BrokersView July 2025 Spread Comparison: Finding the Best Trading Conditions

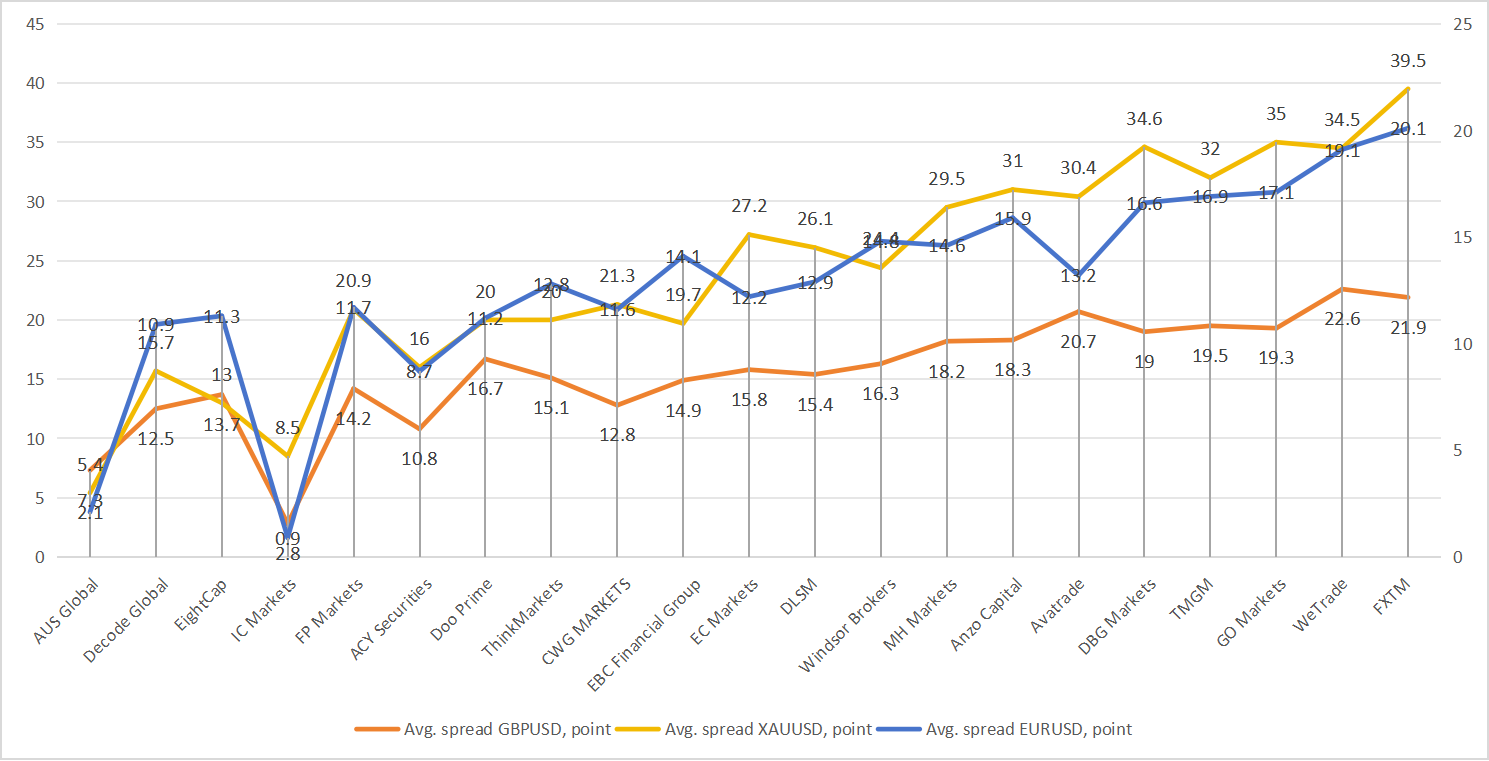

When it comes to trading costs, spreads remain one of the most critical factors for forex and XAU/USD traders. In July 2025, our spread review highlights three brokers—AUS Global, Decode Global, and EightCap—showing how their pricing models differ and what that means for traders.

