-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

South Korea Financial Services Commission

BThe Financial Services Commission (FSC) of South Korea is a statutory government agency responsible for financial policy formulation, regulatory supervision, and consumer protection. It was stablished in February 2008, following a major restructuring prompted by the 1997 Asian financial crisis. The FSC consolidated previously fragmented supervisory bodies and absorbed the Financial Policy Bureau of the former Ministry of Finance and Economy. It also integrated the Korea Financial Intelligence Unit (KoFIU), strengthening its role in anti–money laundering and counter–terrorism financing efforts.

The FSC’s core mandate is to foster economic growth by advancing Korea’s financial industry, ensuring market stability, enforcing fair practices, and safeguarding financial consumers. It drafts and amends financial laws, issues licenses to financial institutions, oversees domestic and cross-border financial activities, including foreign exchange transactions, and investigates misconduct in financial markets.

Through strategic policy tools, the FSC enhances the resilience and efficiency of financial markets while promoting Korea as a global financial hub. It supports the internationalization of domestic financial firms, mediates consumer disputes, and delivers financial education programs—all aimed at building a competitive, stable, and inclusive financial system.

The Regulatory Framework for FX Margin Trading:

1. The margin requirement was raised from 2% to 5% (with leverage capped at 20 times), effective September 1, 2009.

2. The Financial Supervisory Service (FSS) strengthened oversight of intermediaries through mystery shoppers and annual inspections, cracking down on illegal foreign exchange-related activities.

3. Foreign exchange margin trading is restricted to investors with the highest risk tolerance. Proxy trading is prohibited, and platforms must fulfill full risk disclosure and suitability assessments.

4. Platforms are required to evaluate client risk tolerance and disclose fees and risks before account opening, while avoiding excessive linking of employee compensation to sales performance.

The Regulatory Framework for VASPs:

a. FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT

b. ACT ON THE PROTECTION OF VIRTUAL ASSET USERS:

1. User Funds:

VASPs must keep users’ money separate from their own and store it in an approved bank. The money must be clearly marked as users’ property and cannot be used for loans, transfers, or seized—except in rare legal cases. If the VASP shuts down or goes bankrupt, users get their money back first.

2. User Crypto Assets:

VASPs must keep users’ crypto separate from their own, actually hold what they promise, and store part of it offline for safety. They can also use trusted third-party custodians if they meet government security rules. A user list (name, wallet, asset type/amount) must be kept.

3. Insurance:

VASPs must have insurance, a mutual fund, or reserves—set by the FSC—to cover losses from hacks or tech failures.

4. Recordkeeping:

VASPs must save all transaction records for 15 years after a user leaves, so trades can be checked or fixed if needed. Details on how to store or delete records are set by law.

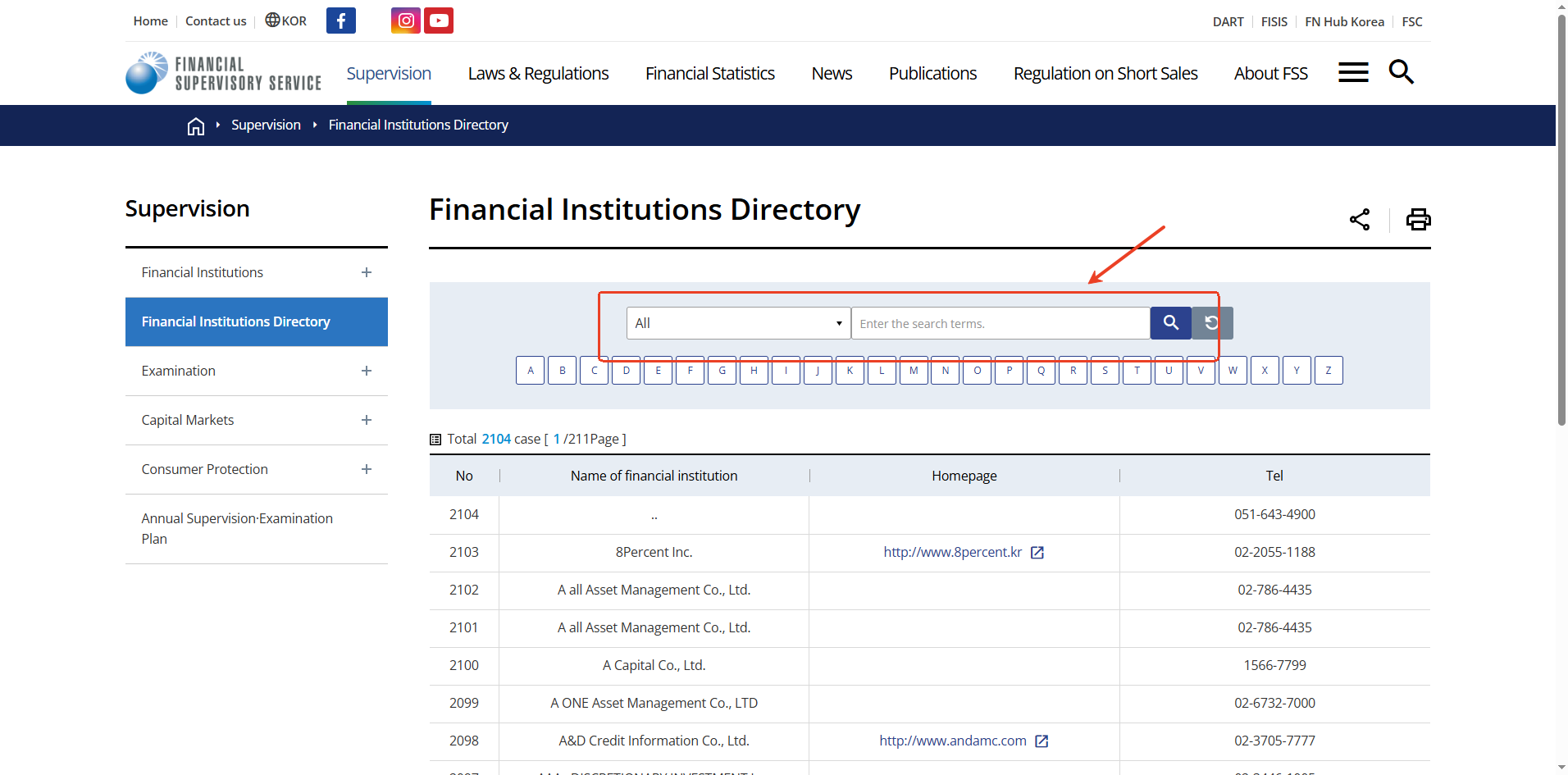

Generally speaking, FSC-regulated broker profile will be found at Financial Institutions Directory Page. Try to find it and check if it will match the info from the broker website.

The detailed steps are as below:

1. Find the entity name of the forex broker, which you can get from the broker's website;

2. Enter the entity name into the search bar on https://www.fss.or.kr/eng/sprvise/instt/list.do?menuNo=400029&pageIndex=1&englsFncEngnName=&fnltCtgryCode=&searchStr=;

If the regulated entity has a registered Homepage, carefully verify whether the registered domain name and phone number information correspond to the website being verified.

Contact the Financial Supervisory Service (FSS):

Website: Visit the FSS English portal for information and complaint submission options.

Email: fssintl@fss.or.kr.

Phone: +82-2-3145-7897 (International Finance Division) for assistance.

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.