-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

De Nederlandsche Bank

BDe Nederlandsche Bank (DNB) is the central bank of the Kingdom of the Netherlands, headquartered in the capital city of Amsterdam. In 1814, King William I of the Netherlands established the central bank to oversee currency issuance, with the state serving as its sole shareholder. The Governor of DNB is appointed by the King.

Under relevant legislation, the DNB's primary responsibilities include formulating national financial policy, serving as the lender of last resort for the banking system, and overseeing banking regulation. As a member of the Eurozone, the DNB is also part of the European Central Bank system. This entails that certain monetary policy functions have been transferred to the European Central Bank. Similarly, in exercising its regulatory duties, the DNB is influenced by relevant institutions of the European Union.

The Dutch Central Bank (DNB) does not directly supervise forex dealers. The Netherlands Authority for the Financial Markets (AFM) and DNB jointly oversee financial markets, working together to maintain financial stability, protect traders' rights, and ensure brokers and financial institutions comply with regulatory standards.

The AFM oversees market conduct, while DNB handles prudential supervision, ensuring financial institutions maintain adequate capital reserves.

DNB reviews financial institutions' operations, verifying they hold sufficient cash reserves and buffers to withstand adverse events, and monitors their anti-money laundering measures. While regulation reduces risks, it does not provide absolute guarantees. Should a Dutch bank fail, customers may recover up to €100,000 in deposits under the Dutch Deposit Guarantee Act.

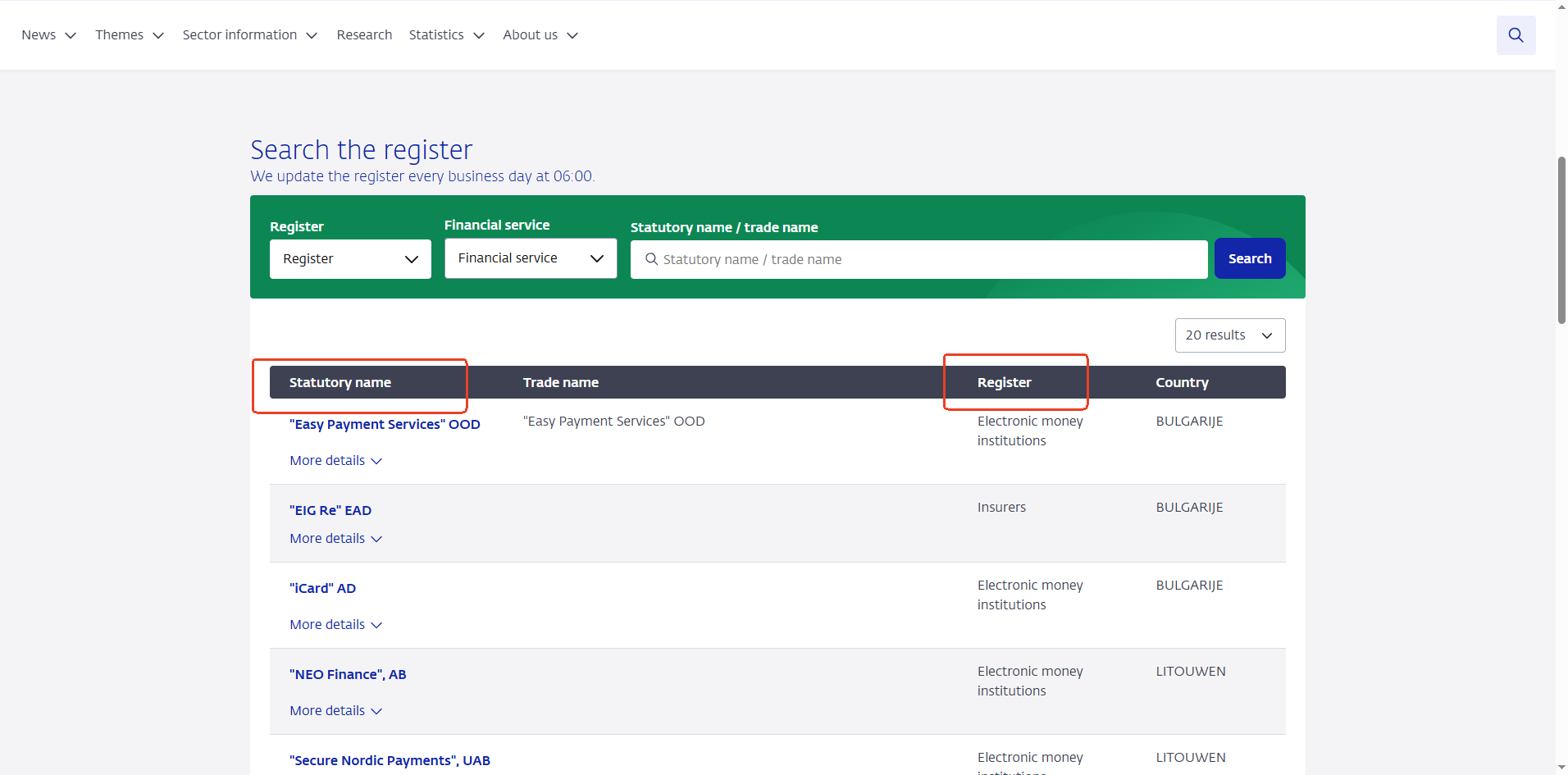

Generally speaking, DNB-regulated broker profile will be found at the Public Registers page on DNB website. Try to find it and check if it will match the info from the broker website.

The detailed steps are as below:

1. Find the trade name/entity name of the licensed entity, which you can get from the platform's website;

2. Enter the trade name/entity name into the search bar on https://www.dnb.nl/en/public-register/?p=1&l=20

When you have disputes with a DNB-registered broker, you can proceed the following ways:

1st way: The recommended way is to contact the broker directly and discuss with them to find a solution.

2nd way: If you're not satisfied with the broker's solution, try to contact DNB, which helps to solve the disputes between the forex broker and the investor.

You can report wrongdoing to the DNB Whistleblowing Platform in several ways:

- Complete the online form

- email: meldpuntmisstanden@dnb.nl

- Post:

De Nederlandsche Bank N.V. Whistleblowing Platform

Postbus 98

1000 AB Amsterdam

- Call DNB at: 0800 020 1068 (calls are recorded)

- In person: you can request a meeting by email, post or telephone.

3rd way: If the first 2 ways above can't solve the dispute, the last way is to issue a case to the court in Netherlands.

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.