-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

Virtual Assets Regulatory Authority

CVirtual Asset Regulatory Authority (VARA) is the world's first independent regulator dedicated to virtual assets, serving as a transparent and trusted authority guiding the rapidly evolving virtual asset ecosystem. Established in March 2022 under Law No. 4 of 2022, VARA is the official regulatory body responsible for overseeing, supervising, and regulating virtual assets (VA) and related activities across all zones in the Emirate of Dubai, including Special Development Zones and Free Zones—excluding the Dubai International Financial Centre. As a key driver behind Dubai’s advanced legal and regulatory framework, VARA is committed to investor protection, setting international standards for industry governance, and supporting Dubai’s vision for a borderless, future-ready economy.

VARA has issued the comprehensive Virtual Assets and Related Activities Regulations 2023, which form the foundation of Dubai’s robust Virtual Asset (VA) Framework. This framework is built on principles of economic sustainability and cross-border financial security, reflecting the UAE’s proactive approach to fostering innovation in the digital asset space while ensuring safety and compliance. It provides clear regulatory certainty, defining the responsibilities of market operators and enhancing market transparency.

To safeguard the global financial system, the framework mandates stringent risk management, gold-standard Anti-Money Laundering (AML), and Counter-Terrorist Financing (CFT) measures for all licensed entities within Dubai. With a mission to set a global benchmark, VARA is also developing a scalable, replicable regulatory model aimed at shaping responsible virtual asset ecosystems worldwide.

VARA has classified virtual asset activities into 8 regulated categories, they are:

1. Advisory Services

2. Broker-Dealer Services

3. Custody Services

4. Exchange Services

5. Lending and Borrowing Services

6. Management and Investment Services

7. Transfer & Settlement Services

8. VA Issuance (Category 1)

This framework is designed to be flexible and adaptable to support innovation and industry growth.

Any Virtual Asset Service Provider (VASP) that wants to operate in Dubai must apply for and obtain a license from VARA before starting activities. A VASP can hold multiple activities under a single license, except for Custody Services, which must be conducted by a separate legal entity with its own dedicated license. This ensures proper asset protection and independent governance.

In addition, licensed VASPs are not allowed to conduct proprietary trading (trading for their own profit) or manage their group’s investment portfolio under the regulated license. Such activities must be carried out through a separate, independent company.

These rules apply to any entity offering virtual asset services in Dubai, whether serving local residents or international customers. All licensed VASPs must continuously comply with regulatory requirements, including strict Anti-Money Laundering (AML), Know Your Customer (KYC), and consumer protection standards.

