USD/lot

CWG Markets ranks third, maintaining an average overnight swap spread of -2.33 USD/lot. While slightly higher than AUS Global, this still represents a reasonable holding cost, particularly for traders who manage shorter swing trades.

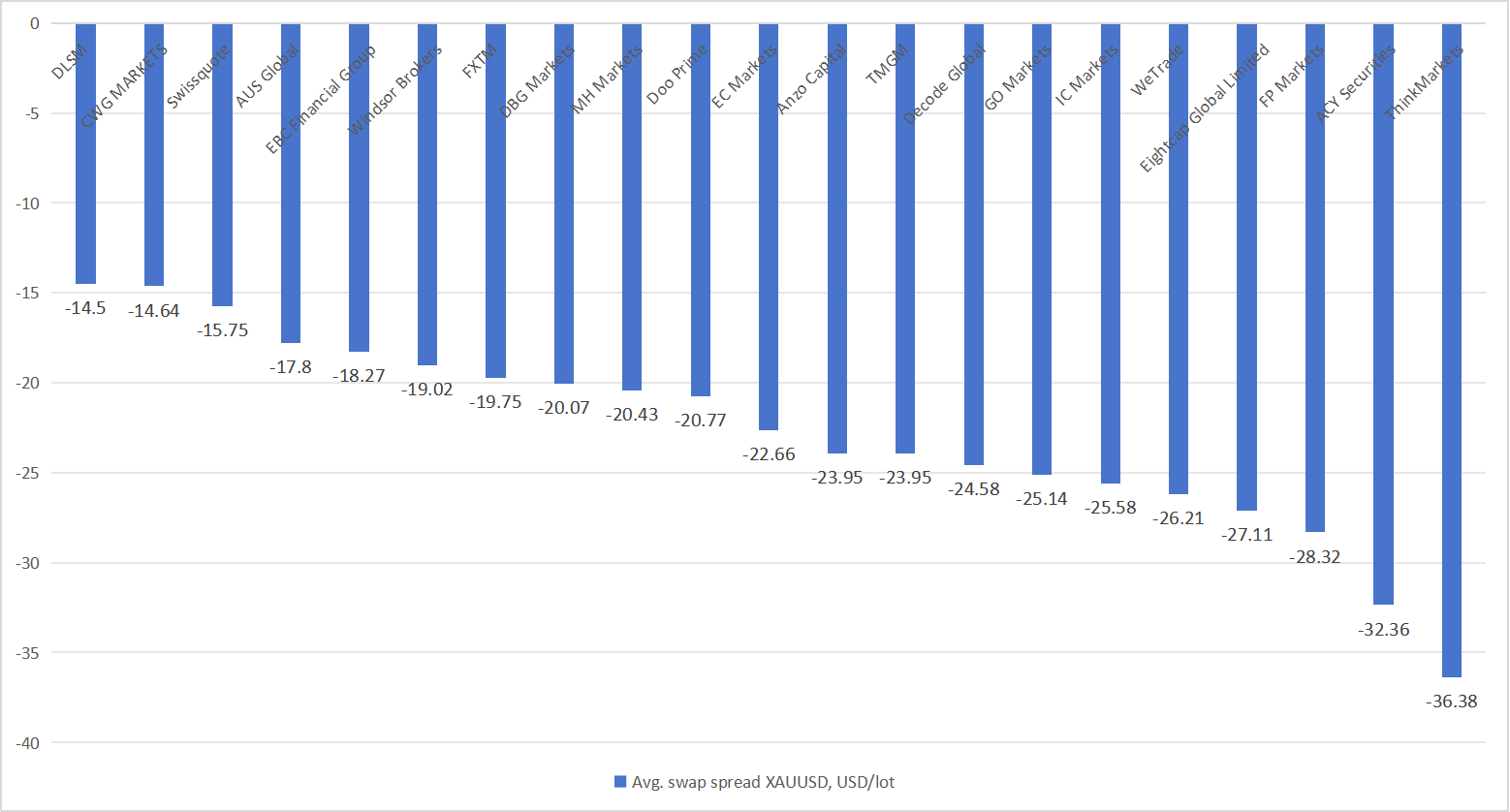

XAU/USD Swap Rates

1. DLSM – -14.50 USD/lot

DLSM offered the lowest overnight cost for XAU/USD, making it the most attractive choice for traders looking to minimize holding fees.

2. CWG Markets – -14.64 USD/lot

Close behind, CWG Markets provided a slightly higher but still very competitive swap, ideal for swing traders and longer-term positions.

3. Swissquote – -15.75 USD/lot

Swissquote rounds out the top three, offering relatively low overnight charges compared to the broader market, ensuring a cost-efficient trading environment for gold.

Conclusion

Swap variation is large, highlighting the importance of factoring rollover costs into trading strategies, especially for swing traders and leveraged positions. Cost-sensitive traders should consider AUS Global or Doo Prime for currency pairs.

For more comprehensive evaluation data, please check the BV evaluation column.