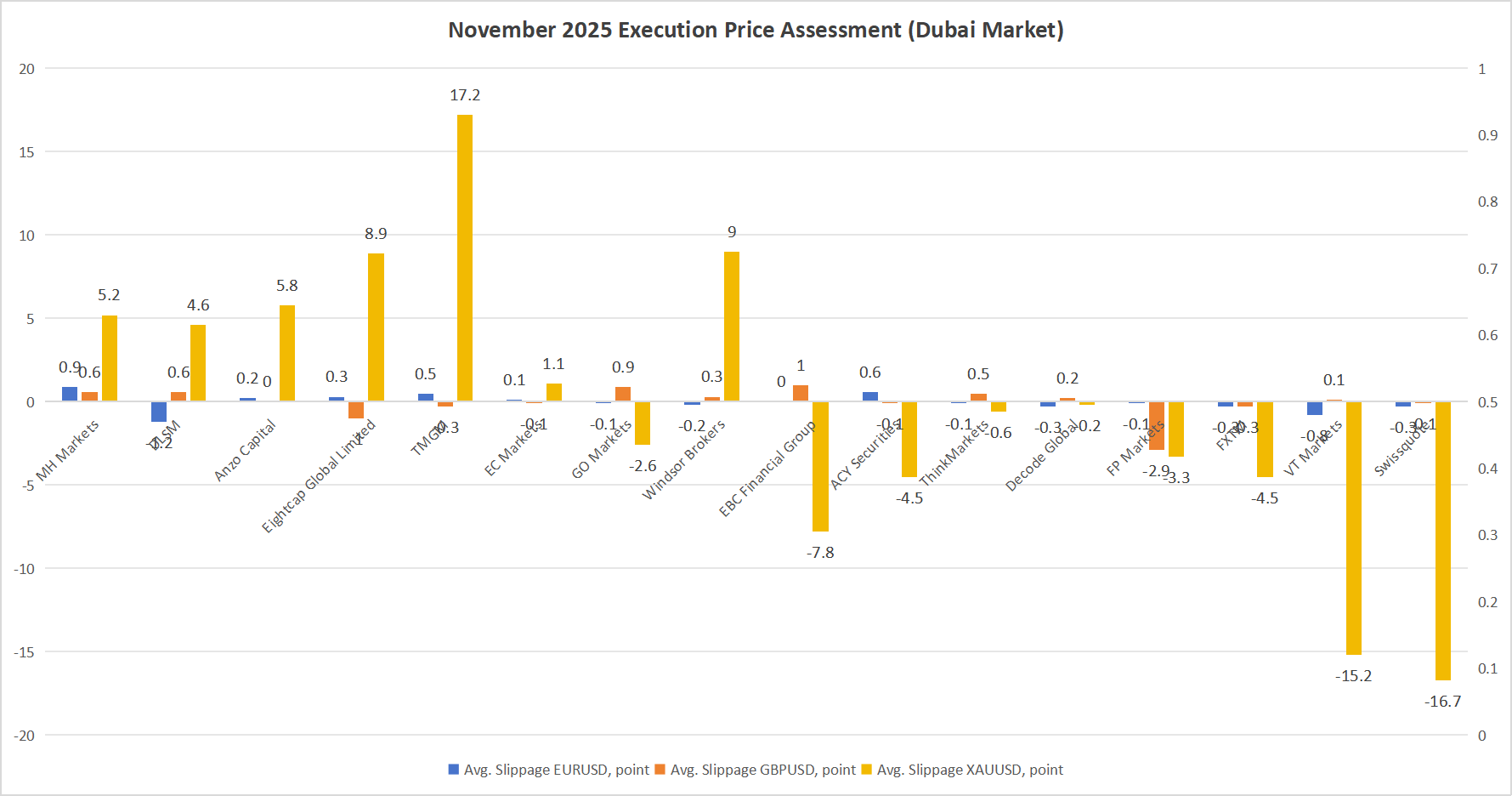

Brokersview November 2025 Dubai FX Market Analysis: Broker Execution Prices and Average Slippage

November’s execution price analysis across major brokers in the Dubai market reveals variations in slippage for EURUSD, GBPUSD, and XAUUSD, highlighting which brokers deliver tighter and more consistent trade execution.

MH Markets – Best Price Execution Broker

MH Markets consistently delivers low slippage across all major instruments, making it the top choice for traders seeking precise and reliable execution.

DLSM

Offers competitive execution, especially for EURUSD and GBPUSD. Slightly better-than-requested execution in EURUSD suggests occasional positive slippage.