1. AUS Global leads the pack

EUR/USD: 2.1 points

GBP/USD: 7.3 points

XAU/USD: 5.4 points

AUS Global delivers the most competitive spreads across all three instruments. Particularly on XAU/USD, its 5.4 points spread is significantly lower than industry averages, making it a strong choice for metals traders. For scalpers and cost-sensitive strategies, AUS Global stands out as the best option in this comparison.

2. Decode Global

EUR/USD: 10.9 points

GBP/USD: 12.5 points

XAU/USD: 15.7 points

Decode Global sits in the middle. While spreads are considerably wider than AUS Global, they remain within a workable range for swing traders or those less sensitive to execution costs. However, for scalpers, these spreads could cut into profits.

3. EightCap

EUR/USD: 11.3 points

GBP/USD: 13.7 points

XAU/USD: 13.0 points

EightCap shows slightly better performance than Decode Global on Gold, with a 13-point spread, but falls behind on major forex pairs. Traders who prioritize metals over forex may still find it a viable alternative.

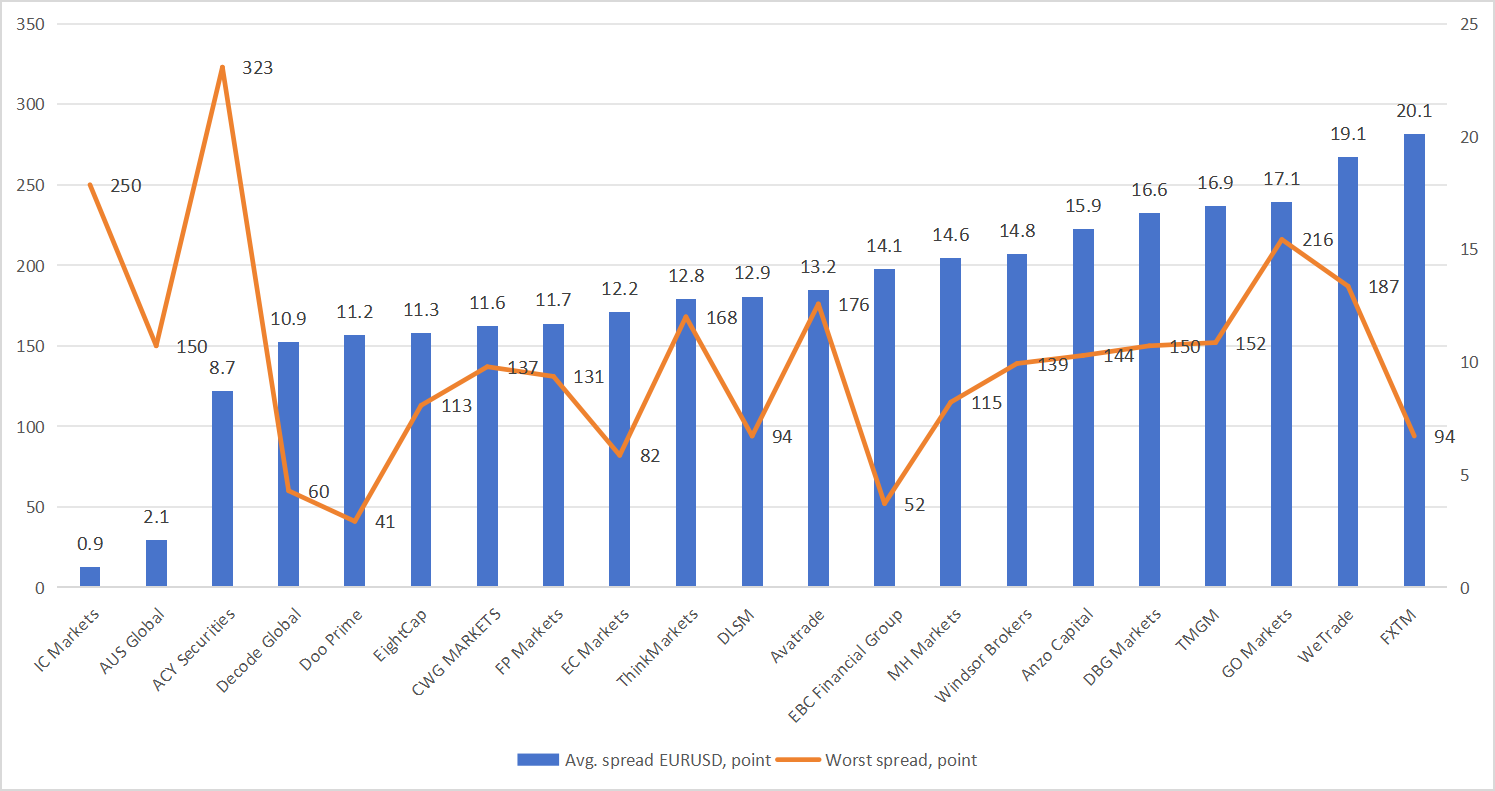

EUR/USD Average Spreads

- IC Markets ranks first with an exceptionally low average spread of just 0.9 points, making it the most cost-efficient choice for scalpers and high-frequency traders. However, the data also reveals occasional spikes, with the worst spread reaching 250 points. Traders who value ultra-tight pricing will find IC Markets highly attractive but should remain aware of potential spread widening during volatile market conditions.

- AUS Global secures second place with an average spread of 2.1 points—still very competitive compared to industry averages. While not as tight as IC Markets, it shows a better balance in terms of stability, with a worst spread of 150 points, which is narrower than some of its competitors. For traders seeking both affordability and consistency, AUS Global stands out as a strong contender.

- ACY Securities takes third place, with an average spread of 8.7 points. While notably wider than IC Markets and AUS Global, it still outperforms many other brokers in the market. However, its worst spread spike of 323 points shows that conditions can deteriorate during extreme volatility. This makes ACY Securities better suited for swing traders rather than short-term scalpers.

