$3,465 Withdrawal Initially Rejected, Then Left Unprocessed—STARTRADER Faces Client Complaint

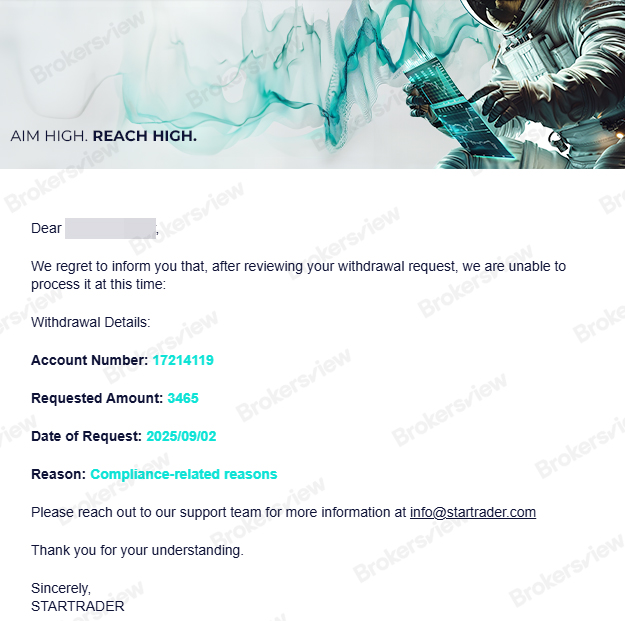

An investor has submitted a complaint via BrokersView, alleging that the forex broker STARTRADER failed to process his $3,465 withdrawal request submitted on September 2, 2025. The request was initially rejected and, as of the complaint date, remained unresolved for over seven days.

The client provided a screenshot showing that STARTRADER cited a “compliance-related” reason for the initial rejection, without offering further explanation.

