Citations

Nouvelles

Analyse

Utilisateur

24/7

Calendrier économique

Education

Données

- Des noms

- Dernier

- Précédent

Comptes de Signaux pour Membres

Tous les Comptes de Signaux

All Contests

Japon Indice Tankan des perspectives des grandes entreprises non manufacturières (Quatrième trimestre)

Japon Indice Tankan des perspectives des grandes entreprises non manufacturières (Quatrième trimestre)A:--

F: --

P: --

Japon Indice Tankan des perspectives de l'industrie manufacturière (Quatrième trimestre)

Japon Indice Tankan des perspectives de l'industrie manufacturière (Quatrième trimestre)A:--

F: --

P: --

Japon Indice Tankan de l'activité manufacturière (Quatrième trimestre)

Japon Indice Tankan de l'activité manufacturière (Quatrième trimestre)A:--

F: --

P: --

Japon Indice de diffusion Tankan pour les grandes entreprises manufacturières (Quatrième trimestre)

Japon Indice de diffusion Tankan pour les grandes entreprises manufacturières (Quatrième trimestre)A:--

F: --

P: --

Japon Tankan - Dépenses d'investissement des grandes entreprises en glissement annuel (Quatrième trimestre)

Japon Tankan - Dépenses d'investissement des grandes entreprises en glissement annuel (Quatrième trimestre)A:--

F: --

P: --

ROYAUME-UNI Indice Rightmove des prix de l'immobilier en glissement annuel (Décembre)

ROYAUME-UNI Indice Rightmove des prix de l'immobilier en glissement annuel (Décembre)A:--

F: --

P: --

Chine, Mainland Production industrielle en glissement annuel (YTD) (Novembre)

Chine, Mainland Production industrielle en glissement annuel (YTD) (Novembre)A:--

F: --

P: --

Chine, Mainland Taux de chômage dans les zones urbaines (Novembre)

Chine, Mainland Taux de chômage dans les zones urbaines (Novembre)A:--

F: --

P: --

Arabie Saoudite CPI YoY (Novembre)

Arabie Saoudite CPI YoY (Novembre)A:--

F: --

P: --

Zone Euro Production industrielle YoY (Octobre)

Zone Euro Production industrielle YoY (Octobre)A:--

F: --

P: --

Zone Euro Production industrielle MoM (Octobre)

Zone Euro Production industrielle MoM (Octobre)A:--

F: --

P: --

Canada Ventes de logements existants MoM (Novembre)

Canada Ventes de logements existants MoM (Novembre)A:--

F: --

P: --

Canada Indice national de confiance économique

Canada Indice national de confiance économiqueA:--

F: --

P: --

Canada Mises en chantier de logements neufs (Novembre)

Canada Mises en chantier de logements neufs (Novembre)A:--

F: --

U.S. Indice de l'emploi manufacturier de la Fed de New York (Décembre)

U.S. Indice de l'emploi manufacturier de la Fed de New York (Décembre)A:--

F: --

P: --

U.S. Indice NY Fed Manufacturing (Décembre)

U.S. Indice NY Fed Manufacturing (Décembre)A:--

F: --

P: --

Canada IPC de base en glissement annuel (Novembre)

Canada IPC de base en glissement annuel (Novembre)A:--

F: --

P: --

Canada Commandes en cours dans l'industrie manufacturière MoM (Octobre)

Canada Commandes en cours dans l'industrie manufacturière MoM (Octobre)A:--

F: --

P: --

U.S. Indice d'acquisition des prix de la Fed de New York pour l'industrie manufacturière (Décembre)

U.S. Indice d'acquisition des prix de la Fed de New York pour l'industrie manufacturière (Décembre)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (en anglais) (Décembre)

U.S. NY Fed Manufacturing New Orders Index (en anglais) (Décembre)A:--

F: --

P: --

Canada Nouvelles commandes manufacturières MoM (Octobre)

Canada Nouvelles commandes manufacturières MoM (Octobre)A:--

F: --

P: --

Canada Indice de base MoM (Novembre)

Canada Indice de base MoM (Novembre)A:--

F: --

P: --

Canada Indice des prix à la consommation (IPC) ajusté YoY (SA) (Novembre)

Canada Indice des prix à la consommation (IPC) ajusté YoY (SA) (Novembre)A:--

F: --

P: --

Canada Stocks manufacturiers MoM (Octobre)

Canada Stocks manufacturiers MoM (Octobre)A:--

F: --

P: --

Canada CPI YoY (Novembre)

Canada CPI YoY (Novembre)A:--

F: --

P: --

Canada IPC MoM (Novembre)

