BrokersView August 2025 Swap Rates Review: A Comprehensive Analysis

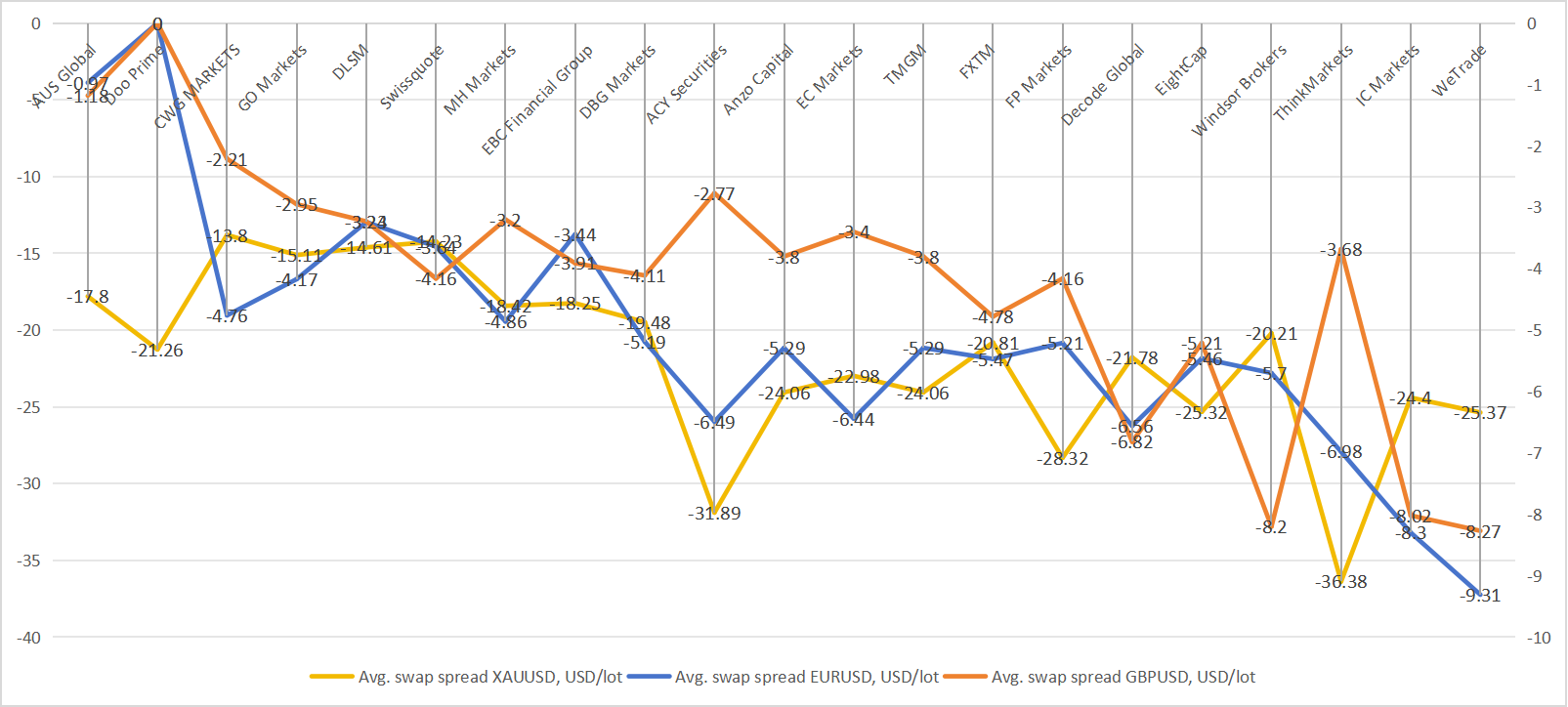

In August, we conducted a comprehensive review of overnight swap rates across major forex and gold trading pairs. The analysis covered EURUSD, GBPUSD, and XAUUSD among a selection of international brokers. The findings reveal notable differences in swap spreads, highlighting both cost-efficient options and more expensive choices for traders.