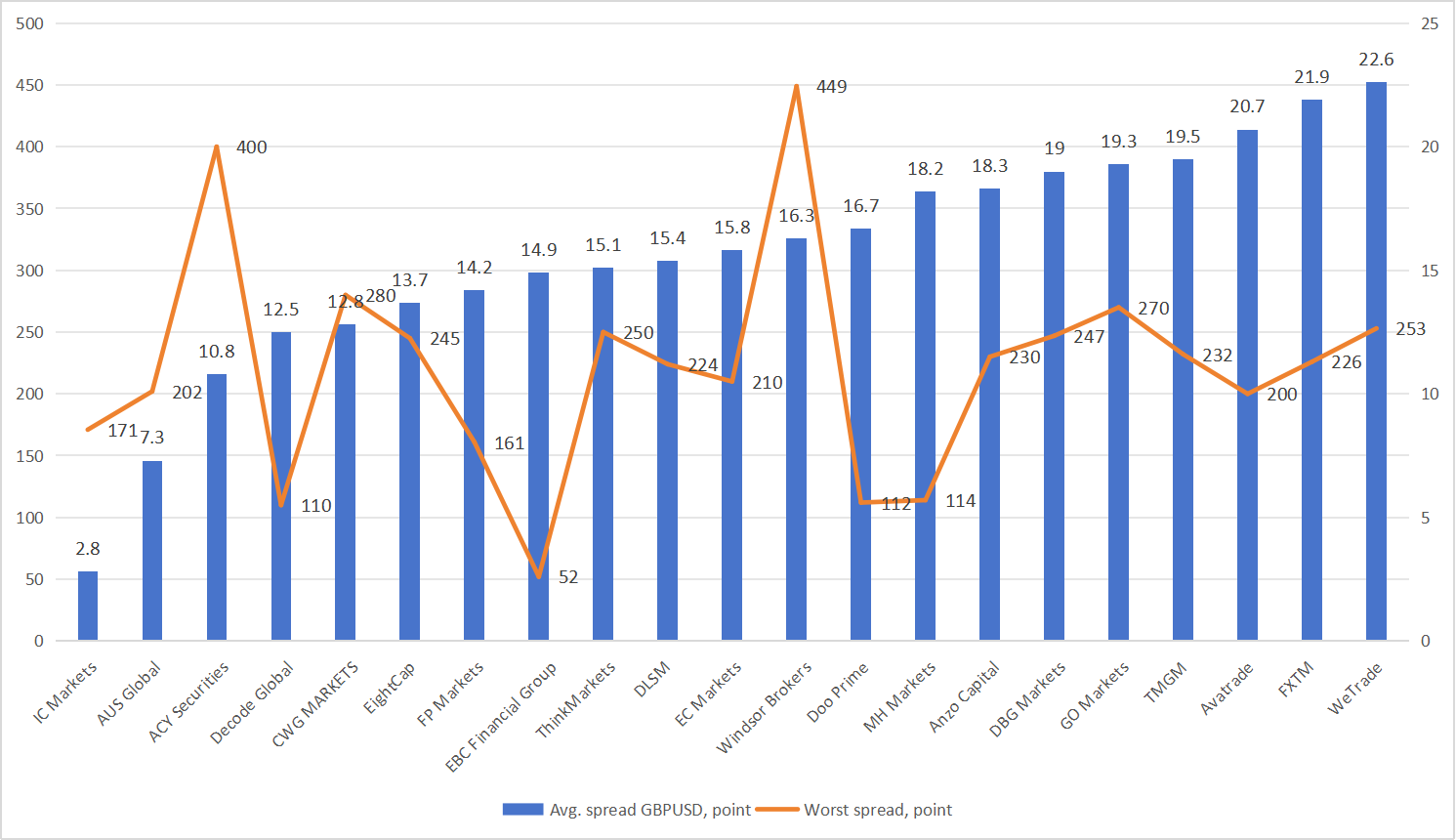

GBP/USD Average Spreads

- IC Markets takes the lead with the lowest average spread on GBP/USD. At just 2.8 points, it offers traders highly competitive pricing, especially for high-frequency and short-term strategies. While worst-case spikes can still occur, IC Markets remains the most cost-efficient choice for trading Cable this month.

- AUS Global secures second place with a 7.3-point average spread. While not as tight as IC Markets, it still provides a relatively stable trading environment. Its performance makes it suitable for swing traders and day traders who prioritize a balance between cost and reliability.

- ACY Securities ranks third with an average spread of 10.8 points. Although higher than the leaders, it still outperforms many competitors. However, the broker’s worst spread spike of 400 points highlights potential volatility risks during fast-moving markets. Traders should factor this in when considering execution during news events.