Canada IPC MoM (Novembre)A:--

F: --

P: --

Canada IPC en glissement annuel (SA) (Novembre)

Canada IPC en glissement annuel (SA) (Novembre)A:--

F: --

P: --

Canada Indice de référence MoM (SA) (Novembre)

Canada Indice de référence MoM (SA) (Novembre)A:--

F: --

P: --

Canada IPC MoM (SA) (Novembre)

Canada IPC MoM (SA) (Novembre)A:--

F: --

P: --

Le gouverneur de la Réserve fédérale, Milan, a prononcé un discours

Le gouverneur de la Réserve fédérale, Milan, a prononcé un discours U.S. Indice NAHB du marché du logement (Décembre)

U.S. Indice NAHB du marché du logement (Décembre)--

F: --

P: --

Australie Composite PMI Prelim (Décembre)

Australie Composite PMI Prelim (Décembre)--

F: --

P: --

Australie Service PMI Prelim (Décembre)

Australie Service PMI Prelim (Décembre)--

F: --

P: --

Australie PMI manufacturier préliminaire (Décembre)

Australie PMI manufacturier préliminaire (Décembre)--

F: --

P: --

Japon PMI manufacturier préliminaire (SA) (Décembre)

Japon PMI manufacturier préliminaire (SA) (Décembre)--

F: --

P: --

ROYAUME-UNI Variation de l'emploi au BIT sur 3 mois (Octobre)

ROYAUME-UNI Variation de l'emploi au BIT sur 3 mois (Octobre)--

F: --

P: --

ROYAUME-UNI Nombre de demandeurs d'emploi (Novembre)

ROYAUME-UNI Nombre de demandeurs d'emploi (Novembre)--

F: --

P: --

ROYAUME-UNI Taux de chômage (Novembre)

ROYAUME-UNI Taux de chômage (Novembre)--

F: --

P: --

ROYAUME-UNI Taux de chômage OIT sur 3 mois (Octobre)

ROYAUME-UNI Taux de chômage OIT sur 3 mois (Octobre)--

F: --

P: --

ROYAUME-UNI 3 mois Salaire (hebdomadaire, y compris distribution) YoY (Octobre)

ROYAUME-UNI 3 mois Salaire (hebdomadaire, y compris distribution) YoY (Octobre)--

F: --

P: --

ROYAUME-UNI Salaire sur 3 mois (hebdomadaire, hors distribution) YoY (Octobre)

ROYAUME-UNI Salaire sur 3 mois (hebdomadaire, hors distribution) YoY (Octobre)--

F: --

P: --

France (Nord) Service PMI Prelim (Décembre)

France (Nord) Service PMI Prelim (Décembre)--

F: --

P: --

France (Nord) Composite PMI Prelim (SA) (Décembre)

France (Nord) Composite PMI Prelim (SA) (Décembre)--

F: --

P: --

France (Nord) PMI manufacturier préliminaire (Décembre)

France (Nord) PMI manufacturier préliminaire (Décembre)--

F: --

P: --

Allemagne Service PMI Prelim (SA) (Décembre)

Allemagne Service PMI Prelim (SA) (Décembre)--

F: --

P: --

Allemagne PMI manufacturier préliminaire (SA) (Décembre)

Allemagne PMI manufacturier préliminaire (SA) (Décembre)--

F: --

P: --

Allemagne Composite PMI Prelim (SA) (Décembre)

Allemagne Composite PMI Prelim (SA) (Décembre)--

F: --

P: --

Zone Euro Composite PMI Prelim (SA) (Décembre)

Zone Euro Composite PMI Prelim (SA) (Décembre)--

F: --

P: --

Zone Euro Service PMI Prelim (SA) (Décembre)

Zone Euro Service PMI Prelim (SA) (Décembre)--

F: --

P: --

Zone Euro PMI manufacturier préliminaire (SA) (Décembre)

Zone Euro PMI manufacturier préliminaire (SA) (Décembre)--

F: --

P: --

ROYAUME-UNI Service PMI Prelim (Décembre)

ROYAUME-UNI Service PMI Prelim (Décembre)--

F: --

P: --

ROYAUME-UNI PMI manufacturier préliminaire (Décembre)

ROYAUME-UNI PMI manufacturier préliminaire (Décembre)--

F: --

P: --

ROYAUME-UNI Composite PMI Prelim (Décembre)

ROYAUME-UNI Composite PMI Prelim (Décembre)--

F: --

P: --

Zone Euro Indice ZEW du sentiment économique (Décembre)

Zone Euro Indice ZEW du sentiment économique (Décembre)--

F: --

P: --

Allemagne Indice ZEW de la situation économique (Décembre)

