Brokersview October 2025 Swap Rate Analysis: Which Broker is the Cheapest for swap spread?

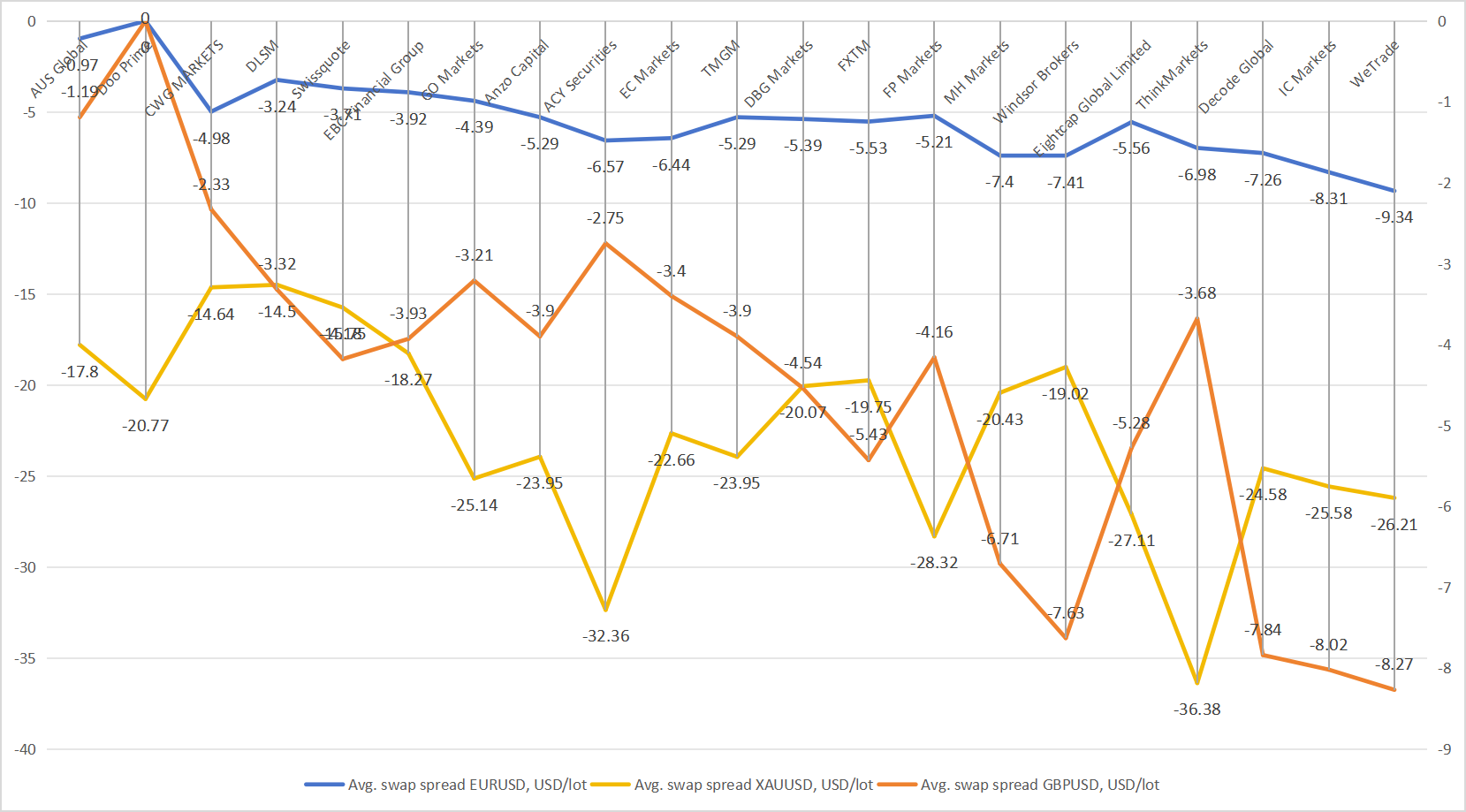

As forex traders are well aware, overnight swap rates can significantly impact trading costs, especially for positions held beyond a single trading day. In this October review, we analyzed the average swap spreads for 21 popular instruments—EUR/USD, GBP/USD, and XAU/USD—across a selection of brokers.

