Brokersview Liquidity Assessment - November 2025 Review (Dubai Market)

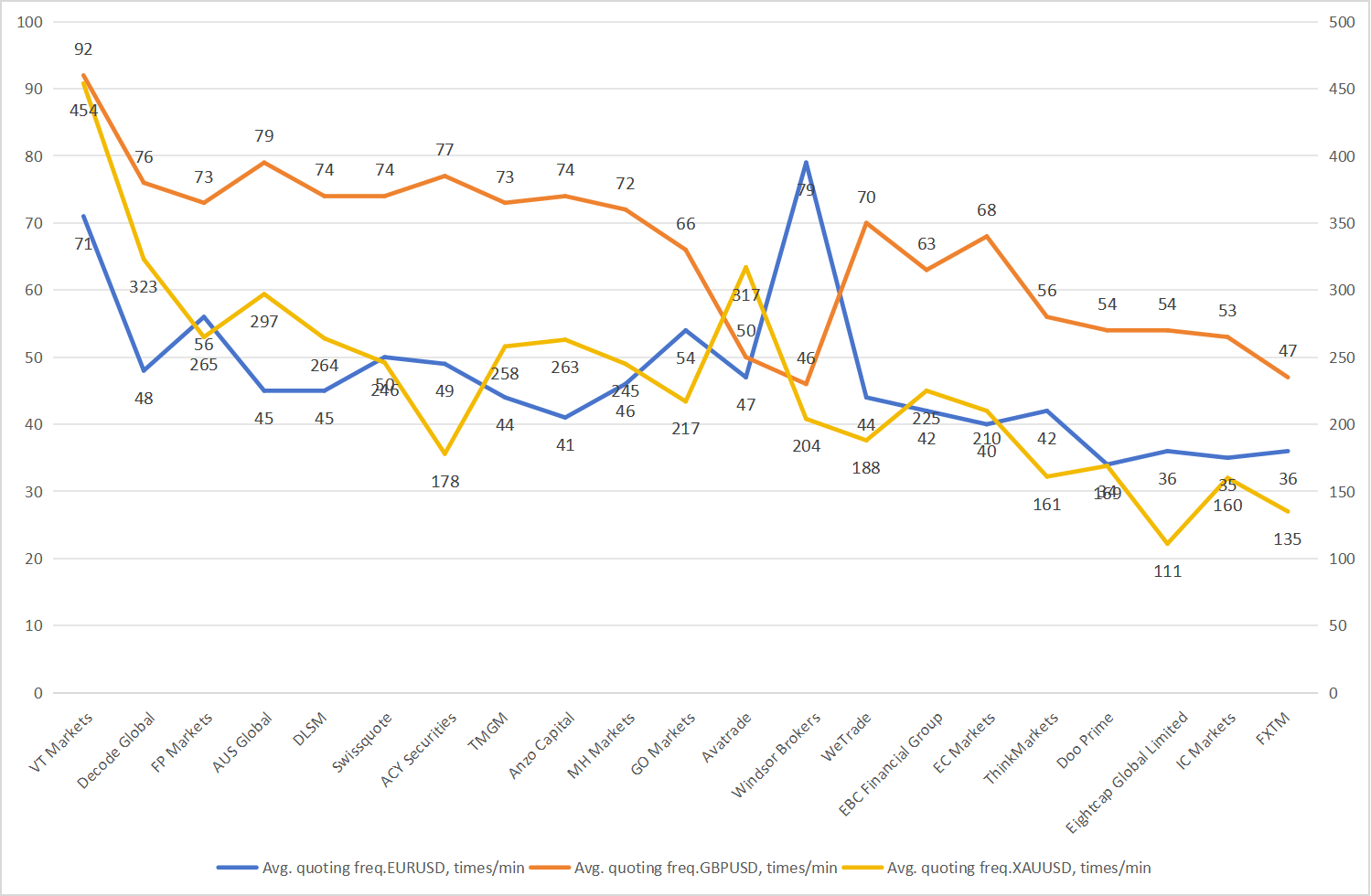

November’s liquidity assessment across major brokers reveals clear distinctions in quoting activity for EURUSD, GBPUSD, and XAUUSD, highlighting how each broker performs under real-time market conditions in the Dubai trading environment.

For traders who prioritize speed, precision, and frequent price updates—especially in XAUUSD—brokers with higher quoting frequencies stand out as preferred choices.

Meanwhile, traders who value stability over speed may opt for brokers offering moderate but consistent market feeds.

Overall Liquidity Observations

VT Markets stands out as the strongest and most consistent liquidity performer across all asset categories, earning the title of BEST TRADING LIQUIDITY Broker for November.