Allemagne Indice ZEW de la situation économique (Décembre)--

F: --

P: --

Allemagne Indice ZEW du sentiment économique (Décembre)

Allemagne Indice ZEW du sentiment économique (Décembre)--

F: --

P: --

Zone Euro Balance Commerciale (Non SA) (Octobre)

Zone Euro Balance Commerciale (Non SA) (Octobre)--

F: --

P: --

Zone Euro Indice ZEW de la situation économique (Décembre)

Zone Euro Indice ZEW de la situation économique (Décembre)--

F: --

P: --

Zone Euro Balance commerciale (SA) (Octobre)

Zone Euro Balance commerciale (SA) (Octobre)--

F: --

P: --

U.S. Ventes au détail MoM (Excl. Automobile) (SA) (Octobre)

U.S. Ventes au détail MoM (Excl. Automobile) (SA) (Octobre)--

F: --

P: --

Pas de données correspondantes

Graphiques Gratuit pour toujours

Chat F&Q avec des Experts Filtres Calendrier économique Données OutilFastBull VIP FonctionnalitésTendances du marché

Principaux indicateurs

Dernières vues

Dernières vues

Sujets d'actualité

Les meilleurs chroniqueurs

Dernière mise à jour

Marque blanche

API de données

Plug-ins Web

Programme d'affiliation

Tout voir

Pas de données

U.S. Dollar Tether supply on major centralized exchanges is rocketing since the bull rally started in early November. Normally, this might be an indicator for the next phase of crypto prices upsurge approaching, CryptoQuant experts say. Meanwhile, the rivalry in the stablecoin segment intensifies.

$43 billion USDT deposited to exchanges, CryptoQuant indicates bullish signal

U.S. Dollar Tether , the largest USD-pegged stablecoin, hit a new record in deposits on centralized exchanges. Since the U.S. presidential elections, traders deposited $12.5 billion in USDT on CEXes, major on-chain analytical firm CryptoQuant says.

CryptoQuant.com@cryptoquant_comJan 31, 2025Stablecoins just hit new highs on exchanges.

Since November 4, USDT has surged from $30.5B to $43B (up 41%), boosting market liquidity.

Historically, more stablecoins often mean higher prices. pic.twitter.com/mbtr3QzRf0

Due to this massive USDT liquidity inflow, the net volume of the stablecoin on exchanges surged by 43% in less than three months to hit an all-time high at $43 billion.

During the same period, the net capitalization of the stablecoin segment surged from $167 billion to $204 billion, as per CryptoQuant's data. This metric is also on record-breaking levels after a 22.1% upsurge in November-January.

As stablecoin liquidity can only be used for purchasing Bitcoin and altcoins, such concentration of stablecoins on CEXes might hint at the next leg of the BTC rally being around the corner.

To provide context, during the most painful phase of the 2021-2022 crypto recession post-FTX/Alameda collapse, the net volume of stablecoins on centralized exchanges touched $18 billion. The total stablecoin segment market cap was sitting at $140 billion back then, almost 30% lower compared to current values.

USDC supply rocketing, challenges USDT dominance

The stablecoin segment remains quite centralized with USDT dominance protecting the 66% level. However, the largest stablecoin is being challenged by key rival USDC by Circle.

As covered by U.Today previously, CryptoQuant called USDC the fastest-growing stablecoin of recent months. The asset cap surged from $35 billion to over $52 billion in three months.

The position of USDT might be threatened by both inception of new regulated stablecoins like Ripple's RLUSD and MiCA-associated delisting for EU customers.

Starting Jan. 31, 2025, USDT is unavailable for all European users of Tier 1 exchange Crypto.com due to the new regulatory framework coming into effect.

Switzerland’s largest bank, UBS, is experimenting with blockchain technology to modernize digital gold investments for retail investors.

The Union Bank of Switzerland (UBS), with over $5.7 trillion in assets under management, has completed a proof-of-concept for its fractional gold investment product, UBS Key4 Gold, on the Ethereum layer-2 (L2) network ZKsync Validium.

By leveraging ZKsync, UBS aims to address scalability, privacy and interoperability for the retail-facing product’s global expansion.

The blockchain-based proof-of-concept reflects UBS’ “continued efforts to explore how blockchain can enhance its financial offerings, according to Alex Gluchowski, ZKsync’s inventor.

“I firmly believe that the future of finance will take place onchain and ZK technology will be the catalyst for growth,” he said in a Jan. 31 X post.

UBS Key4 Gold was initially built on the bank’s UBS Gold Network, a permissioned blockchain connecting vaults, liquidity providers and distributors.