Anzo Capital

Maintains stable and low slippage for EURUSD and GBPUSD; gold execution remains reasonable, providing balanced performance.

Eightcap Global Limited

Shows modest slippage for currency pairs, though XAUUSD execution is slightly slower, indicating higher market volatility impact.

TMGM

Performs adequately on EURUSD and GBPUSD, but XAUUSD slippage is comparatively high, making it less favorable for gold-focused traders.

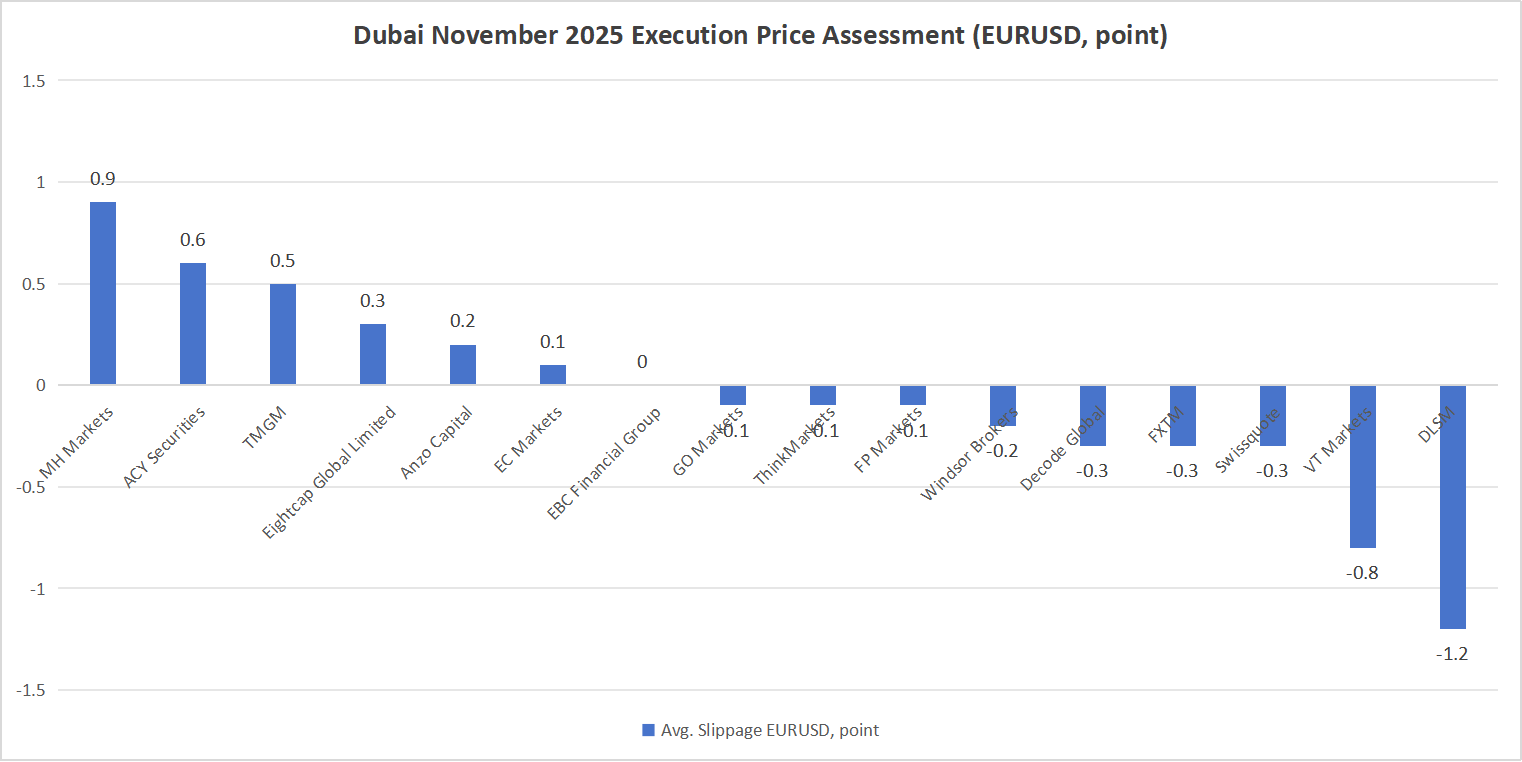

EURUSD Execution Price

MH Markets – 0.9 points

ACY Securities – 0.6 points

TMGM – 0.5 points

MH Markets leads the pack, delivering the tightest and most consistent execution. ACY Securities and TMGM follow closely, providing low-slippage trades suitable for high-frequency strategies.