1. AUS Global

EURUSD: -0.97

GBPUSD: -1.18

XAUUSD: -17.8

AUS Global earns second place with consistently low negative swaps across all three instruments. The spreads are minimal on forex pairs and among the most favorable for gold, making AUS Global a balanced choice for traders looking at both currency and commodity markets.

2. Doo Prime

EURUSD: 0

GBPUSD: 0

XAUUSD: -21.26

Doo Prime stands out as the only broker offering zero swap spreads on both EURUSD and GBPUSD, making it extremely attractive for forex traders who prefer holding positions overnight. While its gold swap is still negative, it remains competitive compared to other brokers with much higher gold carrying costs.

3. CWG Markets

EURUSD: -4.76

GBPUSD: -2.21

XAUUSD: -13.8

CWG Markets secured third position thanks to its competitive gold swap, the lowest among all brokers in our review. Although its forex swaps are slightly higher than AUS Global’s, the attractive XAUUSD rate gives it a strong edge for gold-focused traders.

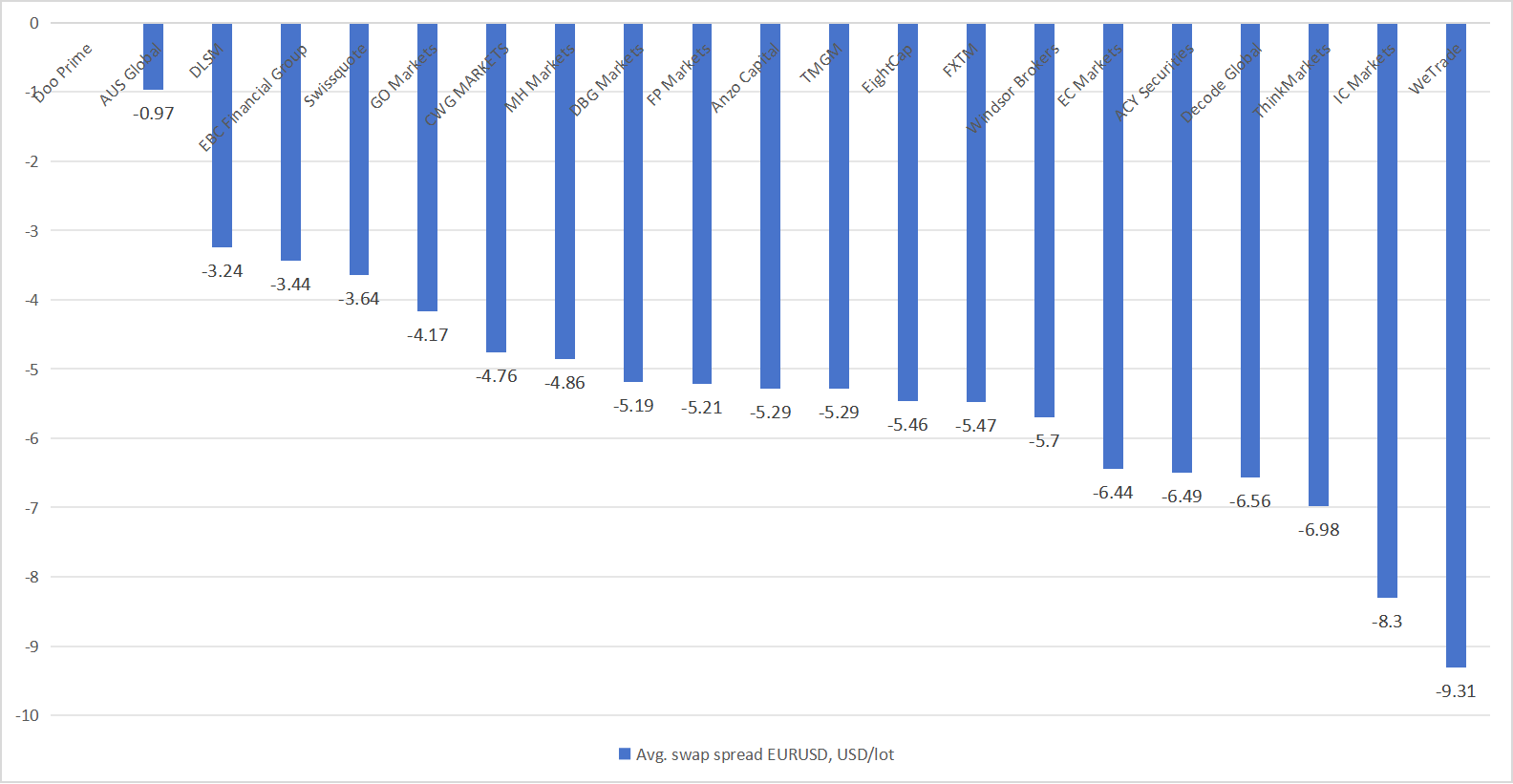

EUR/USD Swap Rates

- Doo Prime – Avg. Swap: 0 USD/lot

Doo Prime stands out with a zero swap for EUR/USD, making it highly attractive for traders who frequently hold positions overnight. A zero swap eliminates interest costs, reducing trading expenses and enhancing flexibility for long-term strategies. - AUS Global – Avg. Swap: -0.97 USD/lot

AUS Global offers a relatively low negative swap of -0.97 USD per lot. While traders incur some cost for holding positions overnight, the impact is modest, making it a reasonable option for medium-term trading. - DLSM – Avg. Swap: -3.24 USD/lot

The average swap spread of DLSM is -$3.24 USD/lot, ranking third. This rate may significantly affect profitability for traders holding large positions or multiple lots overnight. Traders need to weigh this cost against other factors such as spreads and execution quality.