Running its solution on ZKsync Validium boosts privacy, interoperability and higher throughput transactions thanks to offchain data storage.

The blockchain-based pilot comes nearly three months after UBS launched a tokenized fund on Ethereum, aiming to put Ether (ETH) “right into the heart of traditional finance,” Cointelegraph reported on Nov. 1, 2024.

ZKsync aims for 10,000 TPS and near-zero fees in 2025 roadmap

ZKsync has set ambitious targets for 2025, aiming to process 10,000 transactions per second (TPS) while reducing transaction fees to $0.0001.

The L2 scaling solution uses zero-knowledge proofs (ZK-proofs) to improve the scalability, security and privacy of the Ethereum mainnet.

In an effort to improve usability, ZKsync aims to boost its performance to over 10,000 TPS and reduce its transaction fees to $0.0001, according to a 2025 roadmap shared in a Dec. 12, 2024 blog post.

Achieving over 10,000 TPS for Ethereum-native ERC-20 tokens could make ZKsync’s technology more appealing to builders.

Privacy tech may drive crypto adoption

Privacy-preserving technologies could drive institutional adoption of blockchain, according to Remi Gai, founder of Inco.

During the FHE Summit 2024, Gai told Cointelegraph that privacy is important to institutions:

Confidential computing technologies bring significant possibilities to financial institutions. For example, fully homomorphic encryption solutions enable computations to be performed on encrypted data without decrypting it.

Confidential computing could unlock the next $1 trillion worth of capital for the crypto space with continued technological development, according to Gai.

Hayden Adams, CEO of Uniswap Labs, has highlighted key features of newly launched Uniswap V4, marking major improvements over Uniswap V3. Adams, in a post on X, explained how V4 compares in terms of efficiency when executing a token swap.

Uniswap V4’s efficiency test

Uniswap V4 has improved as it is much more gas-efficient than V3. This suggests that users can enjoy cheaper transactions using the protocol.

Adams demonstrated this by swapping $1,000 worth of Ethereum into Tether through the Uniswap V4 12 hours after its launch.

According to him, the Uniswap algorithm suggested he employ a multihop route instead of a single-hop swap.

The multihop swap from ETH to USDC and USDT used two V4 pools with a cumulative Total Value Locked (TVL) of $400,000. Meanwhile, the single-hop swap, which employs direct ETH to USDT through V3 pools, has a massive $150 million TVL.

Hayden Adams 🦄@haydenzadamsFeb 01, 2025Testing a $1000 ETH -> USDT swap like 12hrs after launching v4

Our routing recommends a multihop swap ETH -> USDC -> USDT through two v4 pools with a combined tvl of $400k as the best price

Even compared to a single hop through the any of the v3 pools with a combined… pic.twitter.com/gE973XYeN3

The advantage of Uniswap’s V4 is that even with lower liquidity, the multihop route still yielded the best price. This is due to V4’s improved gas efficiency, which reduces swap costs and makes multihop routes cheaper.

Additionally, it leads to better prices for V4 users while guaranteeing higher profits for liquidity providers.

UNI trading volume surges

Experts consider this development a key to drive growth for the ecosystem and a huge win for the Ethereum chain. They attributed the success to the Dencun upgrade, which helped enhance smart contracts' functionality. This, in turn, supports innovations like the Uniswap V4 architecture.

Besides the lower gas fees, analysts say the more efficient route means smaller pools can compete with large pools in the ecosystem.

This might ultimately drive wider adoption and value. As of this writing, Uniswap (UNI) has crashed below the $12 support level again. UNI was trading at $11.43, a 3.37% decline in the last 24 hours.

However, trading volume has climbed by 58.93% to $336.42 million. This renewed interest from investors might help Uniswap rebound in the short term.

Cryptocurrency exchange Kraken is moving to comply with European crypto regulations by preparing to delist five stablecoins, including Tether’s USDt.

Kraken will fully delist USDt on March 31 to comply with the European Union’s Markets in Crypto-Assets Regulation (MiCA), according to an official announcement by the exchange.

Alongside USDT, the exchange will gradually remove support for PayPal USD (PYUSD), Tether EURt (EURT), TrueUSD (TUSD), and TerraClassicUSD (UST) in the European market.

“These changes ultimately ensure Kraken remains compliant and is able to provide its exceptional trading experience to European clients for the long term,” the company said.

