Brokersview December 2025 Singapore Forex Spread Review: Which Broker firm performed the best?

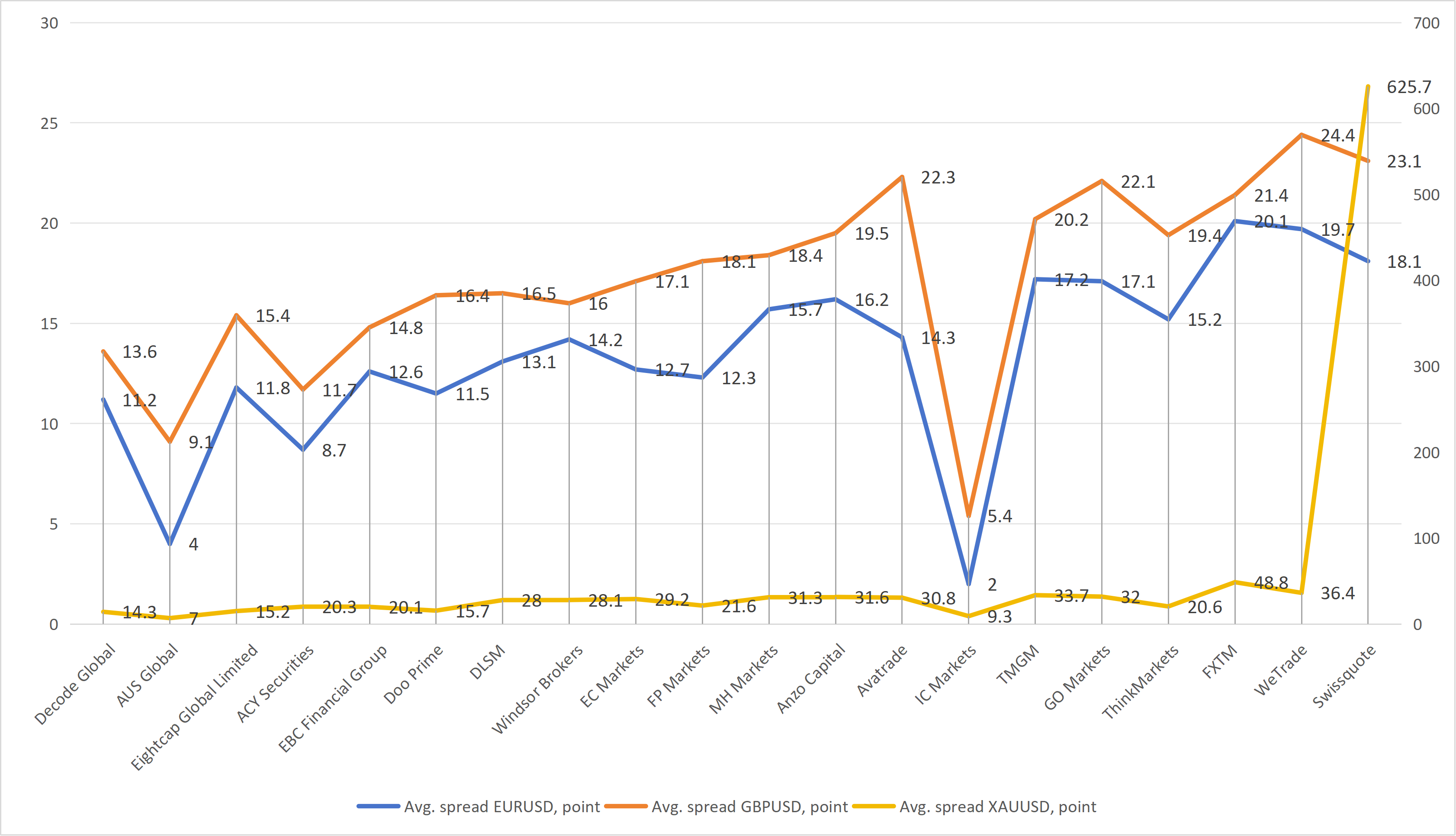

In the last month of 2025, in Singapore’s competitive forex trading landscape continues to see brokers vie for client attention through tight pricing and reliable execution. For active traders, spreads remain a critical factor in determining overall trading costs. This Brokersview review analyses the average spreads for three major currency pairs—EURUSD, GBPUSD, and XAUUSD —across 20 brokers in December 2025, identifying the top performers.

