Servelius Exposed: No License, ASIC's Warning, Scam Risk

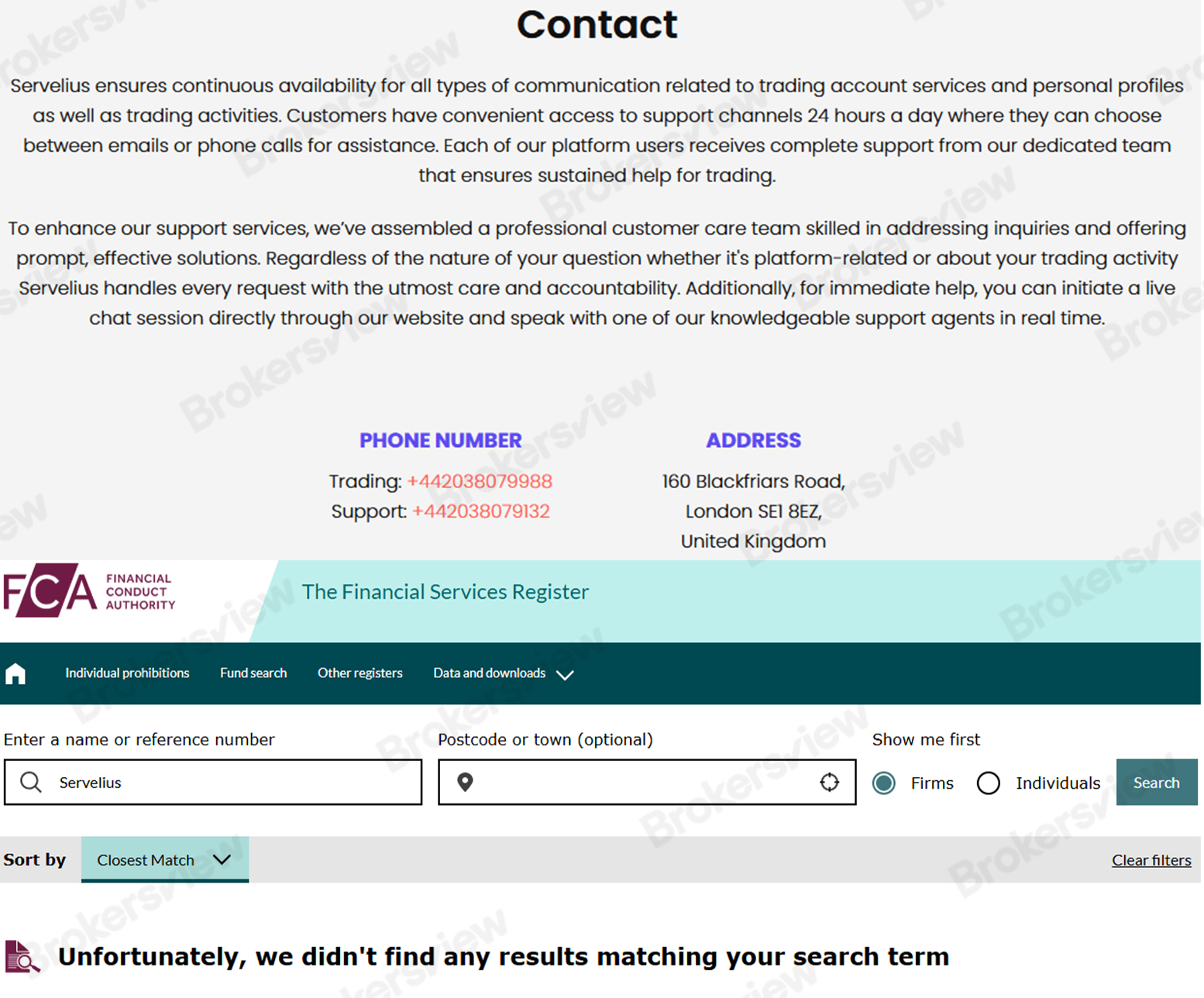

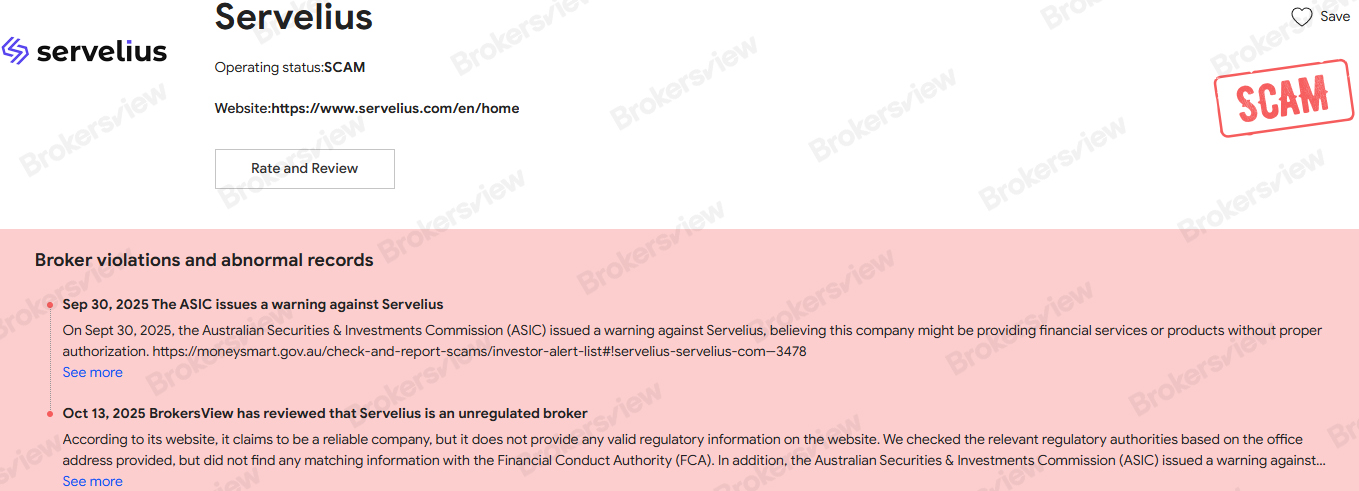

Servelius calls itself a “reliable” trading platform, yet fails to provide any proof of regulatory licensing. Despite listing a UK operational address on its website, the company is not registered with the UK’s Financial Conduct Authority (FCA), a significant red flag for investors.

