-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

Financial Industry Regulatory Authority

C- Recommendation

- Score

No data

The Financial Industry Regulatory Authority (FINRA) is the largest non-governmental regulator overseeing securities firms that conduct business with the U.S. public. Formed in 2007 through the merger of the National Association of Securities Dealers (NASD) and the New York Stock Exchange’s Member Regulation division, under the oversight of the Securities and Exchange Commission (SEC), FINRA is committed to safeguarding investors and ensuring market integrity.

Its responsibilities span nearly every facet of the securities industry: registering and educating industry professionals, examining firms for compliance, developing rules, enforcing both its own rules and federal securities laws, and providing investor education. FINRA also operates critical market infrastructure, such as trade reporting systems, and administers the largest forum in the U.S. for resolving disputes between investors and registered firms.

Membership in FINRA requires a significant commitment, including compliance with numerous safeguards designed to protect investors and the integrity of the securities markets.

Rigorous Membership Approval

Firms must undergo a thorough review before joining FINRA, proving they meet regulatory standards, have sound supervisory systems, and employ personnel without serious misconduct histories.

Financial Stability & Reporting

Member firms must maintain minimum capital, submit regular financial reports, undergo annual audits, and belong to SIPC—ensuring customer assets are protected if the firm fails.

Regular Examinations & Enforcement

FINRA inspects firms at least every four years (more often for high-risk firms) to check compliance with rules and investor protections, and can impose fines, suspensions, or bans for violations.

Registration & Transparency of Brokers

All associated individuals must register with FINRA, disclose personal and professional activities, and their background info is publicly accessible via BrokerCheck.

Qualifications & Dispute Resolution

Registered personnel must pass exams and complete ongoing education. FINRA also operates a widely used arbitration system to resolve customer disputes quickly and affordably, with public awards and enforcement for non-payment.