Top 3 Broker Performance Review

- Decode Global

EURUSD: 11.2 points

GBPUSD: 13.6 points

XAUUSD: 14.3 points

Decode Global emerges as the standout performer in December 2025, securing the top position due to exceptionally balanced and competitive spreads. While not the absolute lowest on individual pairs, its strength lies in providing reliably tight pricing across the board without significant weak spots. This consistency is valuable for traders who operate across multiple assets and seek predictable costs.

- AUS Global

EURUSD: 4 points

GBPUSD: 9.1 points

XAUUSD: 7 points

AUS Global claims a strong second place with competitive, stable spreads. This strong performance, particularly in gold trading where many brokers charge significantly higher spreads, makes AUS Global an excellent all-round choice for traders focusing on these popular markets.

- Eightcap Global Limited

EURUSD: 11.8 points

GBPUSD: 15.4 points

XAUUSD: 15.2 points

Eightcap takes third position with spreads that are competitive within the upper tier of low-cost brokers. Nonetheless, Eightcap maintains spreads that are generally below the broader market average, offering a credible low-cost environment for traders, especially those focused on the EURUSD pair.

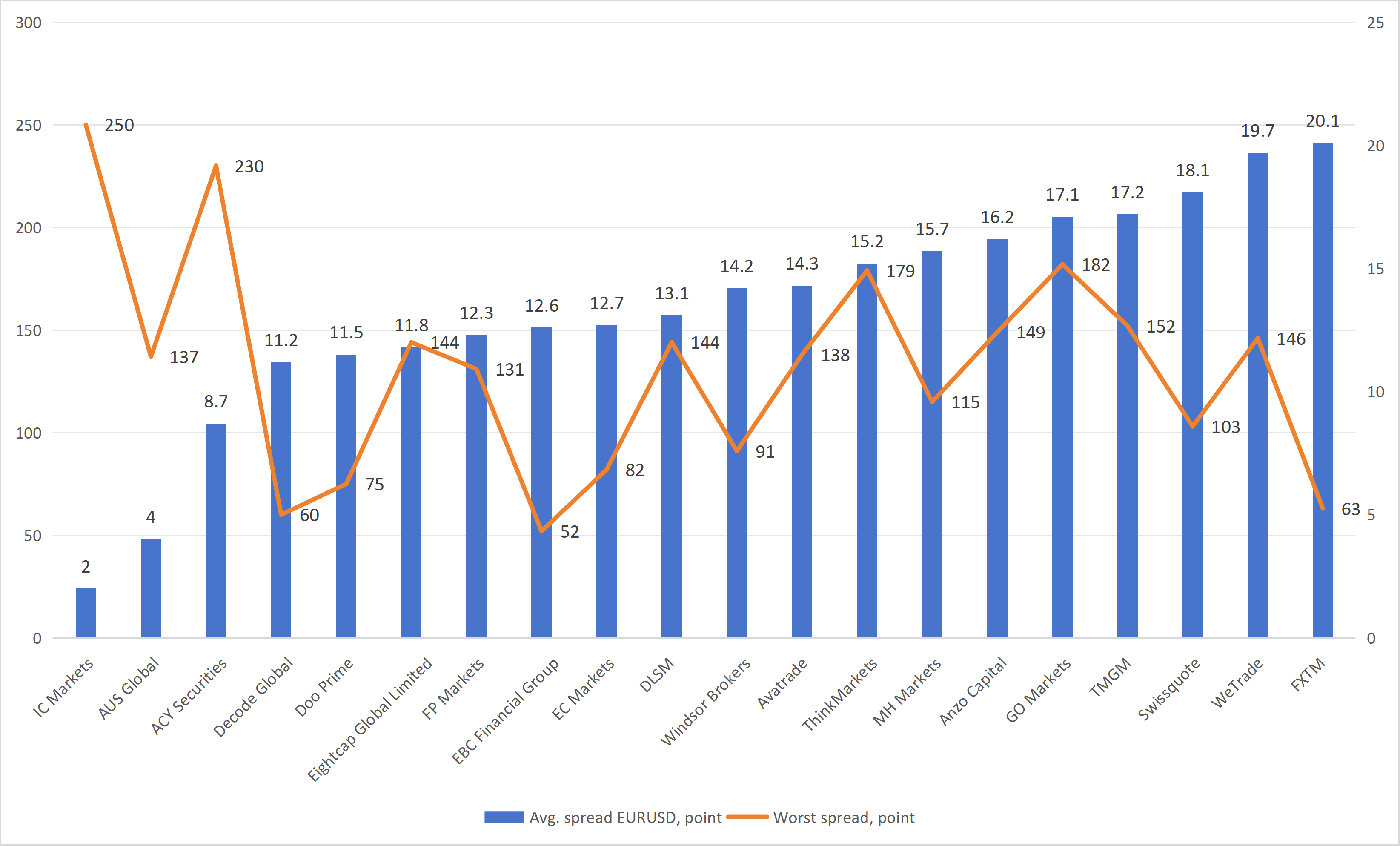

EURUSD Spread Analysis

1st: IC Markets — Tightest average spread, ideal for scalpers and high-frequency traders.