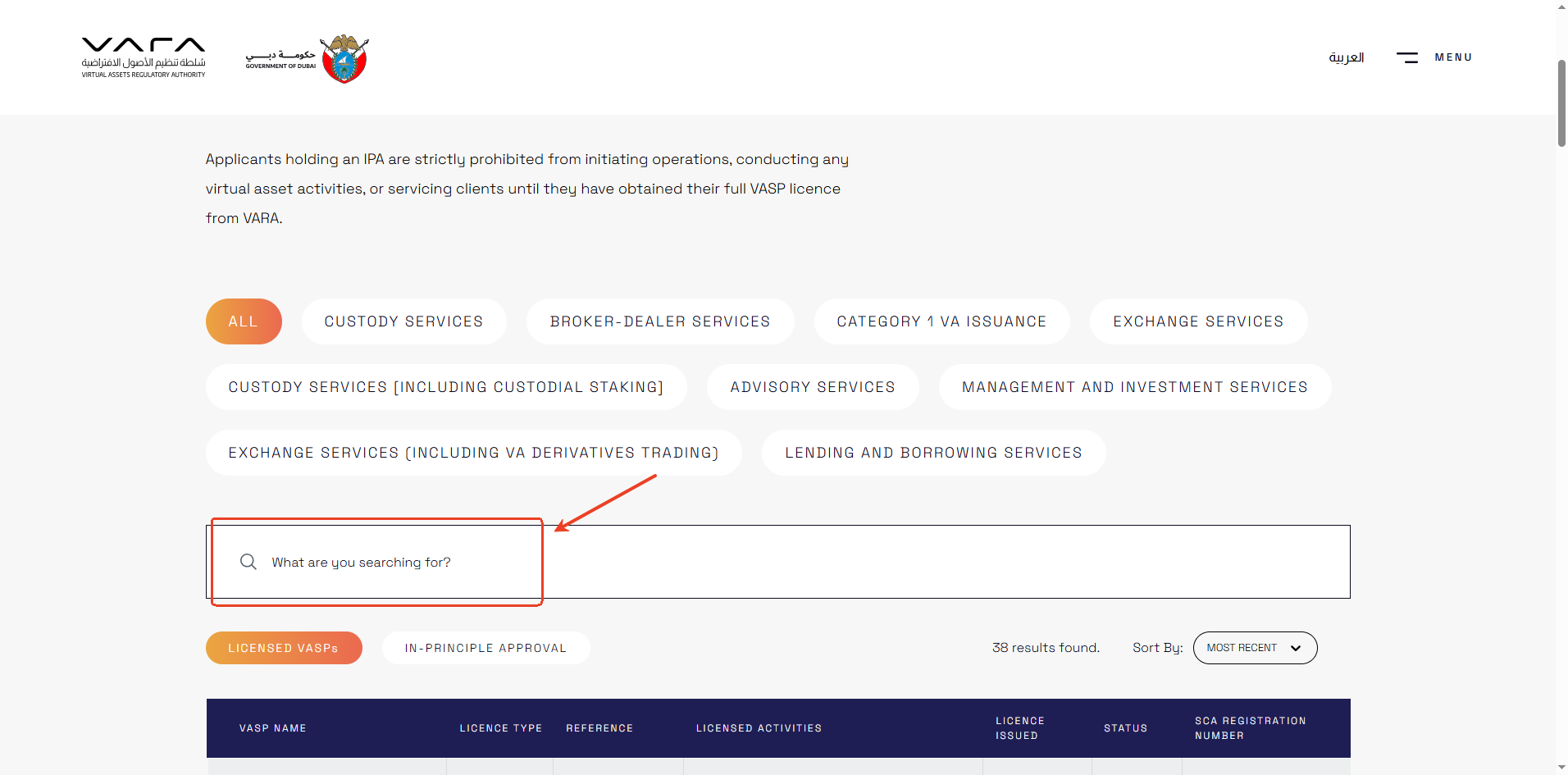

To verify if a broker is genuinely regulated by the Virtual Asset Regulatory Authority (VARA), you should cross-check its details using the VARA Public Register. The detailed steps are as below:

1. Visit the broker’s official website and locate the legal name of the regulated entity.

2. Go to the official VARA Public Register at: https://www.vara.ae/en/licenses-and-register/public-register/

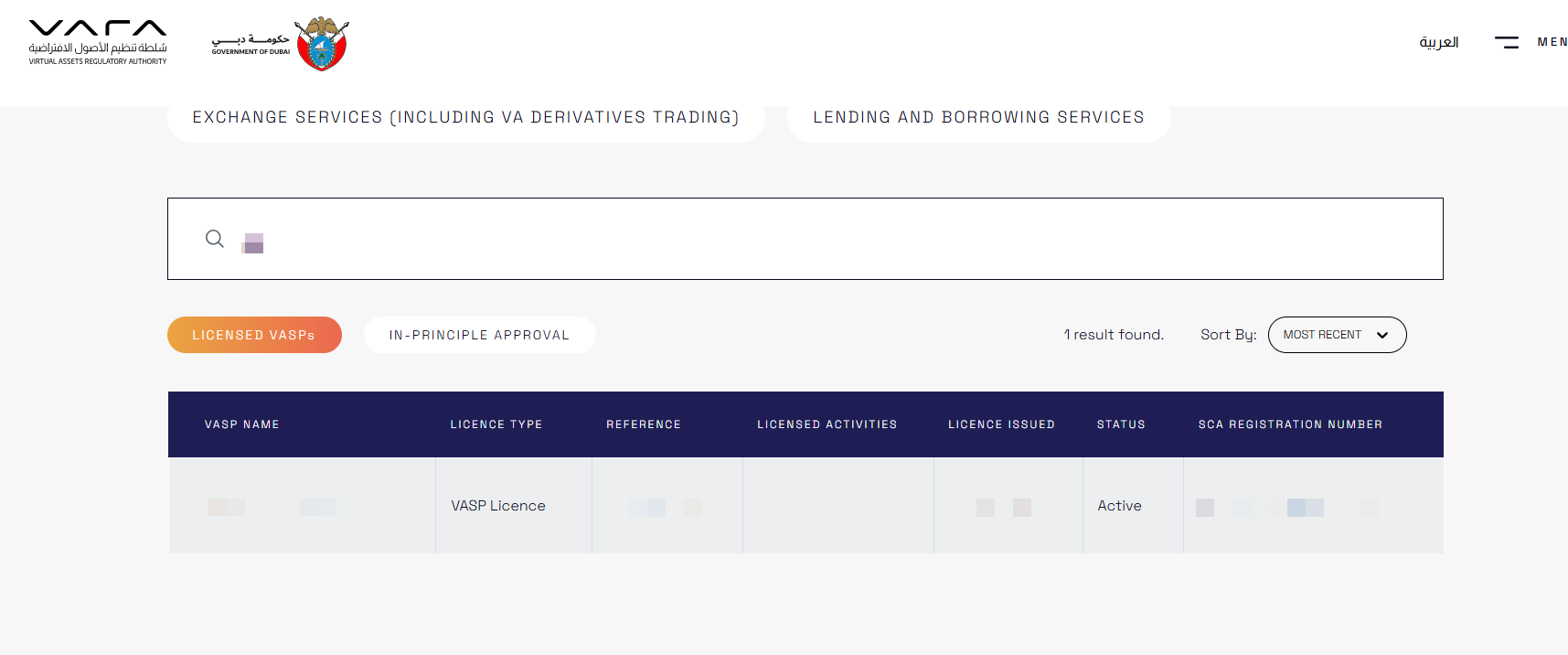

Enter the exact legal company name into the search bar, the initial search results will display key information about the company.

