$30,000 Principal Seized: ThinkMarkets' Dual-Faced Deception Under Regulatory Halo Exposed

"Not only was the $13,685 profit wiped out, but the $30,000 principal has also been withheld for months." This egregious act was not committed by an unknown scam broker, but by ThinkMarkets, a major brokerage firm holding multiple international licenses, including those from the FCA and ASIC. A new complaint has emerged, revealing the platform's disturbing "harvesting model": exploiting offshore entities to bypass regulation and unilaterally seizing client funds on the pretext of "terms violations." As the supposed regulatory model slides into a zone rife with complaints, how much confidence can investors still place in it?

The "Death Sentence" for $30,000 Principal

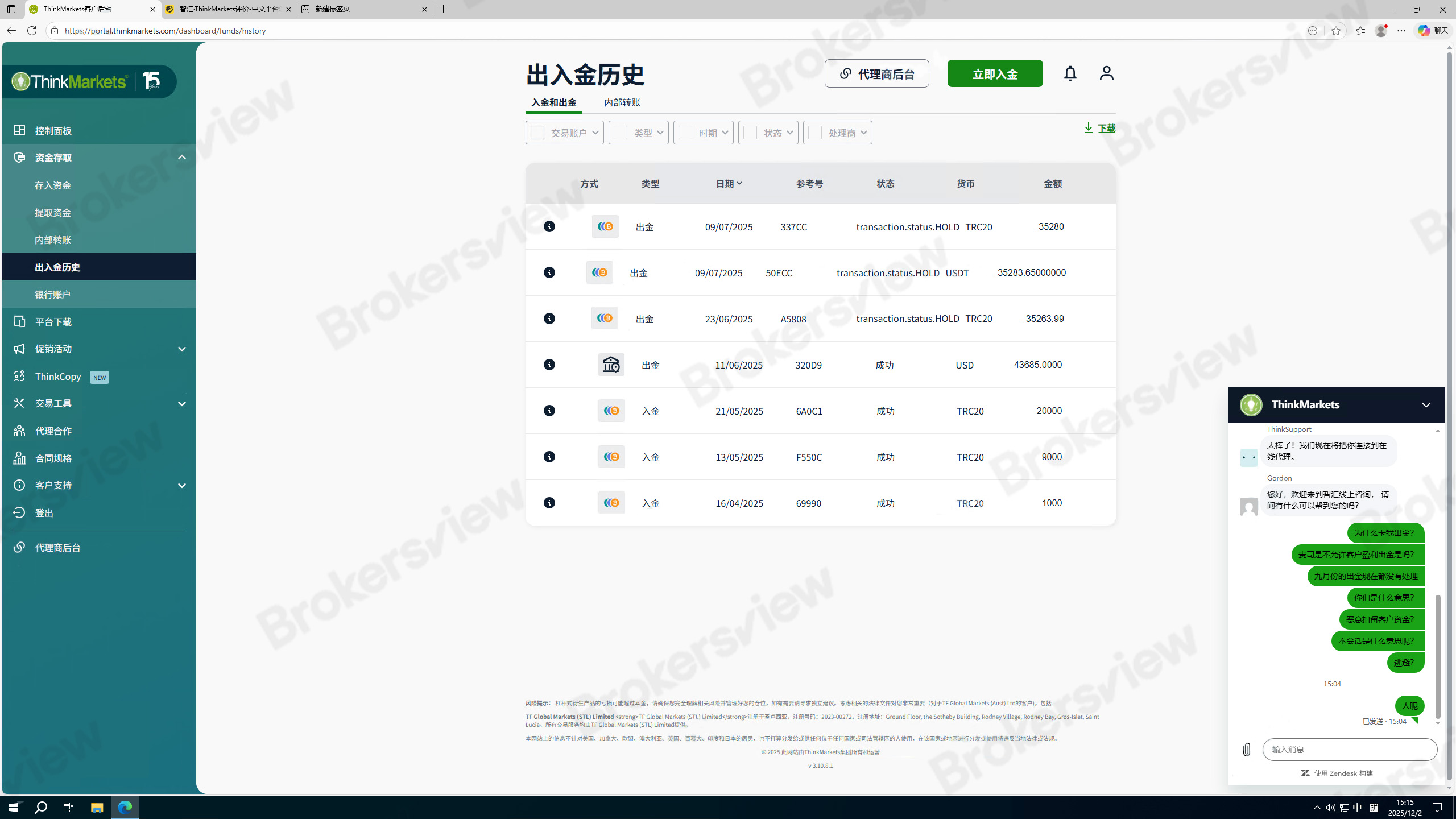

The trader reported depositing a cumulative $30,000 between April and May, and successfully profited from a market move on June 10.