2nd: AUS Global — Its a well-balanced spread profile, but better control over extreme widening. Its a solid choice for intraday and swing traders.

3rd: ACY Securities — Competitive, though more suitable for medium- to long-term traders.

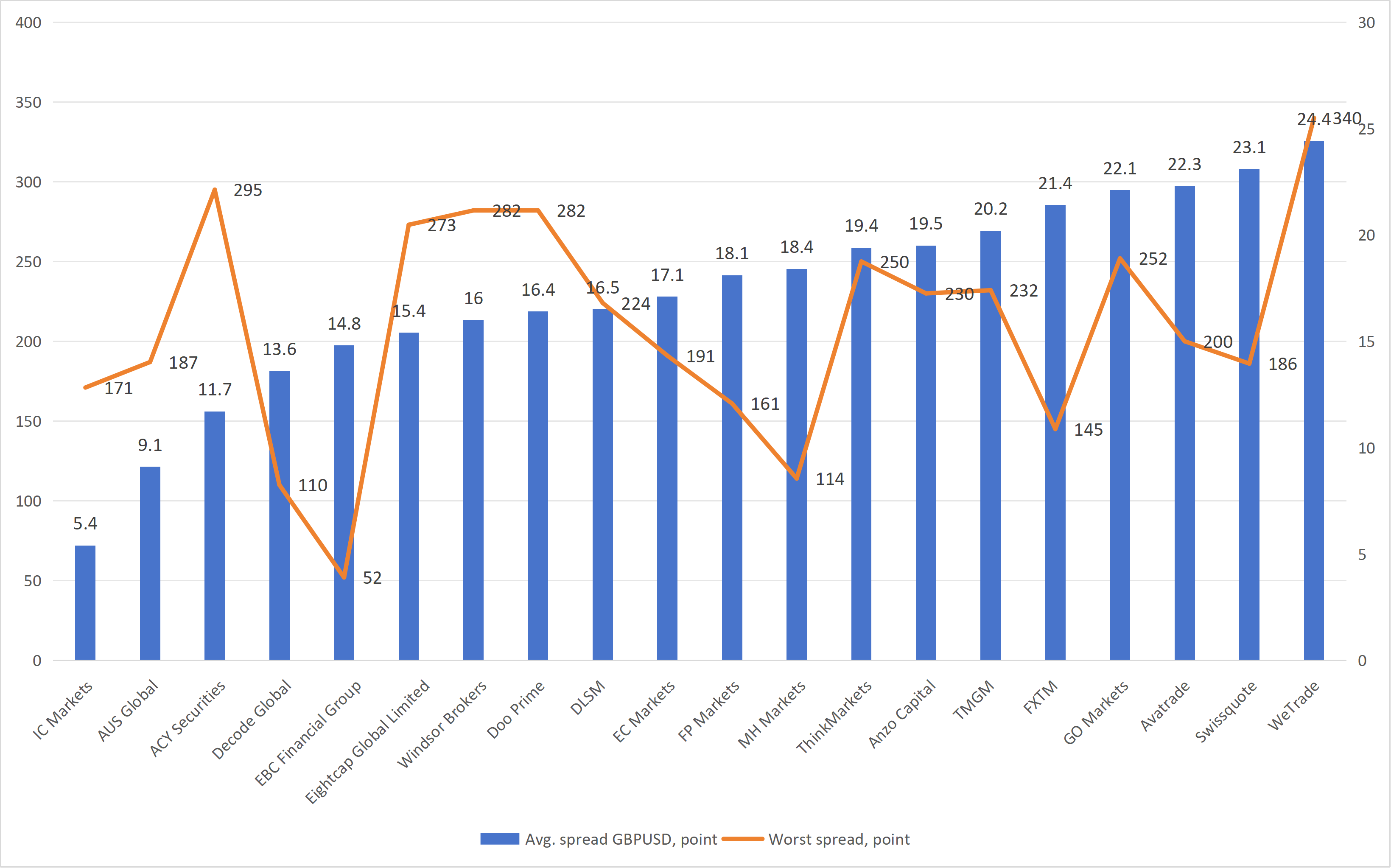

GBPUSD Spread Analysis

1st: IC Markets — Consistently tight average spreads with controlled worst-case expansion.