Gradual delisting process

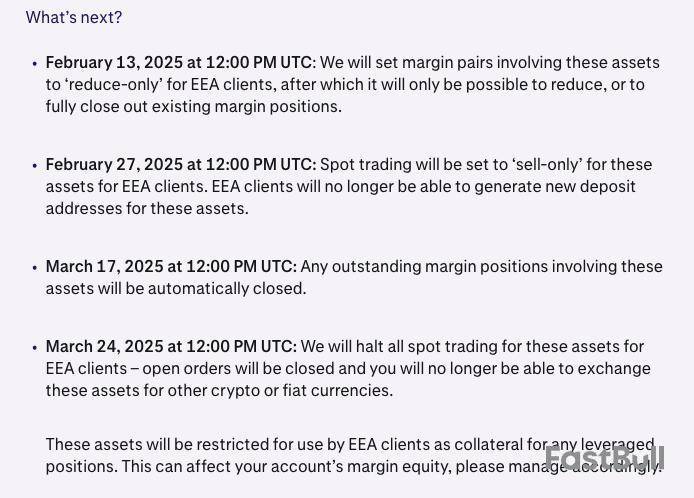

In line with the provisions set by the European Securities and Markets Authority (ESMA) to ensure a smooth and orderly delisting process, Kraken will drop USDT support in stages.

First, Kraken will set margin pairs involving the affected assets to “reduce-only” mode for clients in the European Economic Area (EEA) on Feb. 13. Following this restriction, EEA users will be only able to reduce or fully close out existing margin positions.

By Feb. 27, Kraken will put the affected tokens in “sell-only” mode, restricting EEA clients from generating deposit addresses for tokens like USDT but still supporting trading.

On March 24, Kraken will halt all spot trading for the affected assets, closing all open orders and exchanges into other coins or fiat currencies.

“All remaining EEA client holdings for these assets as of March 31, 2025, will be converted to an equivalent stablecoin,” Kraken stated, adding:

Kraken emphasized that the delistings would only impact clients in the EEA, with affected jurisdictions including 30 countries, such as Austria, Cyprus, Czechia, Malta, Portugal, Spain, Sweden and others.

ESMA urged to avoid “disorderly markets” with abrupt delistings

Kraken’s announcement comes as Crypto.com — another major exchange — confirmed the delisting of USDT and nine other stablecoins starting Jan. 31, 2025.

Crypto.com will also give its users until the end of the first quarter of 2025 to convert the affected tokens to MiCA-compliant tokens. “Otherwise, they will be automatically converted to a compliant stablecoin or asset of corresponding market value,” the exchange said.

The ESMA, which is a key supervisor of MiCA compliance, urged European crypto asset service providers (CASP) to start restricting MiCA noncompliant stablecoins in mid-January.

The agency highlighted the importance of a gradual delisting process to avoid potential market disruptions, calling for CASPs to start with a “sell-only” mode first:

Kraken and Crypto.com are among the first CASPs in the EU to announce delistings of MiCA noncompliant coins in 2025. Previously, the US-based exchange Coinbase delisted eight tokens, including USDT, in December 2024.

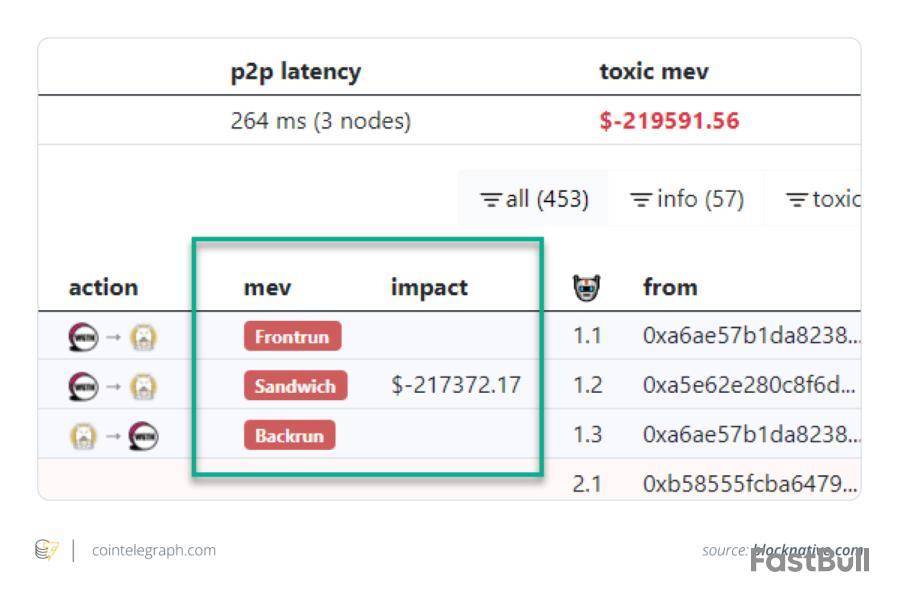

What is a sandwich attack?