1.AUS Global

EURUSD: -0.97 USD/lot

GBPUSD: -1.19 USD/lot

XAUUSD: -17.8 USD/lot

AUS Global presents the most balanced and competitive profile overall. It offers an excellent balance, providing low forex swap costs and the most affordable rate for trading gold, minimizing overall trading expenses.

Best for traders seeking steady overnight conditions and moderate rollover costs.

2.Doo Prime

EURUSD: 0 USD/lot

GBPUSD: 0 USD/lot

XAUUSD: -20.77 USD/lot

Doo Prime stands out for offering zero swap spreads on major currency pairs — a major advantage for forex traders holding positions overnight.

3.CWG Markets

EURUSD: -4.98 USD/lot

GBPUSD: -2.33 USD/lot

XAUUSD: -14.64 USD/lot

CWG Markets offers the lowest XAUUSD swap rate among the three, making it appealing to gold traders who frequently hold positions overnight. However, this benefit is counterbalanced by relatively high FX swap charges, particularly on EURUSD, which may deter currency-focused traders.

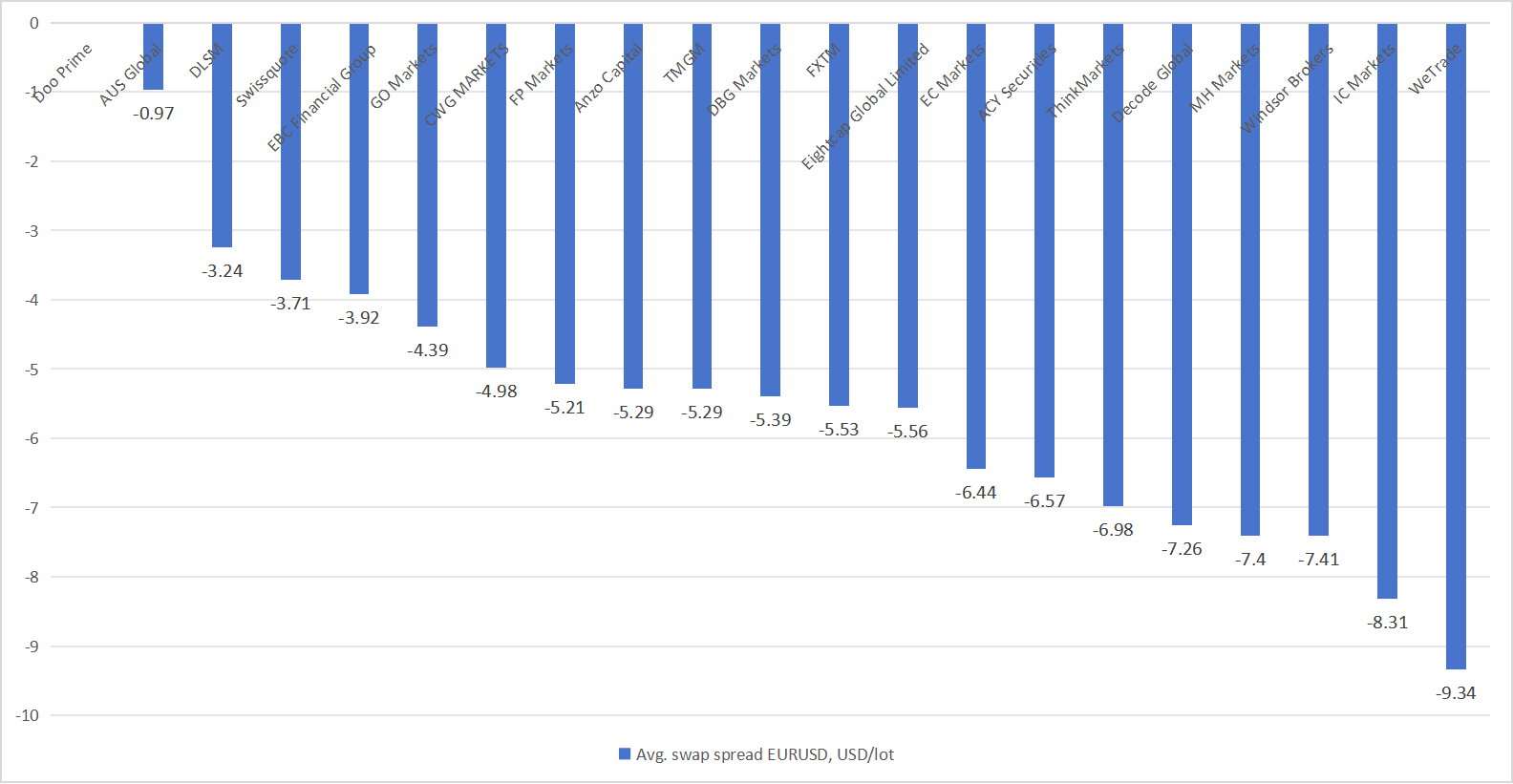

EUR/USD Swap Rates

1. Doo Prime — 0 USD/lot

Doo Prime leads this month’s ranking. This makes Doo Prime especially attractive for long-term strategies, including trend-following or carry-neutral trading systems.

2. AUS Global — -0.97 USD/lot

AUS Global ranks second with a moderately low swap charge. The rate of -0.97 USD/lot positions it among the most competitive brokers for EURUSD trading, particularly for those seeking stable rollover conditions.

3.DLSM — -3.24 USD/lot

DLSM takes third place in this month’s review. It might suit day traders or scalpers who typically close positions within the day and are less affected by overnight charges.