Decode Global and FP Markets show stable, balanced quoting activity, suitable for traders seeking reliable liquidity across assets.

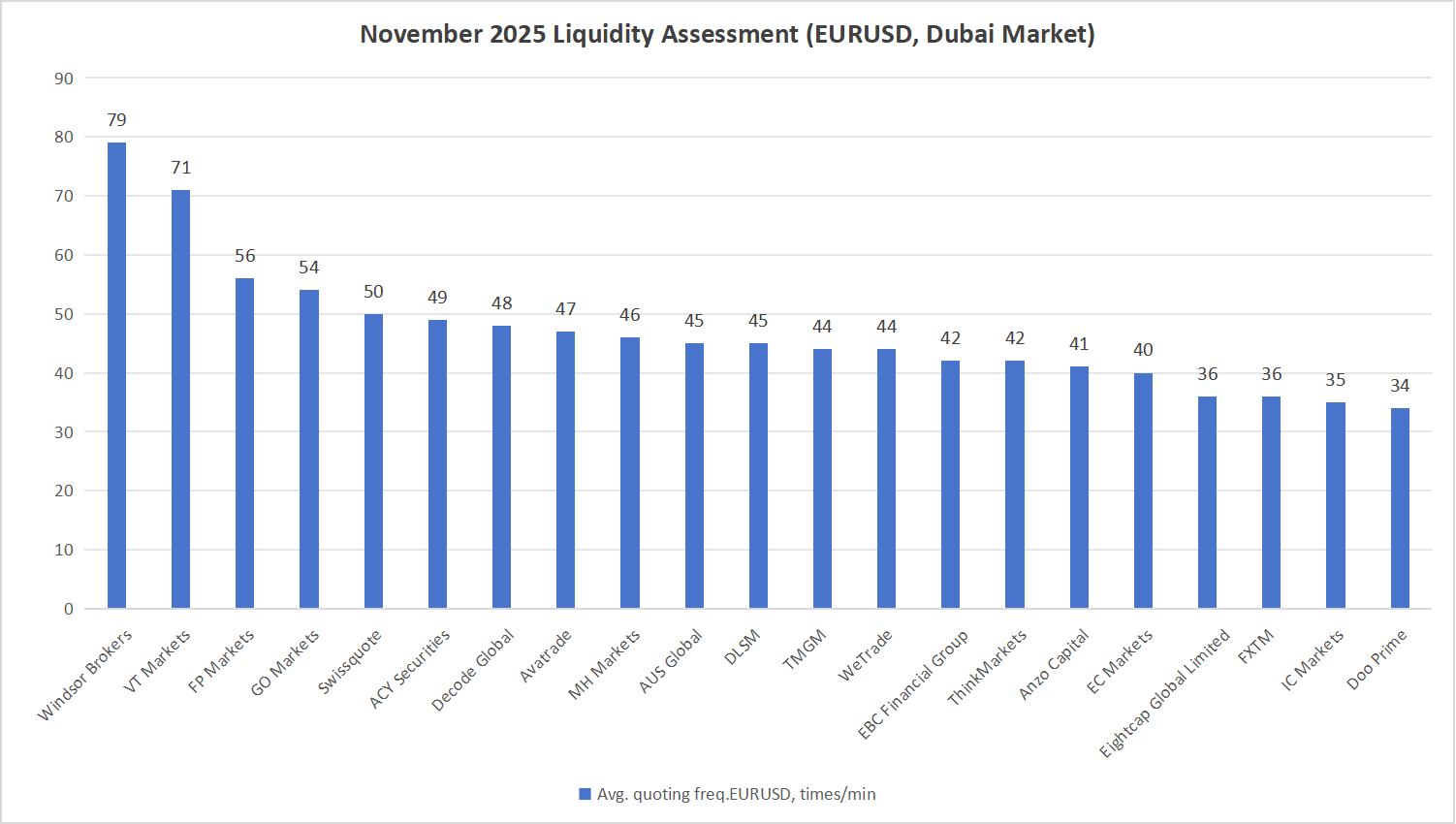

EURUSD Avg. Quoting Frequency

The EURUSD pair shows a diverse range of quoting speeds among brokers:

Windsor Brokers leads with the highest frequency at 79 times/min, indicating highly active liquidity.

VT Markets follows closely with 71 times/min, maintaining strong performance.

Most brokers fall within the 40–56 times/min range.

Doo Prime and Eightcap sit at the lower end of the spectrum, averaging 34–36 times/min.