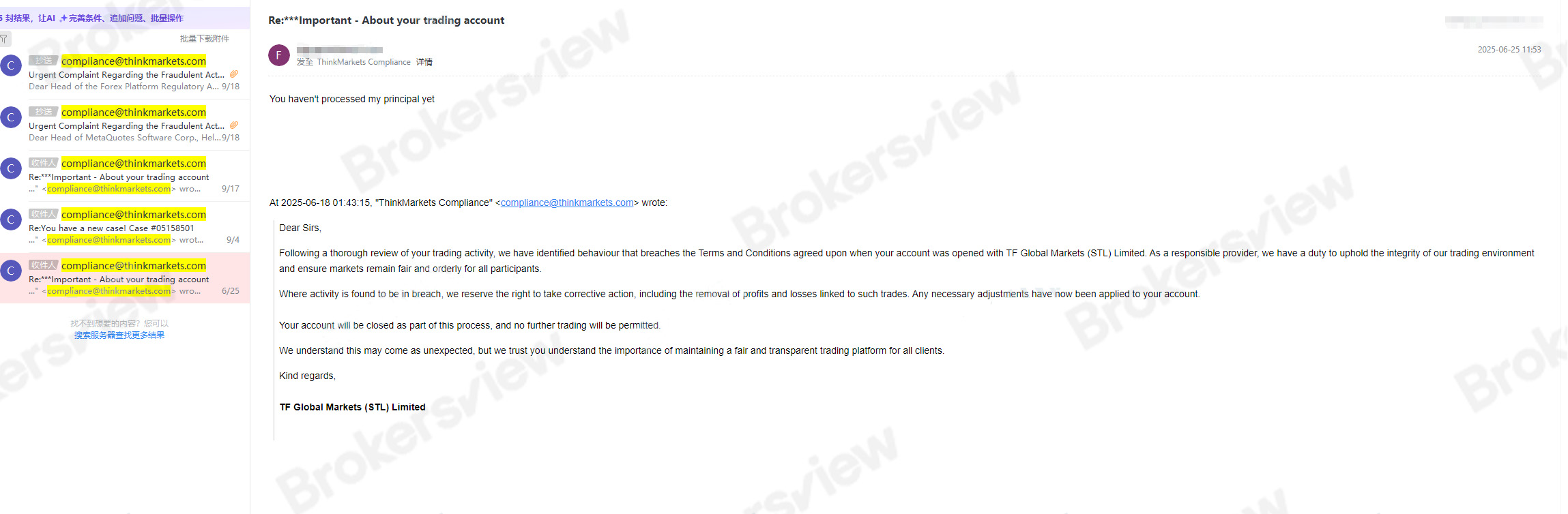

However, when he eagerly applied on the following day (June 11) to withdraw a total of $43,685 (principal and profit), ThinkMarkets did not process the request. Instead, they sent an email claiming his account had "violated terms and conditions" and that they would "adjust the balance and close the account."

The immediate consequence was that the broker wiped out his entire $13,685 profit. Even more concerning, in the months that followed, they completely ignored his reasonable requests for the return of his $30,000 principal. This "take-all" approach, seizing both profit and principal, is entirely inconsistent with the conduct expected of a compliant brokerage.

From "Chronic Delay" to "Acute Seizure"

This is not an isolated incident. In a November 2025 exposé, BrokersView previously detailed the ordeal of another user whose $5,249 fund (including ~$590 profit) was detained by the platform for over 100 days, trapped in an "indefinite review" stalemate.

Comparing these two cases, we can clearly discern ThinkMarkets' two typical tactics against profitable clients:

Tactic 1 (Small Profits): Employing the "Delay Tactic," plunging withdrawal applications into protracted review processes to exhaust the user's patience.

Tactic 2 (Large Profits): Employing the "Termination Tactic," immediately levying a "violation" charge, unilaterally zeroing out the account, and cutting off all communication.

The Regulatory Illusion: Which Contract Did You Sign?

While ThinkMarkets holds licenses from the UK's FCA and Australia's ASIC, it is vital to understand that this does not automatically mean all clients are protected under these strict jurisdictions.

In the case of the seized $30,000 principal, the entity the user contracted with was TF Global Markets (STL) Limited. Investigations show this entity is registered in Saint Lucia (Registration No: 2023-00272), a jurisdiction that has not issued a formal financial regulatory license to the firm. This means that while investors may believe they are trading on a platform with top-tier regulation, their capital is effectively exposed in an unregulated, offshore "black box."

BrokersView Reminds You

When opening an account with brokers like ThinkMarkets, which promote their top-tier licenses, you must ensure that your account is indeed under a valid regulatory body such as the FCA or ASIC, and avoid being directed to offshore entities like Saint Lucia.

Given the recent surge in complaints suggesting a "profit equals violation" mentality at this platform, traders are strongly advised to reconsider before committing large capital amounts to ThinkMarkets.

If you have also suffered similar unfair treatment, please retain all trading records and evidence of communication, and promptly submit a complaint to BrokersView.