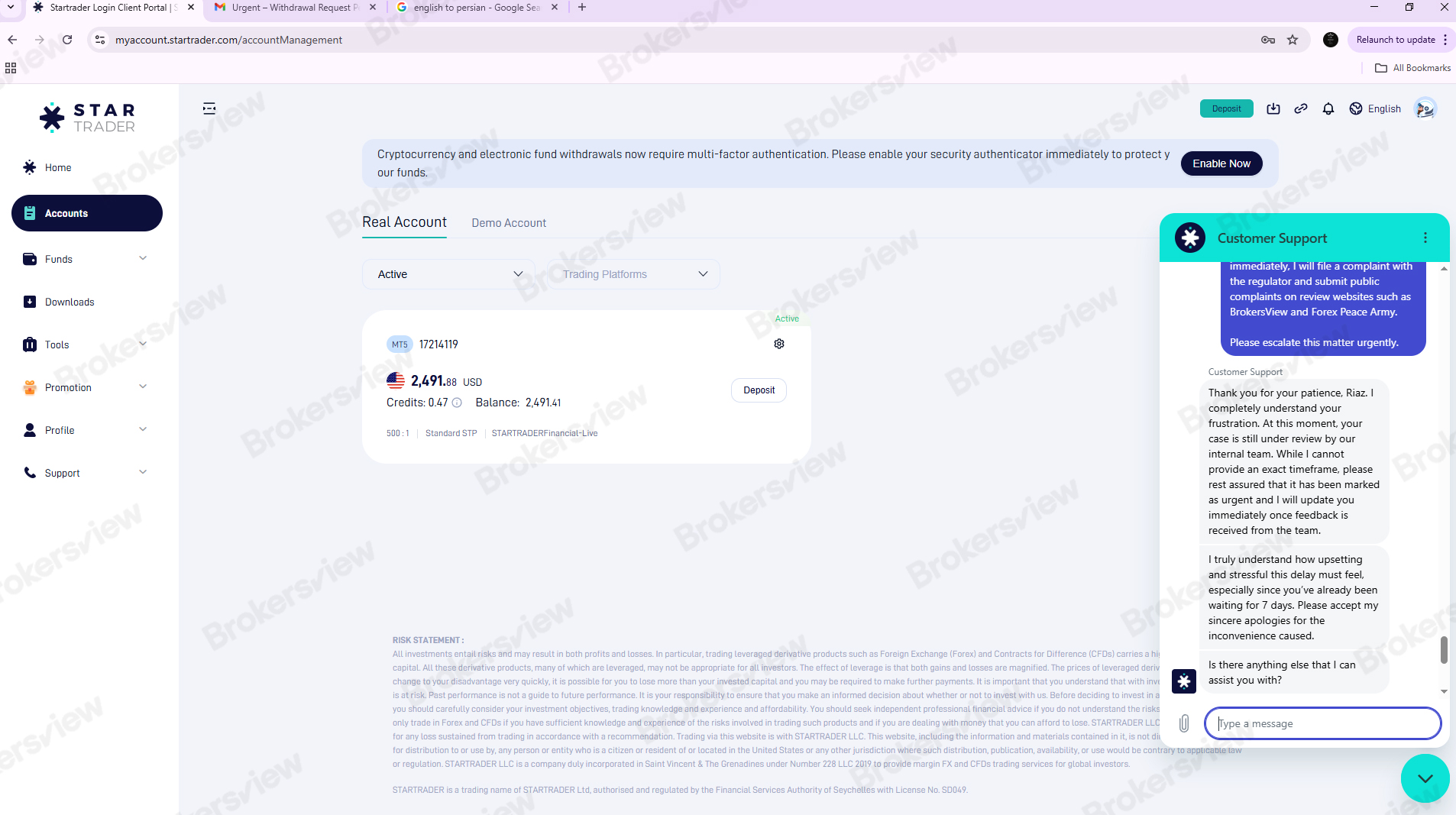

Despite repeated follow-ups, the client reports receiving only generic responses from STARTRADER’s support team, stating the request is “under review.”

The client said that the delay has caused serious issues, including an impact on his credibility as a trading academy instructor.

The client is requesting urgent resolution of his withdrawal issue. BrokersView has relayed the complaint to STARTRADER and is currently awaiting the broker’s response.

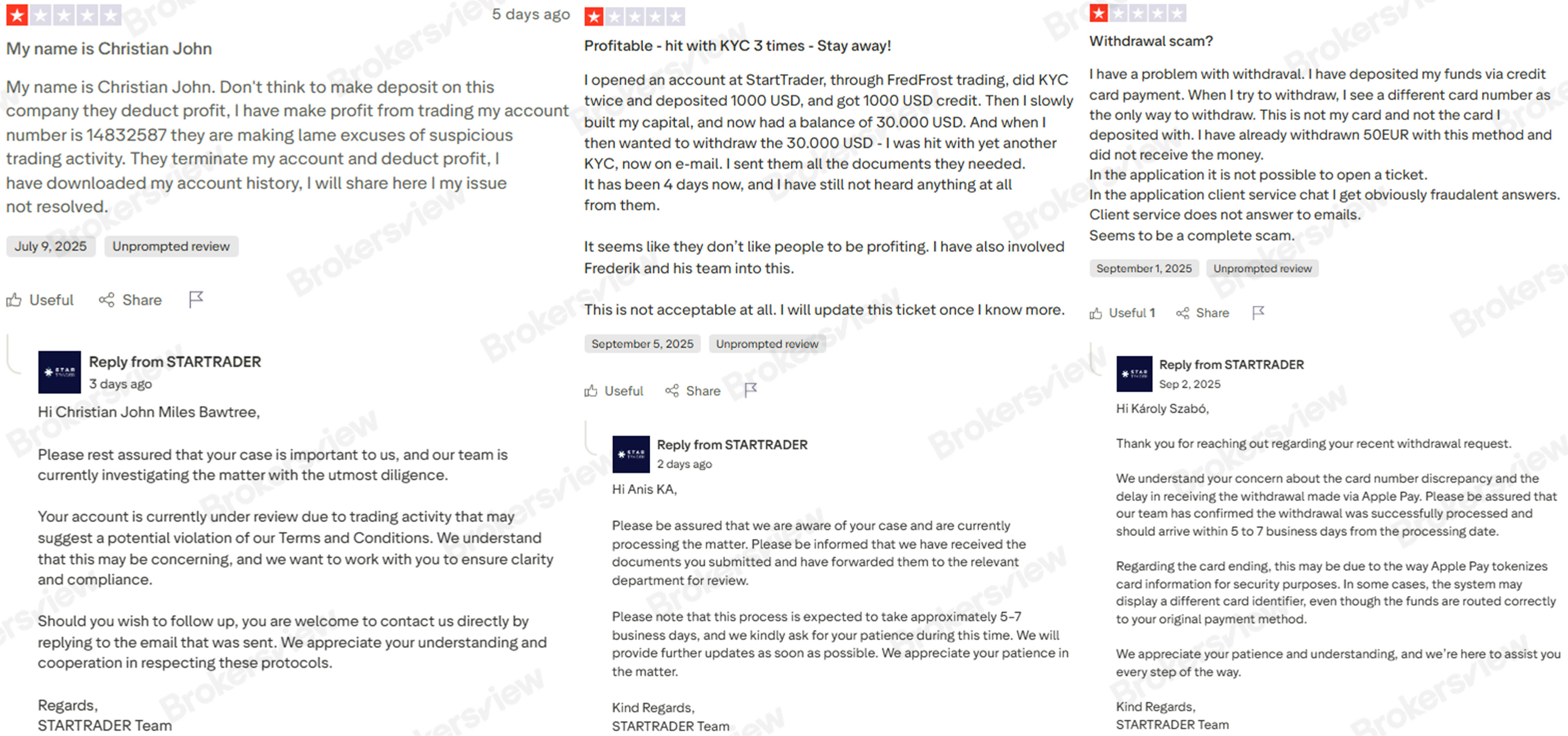

Recent client reports also include STARTRADER’s profit deductions labeled as “suspicious trading activity,” repeated KYC verification requests delaying withdrawals, and instances of unfulfilled withdrawal transactions.