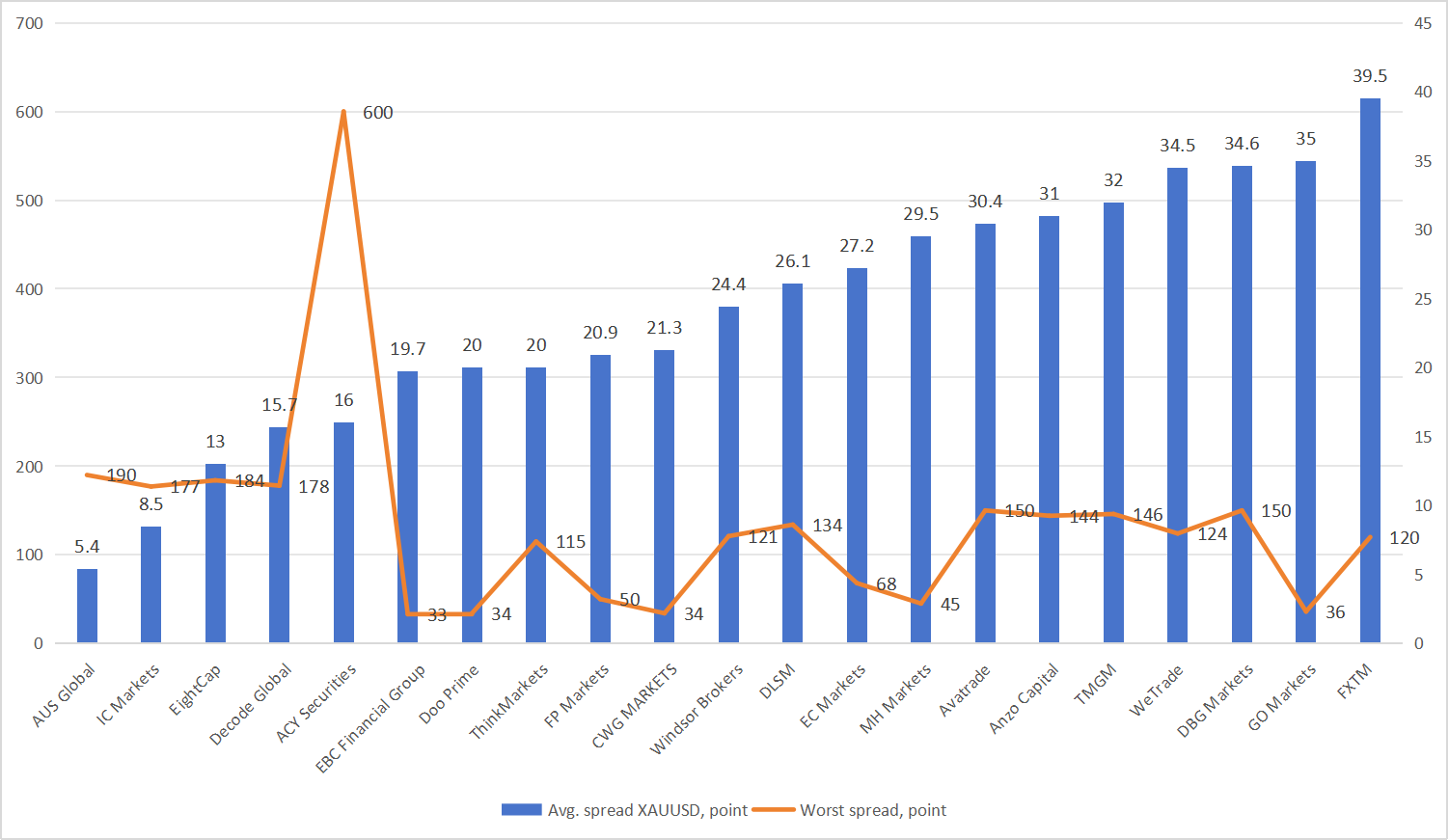

XAU/USD Average Spreads

- AUS Global leads the pack with an exceptionally low average spread of 5.4 points, making it the most cost-effective choice for gold traders. Even under volatile conditions, its worst spread of 190 points remains competitive compared to the industry. For scalpers, day traders, and those heavily focused on gold, AUS Global is clearly the best pick in July 2025.

- IC Markets secures the second position with an 8.5-point average spread. While slightly wider than AUS Global, it still offers highly attractive conditions for active traders. Interestingly, its worst spread of 177 points is marginally tighter than AUS Global’s maximum, showing strong resilience during high volatility.

- EightCap takes third place with a 13-point average spread. While less competitive than AUS Global or IC Markets, it remains a reasonable option for traders who value balance between pricing and platform features. Its worst spread of 184 points indicates decent stability during market swings.

Conclusion

Best for scalpers & cost-sensitive traders: IC Markets and AUS Global remain the top choices due to their consistently low spreads.

Best for metals (Gold): AUS Global takes the lead with the lowest Gold spread (5.4 points), while IC Markets also performs strongly.

Caution for wide spreads: Brokers such as Swissquote impose much higher trading costs, which can significantly impact profitability for high-frequency or short-term strategies.

In summary, spread differences remain dramatic in July 2025. Traders seeking efficiency should pay close attention to broker selection, as the gap between the lowest and highest costs can mean the difference between profit and loss over time.

Data Source: Brokersview Spread Ranking