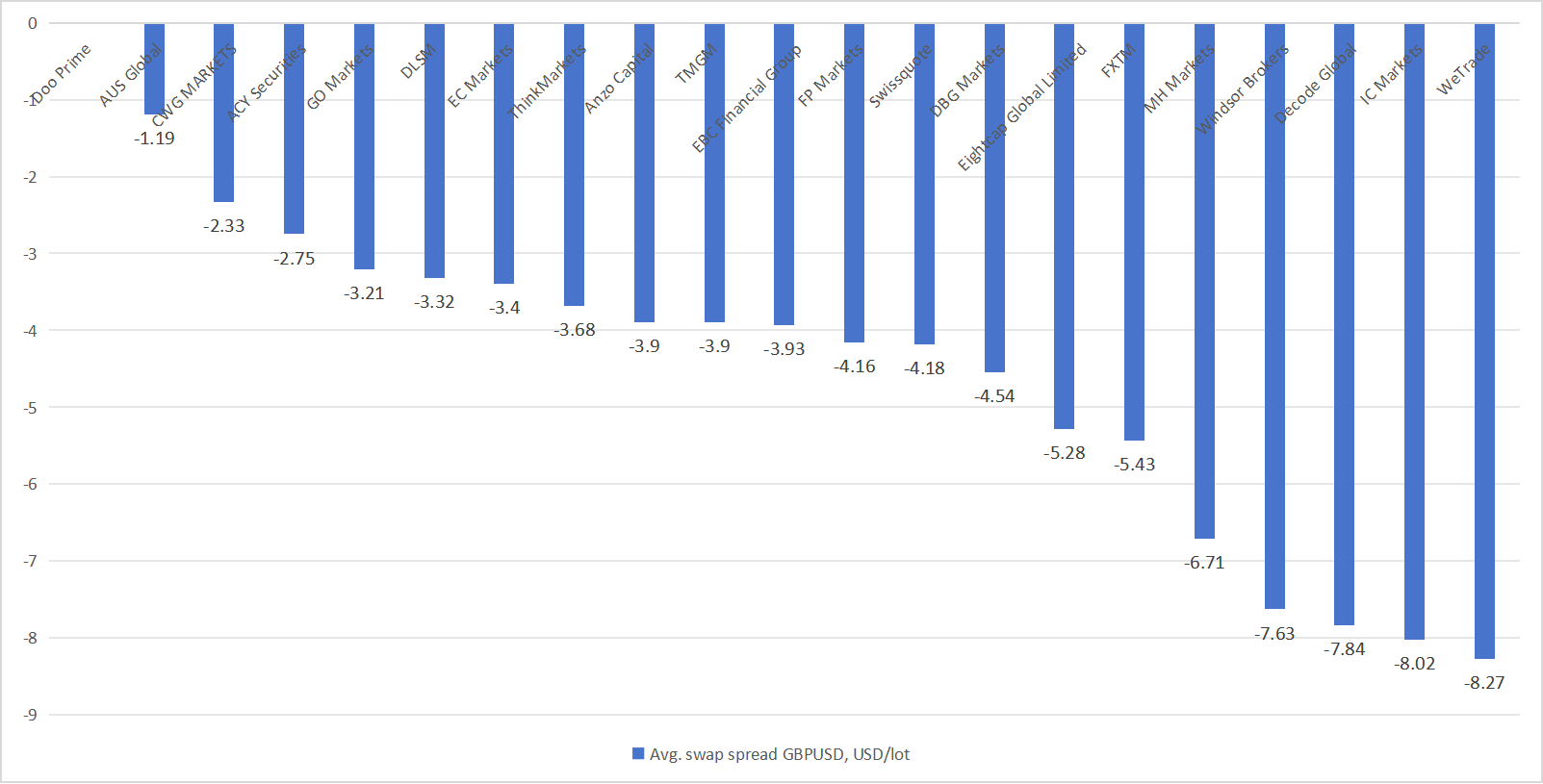

GBP/USD Swap Rates

1. Doo Prime — 0 USD/lot

Doo Prime stands out as the most cost-effective option for GBPUSD, offering zero swap charges. This feature is particularly advantageous for swing and position traders who maintain trades overnight.

2. AUS Global — -1.19 USD/lot

AUS Global's overnight charge is competitive for GBPUSD and ensures predictable holding costs for traders.It is a solid choice for those who want stable and consistent overnight conditions without incurring excessive swap fees.

3. CWG Markets — -2.33 USD/lot

CWG Markets comes in third with a higher swap rate, which may be less attractive for overnight GBPUSD positions. However, this setup may appeal to intraday traders or those who occasionally hold GBPUSD positions but focus primarily on short-term trading strategies.

