-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

Financial Crimes Enforcement Network

CThe Financial Crimes Enforcement Network (FinCEN), a bureau within the US Department of the Treasury, collects and analyses information about financial transactions in order to combat money laundering, terrorist financing and other financial crimes, both domestically and internationally.

FinCEN's mission is to protect the financial system from illicit activity, combat money laundering and the financing of terrorism, and promote national security by strategically using financial authorities and collecting, analysing, and disseminating financial intelligence.

The primary responsibilities of the Financial Crimes Enforcement Network (FinCEN) include:

1. Collecting, analysing and disseminating financial transaction data to support law enforcement, regulatory and national security efforts;

2. Implementing and enforcing anti-money laundering (AML) and counter-terrorism financing (CFT) regulations under the Bank Secrecy Act (BSA);

3. Requiring certain financial institutions, including money services businesses (MSBs) and some foreign exchange dealers, to register with FinCEN and comply with reporting and record-keeping obligations.

4. Coordinating with domestic and international counterparts to combat financial crime.

It is important to note that FinCEN does not regulate forex dealers in terms of their market conduct, capital requirements, or consumer protection. While some forex dealers must register with FinCEN as MSBs for AML/CFT compliance, their broader operational and prudential oversight is the responsibility of other regulators, such as the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). Therefore, FinCEN's role is limited to financial intelligence and BSA compliance, rather than comprehensive regulatory supervision.

In general, the FinCEN-registered broker profile can be found on the MSB Registrant Search page. Try to find it and check whether the information on the broker profile matches that on the broker's website.