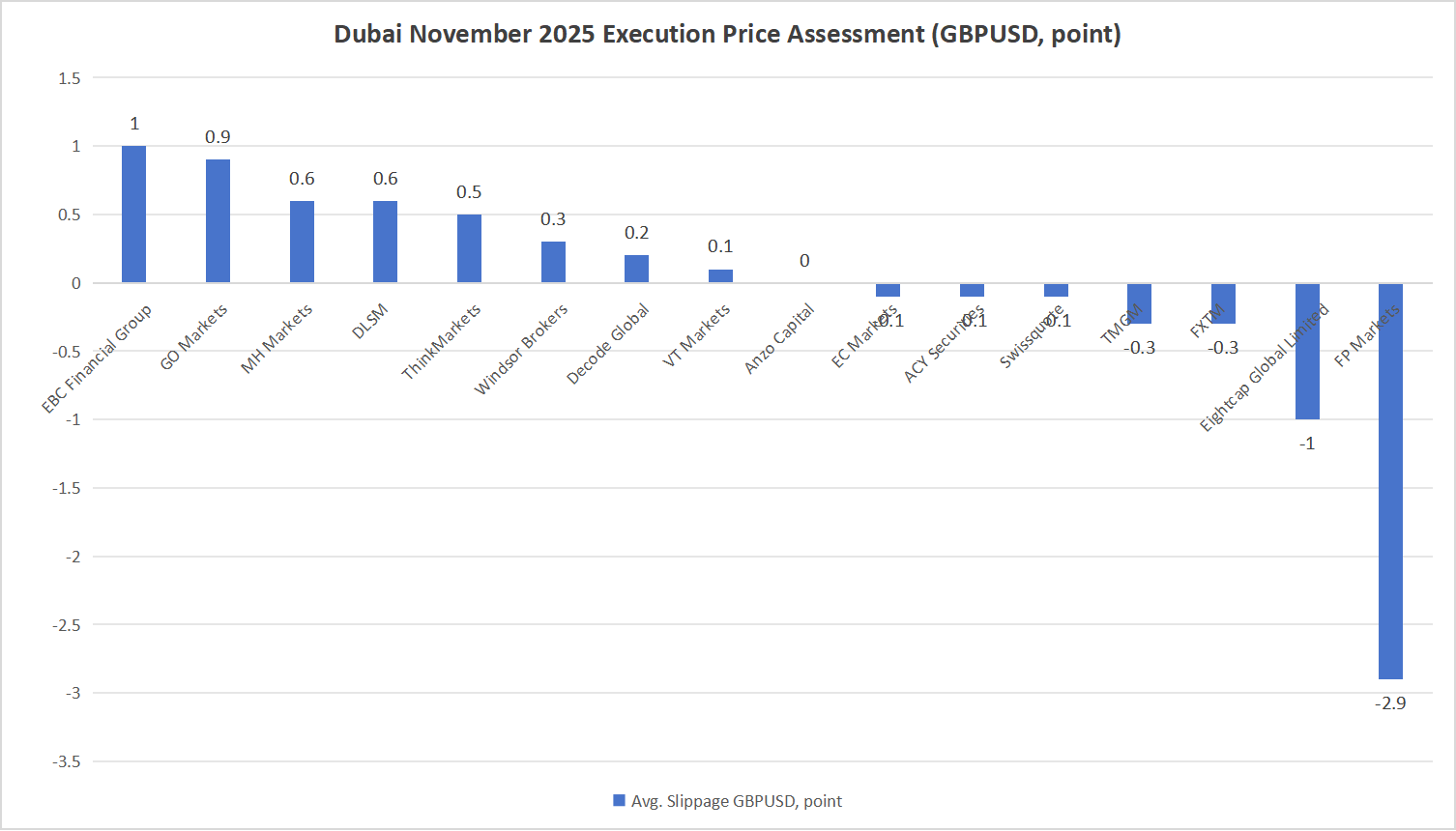

GBPUSD Execution Price

EBC Financial Group – 1 point

GO Markets – 0.9 points

MH Markets – 0.6 points

GBPUSD slippage is generally low across these brokers. EBC Financial Group and GO Markets demonstrate the tightest spreads, providing reliable execution for traders focused on the GBPUSD pair. MH Markets maintains strong performance with consistent mid-tier slippage, while DLSM and ThinkMarkets also offer steady execution quality.