Sandwich attacks are a form of market manipulation that targets users on decentralized exchanges, exploiting price movements to profit off of a victim’s trade.

It is a type of front-running exploit in which an attacker places two orders around a victim’s trade in a way that profits from price slippage.

In a typical sandwich attack, a malicious actor watches the transaction mempool for large trades that might affect the price of a cryptocurrency.

After being identified, the attacker executes a “back-running trade” by placing a “sell” order immediately following the victim’s trade and a “buy” order just before it.

The victim’s trade contributes to the manipulated price, which is intentionally inflated or deflated to their benefit. The attacker makes money by selling their coins once the victim’s transaction is completed.

Why sandwich attacks matter for crypto traders

Sandwich attacks matter significantly for crypto traders, especially beginners, due to their impact on maximal extractable value (MEV).

MEV refers to the additional value that can be extracted from block production beyond standard block rewards. In essence, it allows miners or validators to strategically order transactions within a block to maximize their own profits.

Sandwich attacks are a prime example of MEV exploitation. By manipulating transaction order, attackers capitalize on the public nature of the blockchain to front-run and back-run trades, profiting from the price slippage they induce.

Here’s how these attacks impact traders:

Due to these concerns, the crypto community actively explores solutions to mitigate the negative impacts of MEV, such as:

Did you know? Maximal extractable value was once called miner extractable value. First introduced in the 2019 research paper “Flash Boys 2.0 Frontrunning, Transaction Reordering, and Consensus Instability in Decentralized Exchanges” by Phil Daian and others, the term was later changed to reflect the growing value that could be extracted through these strategies as the DeFi ecosystem expanded.

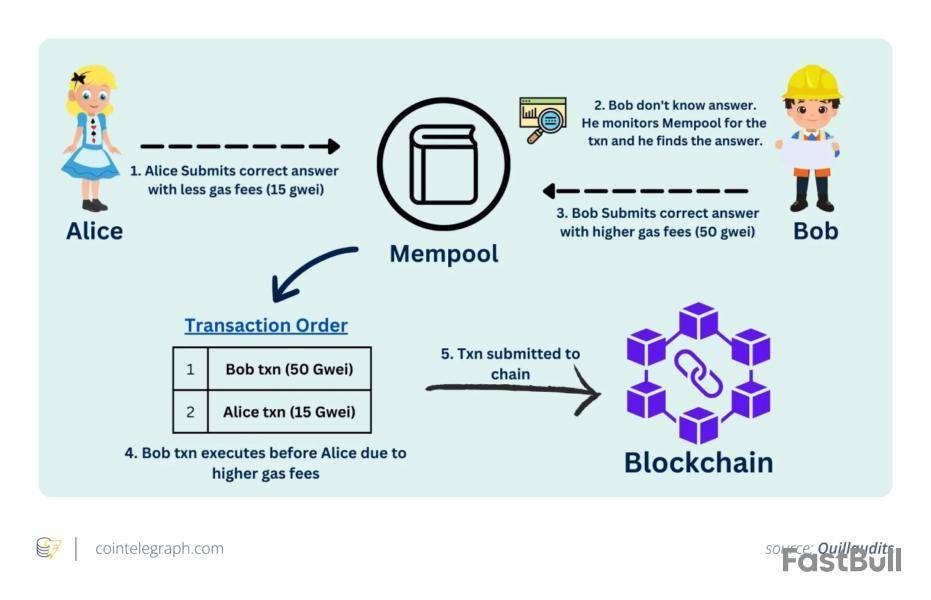

How sandwich attacks work: A step-by-step example

The mechanics of a sandwich attack involve manipulating the price of an asset before and after a victim’s trade, using buy and sell orders strategically placed in the transaction queue.

Let’s break down how a sandwich attack happens, using a simple example.

Imagine you’re a crypto trader looking to buy 100 Ether (ETH) on a decentralized exchange (DEX) like Uniswap. Your large order will likely move the market and raise the price of ETH temporarily. An attacker who has been monitoring the network sees your trade.

But how does an attacker predict a large incoming order?

Attackers predict large incoming orders by monitoring the mempool, a public waiting area for unconfirmed blockchain transactions. Every user’s transaction details — like the tokens being traded, amounts, and slippage tolerances — are visible here before being added to a block.

Automated bots scan the mempool for large trades or high slippage tolerances, signaling opportunities for profit. Since transactions aren’t encrypted, attackers (via bots) analyze this data in real-time.

If a transaction looks profitable to manipulate, the attacker can act on it by submitting their own transaction with a higher gas fee, ensuring it’s processed first and exploiting the user’s trade.