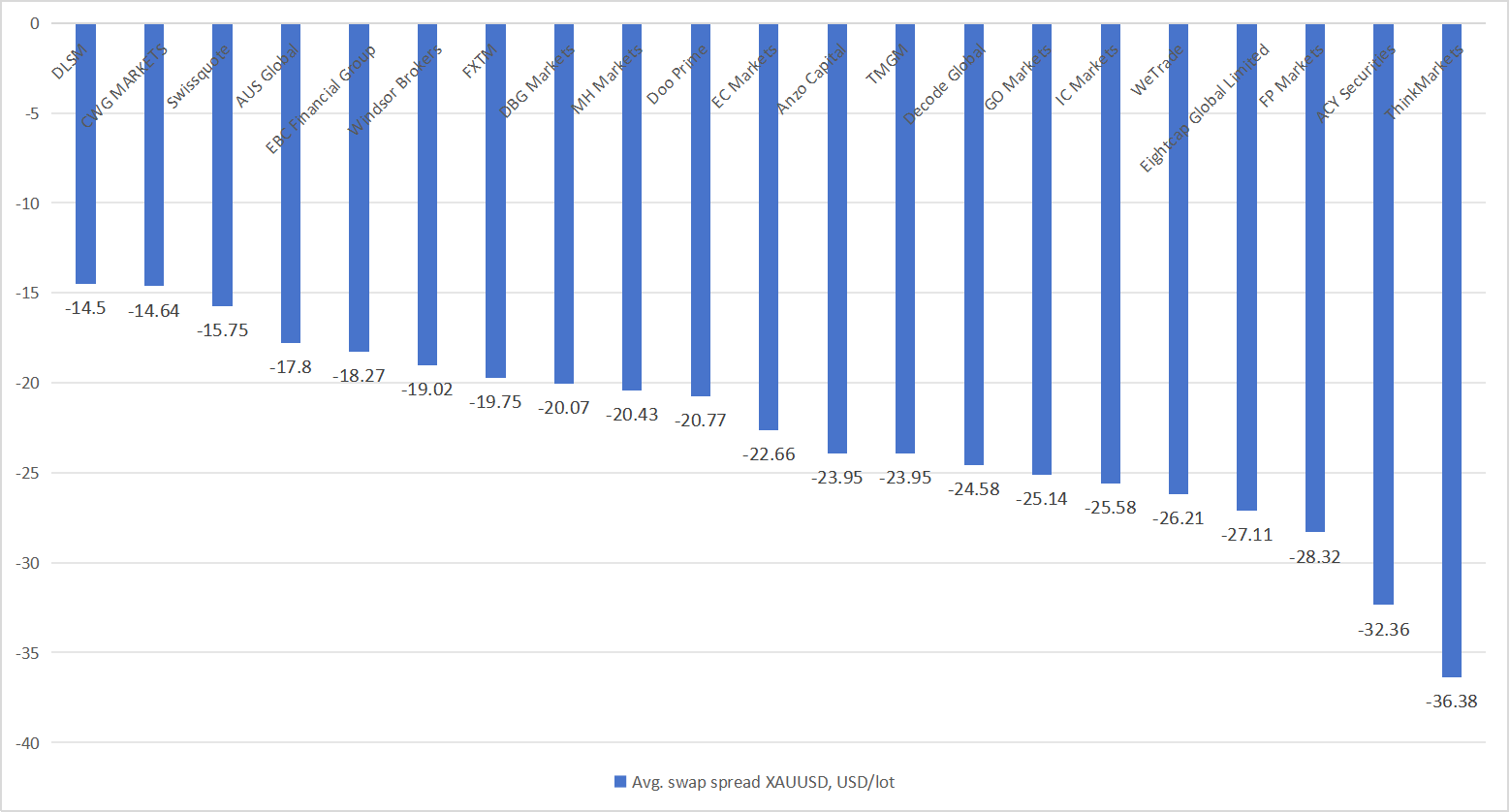

XAU/USD Swap Rates

1.DLSM — -14.5 USD/lot

DLSM ranks first this month, making it ideal for traders who hold XAUUSD positions overnight.

2.CWG Markets — -14.64 USD/lot

CWG Markets comes in a close second, with a swap slightly higher than DLSM. The difference is marginal, but it still represents a competitive overnight cost for gold positions. CWG Markets is suitable for traders who value stability and predictable swap charges while trading XAUUSD.

3.Swissquote — -15.75 USD/lot

Swissquote secures the third position with a swap rate of -15.75 USD per lot. While slightly higher than DLSM and CWG Markets, it remains a very respectable and competitive rate in the broader market. A superb choice for traders who prefer a premium broker and are willing to pay a small premium for its associated benefits and security.

Conclusion

October’s swap analysis highlights that Doo Prime dominates major currency pairs with zero swaps, AUS Global provides consistent value across multiple instruments, and CWG Markets and DLSM offer competitive gold swap rates for commodity-focused traders.

Traders should select brokers based on their primary trading instruments, overnight holding strategies, and tolerance for swap costs, ensuring optimized profitability across both FX and commodity markets.

For more comprehensive evaluation data, please check the BV evaluation column.