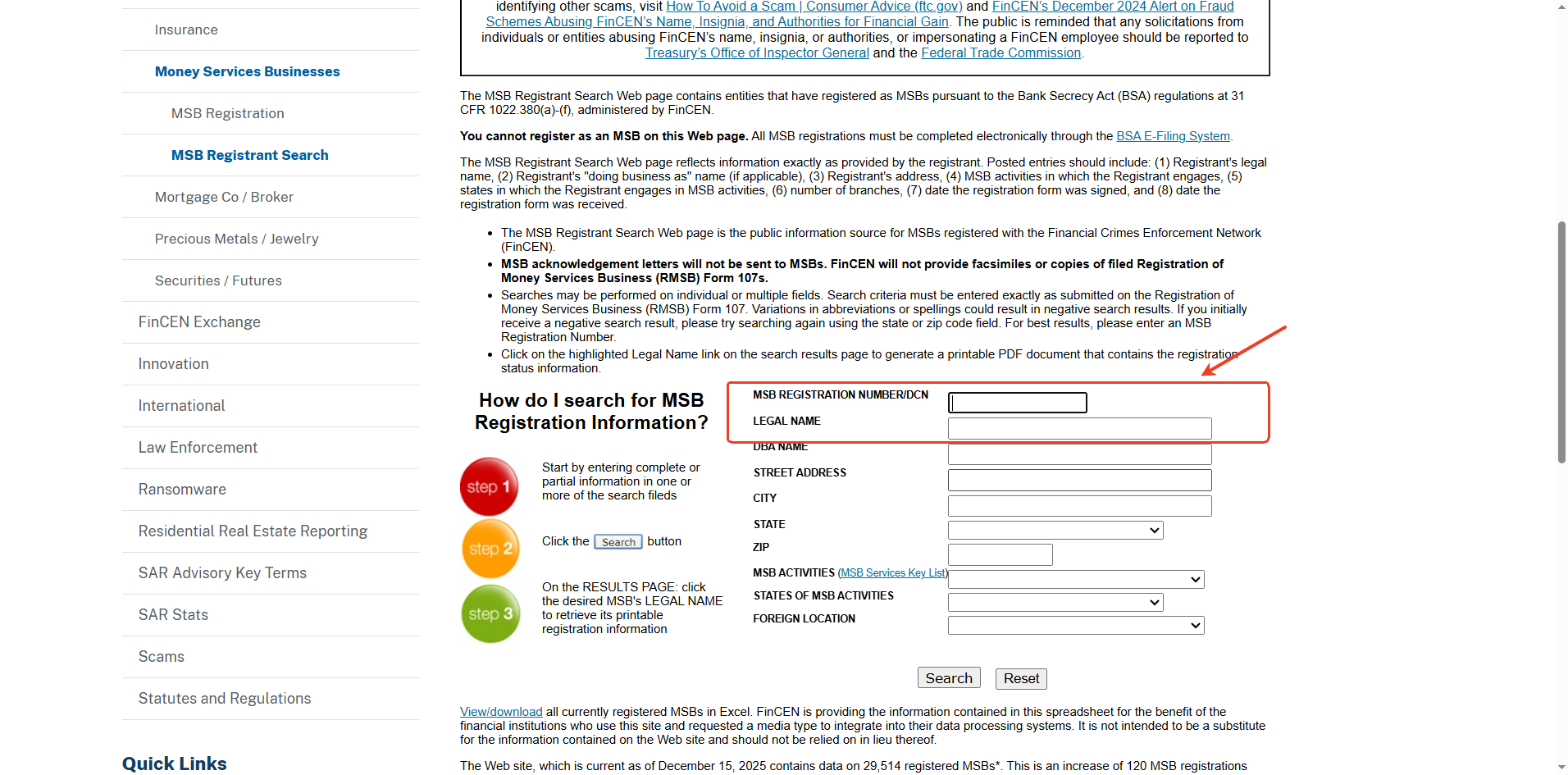

The detailed steps are as follows:

1. Find the MSB registration number or legal name of the broker, which you can find on their website.

2. Enter the MSB registration number or legal name into the search bar at https://www.fincen.gov/resources/msb-state-selector.