Now, let’s understand how the attack unfolds:

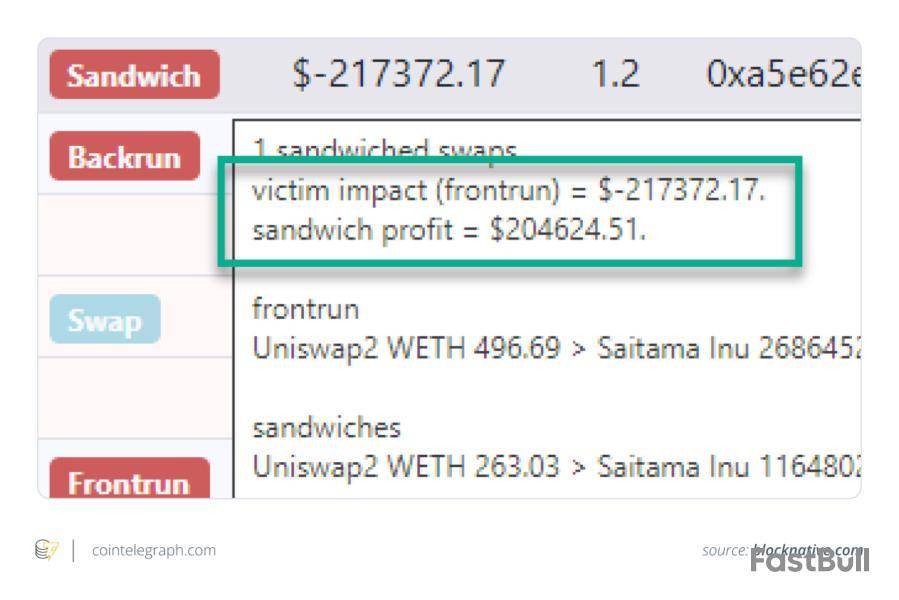

An example in the below image shows a bot spotting a large Saitama token purchase in the mempool and buying the token first, pushing the price up.

The victim, who then purchases the token, ends up paying a higher price. The bot sells the token at this inflated price, earning over $200,000 in profit. The attack was made possible by delaying the victim’s transaction by over a minute.

Is MEV always negative?

No, MEV is not inherently negative.

While it can be exploited through malicious activities like sandwich attacks, it also has positive aspects. MEV can improve market efficiency by facilitating arbitrage and ensuring timely liquidations. It also provides an additional revenue stream for miners and validators, incentivizing their participation in the network.

Furthermore, the pursuit of MEV has driven innovation in areas like blockspace auctions (the competitive process of securing space within a block for your transactions to be included and processed) and privacy-preserving technologies. However, it’s crucial to address the potential impact on traders (as discussed above) to ensure a balanced and sustainable crypto ecosystem.

How to prevent sandwich attacks in crypto

By using slippage tolerance settings, breaking down larger trades, using private transaction services and avoiding high-traffic periods, you can reduce your chances of falling victim to a sandwich attack.

Now that you understand how sandwich attacks work, here are some practical tips to avoid falling victim to them.

Did you know? Two researchers introduced a game-theoretic approach in their paper titled “Eliminating Sandwich Attacks with the Help of Game Theory,” offering an algorithm that significantly reduces the risk of sandwich attacks, outperforming the auto-slippage method used by major automated market makers like Uniswap. This algorithm effectively minimizes transaction costs while safeguarding against the predatory strategies employed by bots in the Ethereum mempool.

Beyond sandwich attacks: Other examples of MEV

MEV includes strategies like liquidation arbitrage, DEX arbitrage, uncle block mining and NFT MEV, each exploiting different market inefficiencies for profit.

MEV encompasses a broader range of strategies, such as:

Liquidation arbitrage

DEX arbitrage

Uncle block mining

NFT MEV

To protect against MEV exploitation, you could employ MEV-aware platforms and utilize time-sensitive execution. Additionally, managing transaction timing through algorithms or obfuscation tools reduces the predictability of your trades.

In the NFT space, choosing contracts resistant to sniping and order cancellation attacks provides added security against manipulation by MEV bots.

Changpeng Zhao, the former CEO of Binance and widely recognized as CZ, is making it clear — Europe needs Bitcoin . Not just as an investment, not as a passing trend, but as something fundamental. The reasoning? The euro is not looking great, and Bitcoin keeps proving itself. Over and over again.

Lately, Bitcoin has been reaching new all-time highs, while the euro struggles to keep up. This gap is widening, making things uncomfortable for those holding euros. It’s not just speculation — numbers speak for themselves. At this moment, Bitcoin is worth €101,200. The euro? In crypto terms, that’s 0.00001 BTC, which is down 65% since the beginning of 2024.