2nd: AUS Global — Reasonable pricing, suitable for traders avoiding high-impact sessions.

3rd: ACY Securities — Higher volatility risk due to significant spread expansion.

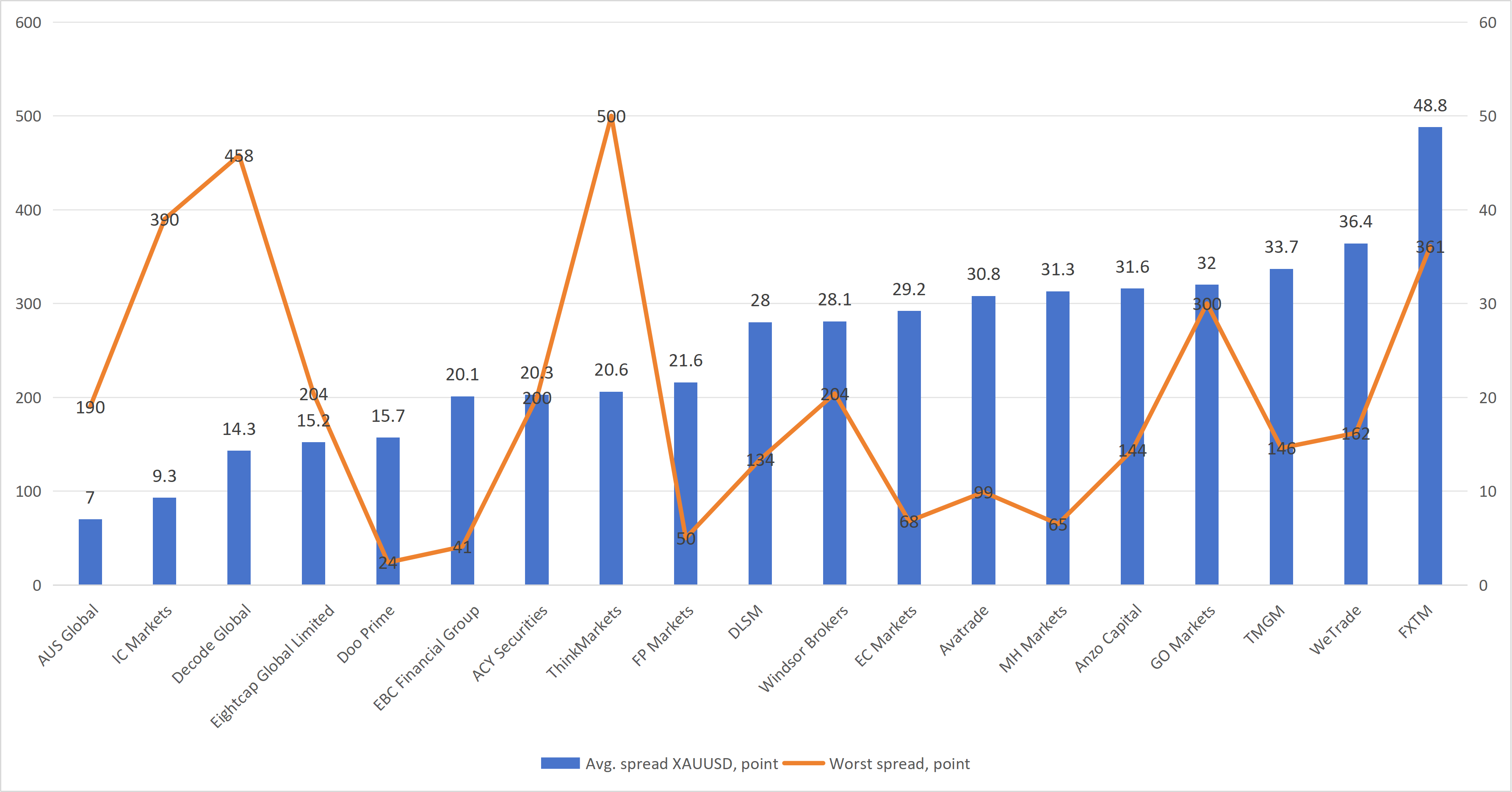

XAUUSD Spread Analysis

1st: AUS Global — Tightest average gold spreads with controlled volatility.

2nd: IC Markets — Competitive averages supported by deep liquidity, though prone to spikes.

3rd:Decode Global — Wider spreads, more suitable for longer-term gold traders.

Conclusion

Spread competitiveness can directly impact long-term profitability, especially in active trading strategies. Of course, traders should consider spreads alongside execution quality, commissions, regulation, and platform stability when choosing a broker.

For more comprehensive evaluation data, please check the BV evaluation column.