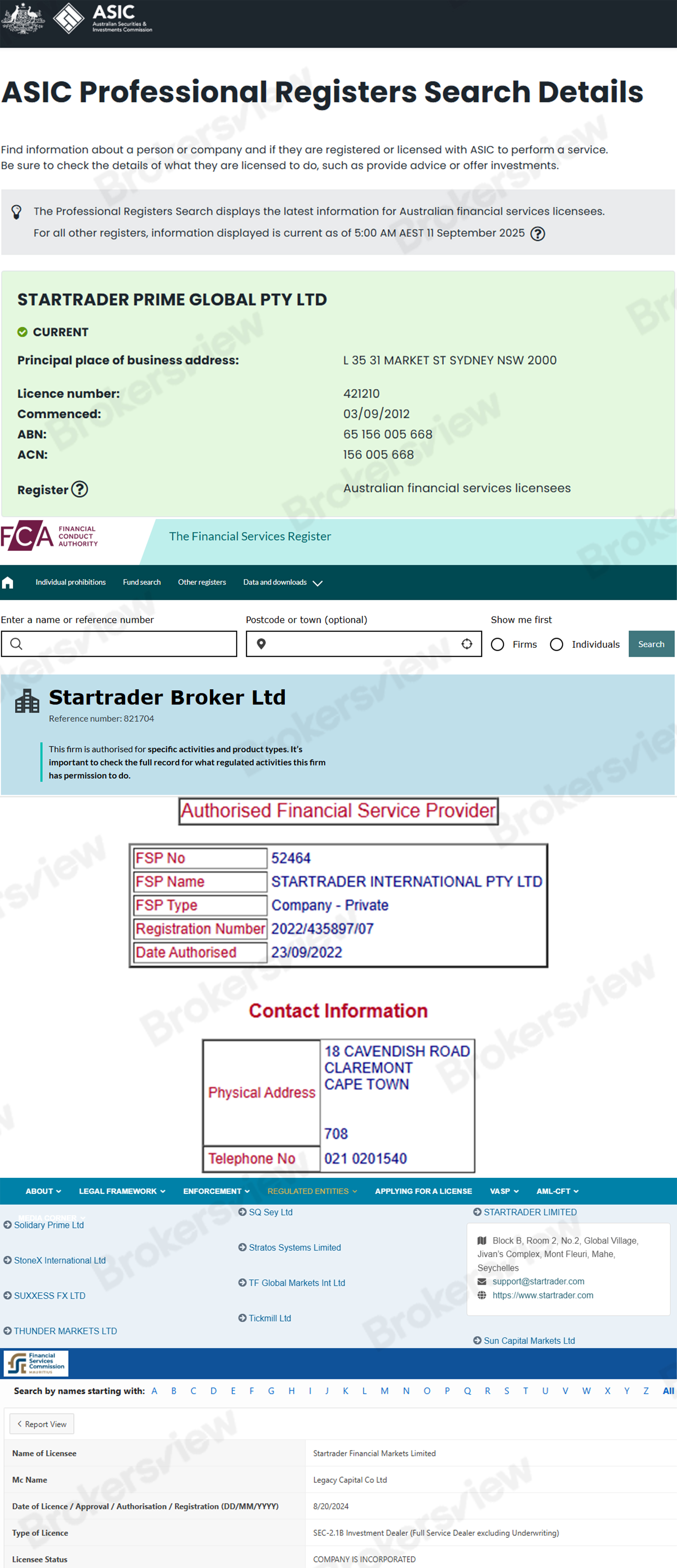

Regulatory Details of STARTRADER

According to STARTRADER’s website, the broker operates through five licensed entities offering financial products and trading brokerage services across multiple jurisdictions. We have verified the authorization information.

These include STARTRADER Prime Global Pty Ltd (ASIC, AFSL No. 421210), STARTRADER Broker Limited (FCA UK, Ref No. 821704), and STARTRADER International Pty Ltd (FSCA South Africa, FSP No. 52464). Two entities—STARTRADER Limited (FSA Seychelles, License No. SD049) and STARTRADER Financial Markets Limited (FSC Mauritius, License No. GB24203371)—are regulated under offshore frameworks, which typically offer weaker oversight and limited investor protection.

Regulatory Warnings

Despite holding multiple licenses, STARTRADER has been flagged by prominent regulators, including Spain’s CNMV and France’s AMF, for allegedly offering financial services or products without proper authorization.