For two years now, the European Central Bank (ECB) has been pushing back against Bitcoin. Reports, warnings, analysis — none of it particularly favorable. Christine Lagarde, ECB chief, has been firm: the cryptocurrency will not be added to ECB’s reserves. Meanwhile, in the U.S., the conversation about Bitcoin’s role in reserves is heating up.

Zhao’s argument comes down to the fact that Europe has a choice. Stick with the old ways, or start seriously considering Bitcoin. Inflation, monetary policies, market uncertainty — traditional financial systems have their challenges.

Bitcoin, with its decentralized nature and fixed supply, offers something different. It is not perfect. It is not risk-free. But in a world where national currencies fluctuate, the cryptocurrency stands as a possible hedge. An alternative, at the very least.

The discussion is not going away. Whether the cryptocurrency becomes a real factor in Europe’s financial future is still unclear, but Zhao’s perspective is not without basis. It’s not just hype or theory anymore. As digital assets continue evolving, the euro’s path forward might just need to include BTC — whether the ECB likes it or not.

TL:DR;

XRP to New ATH Finally?

The daily chart above shows that XRP was stuck below $1 for years, and it was predominantly trading within a tight range between $0.35 and $0.6. It stood close to the latter as the US elections took place, but once it became known that Donald Trump will return to the White House, Ripple’s cross-border token exploded in value.

More positive news for the company behind it came from Gary Gensler’s departureannouncementfrom the SEC, and this sent XRP further north. By the year’s end, the token had neared $3 and broke above it in January. Its peak came in the middle of the month, atjust under $3.4, which is the 2018 ATH, according to CoinGecko.

Since then, XRP has been unable to push further and is even close to breaking below $3. However, there are more positive speculation in the US about its future, including a possible resolution of the SEC lawsuit as well as its introduction into strategic crypto reserve in the country.

DeepSeek, which made the headlines earlier this week by possibly becoming a cheaper version of ChatGPT, outlined the lawsuit against the US securities regulator as the most important factor behind another XRP rally.

“The ongoing lawsuit between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has been a significant overhang on XRP’s price. A favorable outcome for Ripple could lead to a surge in XRP’s price as it would remove a major uncertainty.”Other Factors

DeepSeek also mentioned the overall regulatory environment not only in the US but across the globe. Positive news on that front could “boost investors’ confidence,” especially those who tend to stay away from the uncertainty regarding XRP’s status in the States.

This could also enhance the XRP adoption rates, as well as lead to more strategic partnerships for the company behind it. The AI chatbot further indicated that the overall market conditions, meaning mostly BTC’s price movements, have to remain as bullish as they were in the past few months or even go beyond for XRP to resume its rally.

Lastly, DeepSeek said XRP could benefit a lot from an altcoin season. It’s currently the second-largest alt and, given ETH’s underperformance lately, could be among the leaders in terms of further gains against the dollar and BTC. However, there have been many industry experts who doubted the existence of an altseason under the current market conditions.

In conclusion, the ChatGPT alternative said it’s quite probable that XRP can indeed reach a new all-time high this year, but it needs the alignment of at least a few of the aforementioned factors.

Marque blanche

API de données

Plug-ins Web

Créateur d'affiches

Programme d'affiliation

Le risque de perte dans la négociation d'instruments financiers tels que les actions, les devises, les matières premières, les contrats à terme, les obligations, les ETF et les crypto-monnaies peut être substantiel. Vous pouvez subir une perte totale des fonds que vous déposez auprès de votre courtier. Par conséquent, vous devez examiner attentivement si ce type de négociation vous convient, compte tenu de votre situation et de vos ressources financières.

Aucune décision d'investissement ne doit être prise sans avoir procédé soi-même à une vérification préalable approfondie ou sans avoir consulté ses conseillers financiers. Le contenu de notre site peut ne pas vous convenir car nous ne connaissons pas votre situation financière et vos besoins en matière d'investissement. Nos informations financières peuvent avoir un temps de latence ou contenir des inexactitudes, de sorte que vous devez être entièrement responsable de vos décisions en matière de négociation et d'investissement. La société ne sera pas responsable de vos pertes en capital.

Sans l'autorisation du site web, vous n'êtes pas autorisé à copier les graphiques, les textes ou les marques du site web. Les droits de propriété intellectuelle sur le contenu ou les données incorporées dans ce site web appartiennent à ses fournisseurs et marchands d'échange.

Non connecté

Se connecter pour accéder à d'autres fonctionnalités

FastBull VIP

Pas encore

Acheter

Se connecter

S'inscrire