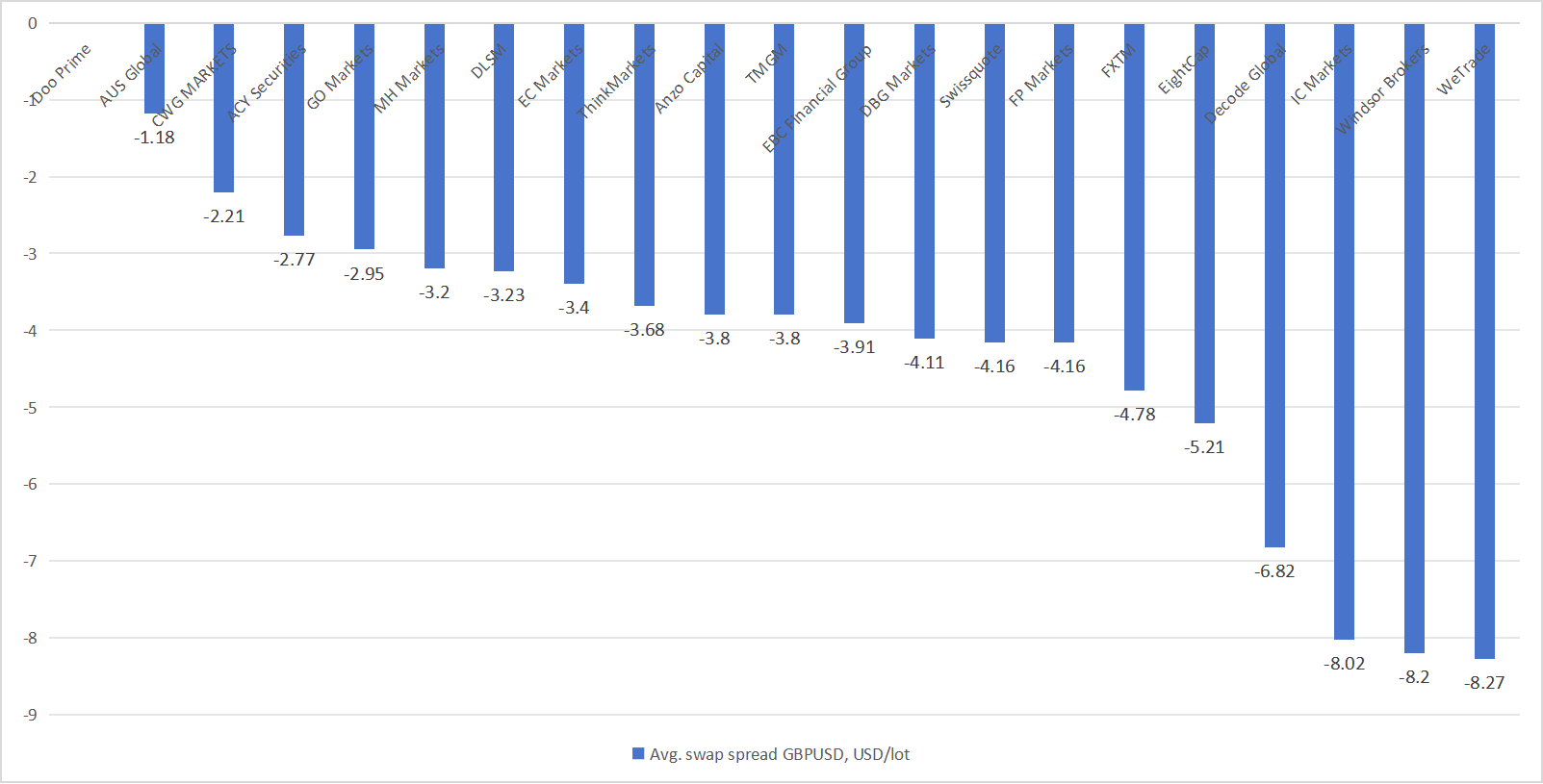

GBP/USD Swap Rates

- Doo Prime – 0 USD/lot

Doo Prime offered a neutral swap for GBP/USD in August, meaning traders neither paid nor earned interest for holding overnight positions. This is particularly advantageous for long-term traders who want to avoid additional costs when keeping positions open. - AUS Global – -1.18 USD/lot

AUS Global charged a moderate negative swap for GBP/USD positions. Traders holding overnight positions would incur a small cost of $1.18 per lot, which is relatively reasonable compared to other brokers, making it acceptable for medium-term trading strategies. - CWG MARKETS – -2.21 USD/lot

CWG MARKETS had the highest negative swap among the three, meaning overnight positions would cost $2.21 per lot. This makes it less favorable for traders who prefer to hold positions overnight but may be acceptable for those employing short-term intraday strategies.