This variation illustrates differing levels of liquidity infrastructure and market responsiveness.

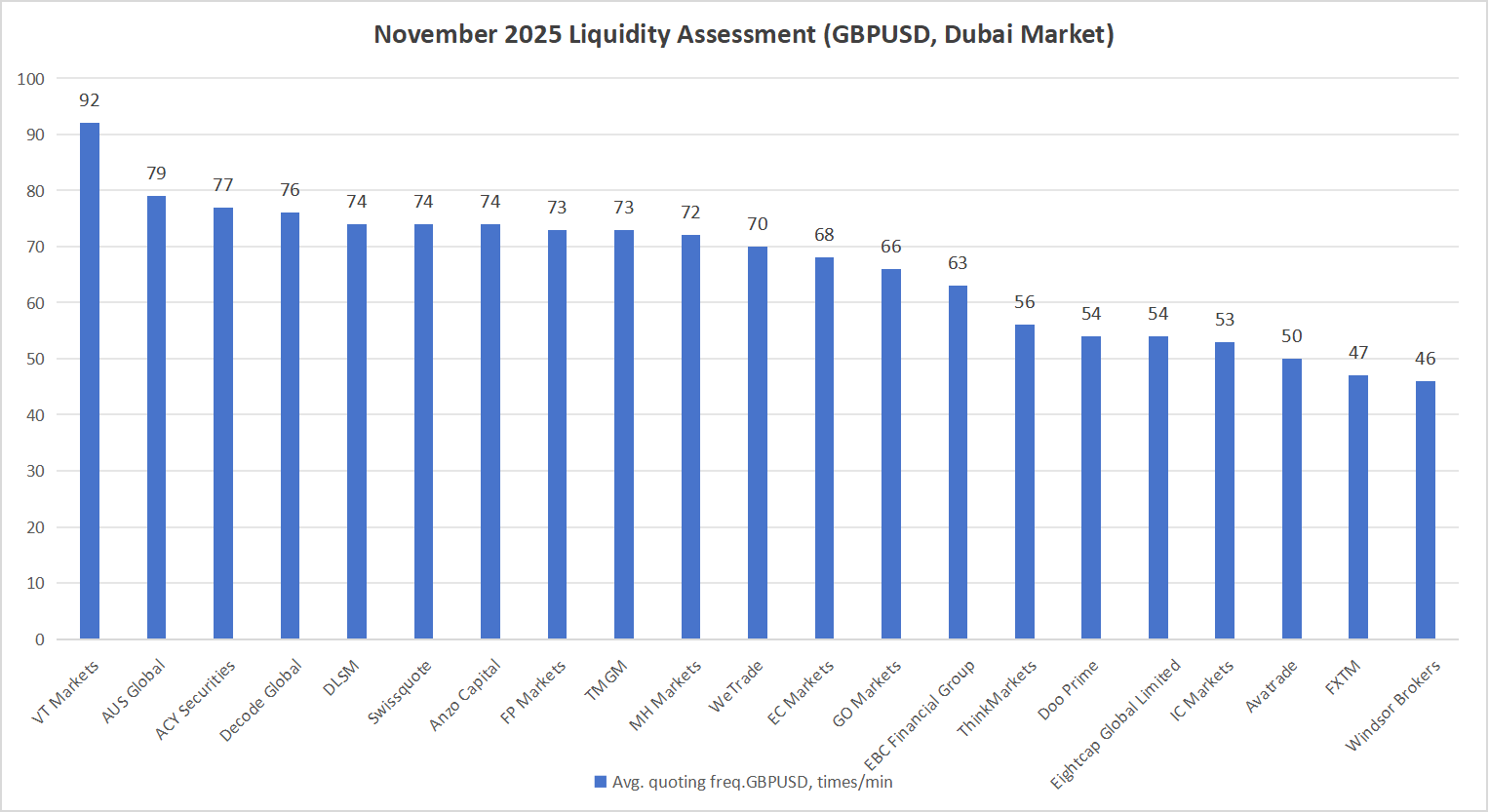

GBPUSD Avg. Quoting Frequency

GBPUSD activity demonstrates stronger spreads between top and mid-tier performers:

VT Markets again ranks highest with 92 times/min, showing consistent superiority across asset classes.

Decode Global, ACY Securities and AUS Global also perform strongly at 76–79 times/min.

And Avatrade, ThinkMarkets, and Doo Prime record quoting frequencies in the 50–56 range.

The results suggest that only a handful of brokers offer top-tier liquidity for GBPUSD in fast-moving markets.