Contradictory Claims and Vague Compliance

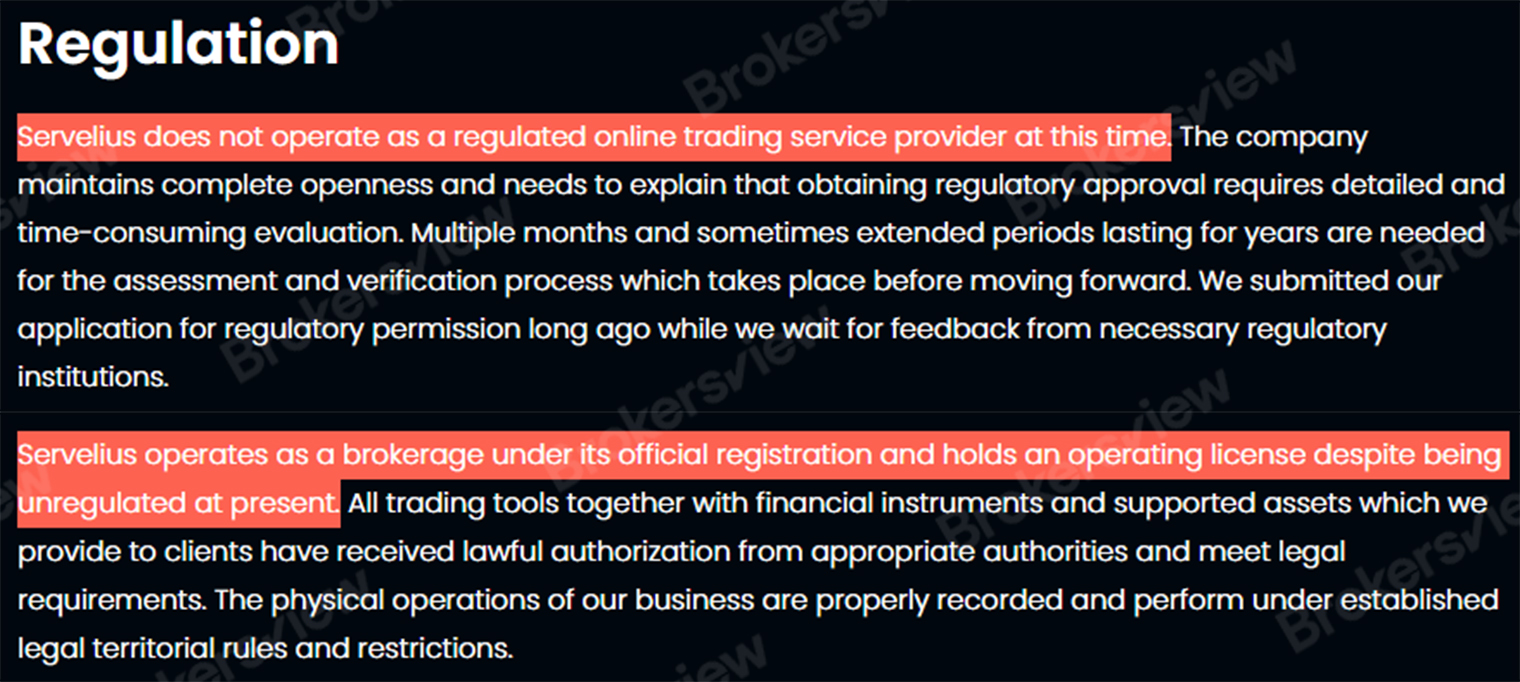

A careful reading of Servelius's own disclosures reveals contradictions. The platform attempts to reassure clients while simultaneously admitting to fundamental regulatory failures, but claims to hold "an operating license despite being unregulated."

To justify its unlicensed status, Servelius cites “pending application feedback from regulators.” However, legitimate financial firms secure approval before launching services, especially when handling client funds.

While Servelius dedicates significant text to security measures, its compliance framework lacks specific, verifiable details.

Regulatory Warning from ASIC

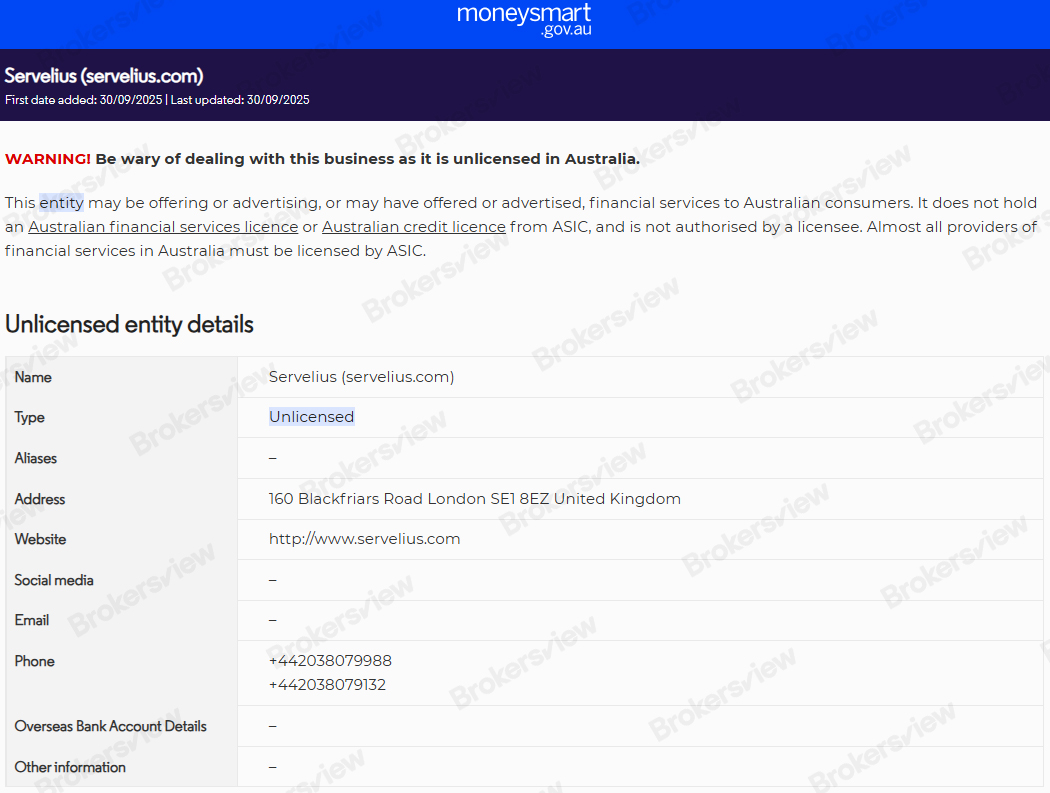

On September 30, 2025, the Australian Securities & Investments Commission (ASIC) added Servelius to its Investor Alert List, indicating the company may be offering or advertising financial services without proper authorization. This marks a serious regulatory concern and underscores the urgency for investor vigilance.

Be Skeptical of "Reliable" Labels

Regulated brokers prove their legitimacy with credentials. Scam platforms rely on marketing buzzwords and exaggerated promises, including guaranteed returns based on tiered investment plans. These are classic red flags.

BrokersView Reminds You: No License, No Protection

If a platform is unregulated, your funds have no protection. There’s no authority to hear your complaint, and recovery is highly unlikely. Therefore, avoid dealing with Servelius.

Before investing, always demand a verifiable regulatory number and check it yourself on the regulator's official website. If you fell for a forex scam, Submit a Complaint through BrokersView.