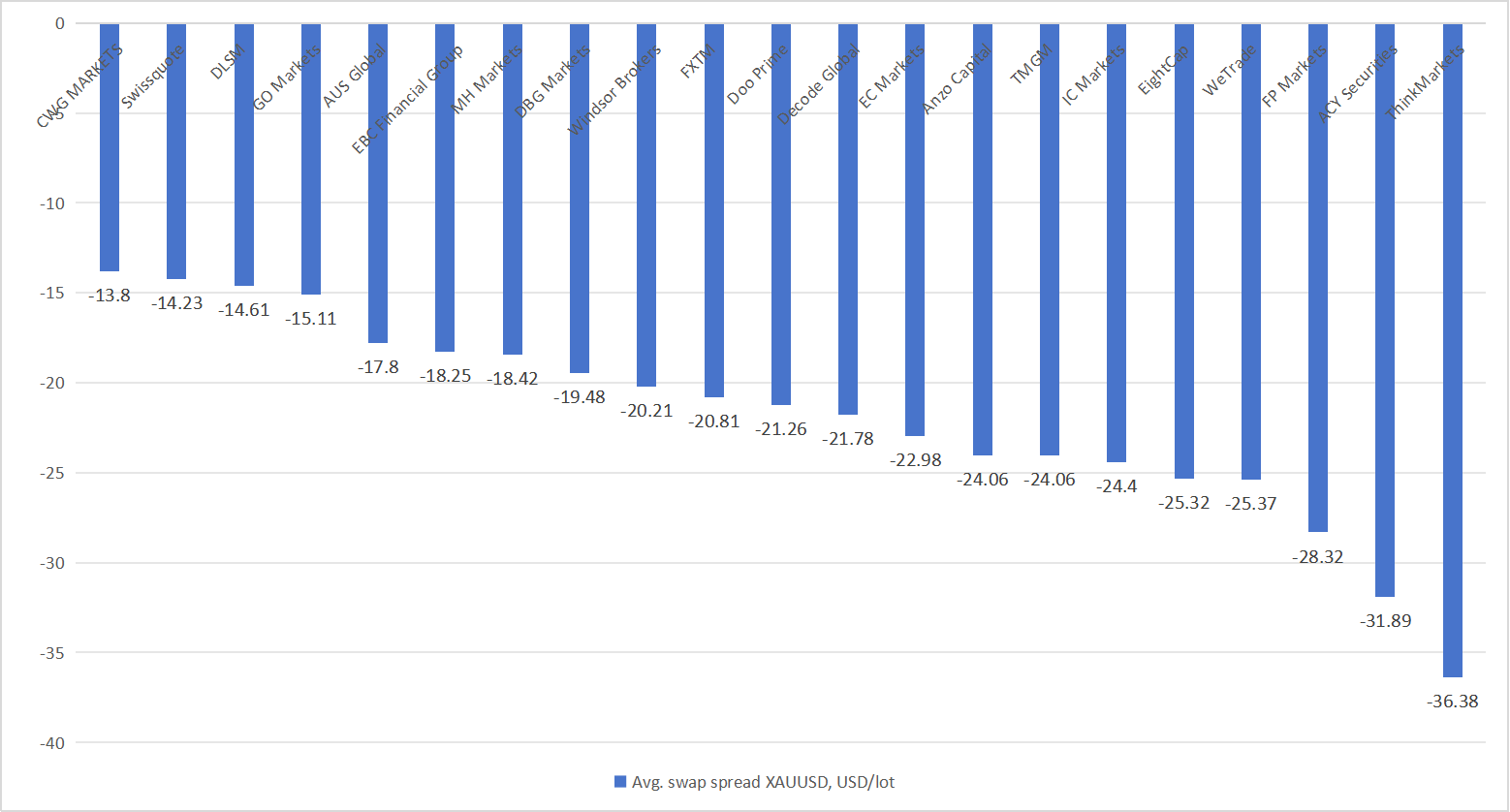

XAU/USD Swap Rates

- CWG MARKETS – Avg. Swap:–13.8 USD/lot

CWG Markets offered the most favorable average swap in August, with an average swap spread of –13.8 USD per lot. This relatively lower overnight cost provides traders with an advantage, particularly those who hold longer positions in gold. For active swing traders or institutions managing large volumes, the reduction in swap expenses can meaningfully improve net returns. - Swissquote – Avg. Swap:–14.23 USD/lot

Swissquote ranked second, with an average swap spread of –14.23 USD per lot. While slightly higher than CWG Markets, Swissquote’s established reputation and regulatory standing may offset the marginally higher swap costs. For traders prioritizing security and global brand trust, Swissquote remains a strong contender. - DLSM – Avg. Swap:–14.61 USD/lot

DLSM posted the third-lowest average swap spread at –14.61 USD per lot. Although it is less competitive than the first two, the rate still falls within a reasonable range compared with the industry average.

Conclusion

The August review highlights how swap spreads vary widely among brokers. Doo Prime leads with zero forex swaps, AUS Global offers well-balanced and low-cost swaps across all instruments, and CWG Markets provides the most favorable gold swap.

For traders who regularly hold positions overnight, choosing the right broker can significantly reduce trading costs and improve long-term profitability.

For more comprehensive evaluation data, please check the BV evaluation column.