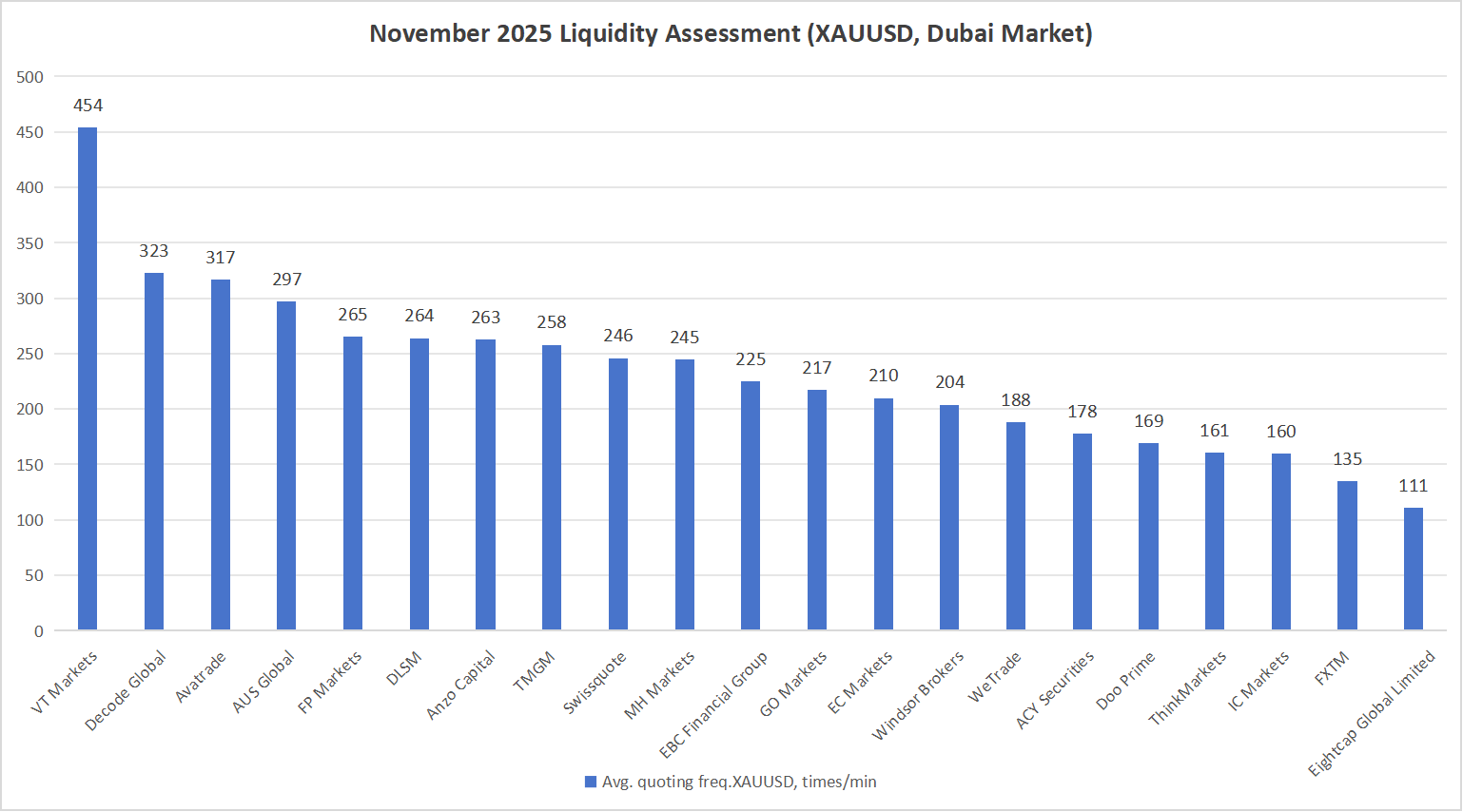

XAUUSD Avg. Quoting Frequency

XAUUSD shows the widest performance gap of all instruments:

VT Markets stands out significantly with an exceptional 454 times/min, far surpassing all competitors.

Decode Global, Avatrade and AUS Global remain active in the 297–323 range.

Lower-frequency brokers such as Eightcap (111 times/min) and FXTM (135 times/min) reflect slower price-feed responsiveness.

The dramatic variability underscores large differences in liquidity technology and market-data throughput between brokers.

Conclusion

November’s liquidity data highlights significant disparities in quoting activity across the industry.

As liquidity conditions continue evolving, Avg. Quoting Frequency remains a key indicator of execution quality and technological capability across the Dubai market.

Data Source: Brokersview Spread Ranking