BrokersView Reminds You

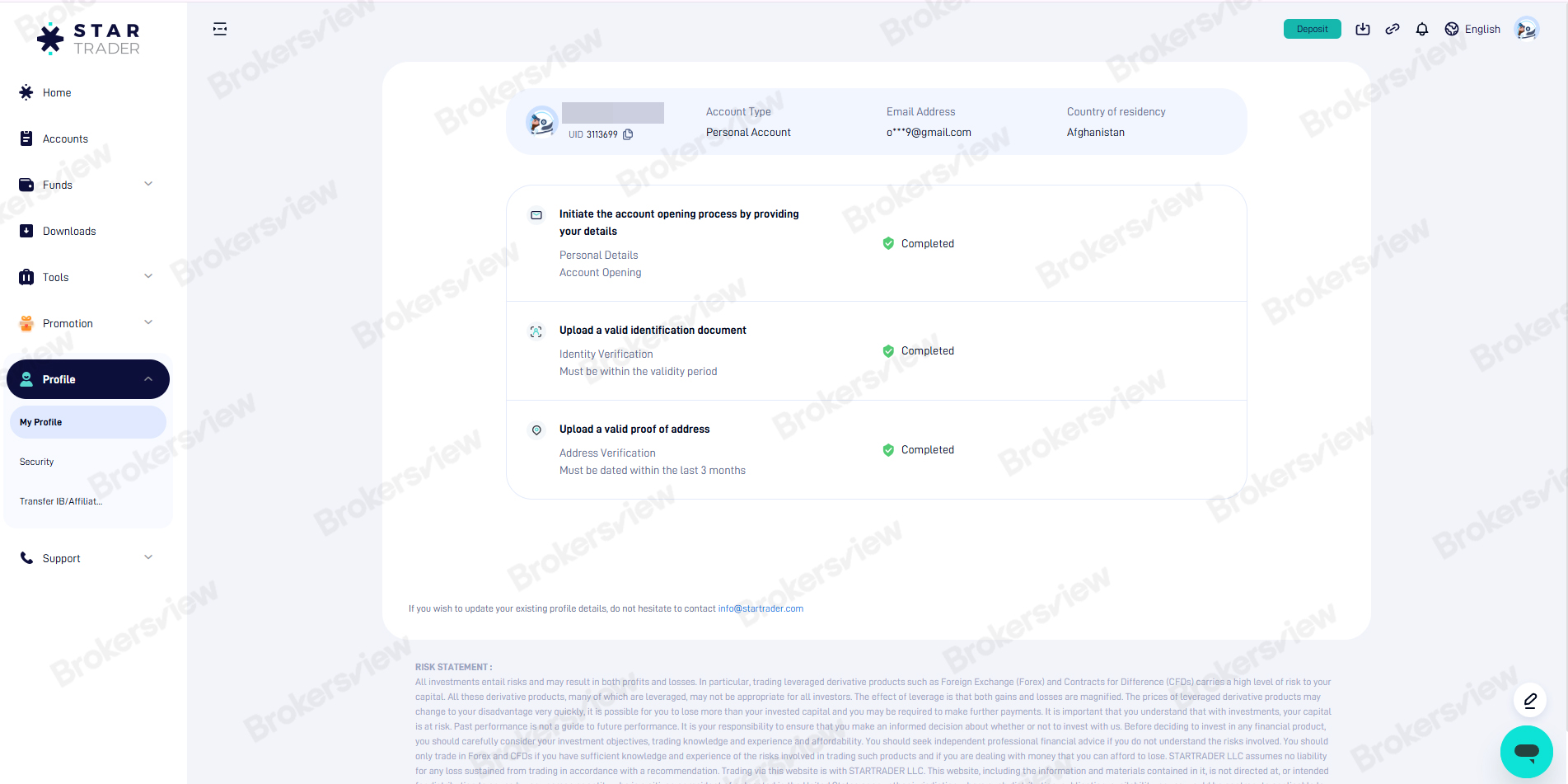

Based on STARTRADER’s disclosed regulatory information, clients in regions without direct regulatory coverage are likely onboarded under one of its offshore-regulated entities. Therefore, the complainant from Afghanistan likely opened an account through STARTRADER’s Seychelles entity or Mauritius entity, leading to weaker oversight and limited accountability.

Screenshot showing the complainant’s account information on STARTRADER

To ensure stronger investor protection and access to recourse in cases of broker misconduct, it is crucial to engage with a broker that is fully regulated within your own jurisdiction.

Investors are strongly advised to assess regulatory risks carefully and verify a broker’s licensing status thoroughly before investing, to avoid unnecessary losses and ensure proper protection. We encourage investors to Submit a Complaint if they encounter fraud.