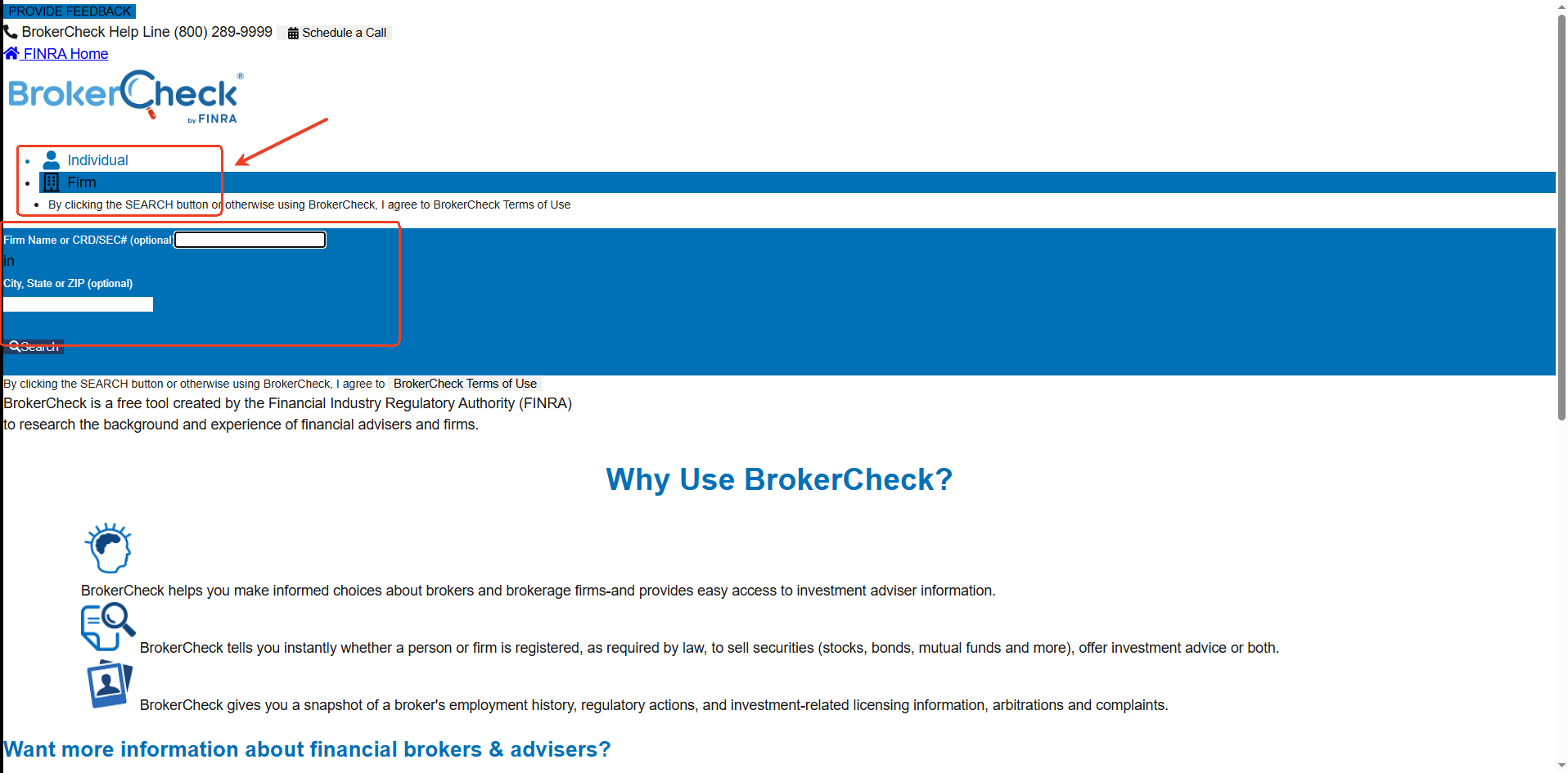

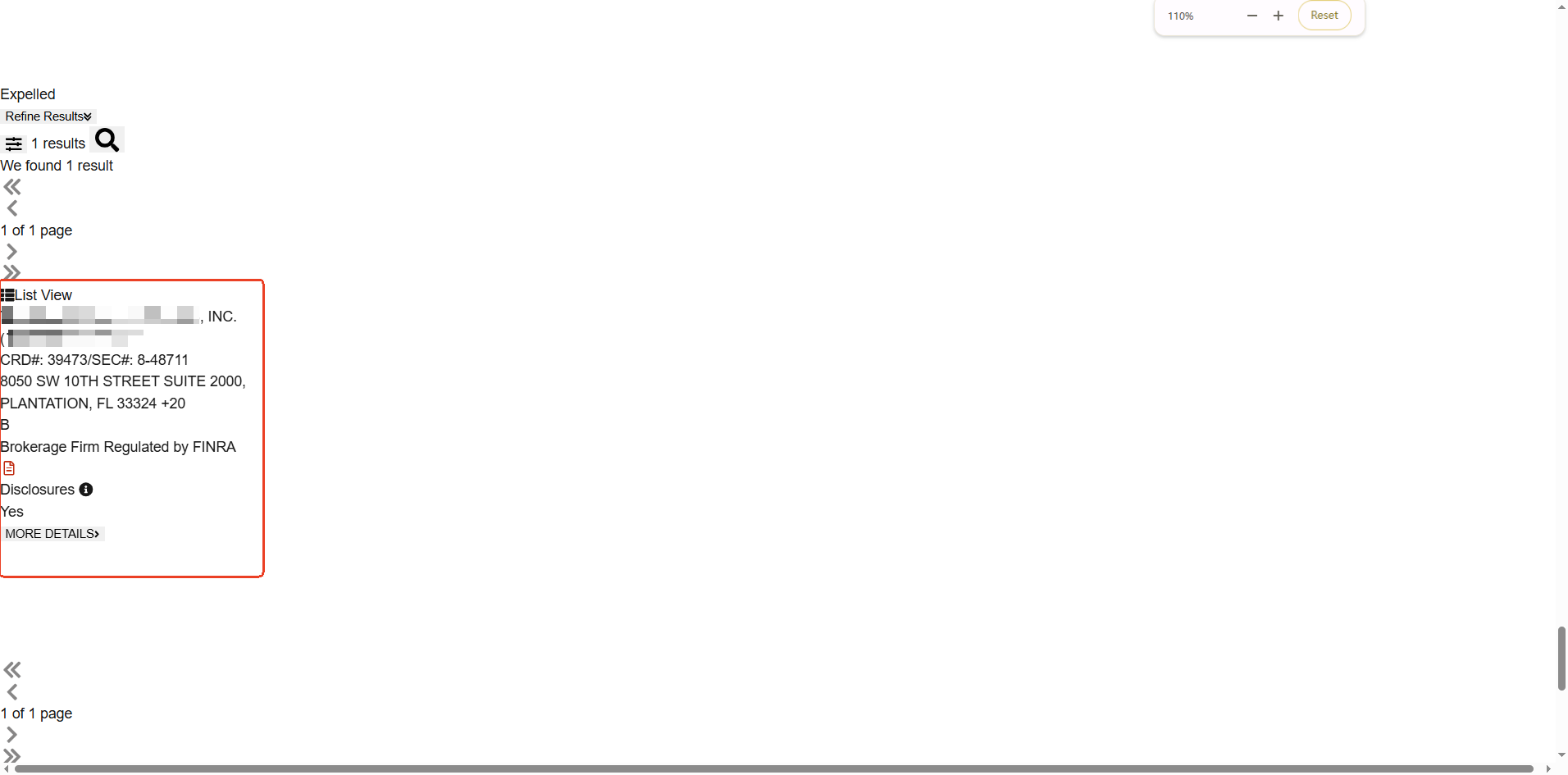

Generally speaking, FINRA-regulated broker profile will be found on FINRA’s BrokerCheck Page.

- Go directly to FINRA’s BrokerCheck website: https://brokercheck.finra.org.

- Select the “Firm” tab (instead of “Individual”).

- Enter the firm’s name or any other identifying information provided by the broker (e.g., CRD number, address) in the search field.

- After submitting your search, scroll down to the bottom of the page, search results will appear there, displaying details such as the firm’s name, business address, registration status, and CRD number.

When you have a dispute with a FINRA-regulated broker, you can proceed in the following ways:

1st way:

The recommended first step is to contact your broker directly to ask about any transaction you don’t understand or didn’t authorize. If you’re not satisfied with the response, escalate the issue to the firm’s branch manager or compliance department. If you suffered financial loss or there was an unauthorized trade, submit your complaint in writing and keep copies of all correspondence.

2nd way:

If the issue remains unresolved, or if you’re unsure whether your concern falls under FINRA’s authority, you may file a complaint with FINRA online:

https://investor-complaints.datacollection.finra.org/

3rd way:

FINRA's Dispute Resolution Services (DRS) helps investors and firms resolve securities-related disputes through Arbitration and Mediation.

File Arbitration Claim: https://www.finra.org/arbitration-mediation/file-claim#arbitration

Request Mediation: https://drapps.finra.org/medforms

Note: FINRA may refer your complaint to another regulator if it’s outside its jurisdiction, which could delay the investigation.

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.