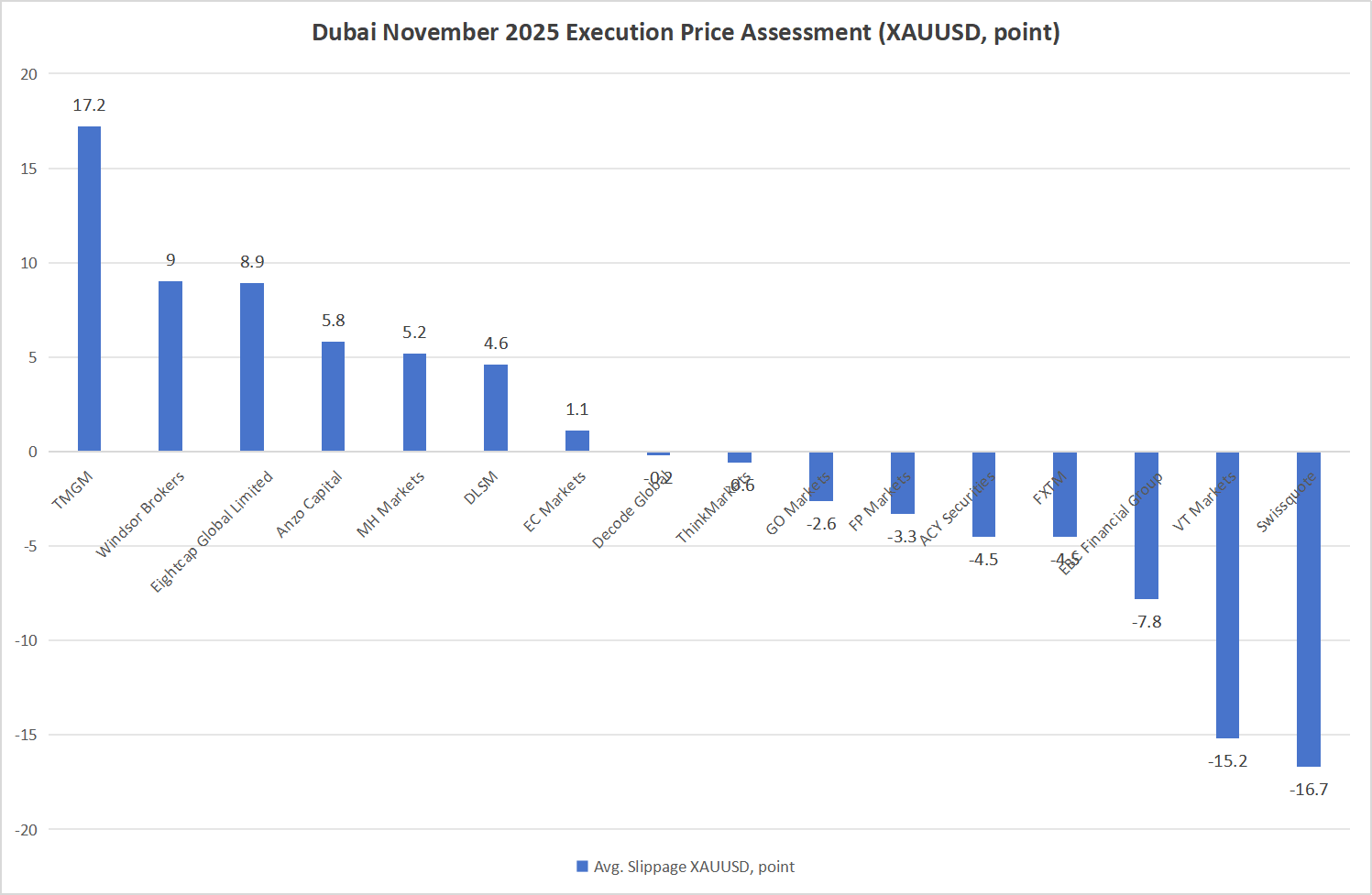

XAUUSD Execution Price

XAUUSD execution shows the largest variation among brokers. The top 3 brokers for low slippage are:

MH Markets – 5.2 points

Anzo Capital – 5.8 points

Eightcap Global Limited – 8.9 points

MH Markets and Anzo Capital deliver the most efficient gold execution among the top five, with relatively low slippage considering gold’s high volatility. Eightcap and Windsor Brokers show moderate slippage, suitable for traders prioritizing balance between speed and market access.

Conclusion

November’s data underscores the importance of monitoring execution quality when selecting brokers. For currency traders, MH Markets and ACY Securities provide the most competitive execution for EURUSD and GBPUSD, while for gold-focused strategies, MH Markets and Anzo Capital offer the tightest slippage.

Data Source: Brokersview Execution Price Ranking