-

Brokers

HOT Advanced SearchSearch by account type, minimum deposit, and maximum leverage in 2,000+ forex brokers.Find out moreBrokers Comparison ToolGet to know the regulation, account types, trading cost, services, and updates of forex brokersFind out moreLive Spread ComparisonAccess to real-time spreads, bid/ask prices, historical data, account types and swap.Find out moreIntroducing BrokersA large number of IBs are included in BrokersView. A variety of tools are provided to help you make one-stop search, compare IBs information, and select your preferred IBs effectively.Find out more

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims Q&AIs the broker legit or regulated by my state regulator? Questions you should ask about your investment.Find out moreComplaintReport any financial complaints, fraudulent activities or investment scams with brokers or investment firms hereFind out moreScam Alert VideosWatch the most common forex scam videos and how to avoid them starting right now.Find out moreTips to Detect ScamReview our tips for indentifing scams to help minimize the chance you will get duped.Find out more

- Expo

- Event

- Awards

Scan to download

It is more convenient and faster to find brokers and complain

- 中文(简体)

- 中文(繁体)

- English

- Tiếng Việt

- اللغة العربية

- ภาษาไทย

- Bahasa

- 日本語

- 한국어

Banco de España

BBanco de España (BdE) is Spain's central bank. Founded in Madrid in 1782 by King Charles III, today the bank is a member of the Eurosystem and the European System of Central Banks. It is Spain's national competent authority for banking supervision within the Single Supervisory Mechanism. Its activities are regulated by the Bank of Spain Autonomy Act of 1994.

The Banco de España performs these functions as a member of the following European institutions: the European System of Central Banks (ESCB), the Eurosystem, the Single Supervisory Mechanism (SSM) and the Single Resolution Mechanism (SRM). Its mission is to achieve price stability and financial stability in order to support stable economic growth. The Bank’s analysis also contributes to other economic policy-making.

In Spain, the CNMV is responsible for regulating and supervising Spain’s securities markets and all participants involved in investment services, including brokers, asset managers, and listed companies.

Meanwhile, the Banco de España, since October 2013, oversees the banking sector. It also directly supervises other financial entities, including credit institutions (which cannot take public deposits), payment institutions, and electronic money (e-money) institutions.

Together, the CNMV and the Banco de España ensure comprehensive and coordinated supervision of Spain’s financial system, each focusing on their respective domains while working in tandem to maintain stability, transparency, and investor protection.

In Spain, the regulatory authority for forex brokers is the Comisión Nacional del Mercado de Valores (CNMV). The Banco de España (BdE) primarily oversees banks and financial institutions to ensure public confidence in the stability of the banking system. It does not directly regulate forex brokers.

However, the BdE plays a supportive role in the broader financial supervision framework. In relation to forex brokers, the BdE's involvement is indirect but includes the following key aspects:

-

Behavioral and Conduct Supervision: The BdE monitors the conduct of financial institutions to ensure compliance with laws and regulations, focusing on transparency, fairness, and ethical business practices. This includes assessing whether firms treat clients fairly and manage conflicts of interest appropriately.

-

Supervision of Advertising: The BdE enforces rules on financial advertising to prevent misleading or exaggerated claims. It ensures that marketing materials are clear, accurate, and compliant with legal standards, protecting consumers from deceptive practices.

-

Client Service Department Oversight: The BdE supervises customer service departments (CSDs) of financial entities to ensure they handle client complaints effectively, resolve disputes fairly, and maintain proper internal procedures to safeguard client interests.

-

Risk Monitoring and Compliance Checks: Through regular assessments and audits, the BdE evaluates the operational and risk management practices of regulated institutions, helping to identify and mitigate potential systemic risks.

While the CNMV holds primary responsibility for licensing and regulating forex brokers, the Banco de España supports overall financial stability by ensuring sound conduct, transparency, and consumer protection across the financial sector.