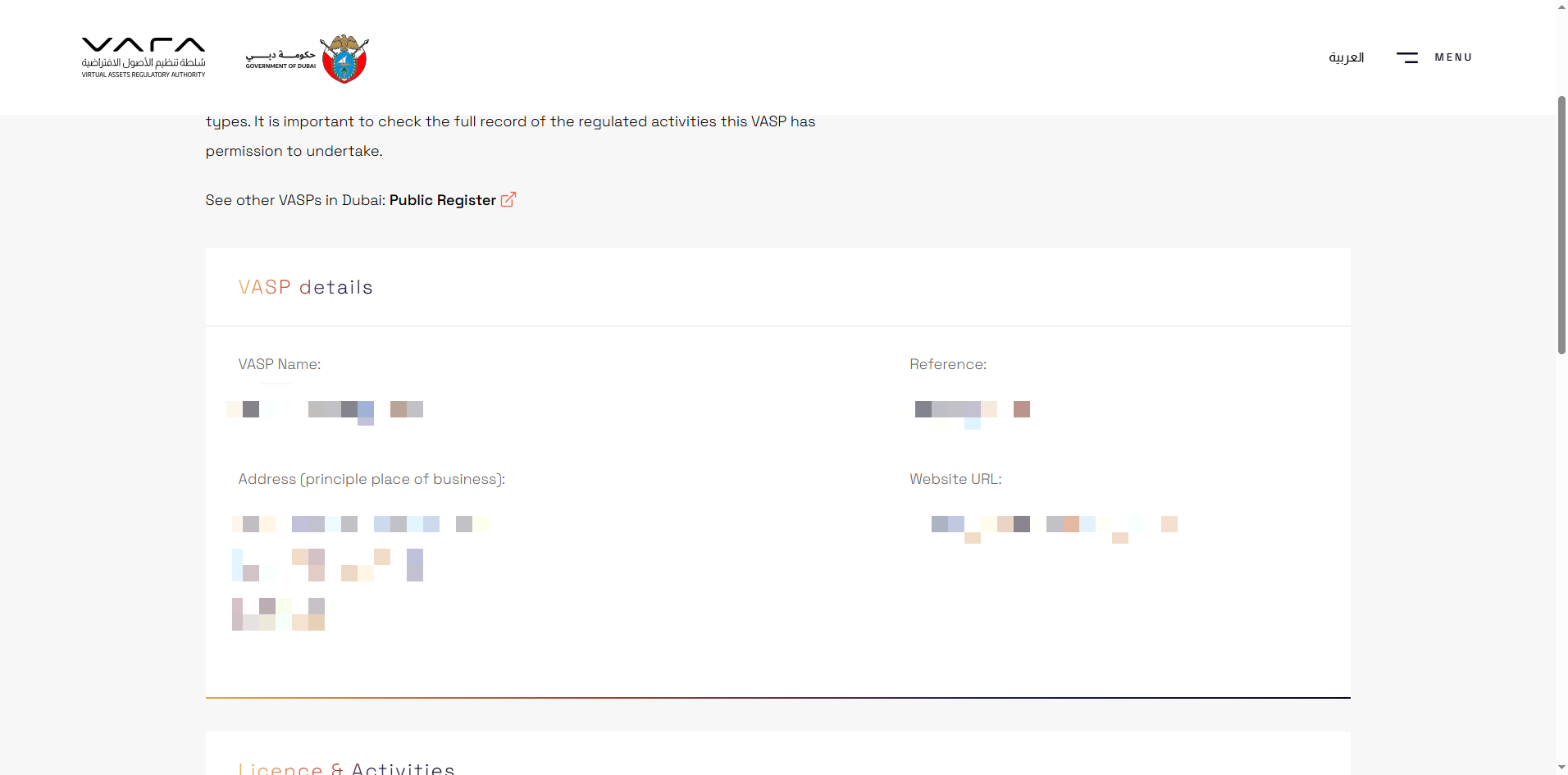

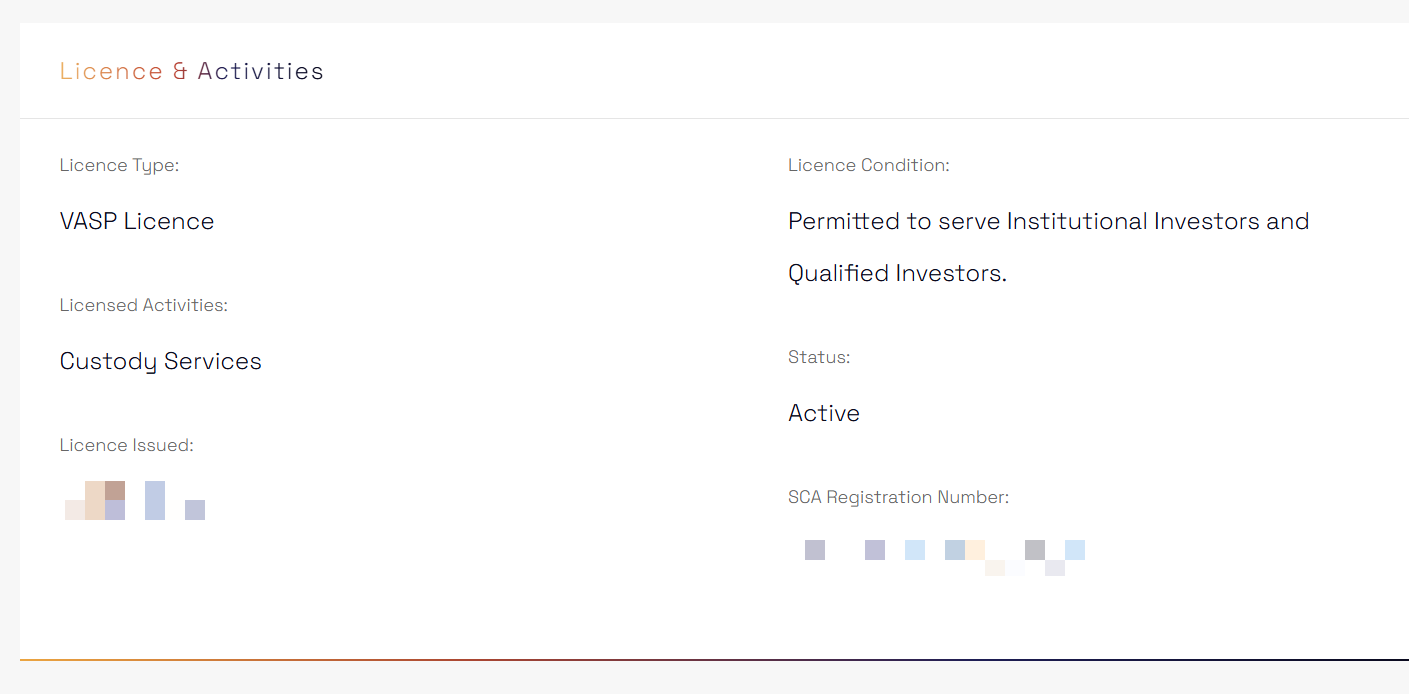

3. Click on the company name in the search results to access the full license details page. This provides a more comprehensive view.

Compare the official website URL listed on the VARA register with the VASP’s website you are checking. Ensure they match exactly.

If all the information matches, this means that the broker is officially regulated by VARA.

When you have disputes with a Virtual Asset Service Provider (VASP), you can proceed the following ways:

1st way: The recommended way is to contact the VASP directly and discuss with them to find a solution.

2nd way: If the response was not what you were hoping for, you may submit your written complaint via VARA Online Complaint Form.

VARA’s regulatory remit covers virtual assets and related services in the emirate of Dubai, excluding Dubai International Financial Centre. If you have been the victim of fraudulent activity, your complaint or matter may fall outside VARA’s regulatory remit. You should also consider filing a consumer complaint or contacting the nearest police station for further action.

3rd way: If the 2 ways above can't solve the dispute, the last way is to issue a case to the court in Dubai.

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.