-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

Central Bank of Bahrain

BThe Central Bank of Bahrain (CBB) is a public corporate entity established by the 2006 CBB and Financial Institutions Law. It is responsible for maintaining monetary and financial stability in the Kingdom of Bahrain and succeeded the Bahrain Monetary Agency, which had previously carried out central banking and regulatory functions since its establishment in 1973.

The CBB implements the Kingdom’s monetary and foreign exchange rate policies, manages the government’s reserves and debt issuance, issues the national currency and oversees the country’s payments and settlement systems. It is also the sole regulator of Bahrain’s financial sector, covering the full range of banking, insurance, investment business and capital markets activities.

The CBB’s wide scope of responsibilities allows a consistent policy approach to be undertaken across the whole of the Kingdom’s financial sector. It also provides a straightforward and efficient regulatory framework for financial services firms operating in Bahrain.

No person may market any financial services in the Kingdom of Bahrain unless:

(a) Allowed to do by the terms of a license issued by the CBB;

(b) The activities come within the terms of an exemption granted by the CBB by way of a Directive;

(c) Has obtained the express written permission of the CBB to offer financial services.

In general, the profile of a CBB-regulated trading company can be found in the CBB Licensing Directory. Try to find it and check if the information matches that on the broker's website.

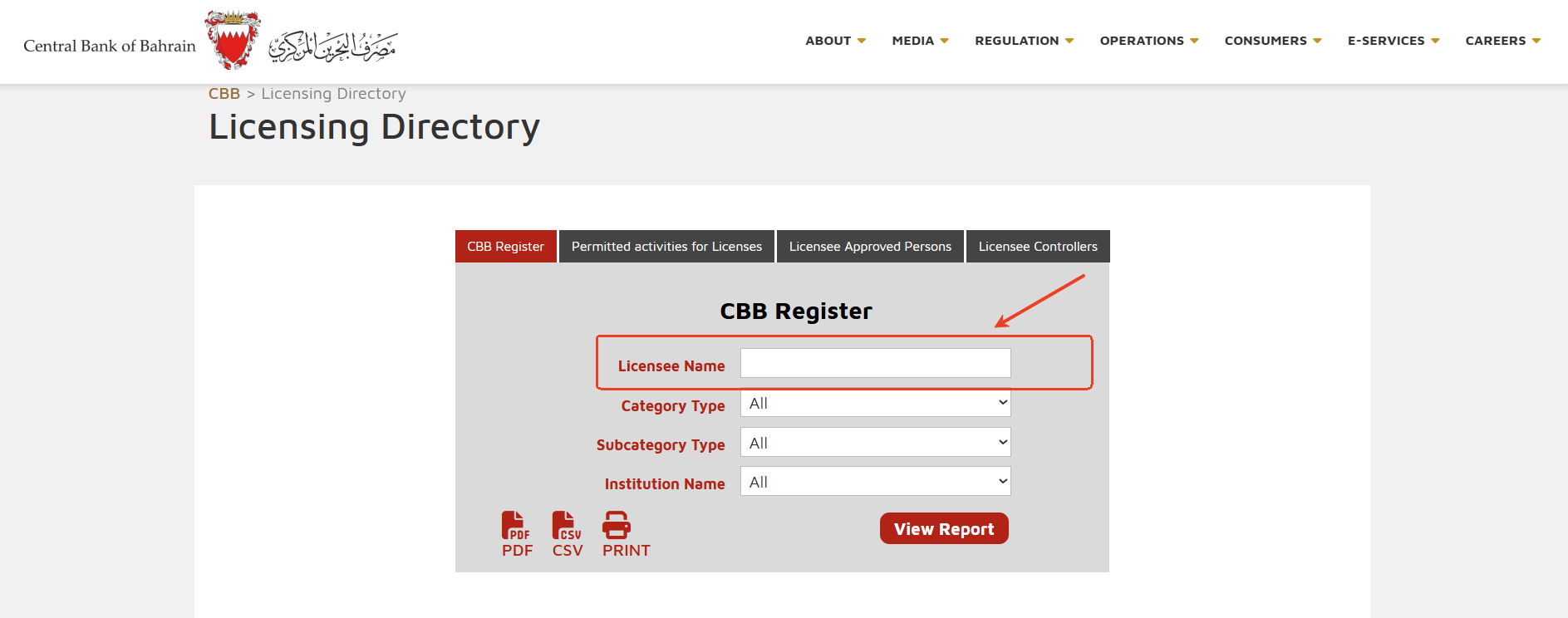

The detailed steps are as follows:

1. Find the trading company's entity name, which you can get from the broker's website.

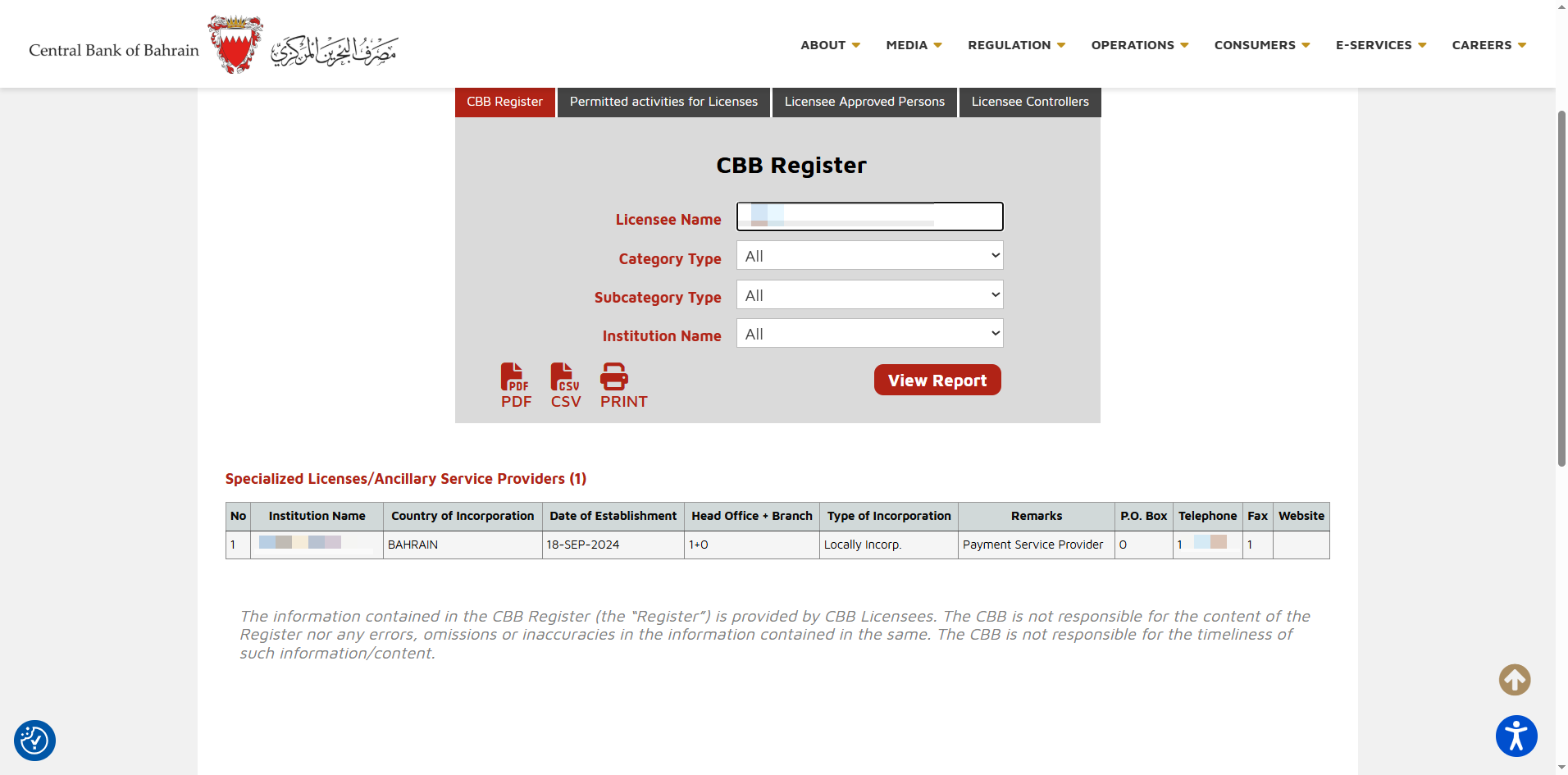

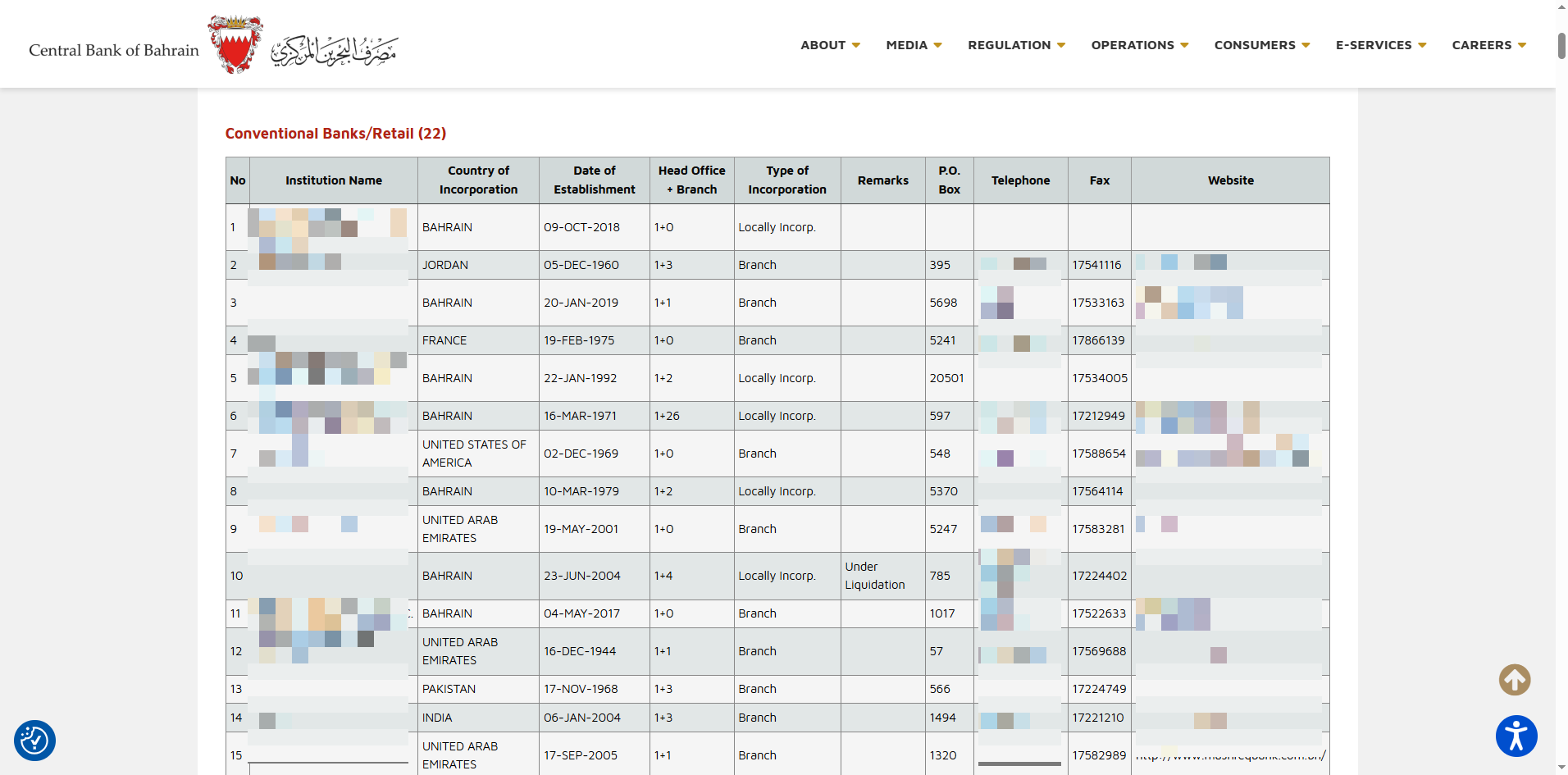

2. Enter the company name into the search bar at https://www.cbb.gov.bh/licensing-directory/ and click Search. A list of companies will appear below the search bar.

3. Check that the registered information of the licensed firm corresponds with what is shown on the broker's website. Most importantly, verify that the website belongs to the same licensee as the broker's operating domain.

When you have disputes with a CBB-regulated broker, you can proceed the following ways:

1st way: The recommended way is to contact the broker directly by sending a formal complaint via email or an official letter to their designated complaints team.

2nd way: If you are not satisfied with the broker’s response or if they fail to respond within the stipulated timeframe, you may escalate your complaint to the Central Bank of Bahrain (CBB). You can do this through:

- In person at the CBB headquarters

- By calling the CBB Consumer Protection Office at +973 17547789

- Online Complaint Form: https://www.cbb.gov.bh/complaint-form/

3rd way: If the above steps do not resolve your dispute, you may consider pursuing legal action by filing a case in the appropriate court in the Kingdom of Bahrain.

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.