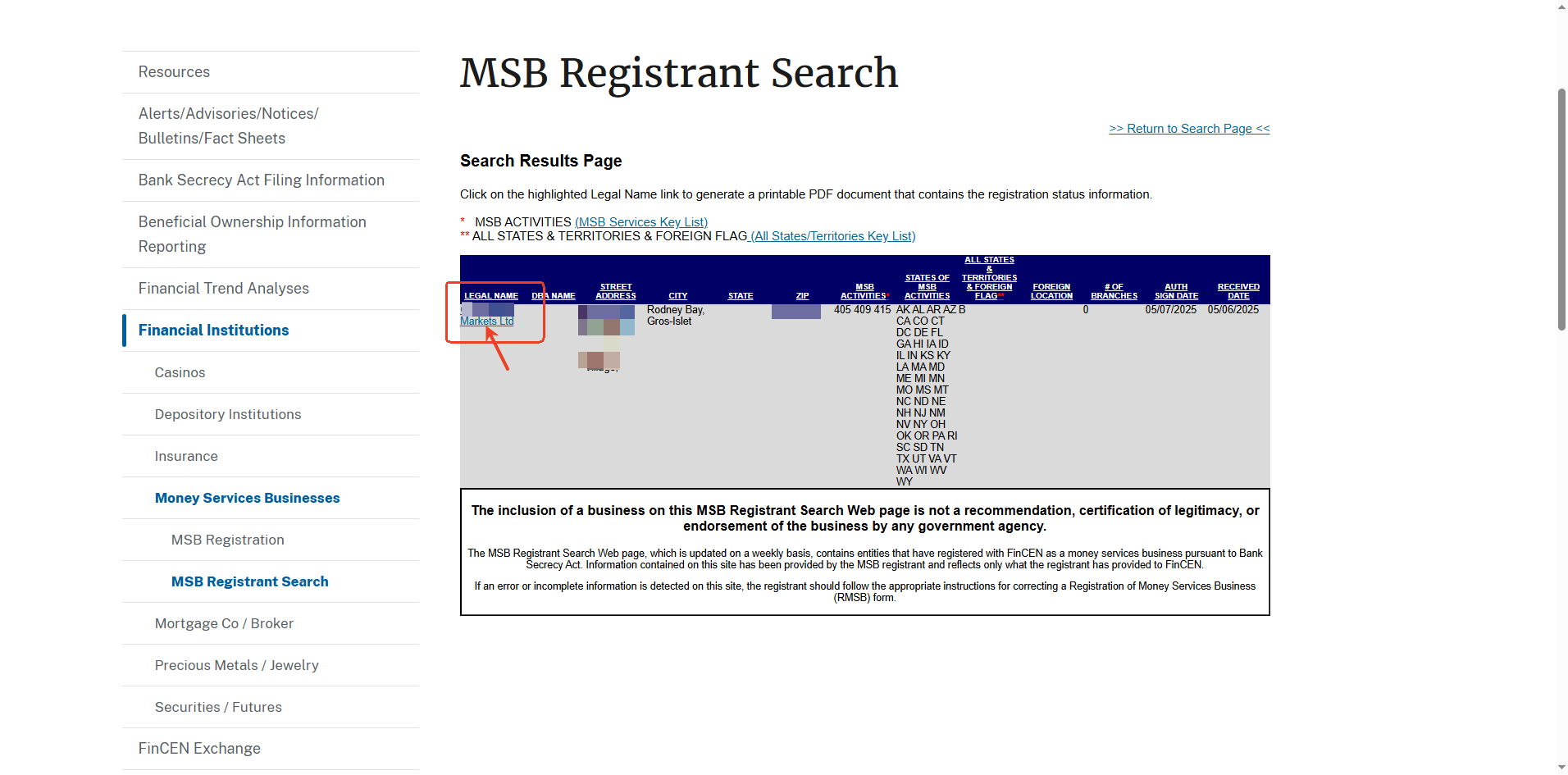

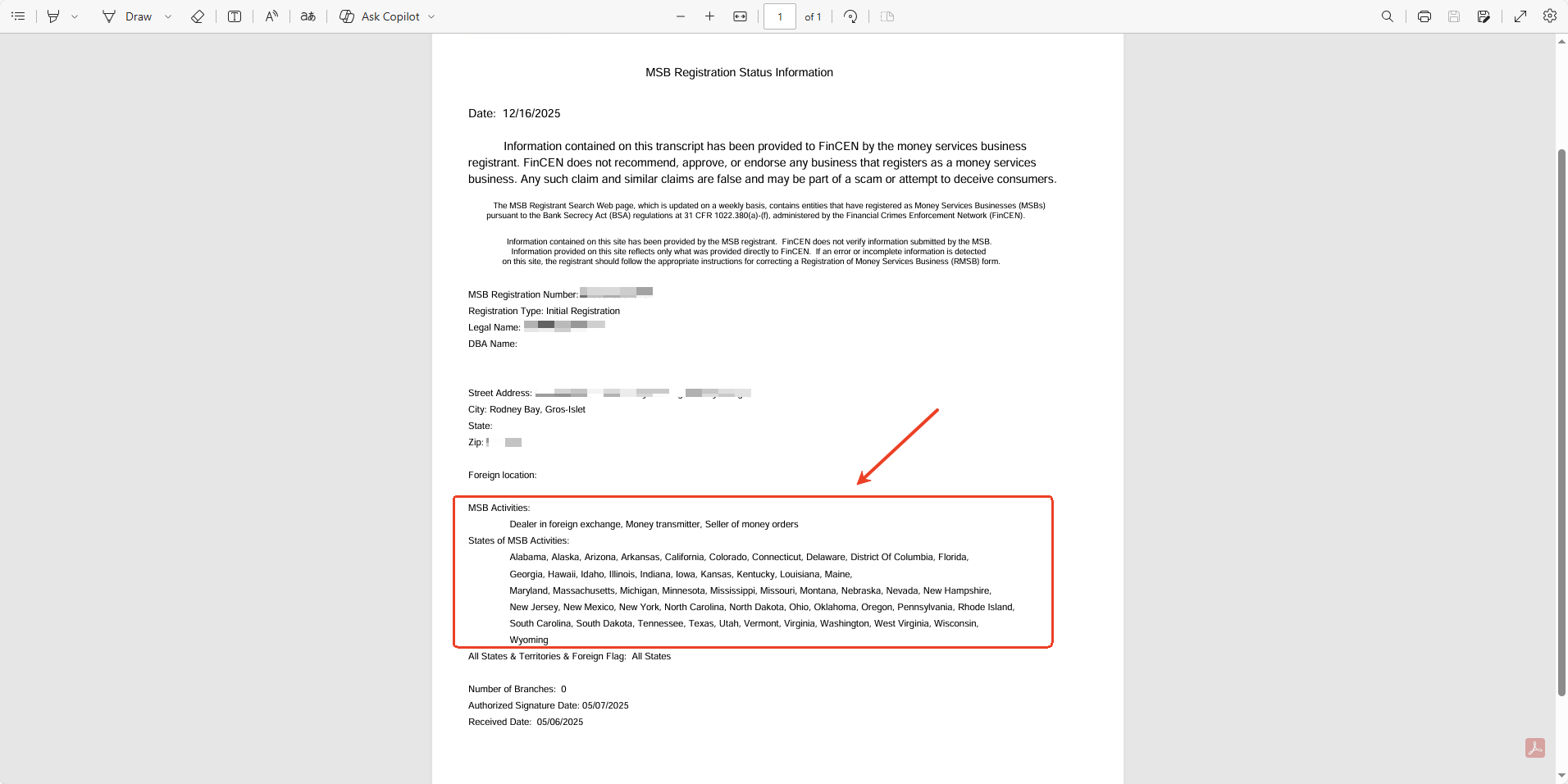

3. You will then see a brief profile of the broker on the FinCEN website. Click the broker's name to download the document and check its registration details, including its authorised MSB activities.

When you have disputes with a FinCEN-registered broker, you can proceed the following ways:

1st way: The recommended way is to contact the broker directly and discuss with them to find a solution.

2nd way: If you're not satisfied with the broker's solution, you may contact FinCEN through: https://assistance.fincen.gov/contact/s/.

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.