70% Revenue Drop in "Very Difficult" 2024: CPT Markets UK Appoints New CEO to Lead Strategic Shift

CPT Markets UK Limited, the UK arm of Forex and CFD broker CPT Markets, has reported a sharp decline in revenue and a significantly widened annual loss for the 2024 financial year, citing client concentration and liquidity delays as key factors.

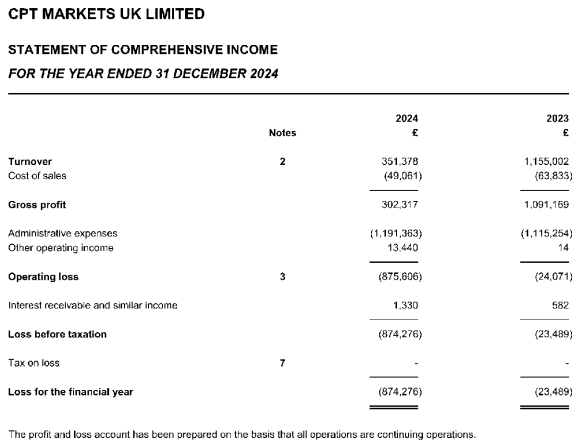

According to its latest filing with Companies House, turnover fell 70% to £351,378, down from £1,155,002 in 2023. Administrative expenses edged up to £1,191,363 from £1,115,254, resulting in a net loss of £874,276, compared to just £23,489 the previous year.

Source: CPT Markets UK Limited FY24 Financial Report

The firm’s return on assets plunged to -111%, from -2.5% in 2023, while net assets declined 18% to £788,826 from £958,102.

Management attributed the downturn to two major clients pausing trading for extended periods and delays in onboarding a liquidity provider requested by new clients. The report cited “an over-reliance on a small number of clients” and “a long delay in the provision of an LP” as the primary causes of low revenue.

In response to the “very difficult year” described by the company, CPT Markets UK announced a leadership change. Mike Greenhalgh, currently Head of Sales & Trading, will step into the role of Chief Executive Officer, pending regulatory approval. He replaces Nick Lewis, who has served as CEO for over a decade.

Greenhalgh is expected to lead the firm’s strategic pivot toward institutional business, targeting small to mid-sized funds and proprietary traders. CPT Markets UK also plans to raise the minimum investment threshold for retail clients.

The company also plans further recruitment when market conditions improve. To diversify its revenue streams, CPT Markets UK plans to offer liquidity services to other brokers on a B2B basis and expand its product suite to include equities, fixed income, and derivatives, alongside its existing forex, commodities, and indices CFDs.