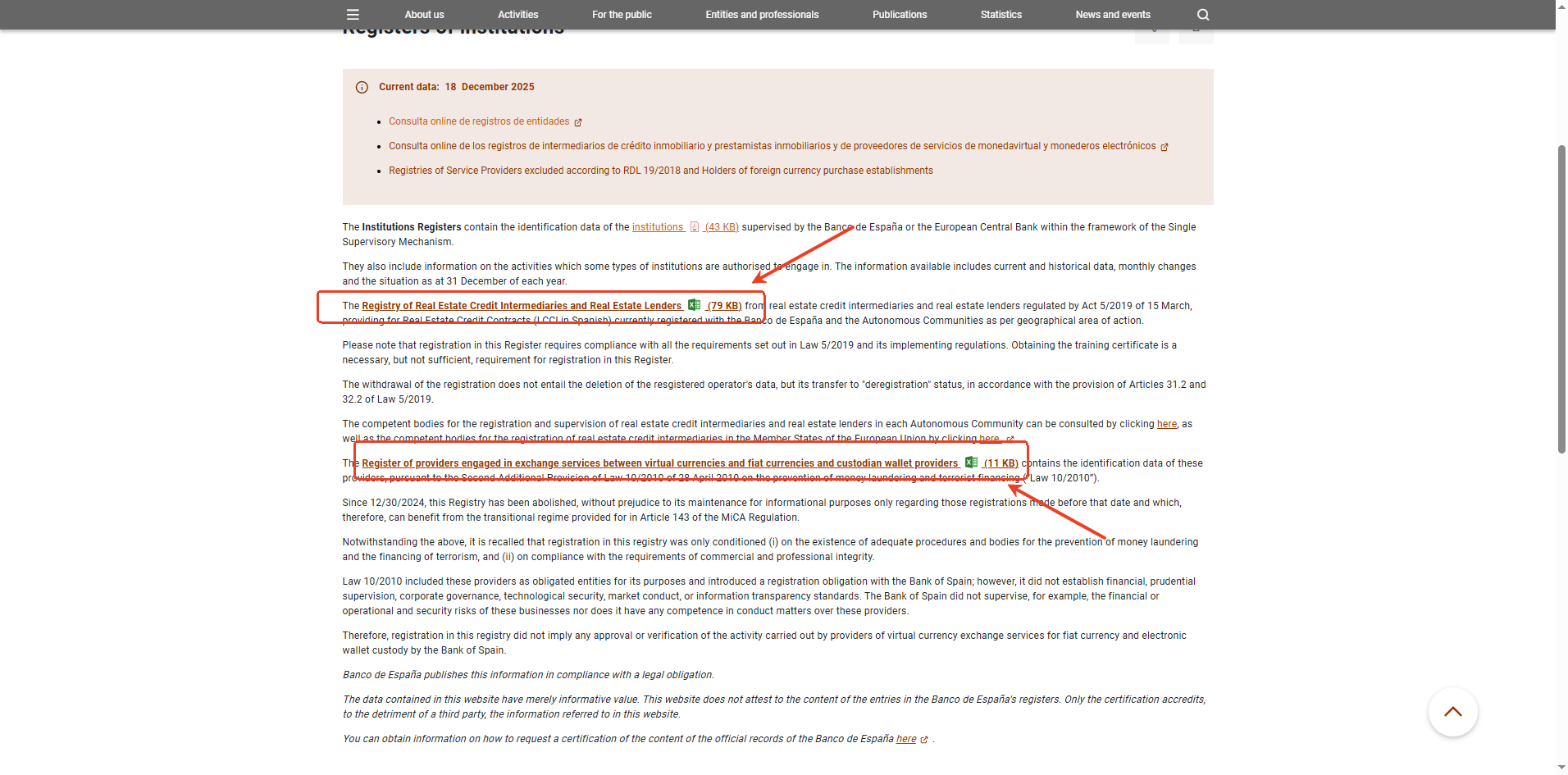

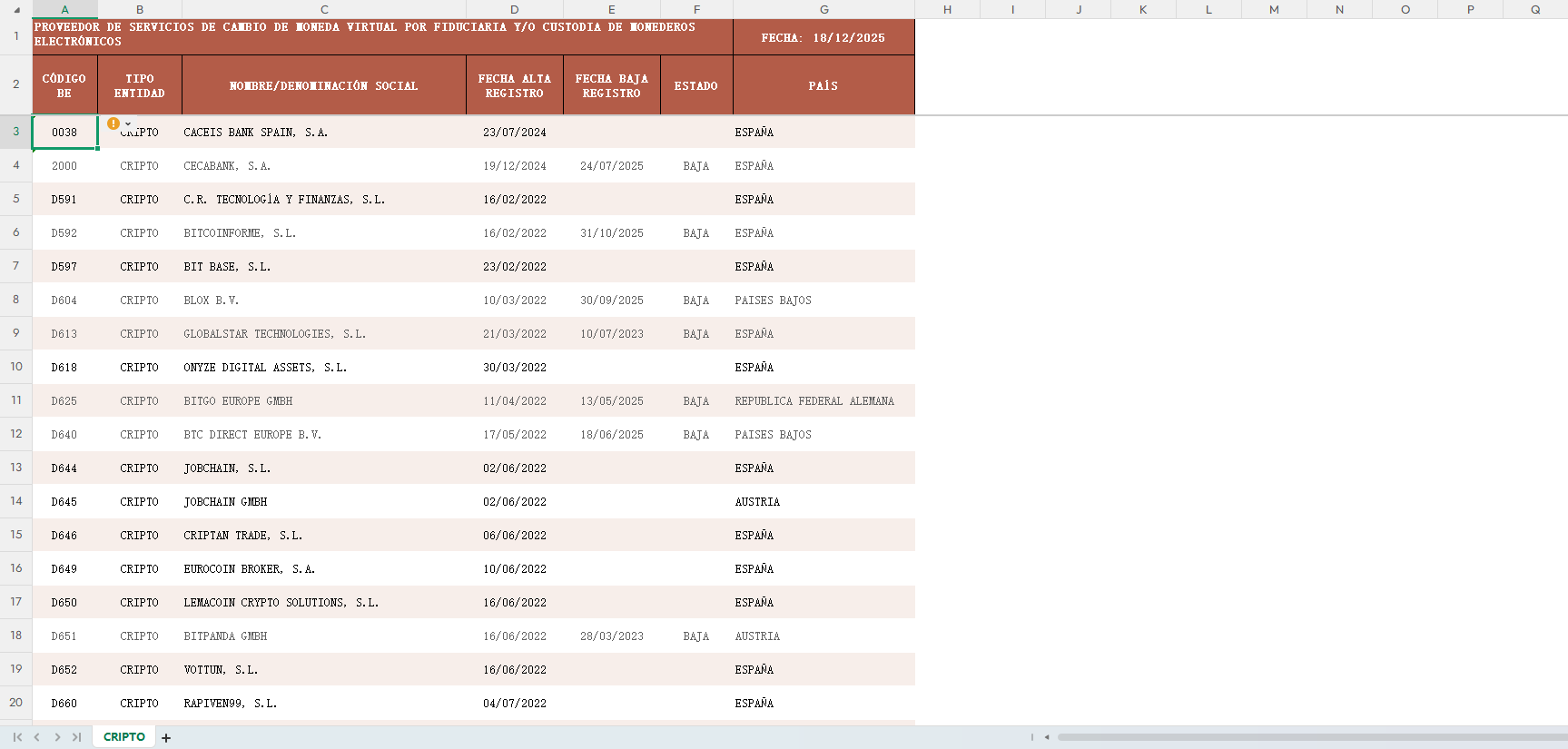

Generally, entities registered with the Banco de España (BdE) can be found in the table documents provided on the BdE's Registered Entities Page.

To verify a specific broker or financial service provider, locate the entity's name as provided on its website and search for it within these documents.

The BdE's registry includes several categories such as the Register of Credit Intermediaries and Loan Providers, which lists real estate credit intermediaries and lenders, and the Register of Virtual Currency Service Providers (VASP) and Custodian Wallet Providers.

By navigating to the relevant section and searching through the corresponding tables, you can check whether an entity is registered with the BdE and therefore authorized to provide its declared services within Spain.

When you have disputes with a BdE-registered broker, you can proceed the following ways:

1st way: The recommended way is to contact the broker directly and discuss with them to find a solution.

2nd way: If you're not satisfied with the broker's solution, try to file a complaint to BdE.

a. Online: https://app.bde.es/psr_www (in Spainish)

b. In person, either in Madrid or at any of the Bank's branch offices.

c. By post, addressed to:

Banco de España

Departamento de Conducta de Entidades

c/ Alcalá, 48

28014 Madrid

The complainant and the entity will be informed of a case being opened within ten working days of the complaint being lodged.

The entity will receive a copy of the complaint so that it can present its submissions within 15 working days.

The complainant will have 15 working days to respond to the entity’s submissions.

Once the case is complete, the Banco de España will in general issue a report within 90 days.

Risk Warning

FX trading is of high risk and may not be suitable for all investors. Leverage will create additional risks and loss. Before trading, please carefully consider your investment objectives, experience level and risk tolerance. You may lose part or all of your initial investment; do not invest money that you cannot afford. Educate yourself about the risks associated with FX trading. If you have any questions, please consult an independent financial or tax advisor. Any data and information are provided "as is" and only for information purpose, not for trading or recommendations. Past performance does not predict future results.

Disclaimer

The data contained in this website may not be real-time and accurate. The data and prices on this site are not necessarily provided by the market or exchange, but may be provided by market makers, so prices may be inaccurate and differ from actual market prices. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website.