-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

Liechtenstein Financial Market Authority

CLiechtenstein Financial Market Authority (FMA) serves as an integrated and independent supervisory authority responsible for overseeing financial market participants in the Liechtenstein financial centre. Through its supervisory activities, the FMA ensures the stability of financial institutions and the broader financial market, while safeguarding client interests; where supervisory rules are violated, it takes necessary enforcement measures to protect clients and uphold the reputation of the financial centre, including addressing cases where licensable activities are conducted without the appropriate authorization.

The Liechtenstein FMA covers the regulation of banks, insurance companies and intermediaries, pensions funds, investment companies, asset management companies and other financial intermediaries. In its regulatory role, the FMA ensures the implementation of international standards, participates in drafting financial market legislation on behalf of the Government, advocates for sustainable regulation that enables efficient and effective supervision, and further clarifies laws and their implementing ordinances by issuing guidelines and communications.

Through Liechtenstein’s membership of the European Economic Area (EEA) licenses issued by FMA allow companies to operate some services through all member countries of the EEA.

The Investment Firms Act (WPFG) sets out authorisation and organisational requirements for investment firms, aiming to protect investors and maintain confidence in the Liechtenstein capital market.

The Investment Services Act (WPDG) establishes conduct-of-business rules that investment firms must follow when providing investment services or performing investment activities.

The Trading Venues and Exchanges Act (HPBG) governs market operators of regulated markets as well as alternative trading venues such as MTFs and OTFs, systematic internalisers, and algorithmic trading. It also includes supplementary issuer obligations and rules on admitting financial instruments to trading.

To ensure compliance, the FMA monitors financial service providers through defined reporting requirements. Investment firms must fulfill periodic and ad hoc reporting obligations as outlined in FMA instructions, using the FMA’s e-Service forms.

Fintech:

The necessary implementation into Liechtenstein law is carried out through the Law implementing Regulation (EU) 2023/1114 on Markets in Crypto-Assets (EEA MiCA Implementation Act, EWR-MiCA-DG), which entered into force on 1 February 2025.

MiCAR regulates the following activities:

- The offer to the public and application for admission to trading of asset-referenced tokens (ARTs).

- The offer to the public and application for admission to trading of e-money tokens (EMTs).

- The offer to the public and application for admission to trading of crypto-assets other than ARTs and EMTs (Title II tokens).

- The provision of crypto-asset services by crypto-asset service providers (CASPs).

Generally speaking, FMA-regulated broker profile will be found at the Register of licensees page on FMA website. Try to find it and check if it will match the info from the broker website.

The detailed steps are as below:

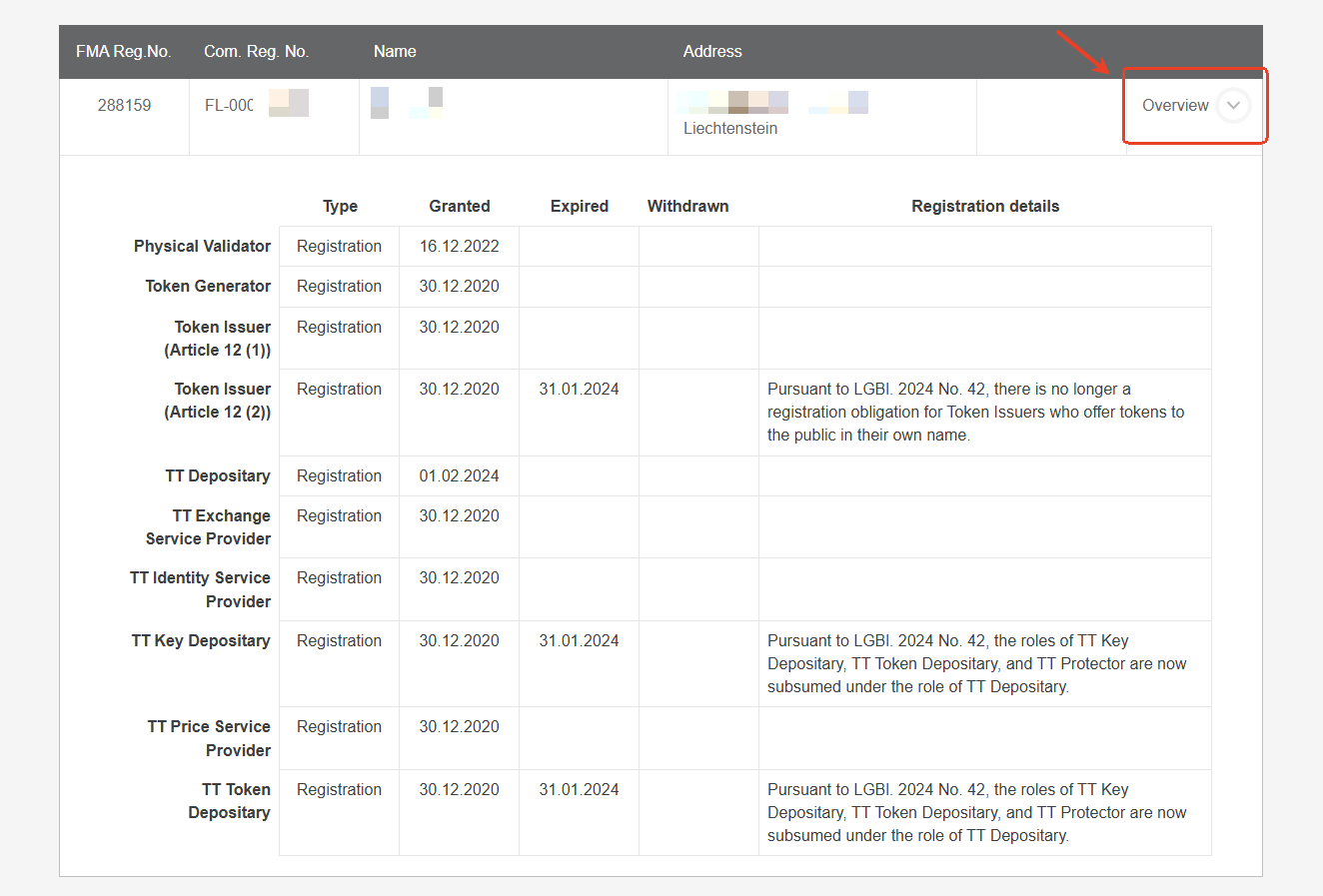

1. Find the FMA Registration Number or name of the financial provider, which you can get from the its website;

2. Enter the Registration Number or Name into the search bar on https://register.fma-li.li/search;

3. Click on "Overview" to view additional company details.

When you have disputes with a FMA-regulated broker, you can proceed the following ways:

Step 1: The Liechtenstein Financial Market Authority (FMA) recommends first contacting the financial intermediary or wire transfer service provider directly to clarify the issue.

Step 2: Submit a complaint to the Liechtenstein FMA:

-

Complainant’s details:

Full name (first and last);

Contact information (address, phone number, email). -

Details of the relevant party:

Name or business name of the regulated financial intermediary or other entity/person;

Address;

Relationship (e.g., client, interested party). -

Complaint content:

Description of the facts;

Grounds for the complaint;

Supporting documents (e.g., correspondence, account statements, contracts, investor materials, product information, marketing materials)—copies only, not originals. -

Date and signature

Send the complaint to the FMA via:

Email: info@fma-li.li

Postal address:

Financial Market Authority Liechtenstein

Landstrasse 109

P.O. Box 279

9490 Vaduz

Liechtenstein

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.